DjelicS/E+ via Getty Images

I don’t know about you, but when I decided to initiate a Netflix (NASDAQ:NFLX) subscription, I did that because the content of the free television was intolerable. I mean, gossip shows, talent shows, talk shows, survival shows, cooking shows, all of these make me sick. I get that after a tiring day at work, putting your mind at ease by watching some of these choices is a thing that many people like to do, but for me, it was a nightmare. Not so often, televisions have a nice movie or some nice domestic or international series but the advertisement interruptions were so often and long, that watching TV was ultimately not an option, at all.

Although the initial enthusiasm about Netflix’s content was somewhat softened by the fluctuations in its quality, I’m not thinking about canceling my subscription any time soon. This brings me in total disagreement with 200k people that cancelled their Netflix subscription during the first quarter of 2022. Although I must admit that where I live, not all of Netflix’s competitors have presence, even if they had, I wouldn’t move to another platform. Want to know why?

Because, from a purely behavioral standpoint, there is no such thing as diminishing quality of content. I believe that much of the fuss regarding Netflix’s content has been created by flagship shows available in other platforms. Similarly, these other platforms will also have second or third-class shows available, and viewers will start to realize that as soon as their favorite shows come to an end. For example, a couple of years ago, there was some hype associated with HBO’s Chernobyl series, which received excellent ratings. Additionally, the Game of Thrones was another flagship show of the platform. But apart from these names, taking a quick look in HBO’s content, it seems that there isn’t another strong name. Note, however, that the series may be good and of high quality, but there is no hype associated with them.

Advertisements will accelerate recovery…. but they have to be limited

So, at some point, Netflix’s subscriber outflows will stop, but this point will be sooner than many people think. The reason is the newly, experimentally launched ad subscription plan, which will be cheaper than the existing ones, and it is currently up and running in South America. With this move, the platform aims to compete with its rivals, such as HBO, Disney+ (DIS), Hulu, etc., which are already offering ad subscription plans. The cheaper subscription could enable on-demand TV fans to subscribe to more than one platform at the same time, at the cost of tailored ads at a reasonable frequency and length. We do know that the platform is considering 15- to 30-second commercials before the start of streaming and also during streaming, and that in any case total ad time won’t exceed 4 minutes per hour. It is estimated that once ad-tiered subscription plans become available worldwide, they will contribute more than $2 billion in revenue, during the next five years.

Such revenue addition would mean a total revenue increase of nearly 20%. At a net income margin of 16%, this additional revenue could be translated to more than $300 million of additional profit. The company is now trading at 22 times its forward earnings. Such profit addition could lower this ratio down to 20x.

Therefore, I arrive at the conclusion that Netflix’s share price decrease during the last few months is overrated, as it was solely based on subscriber numbers, rather than actual revenue increase projections. In addition, the current share price indicates that the ad-tiered subscription model and its implications probably haven’t been priced in yet.

On the contrary, the market had assigned a quite optimistic earnings multiple to the company, based on the absence of competitors. Clearly, this isn’t the case anymore. But still, it is only natural for a new kid on the block to show rapidly increasing subscriber numbers, just as Netflix did back in the day. This can’t continue forever though.

Ad-tiered plans may be the future

With the global economy slowing down and with prices going up, consumers will opt for more cost-effective solutions whenever they can. In this context, cheaper on-demand TV plans may appeal increasingly more to lower-income households.

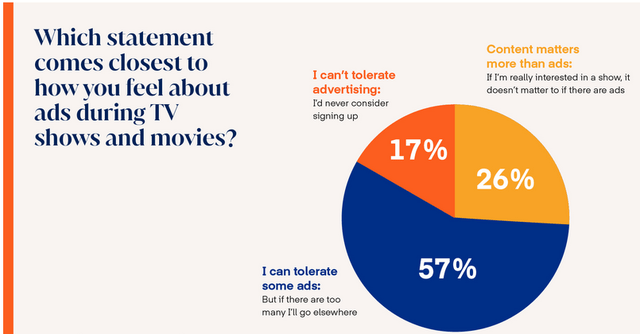

Watchers opinions regarding ads (The Trade Desk)

Last year, a survey from Hub Entertainment Research showed that more than 8 out of 10 respondents either could tolerate some ads or they don’t care about them at all. As I wrote above, the “some ads” component is of crucial importance, and I believe that they know this at Netflix.

Moreover, in another survey, 71% of respondents said they prefer tailored ads instead of random ones. Netflix has partnered with Microsoft in order to launch their ad-tiered program, so we can expect personalized ads and, thus, greater user engagement.

Bottom line

Personally, I will continue to pay my non-ad, monthly Netflix subscription and keep on watching Better Call Saul and every other show that meets my standards – and there are many. But I know people that are more inclined to watching sports, that do have subscriptions in on-demand sports channels that would be also interested in some quality series or movies but wouldn’t pull the trigger at the current rates. These people are the company’s most valuable profit from the ad-tiered plans. Of course, this process works both ways. People could opt for the cheaper plan, in order to use the cash left for a subscription to another platform. In any case, the market will get what they want: Increasing subscriber numbers. Therefore, I would buy Netflix at this price level.

Be the first to comment