MF3d

Investment Thesis

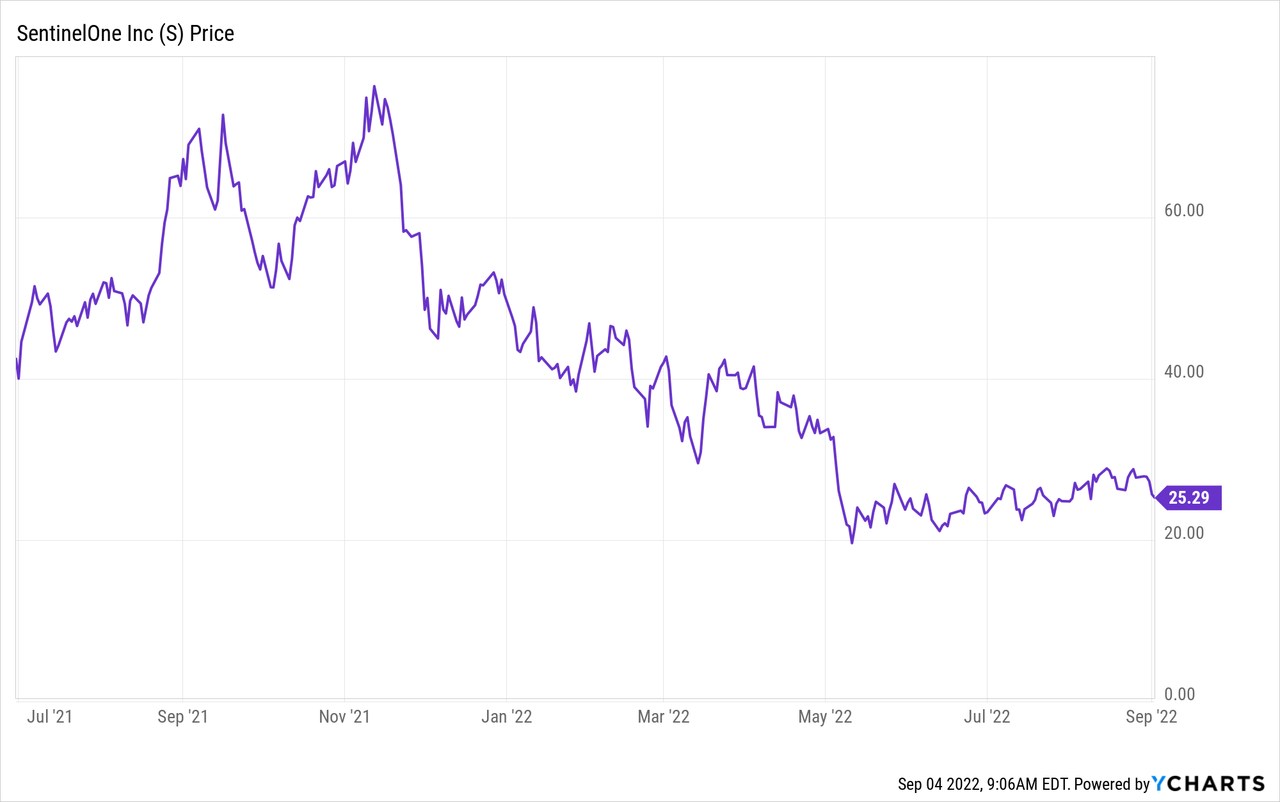

SentinelOne, Inc. (NYSE:S) is a U.S.-based cybersecurity company founded by Tomer Weingarten in 2013. The company went public in July last year at a share price of $35, raising approximately $1.23 billion in gross proceeds. After reaching an all-time high last November, SentinelOne got caught in the broad market sell-off and is now down over 65%. However, the massive selloff is unjustified in my opinion.

SentinelOne reported its second quarter earnings last week and it impressed once again, beating analysts’ expectations across all metrics. The company is also operating in a fast-growing industry with a large total addressable market (“TAM”) and is benefiting from the acceleration of digital transformation. I believe the current share price is compelling and presents a good buying opportunity for long-term investors.

Overview

SentinelOne is a cybersecurity company that focuses on endpoint protection. The company’s main solution is its Singularity XDR Platform, which leverages AI and machine learning technologies to provide automated protection across different surfaces including endpoints, cloud, identity, IoT, email and more. The platform is also able to unify all the data collected and provide visibility and analytic solutions to enterprises. The company also offers a marketplace that provides one-click integrations with different partners such as AWS (AMZN), Splunk (SPLK), Zscaler (ZS), Okta (OKTA), and more. Customers are able to leverage these integrations and expand their use cases accordingly. For example, they can sync threats from SentinelOne into ServiceNow (NOW) for unified security operations and incident response. The company has an impressive list of customers including companies like Samsung (OTCPK:SSNLF, OTCPK:SSNNF), Estee Lauder (EL), Electronic Arts (EA), Autodesk (ADSK), and more.

The TAM for endpoint security is huge and presents a massive opportunity for SentinelOne. According to Statista, the endpoint security market is forecasted to grow from $11.2 billion in 2021 to over $19 billion in 2025. Fortune Business Insights projects the market to grow at a CAGR (compounded annual growth rate) of 8.3% from 2021–2028. The industry is expanding rapidly, as it is benefiting from multiple tailwinds such as the shift to the cloud, and broader adoption of new technologies like artificial intelligence (AI), internet of things (IoT), and 5g. The increase in cyber threats in recent years also significantly boosted the demand for endpoint security products.

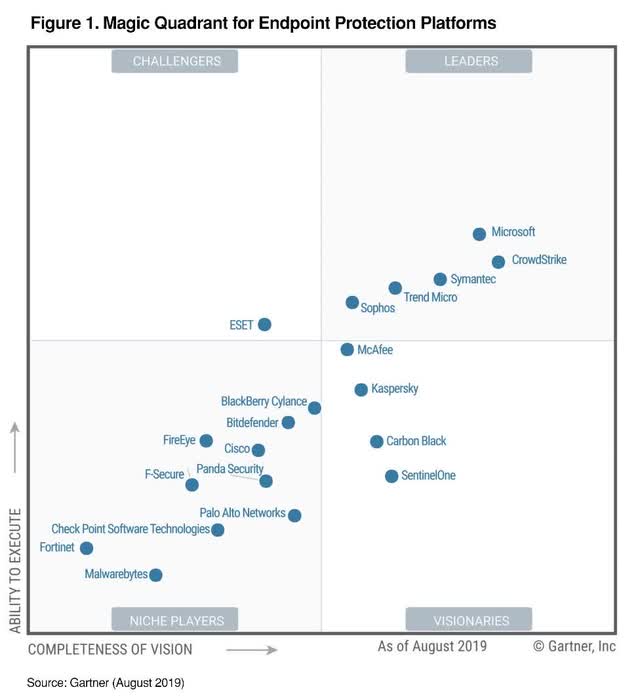

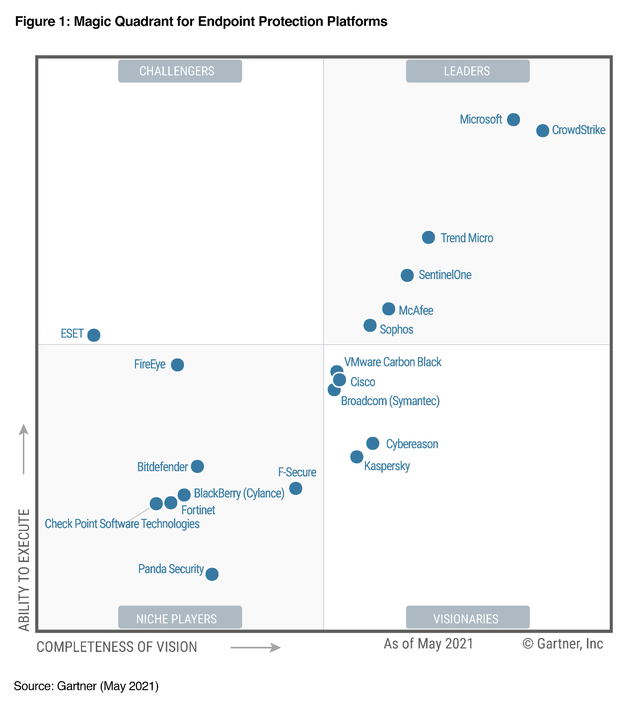

SentinelOne has been gaining strong traction in the past few years. In August 2019, the company was named a visionary by Gartner, as shown in the first graph below. In a little less than two years, it leapfrogged into the leader category, as shown in the second graph. As the company continues to grow exponentially, I believe it will continue to grab market shares and may soon catch up with the likes of CrowdStrike (CRWD) and Microsoft (MSFT).

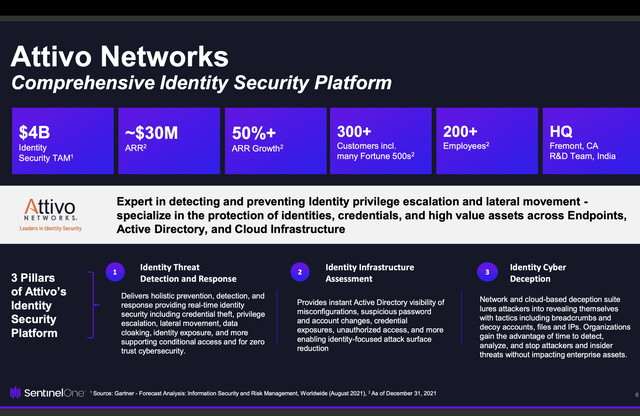

Acquisition

Earlier this year, SentinelOne acquired Attivo Networks for $616.5 million (around 20x price to sales), a leading company in the identity security market. While the price tag is pretty heavy, I really like the acquisition. It allows SentinelOne’s XDR platform to provide a much more complete solution by bringing in the much-needed identity security capabilities, and also expands the company’s addressable market by over $4 billion as it enters the fast-growing identity security space. I believe the improved platform with broadened capabilities will give SentinelOne a stronger competitive advantage moving forward.

Nicholas Warner, SentinelOne’s COO, on Attivo acquisition

“The shift to hybrid work and increased cloud adoption has established identity as the new perimeter, highlighting the importance of visibility into user activity. Identity Threat Detection and Response (ITDR) is the missing link in holistic XDR and zero trust strategies. Our Attivo acquisition is a natural platform progression for protecting organizations from threats at every stage of the attack lifecycle.”

Financials and Valuation

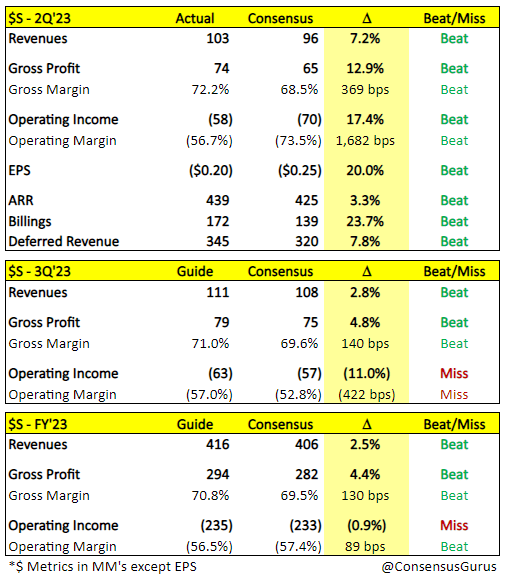

SentinelOne reported its second-quarter earnings last week and they completely smashed it, beating consensus on all metrics. The company reported revenue of $102.5 million, up 124% YoY (year over year) from $45.8 million, while ARR (annualized recurring revenue) increased 122% to $438.6 million. International revenue was one of the fastest growing segments, up 135% YoY, now representing 33% of total revenue. The total customer count increased by 60% to 8,600 while customers with ARR over $100K grew 117% to 755. Dollar-based net retention rate (DBNRR) was a record 137%, up from 125% a year ago. This is driven by the increasing adoption of new modules and cross-selling of adjacent solutions.

Tomer Weingarten, CEO, on Q2 earnings

We once again delivered substantial revenue and ARR growth, both grew over 120% year-over-year, driven by strong demand for our XDR platform across endpoint, cloud and identity. We outperformed all of our expectations in the quarter through strong focus on execution, platform innovation and our partner-friendly go-to-market strategy. Looking forward, we’re raising our full year revenue growth guidance to 103% from prior 98%. We’re combining this rapid growth with meaningful margin improvement, showcasing strong unit economics and operational efficiencies.

ConsensusGurus

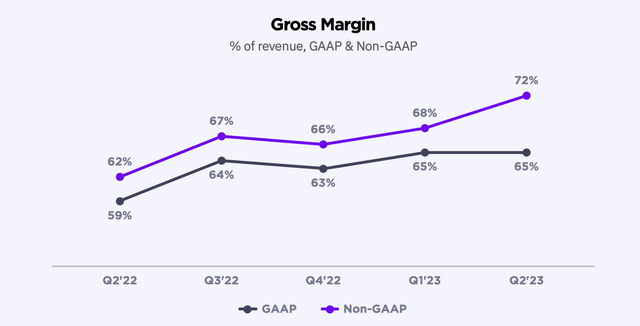

The highlight of the quarter was definitely the improvement in gross margins, which has been the company’s weakness historically. Non-GAAP gross margin for the quarter was 72% compared to 62%, up 1,000 basis points YoY. The significant expansion in gross margins is driven by strong economies of scale.

As the company continues to grow its client base and platform portfolio, it is able to leverage the data ingested and reuse it for other different security applications. It is also benefiting from channel leverage which vastly increases sales efficiency.

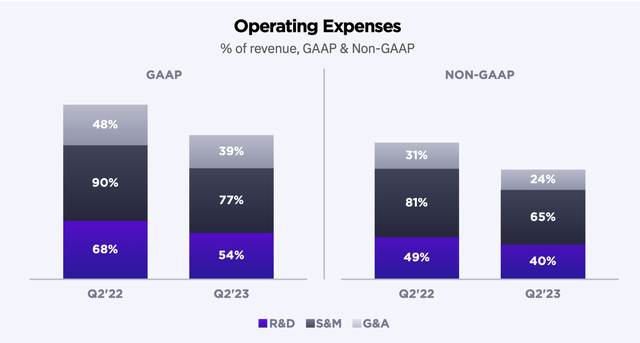

The bottom line remains negative as the company continues to invest heavily back into the business. Operating loss widened from $67.2 million to $108.2 million while operating cash flow went from negative $(72.8) million to negative $(111.5) million. Non-GAAP operating expenses increased 80% from $73 million to $132 million, largely attributed to the increase in R&D and S&M expenses. Operating expenses as a percentage of revenue improved from 160% to 129%. This resulted in the Non-GAAP operating margin for the quarter coming down from (98)% to (57)%, a 42 percentage points improvement. Net loss per share also improved from $(0.57) to $(0.35) this quarter.

I am not too worried about the company’s bottom line at the moment as it is still currently in the hypergrowth stage. I believe profitability will improve as it continues to scale and gain operating leverage. The company’s balance sheet is also very strong. It ended the quarter with approximately $1.2 billion in cash and equivalents, providing a solid buffer for its current cash burn. The company also raised its guidance for both Q3’23 and FY’23, now expecting revenue of $111 million and $416 million respectively, up from $108 million and $406 million.

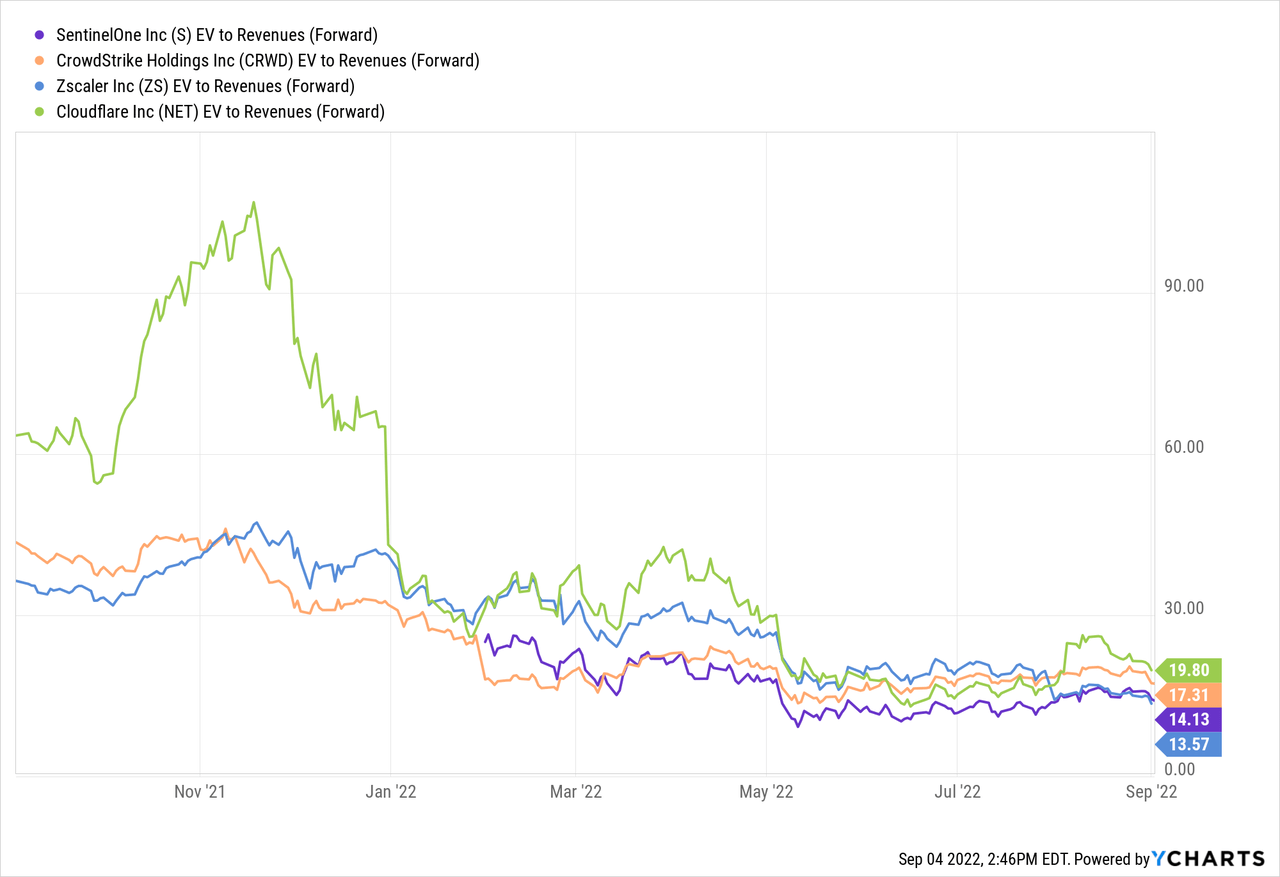

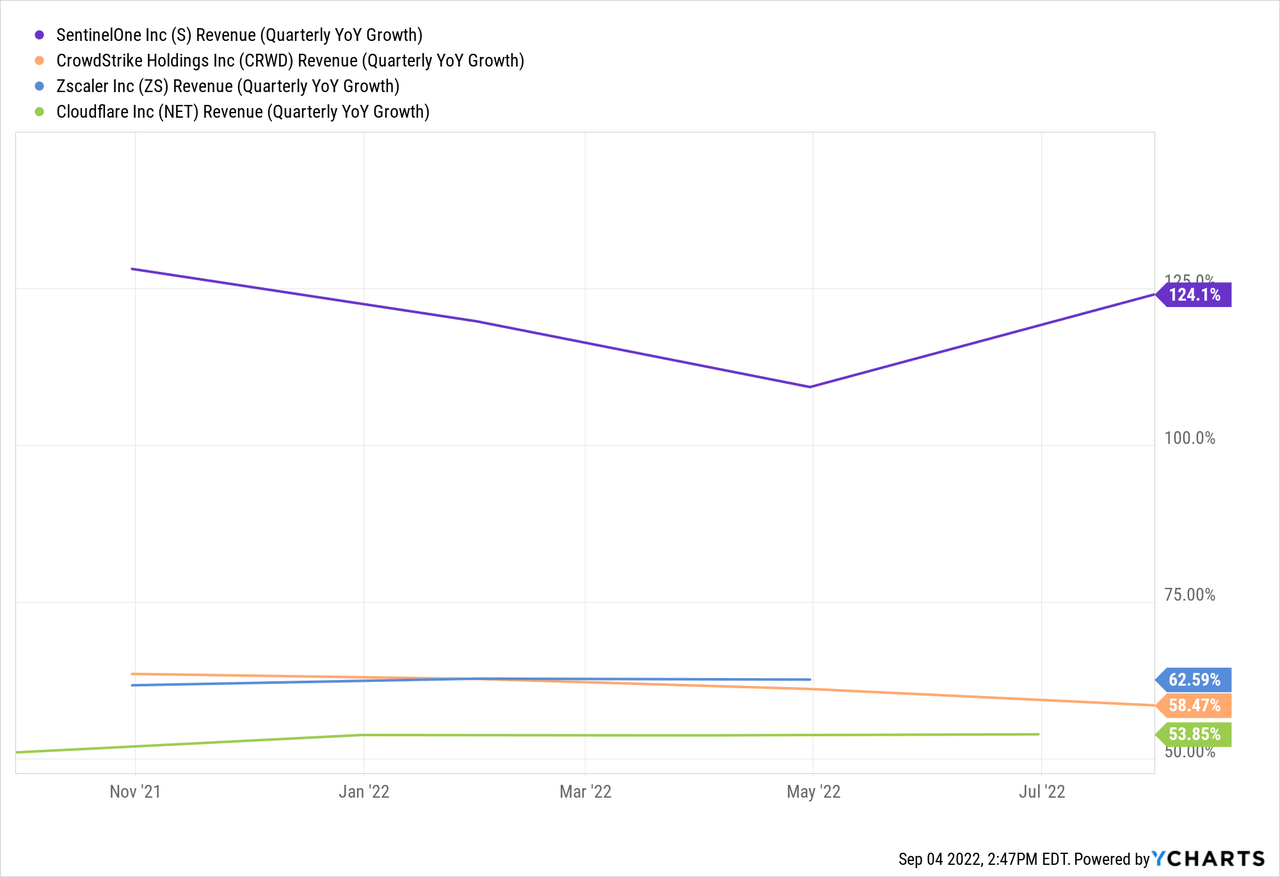

After the massive drop, I believe the current share price for SentinelOne is very compelling. From the first chart below, you can see that on an FWD EV/sales basis, SentinelOne is currently trading at a discount compared to CrowdStrike and Cloudflare (NET), and is on par with Zscaler (I am using EV/sales rather than P/S as it takes the company’s cash and debt position into account). However, in the second chart, you can see that it is actually growing revenue almost twice as fast compared to all of its cybersecurity peers. While SentinelOne historically has lower margins compared to others, it has significantly improved its gross margin in the past few quarters, as mentioned above. I believe the valuation gap is unjustified and the company should be trading at a valuation on par with CrowdStrike and Cloudflare as it continues to post triple-digit revenue growth while improving margins.

Conclusion

In conclusion, I believe the current sell-off offers a good buying opportunity for investors. There are certainly concerns about whether the deteriorating macro environment will affect sales and IT budgets but I believe cybersecurity is one of if not the most resilient industries at the moment. Most companies are unlikely to cut their security spending as the number of cyber threats continues to increase. The industry is also benefiting from multiple tailwinds such as digital transformation and the shift to the cloud.

Despite facing tough conditions, SentinelOne still managed to grow revenue by over 120% and continue to improve its margins, demonstrating the strength and resilience of the company. It is also trading at a discounted valuation compared to its peers when considering its growth rate. Therefore, I rate SentinelOne as a buy at the current price.

Be the first to comment