nantonov/iStock via Getty Images

Investment thesis

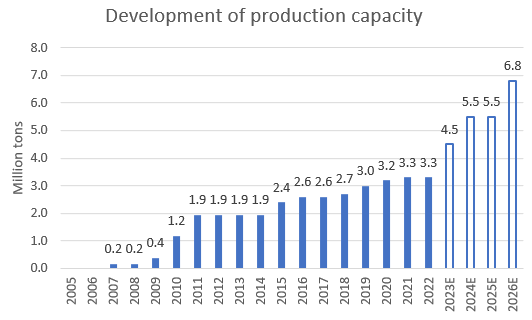

Buffett once (or twice?) said something clever and this time it went something like this: “when a management team with a good reputation tackles a business with a reputation for poor fundamentals it’s the reputation of the business that remains intact”. He was at least partly referring to the old textile operations of Berkshire Hathaway which couldn’t compete with textile mills in countries with lower labor costs. He praised his management team of Berkshire Hathaway’s textile mills often in his annual investor letters but, ultimately, the poor business fundamentals of US textile mills retained their reputation. My point being that it may be smart to heed Buffett’s advice and invest in companies with megatrends as a tailwind instead of a headwind. If I caught your attention, then look no further than Neste (OTCPK:NTOIF; OTCPK:NTOIY). The megatrend Neste is benefitting from is perhaps the biggest one of them all, namely the green transition. Throw in being the market leader in its segment, producing average annual returns on net assets of 38% during the last five years, expecting to double production capacity over the next five years and you have a compelling investment case. The catch? The valuation.

Company overview

Neste operates in the refinery market which, in the simplest terms, means it refines renewable raw materials and oil into products that can be used in different applications such as the fuel for a truck or the jet-fuel for an airplane. In addition to this, Neste produces renewable polymers and chemicals and are in the early stages of researching and developing green hydrogen. Neste defines its operations into three business segments:

- Renewable Products uses several different renewable raw material feedstock to produce fuels for the transport and aviation industries. In addition, it also applies the renewables to produce plastics (polymers) and chemicals

- Oil Products refines oil mostly into light- and middle distillates but also heavy fuel oil. These are then used for the usual purposes such as diesel, jet fuel, gasoline and so on

- Marketing & Services owns a network of fuel stations in Finland and the Baltics

The Oil Products segment is becoming less and less important while the Marketing & Services segment contributes only a small amount to Neste’s profits.

I’d also like to note at this point that the Finnish government owns >40% of Neste’s shares which gives me some headaches. State-owned companies may not always act in the owners’ best interests nor make the most rational decisions when trying to win the public’s favor. I’m willing to accept the state-ownership in Neste’s case but it will of course impact the price I’m willing to pay for Neste.

The road to becoming the global leader

Neste’s renewable products production capacity (Company financial statements / company website)

The renewable diesel market

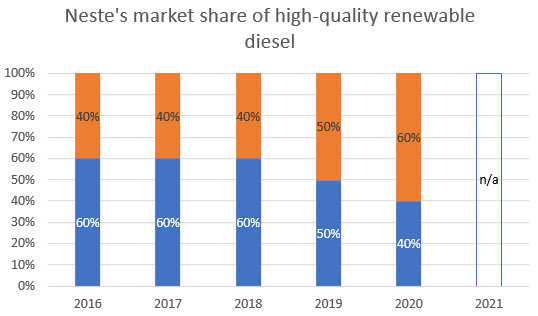

Neste’s market share in renewable diesel (Company financial statements / company website)

Neste is of course not unique in its ability to produce high-quality renewable diesel. Their own market share estimate of high-quality renewable diesel was around 40% in 2020 and has been decreasing since they started reporting it in 2016. Large competitors like Valero Energy have started to ramp up their own production of renewable diesel (estimated total production capacity of about 1 million tons in 2023). This and other competitors’ capital allocation to the market will further erode Neste’s market share. I’m not that worried about that at this point as the total market for high-quality renewable diesel was estimated to be only 8 million tons in 2020 (according to Neste). Logically, there should be enough room for several players to grow as the conventional fuel market is enormous globally (interestingly, I couldn’t find any better source for traditional nor biodiesel volumes that weren’t behind a paywall). My point being that renewable diesel will most likely continue to take market share from the conventional diesels and jet-fuels as companies transition to more sustainable business operations.

Oil Products and Marketing & Services not as interesting

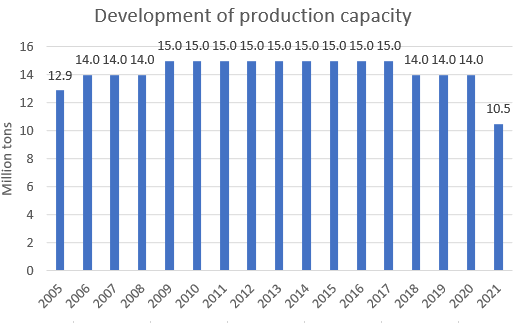

Neste’s oil products production capacity (Company financial statements)

Neste’s roots are in oil refinery but the company has decreased their focus on this segment. The most recent example is the closing of the Naantali oil refinery in 2021 which decreased total production capacity to 10.5 million tons. Neste also owns a network of fuel stations in Finland and the Baltics (about 950 stations). These segments are, in my opinion, not as interesting as the renewable products segment when you consider the long-term investment case for Neste which is why I don’t spend a good deal of time on them.

Renewable products

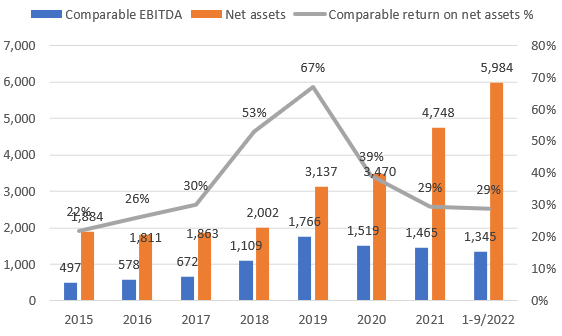

Financial development of Renewable Products (Company financial statements)

A large amount of capital has been allocated to the renewable products segment since the start of 2019 as net assets have increased from about $2 billion in 2019 to almost $6 billion at the end of September 2022. That’s equal to a tripling of the net assets. Earnings (comparable EBITDA in this case) haven’t tripled however. Usually people talk about how fast management are growing earnings but they don’t take into account the extra capital that management invested to generate those incremental earnings. After all, you and I can also increase our, let’s say, dividend income by investing additional capital into a dividend paying stock. Do we expect others to treat us as geniuses as we increased our earnings by 15% YoY? Of course not, we invested in the business and were provided an (hopefully) adequate return on that capital. In Neste’s case, earnings have actually decreased since the record year in 2019 even though net assets have increased (an even worse scenario than what I just described). Why is that? Let’s look at the next graph.

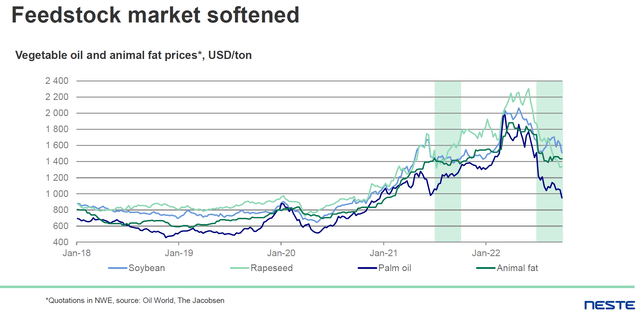

Market prices for renewable feedstock (Company financial statements)

The prices of the feedstock that Neste uses to refine renewable products was relatively cheap in 2018-2019 when they made over 50% return on net assets (RONA). Since 2020 the market has been fairly rich and Neste’s margins have been squeezed due to this. The prices has begun to decrease from their peak earlier in 2022 but it’s hard to predict how prices will behave in the future. With that said, I don’t think any capital intensive business like Neste can earn RONAs of over 50% or even 40% sustainably as the margins would be eroded by more players entering the market. It seems however that a 20% RONA could be achievable when looking at the historical track.

The feedstock input prices is of course a risk to Neste as they are a price taker in these global raw material markets. Demand for these raw materials will most likely increase as more and more players use them to produce renewable fuels. What Neste has done well however is that, over the years, they have acquired different companies that collects, distribute and trade the feedstock that Neste needs for their renewable production such as animal fats (from food industry waste), used cooking oil, vegetable oil etc. Interestingly, Neste has stated that they expect palm oil to be 0% of their total input in 2023. Use of palm oil has of course been controversial historically. Some examples of acquired companies are Walco Foods (as recent as in Q3/2022), IH Demeter, Bunge Loders Croklaan, Count Terminal, Mahoney Environmental and Agri Trading.

Valuation looks rich currently but fair if you have conviction

So what can you buy Neste for currently? TTM comparable P/E is 19.5x. Comparable in this case means that GAAP P/E is adjusted mostly with inventory valuation gains/losses and fair value changes in commodity and currency derivates. This is as it should be as these are non-cash items and can distort the P/E ratio significantly. So 19.5x for a refinery business? Doesn’t sound that fair on initial look considering peers such as Phillips 66 (PSX), Valero Energy (VLO), Marathon Petroleum (MPC), HF Sinclair (DINO)and Cosan (CSAN) are trading at less than 10x P/E. These players are not as heavily skewed towards renewables as Neste however. If you also take into account that Neste’s renewable production capacity will (most likely) double over the next 5 years it could also double the renewable products segment EBITDA holding everything else constant. Current TTM EV/EBITDA is 11.5x and it would decrease well below 10x if my assumptions hold. I’m throwing it in here that Neste’s balance sheet is also solid at 0.5x net debt/EBITDA and the company therefore has financial optionality to raise more debt for incremental acquisitions/expansion capex if need be.

The main reason to invest in Neste is however not what it will be in five years’ time but what it could be decades from now. The company is the market leader in its segment, has a proven best-of-class product (NExBTL-diesel), sound business fundamentals, strong balance sheet and perhaps the strongest reason of all: benefits from the green transition megatrend. Remember, even if Neste’s management team had a poor reputation (which they do not) and tackled a business with a reputation for strong fundamentals, it’s the reputation of the business that remains intact. In other words, it’s hard for management to screw this up.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which ran through November 7. This competition is now closed but stay tuned for the next competition announcement!

Be the first to comment