sarkophoto

From the article title you might be wondering why I would be selling my position in Magellan Midstream Partners, L.P. (NYSE:MMP). This article will be an update on the company, why I’m still bullish, and my personal reasons for selling my position. I still think the units are undervalued and will eventually rerate higher, but I’m taking profits for several reasons.

Investment Thesis

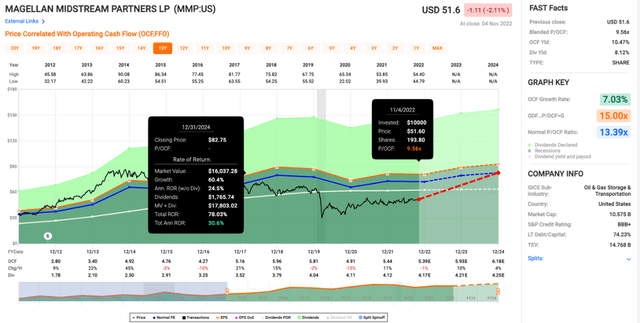

Magellan has a solid reputation among investors as one of the most reliable companies in the midstream MLP space. The company is riding a 20-year distribution growth streak and recently announced a small hike for the Q4 distribution. The valuation is still cheap even after a decent run in recent months just below 10x price/cash flow. After the distribution hike, the yield now sits at 8.1%, and the buybacks continued in Q3. However, I plan to sell my remaining units in the next couple weeks for reasons I will explain below.

Q3 Earnings

Magellan recently reported earnings for Q3. It was another solid quarter. The distribution was raised, which keeps their streak alive. It wasn’t a huge hike (1%), but that puts the forward 8.1%.

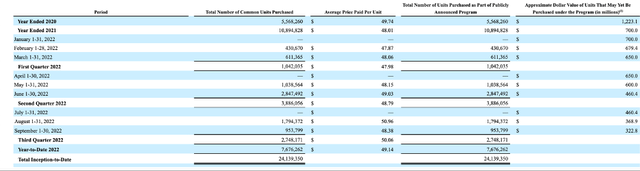

While the business has been stable recently, one of the things that popped out to me while reading the 10-Q was the repurchase program. While plenty of other companies just say how much they spent on buybacks, management does us a favor by showing the monthly breakout below.

The font is tiny, but if you zoom in, you will see that Magellan’s management has been pretty disciplined about not paying over $50 when repurchasing units, which I think is a happy medium for investors. You don’t want buybacks at any price, but if management only buys units after massive declines, then you aren’t going to get the volume of buybacks required to move the needle. I like the price discipline, and even with units slightly over $50, the valuation is still attractive today.

Valuation

Magellan is still trading well below its average cash flow multiple for the last decade. While the distribution growth was obviously more impressive in the first five years below, it has slowed down materially since 2019. I think that is a main reason that units are trading at a lower multiple today. When you combine that with the COVID panic selloff (which units still haven’t recovered from), there are a couple things that likely contributed to the cheap unit price over the last couple of years.

Price/Cash Flow (fastgraphs.com)

While I don’t know if units are worth a 13-14x multiple with the slower growth Magellan has had more recently, I think somewhere in the 10-12x range would make sense. With units at 9.6x cash flows, I think units are cheap enough to be bullish today, even after a solid 10% return YTD in a terrible year for broader markets. Despite my bullish stance, I plan to take my profits and exit the position soon.

Why I’m Selling

There are several reasons I’m selling my remaining units in the coming weeks. A couple are personal, and a couple are related to the company and my overall investment portfolio. The first reason is that I want to start saving up some cash because I plan to move when spring rolls around. I’m not sure where I’ll end up yet, but I’m going to take a road trip and find out. I also want to set aside some cash to make my Roth IRA contribution for the year.

Another reason I will be heading for the exit is to eliminate a K-1 form for 2023. The other main reason is my overall portfolio and my estimated upside for Magellan versus some of the other holdings I own. While I still think there is upside in Magellan, I think some of my other holdings are cheaper today. The last reason is portfolio weighting. Even after selling Magellan, my portfolio will still be very overweight in the midstream sector, as Enterprise Products Partners (EPD) has been my largest holding (by a wide margin) for some time now. I still like the broader energy sector, and recently I have been looking for ways to diversify that exposure. This includes small options speculations in coal and offshore drilling.

Conclusion

It is a tough thing to sell an asset that you are still bullish on. Over the next couple years, I fully expect Magellan to trade above $60 while maintaining its fat distribution. While it’s hard to pass up on what I think will be double-digit returns, there are enough reasons for me to sell my last units of Magellan.

If you are looking for income in the energy sector, Magellan might be an interesting option with a yield of 8.1% and a cash flow multiple below 10x. If you are patient, you might be able to find an entry point below $50 in the coming months, as shares have been bouncing between the mid-$40s and mid-$50s all year.

Be the first to comment