Viorika

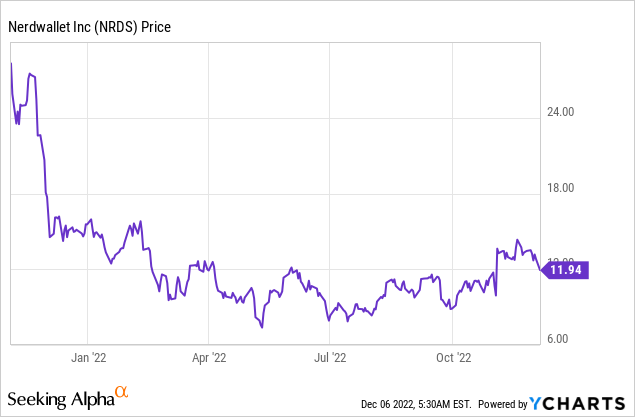

NerdWallet, Inc. (NASDAQ:NRDS) is a popular financial comparison website that helps consumers get the best deals on financial products. The original website was founded 2009 with just $800 of initial capital and provided information about credit cards. Traffic boomed to 30 million users by 2014, and in 2015 the company raised $64 million, at a $500 million valuation. In 2021, the company finally went public and it has had a strong start, recently beating top and bottom line financial estimates in Q3 2022. In this post, I’m going to break down the company’s business model, financials and valuation. Let’s dive in.

Business Model

NerdWallet is a financial website and mobile application which can be used to compare various financial products from loans to credit cards. The business is not a financial advisor in itself, nor does it assume any liability. Instead, the company had a simple business that makes its money mostly from “kickbacks,” or affiliate commissions.

NerdWallet Products (NerdWallet)

The business has grown organically, through marketing spend and acquisitions. In 2016, the company acquired the retirement planning company “AboutLife” for $520 million. In 2020, it acquired U.K based Know Your Money to expand its presence in the country. In July 2022, the company continued to expand and acquired Robo-advisor platform On The Barrelhead (“OTB”) for $120 million.

NerdWallet Loan Comparison (NerdWallet U.K)

Strong Financials

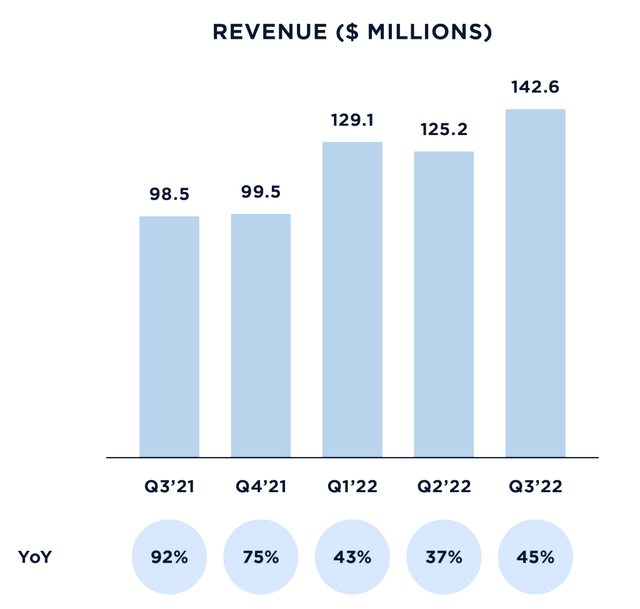

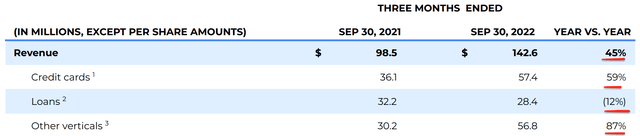

NerdWallet reported strong financial results for the third quarter of 2022. Revenue was $142.6 million, which increased by a rapid 45% year-over-year and beat analyst estimates by $7.9 million.

NerdWallet Revenue (Q3,22 report)

The Credit Card segment was a key growth driver, as it generated $57 million in revenue and increased by a blistering 59% year-over-year. This was driven by strong product feature improvements and a recovery in pricing. This segment looks to have now stabilized at pre-pandemic levels

Loans declined by 12% year over year to $28 million. This was driven by a slowdown mortgages as the rising interest rate environment has curbed the enthusiasm of home purchases. A positive is personal loans still continued to generate solid growth, driven by conversion rate optimization [CRO] improvements across its user experience. In addition, the aforementioned acquisition of OTB has improved personal loans.

The “Other Verticals” segment reported rapid revenue growth of 87% year-over-year to $56.8 million. This was driven by strong growth in its SMB products and banking segment. Banking was a stand-out performance, as its revenue grew by a rapid 250% year-over-year on the back of a spike in savings accounts as consumers wished to benefit from the rising interest rates.

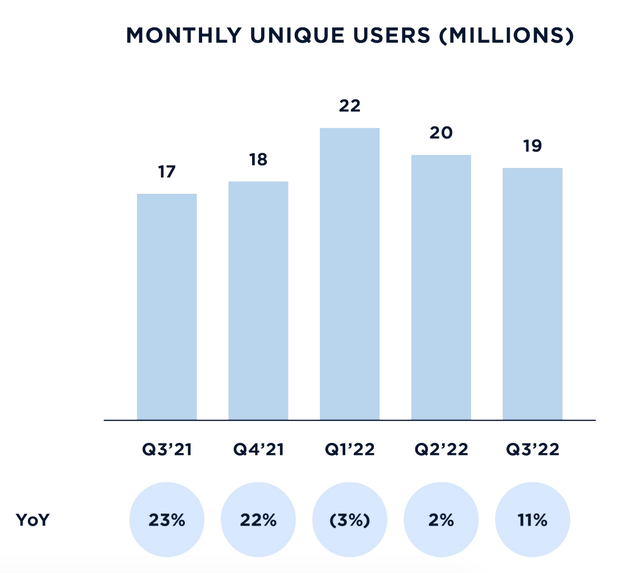

Overall engagement in the NerdWallet ecosystem continued to grow as Monthly Active Users (“MAU”) increased by 11% year-over-year to 19 million people. Even during a recessionary environment, users are actively (if not more so) seeking answers to burning financial questions through community engagement.

Monthly active users (Q3,22 report)

On to profitability. NerdWallet reported $0.01 in Earnings Per Share, which beat analyst expectations by $0.14. This was a stark improvement over the negative $0.16 EPS reported in the third quarter of 2021. This was mainly driven by a $9.9 million one-time tax benefit, related to the acquisition of Barrelhead.

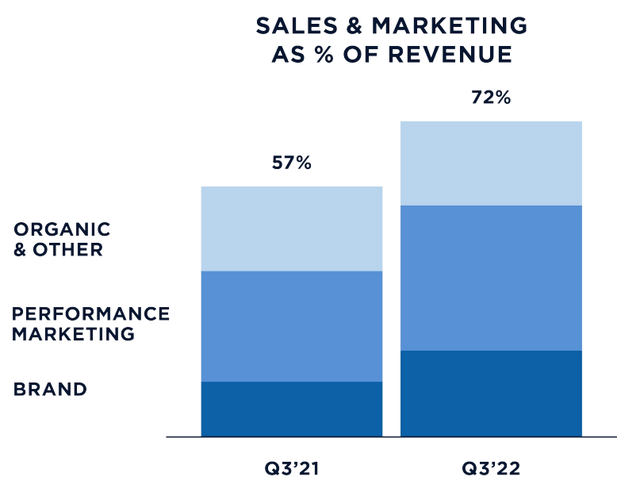

Adjusted EBITDA showed an 11-point margin decline to 10% and $14.5 million as the company invested into its first national brand campaign. Sales and Marketing expenses as a portion of revenue increased from 57% to 72%. This increase in expenses was mostly driven by the aforementioned Brand Marketing campaign (27% of expenses), as the company aims to keep its brand top of mind. Brand Marketing is often criticized as old-fashioned and difficult to measure. However, Airbnb (ABNB) has proven that building a brand is a great way to actually lower your customer acquisition costs longer term. This is because once a customer knows your brand, they will be more likely to visit your website direct, cutting out the middle man. Nerd Wallet already reports that 70% of its website traffic comes from direct or unpaid sources and, thus, this isn’t a crazy idea. In addition, the majority or 46% of its expenses are still spent on ROI-based Performance Marketing, thus the business is capturing the best of both worlds.

Sales and Marketing Expenses (Q3,22 report)

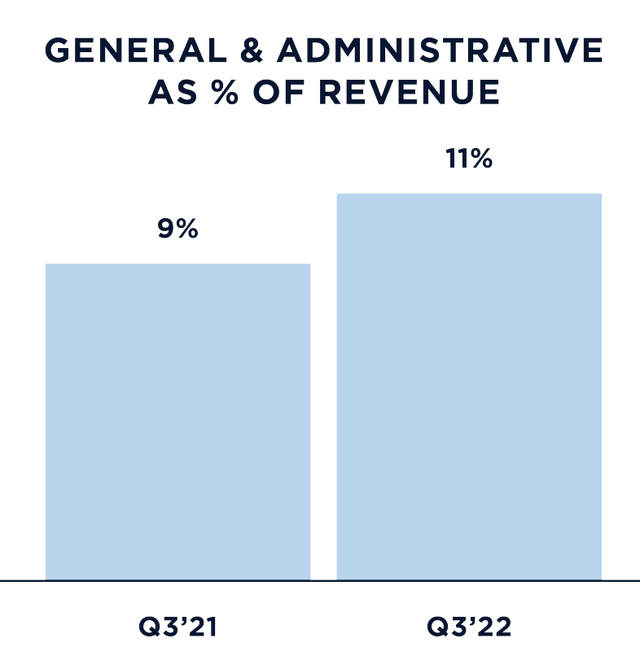

General & Administrative expenses did increase by an eye-watering 70% year-over-year, due to increased costs related to public company capabilities and acquisition costs. A positive is as a portion of revenue, G&A expenses were only 2% higher.

General and Administrative expense (Q3,22 report)

The company has a solid balance sheet with $138.4 million in cash and cash equivalents. This is in addition to $70 million in debt, which was a result of financing the cash portion of its Barrelhead acquisition, through the use of its credit facility.

Advanced Valuation

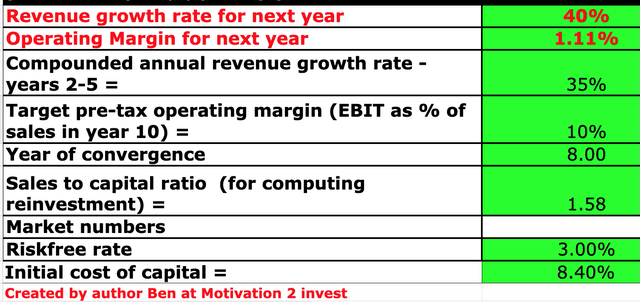

In order to value NerdWallet, I have plugged the latest financial data into my advanced valuation model which uses the discounted cash flow (“DCF”) method of valuation. I have forecasted 40% revenue growth for next year, aligned with the midpoint of management guidance, which I have extrapolated out. In addition, I have forecasted 35% revenue growth over the next 2 to 5 years, as the business continued to grow and benefit from a recovering economic environment.

NerdWallet stock valuation (created by author Ben at Motivation 2 Invest)

To increase the accuracy of the valuation, I have capitalized R&D expenses, which has lifted net income. I have forecasted the company to have a pre-tax operating margin of 10% over the next 8 years as the business benefits from brand marketing and operating leverage.

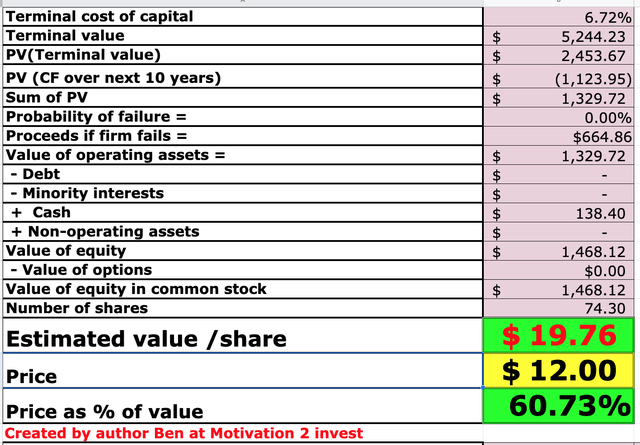

NerdWallet stock valuation 2 (created by author Ben at Motivation 2 Invest)

Given these factors I get a fair value of $19.76 per share. The stock is trading at $12 per share at the time of writing and is thus ~40% undervalued.

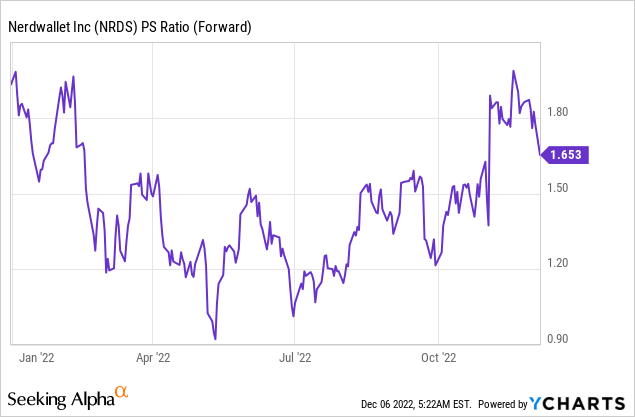

As an extra data point, NerdWallet trades at a Price to Sales ratio = 1.6, which is cheaper than the historic levels in 2020 and 2021.

Risks

Recession/High-Interest rates

The high inflation and rising interest rate environment have caused many analysts to forecast a recession. During a recessionary environment, loan defaults often increase and people often miss credit card payments. In addition, the high-interest rate environment is already impacting the mortgage part of the business thanks to a tepid housing market.

Final Thoughts

NerdWallet, Inc. is a diversified financial services company that has a low Capex online business model. The company has continued to generate strong financial results despite the tough economic climate. In addition, NRDS stock is undervalued intrinsically, thus it could be a great long-term investment.

Be the first to comment