onurdongel

In 3Q 2022, Devon Energy (NYSE:DVN) net earnings increased by 125% YoY as energy prices hiked in 2022. In my last article on Devon, I said that the company’s Delaware Basin revenues will remain high. As oil and gas production in the Permian region and DVN’s capital expenditures in the Delaware Basin are still increasing, I expect that despite decreased prices, the company’s Delaware Basin revenues to remain high. Overall, due to the company’s recent developments and acquisitions and its increasing upstream capital expenditures and increasing oil and natural gas production in the United States (despite lower global demand), Devon’s oil, NGL, and natural gas production in the fourth quarter will be higher than in the third quarter of 2022. However, due to the negative effect of lower energy prices, DVN’s realized prices in 4Q 2022 will be lower than in 3Q 2022. Even with the current prices that are lower than a few months ago, the market condition is still in favor of Devon Energy and the company will make huge profits. Thus, the stock is a buy.

Quarterly results

In its 3Q 2022 financial results, DVN reported total revenues of $5432 million, compared with 2Q 2022 total revenues of $5626 million and 3Q 2021 total revenues of 3466 million. The company’s production expenses increased from $555 million in 3Q 2021 to $729 million in 2Q 2022 and increased further to $735 million in 3Q 2022. DVN’s total expenses increased from $2502 million in 3Q 2021 to $3131 million in 2Q 2022, and then decreased to $2967 million in 3Q 2022. The company reported 3Q 2022 net earnings attributable to Devon of $1893 million, compared with $1932 million in 2Q 2022 and $838 million in 3Q 2021. Devon’s total assets increased from $21025 million on 31 December 2021 to $23557 million on 30 September 2022. Its total equity increased from $9399 million on 31 December 2021 to $11007 million on 30 September 2022.

Devon’s oil production in the third quarter of 2022 was 294 MBbls/d, compared with 300 MBbls/d in 2Q 2022, driven by lower oil production in Delaware Basin, Anadarko Basin, and Powder River Basin, partially offset by higher oil production in Williston Basin. The company’s natural gas liquids production decreased from 156 MBbls/d in 2Q 2022 to 154 MBbls/d in 3Q 2022, driven by lower production in Delaware Basin and Williston Basin, partially offset by higher production in Anadarko Basin. Finally, DVN’s gas production increased from 961 MBoe/d in 2Q 2022 to 1000 MBoe/d in 3Q 2022, driven by increased production in Delaware Basin, Anadarko Basin, Williston Basin, and Eagle Ford Basin.

“We also took important steps to opportunistically strengthen the quality and depth of our asset portfolio by closing on two highly accretive bolt-on acquisitions that further enhance our ability to deliver sustainable long-term results,” the CEO commented. “As a result of the immediate value these acquisitions create, we are revising our financial and operational outlook higher for the fourth quarter,” he continued.

The market outlook

Devon’s total capital expenditure increased significantly from $580 million in 2Q 2022 to $3222 million in 3Q 2022, driven by considerable acquisitions and higher upstream capital expenditures. DVN’s capital expenditure in Delaware Basin increased by 19% QoQ to $444 million, in Anadarko Basin increased by 31% QoQ to $55 million, in Williston Basin increased by 171% QoQ to $57 million, in Eagle Ford increased by 3% to $38 million, and in Powder River Basin increased by 19% QoQ to $44 million.

Devon’s oil realized price (including cash settlements of $(8.60) per barrel) in 3Q 2022 was 84.38 per barrel, compared with $95.80 in 2Q 2022 and $57.59 in 3Q 2021. The company’s natural gas liquids realized price (with zero cash settlements) in 3Q 2022 was $34.44 per barrel, compared with $40.28 in 2Q 2022 and $30.80 in 3Q 2021. Finally, DVN’s gas realized price (including cash settlements of $(1.42) per thousand cubic feet) was $5.83/Mcf, compared with $5.06/Mcf in 3Q 2022, and $2.77 in 3Q 2021.

In the third quarter of 2022, WTI crude oil price, Henry Hub natural gas price, and Mont Belvieu NGL price, were $91.87/Bbl, $39.67/Bbl, and $8.20/Mcf, respectively.

According to International Energy Agency (IEA), due to the weakening global economy, the world oil demand is projected to decrease to 1.6 mb/d in 2023 from 2.1 mb/d in 2022. China’s low growth rates as a result of COVID-19, the energy crisis in the European Union as a result of the war in Ukraine, and U.S. dollar appreciation as a result of the Fed’s hawkish monetary policy to combat inflation, cause oil consumption to decrease. Thus, WTI crude oil price decreased significantly in the past few weeks, to $75 per barrel (see Figure 1).

However, the relaxation of COVID-19 restrictions in parts of China is happening, implying that the country’s economy may start to recover (it is important to know that the country’s zero COVID-19 policy is still continuing and we cannot expect the policy to end soon as the number of new cases hiked recently). Also, OPEC+ announced that it will stick to its existing policy of reducing oil output by 2 million barrels a day from November through 2023. Moreover, the EU embargo on Russian crude oil has started (The European Union decided to ban Russian oil imports from 5 December 2022, and G7 agreed to impose a cap of $60 per barrel on Russian crude). Thus, oil prices are supported. However, without stronger signs that can be interpreted as China’s economic recovery, I don’t expect Oil prices to increase significantly.

Figure 1 – WTI crude price

Also, Henry Hub natural gas price decreased from $7.7/MMBtu on 23 November to $5.9/MMBtu on 5 December 2022 (Figure 2) as Freeport LNG delayed the restart of its LNG export plant, leaving more gas in the domestic market. Also, the weather has not been as cold as it was expected. Thus, gas storage in U.S. utilities increased. Furthermore, the U.S. average gas output increased to a monthly record of 99.5 bcf/d, up from 99.2 bcf/d in October. However, the next weeks will be colder, and domestic natural gas demand will increase. Also, Freeport LNG export is expected to be started by the end of the year, meaning there will be lower natural gas for domestic use. Thus, I expect Henry Hub natural gas prices to bounce back. Altogether, DVN’s natural gas average realized price in 4Q 2022 will be lower than in 3Q 2022. However, I expect the company’s natural gas realized price in 1Q 2023 to increase.

Figure 2 – U.S. natural gas price

4Q 2022 revenue estimation

DVN expected its 4Q 2022 oil production to be between 319 to 326 MBbls/d. The company expected its NGL production to be between 154 to 161 MBbls/d. Finally, Devon expected its 4Q 2022 gas production to be between 1000 to 1040 MMcf/d. Also, the company expects its 4Q 2022 oil, NGL, and gas production to be 640 to 660 MBoe/d, compared with 3Q 2022 total production of 614 MBoe/d. Furthermore, DVN expects its total upstream capital expenditures to be between $845 to $915 million, compared with $639 million in 3Q 2022.

For the fourth quarter of the year, Devon planned to operate 16 rigs and 3 completion crews across its 400,000 net acres in the Delaware Basin. The company’s number of new wells in the fourth quarter of 2022 will increase as it plans to have 215 new wells in 2022. In the Anadarko Basin, DVN expects the number of its new wells in 4Q 2022 to be 25. In the Williston Basin, Devon will bring online more than 10 wells in 4Q 2022. In Eagle Ford, the company expects to bring online 20 new wells in 4Q 2022. In Powder River Basin, the company expects the number of its new wells in 4Q 2022 to be 5.

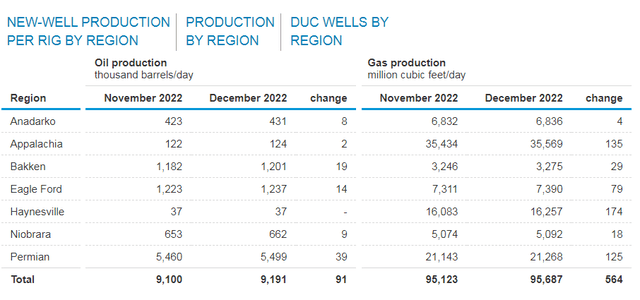

According to EIA’s drilling productivity report (released on 14 November), in December, oil production and gas production in the Anadarko region is expected to increase by 8 thousand barrels per day and 4 million cubic feet per day, respectively (see Figure 3). Oil production and natural gas production in the Appalachia region is expected to increase by 2 thousand barrels per day and 135 million cubic feet per day, respectively. In the Bakken region, oil production and natural gas production are expected to increase by 19 thousand barrels per day and 29 million cubic feet per day, respectively. In the Eagle Ford region, oil production and natural gas production are expected to increase by 14 thousand barrels per day and 79 million cubic feet per day, respectively. In the Niobrara region, oil production and gas production are expected to increase by 9 thousand barrels per day and 18 million cubic feet per day, respectively. Finally, in the Permian region (the Delaware Basin lies within the Permian region), oil production and gas production are expected to increase by 39 thousand barrels per day and 125 million cubic feet per day, respectively.

Thus, DVN’s revenue is positively affected by the higher production in the fourth quarter of 2022. However, the company’s revenue is negatively affected by lower oil and natural gas prices in the fourth quarter of the year. As the negative effect of the lower prices is stronger than the positive effect of the higher production, I expect DVN’s 4Q 2022 revenue to be lower than in 3Q 2022. However, the company’s 4Q 2022 revenues will be higher than in the same period last year.

Figure 3 – U.S. oil and gas production by region

Summary

Higher oil, NGL, and natural gas production as a result of Devon’s recent acquisitions and significantly high upstream capital expenditures, affect the company’s revenues positively. However, lower energy prices as a result of the weak global economy will affect DVN’s revenues negatively. I expect the company’s 4Q 2022 results to be stronger than in 4Q 2021; however, not as strong as in 3Q 2022. Even with the current oil and natural gas prices, Devon will continue benefiting from its expanded operations. I am bullish on DVN.

Be the first to comment