Esther Derksen/iStock via Getty Images

Overview

Nerdwallet is a financial website that earns money through affiliate marketing. What this means is that it is a lead generator for its financial customers. Users of the website browse and compare various credit products, and Nerdwallet earns a commission when they purchase any of these.

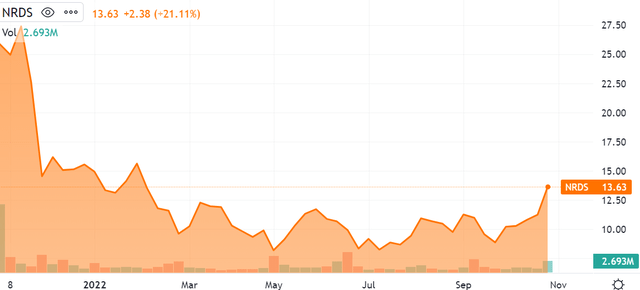

Going through with an initial public offering in Q4 2021, Nerdwallet entered the market at $18 per share. It has depreciated significantly since then, in line with the overall market.

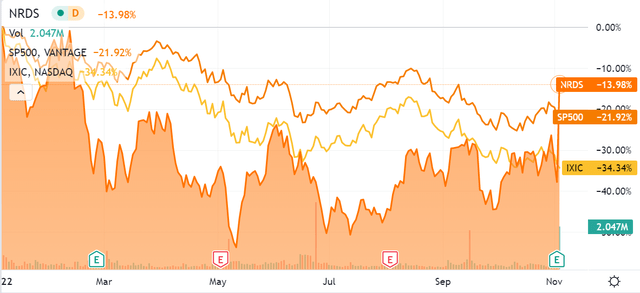

Year-to-date, Nerdwallet was performing roughly in line with the NASDAQ composite:

However, November 3rd 2022 is the day that things became interesting for this stock. Nerdwallet is up 40% as of this article and is now well beyond both the SP500 and NASDAQ as to year-to-date performance.

Given that the company just released earnings after market close yesterday, there is clearly something to see here. We will investigate what’s driving this stock’s significant appreciation and determine if it makes sense to establish a position after such a significant price move.

Earnings

First and foremost, Nerdwallet published an earnings per share of $0.01, which was $0.14 above Wall Street estimates. Worth noting is that this is GAAP EPS, which generally allows us to accept it at face value.

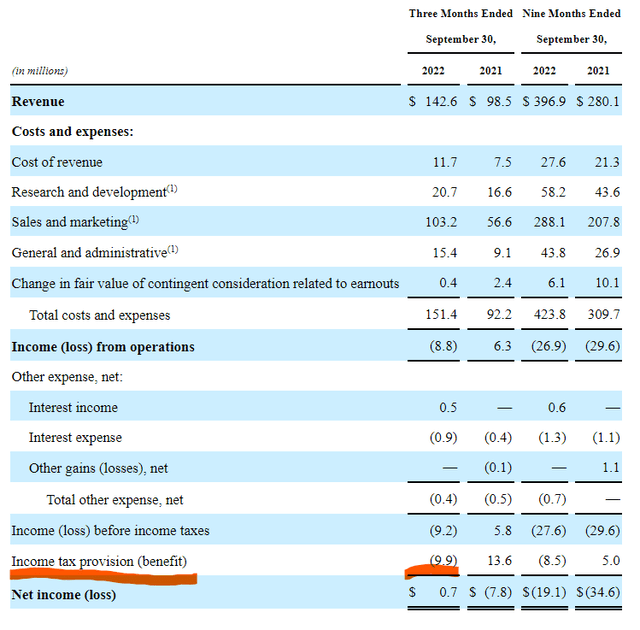

Not so fast, though – things get much more complicated when we actually look at firm’s 10-Q filing:

SeekingAlpha.com NRDS 10-Q 11.2.2022

Let’s go through this line by line and compare Q3 2022 to Q3 2021. Revenue grew from $98.5M to $142.6M – an increase of 44.7%. This is certainly healthy revenue growth, but I know people in Silicon Valley that would disagree. A company with less than a $1B yearly revenue would be expected to put up higher growth metrics than this, and well-known brands often have. However, this is not Silicon Valley, so we will chalk it up as good.

Looking into Costs & Expenses, the picture becomes less rosy. In Q3 2022, Total Costs & Expenses rose from $92.2M to $151.4M – a whopping 64.2% increase.

This was driven primarily by a $46.6M (82.3%) increase in Sales & Marketing costs. We must now determine how to interpret this. Oftentimes in business we find companies that have to expend this kind of capital in order to consistently drive sales; without it, the firm’s top line revenue falls. Alternatively, some companies spend heavily on marketing in order to achieve a dominant market position – and then taper off. It is unclear which one Nerdwallet falls into just yet, but I am always inclined to take a skeptical outlook first – especially when company basically doubled its spend on this.

G&A costs also increased by $6.3M from Q3 2021. Since this kind of cost is more structural, and does not tend to go down, it’s worth asking what percentage of quarterly revenue this represents. For Q3 2021 this comes in at 9.2%, and for Q4 2022 it is 10.8%. The fact that G&A costs are a higher proportion of revenue than they were one year ago is not a good indicator of business model strength.

Looking further, we see that Nerdwallet actually generated a net operating loss because of its significant marketing spend. How, then, did it arrive at a positive GAAP EPS for the quarter?

The answer is taxes. As indicated in the chart above, Nerdwallet leveraged a tax provision of $9.9M to bring itself into profitability for the quarter. Although the details of this are complex, it is basically using something that it had in its pocket because of the way it accounted for things previously. This is financial engineering at its best, although I don’t want to jump to conclusions.

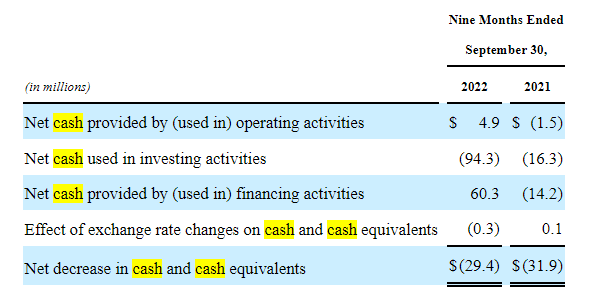

Let’s take a look at the cash. As mentioned by the CEO on the earnings call, the firm had $126M cash on hand. As to cash flow, the 10-Q includes results on a rolling 9 month basis but does not break it down quarter by quarter:

SeekingAlpha.com NRDS 10-Q 11.2.2022

Since the firm expended $70M in cash during Q2 2022 to purchase ‘On the Barrelhead’, which was a similar offering to Nerdwallet’s, it actually lost cash during that time. However, the press release for the acquisition states that Nerdwallet leveraged its credit facility for that $70M – which means it would not necessarily be showing up as a cash expense in the way that it is. This requires further study, as accounting standards are complex enough to allow for both situations to be present.

Net cash from operations came in at $4.9M over the rolling 9 month period concluding at the end of Q3 2022. This is a small number compared to the other cash flows the firm is working with, and certainly gives me pause.

Conclusion

Overall this is not a story I am buying at the moment. If everything checked out neatly from a look at the 10-Q, then I would accept the companies surge in price today. This is not the case, however. I am skeptical due to the firm’s poor ability to generate operating cash flow, rapidly rising costs, and the fact that it swung into profitability through accounting as opposed to business performance. I think the market is getting ahead of itself, and I will rate this stock a sell at this time.

Be the first to comment