S&P 500, HANG SENG, ASX 200, ASIA-PACIFIC MARKET WEEKLY OUTLOOK:

- Wall Street equities rebounded on strong non-farm payrolls report, retreating yields

- Senate Democrats passed a $1.9 trillion Covid relief package on Saturday, paving way for a faster recovery

- US inflation rate, ECB and BoC interest rate decisions and China’s National People’s Congress are in focus this week

Recommended by Margaret Yang, CFA

Get Your Free Equities Forecast

NFP, US Stimulus, ECB and BoC Interest Rate Decision, Asia-Pacific Stocks Weekly Outlook:

Asia-Pacific equities kicked off the week with an upbeat tone following a strong session on Wall Street last Friday. The S&P 500, Dow Jones and Nasdaq Composite rebounded 1.95%, 1.85% and +1.55% respectively after the release of a robust US nonfarm payrolls report. The figure came in at 379k, beating the baseline forecast of 182k by a wide margin. The previous month’s reading was revised up to 166k from an initial print of 49k, further underscoring a decent rebound in the service sector with rapid vaccine rollout.

More encouragingly, Senate Democrats passed the US$ 1.9 trillion Covid relief package on Saturday, and the bill is expected to be sent to President Joe Biden’s desk before March 14 to extend unemployment aid programs. The fruition of the long-anticipated fiscal stimulus is likely to boost equity market sentiment on the back of more household spending, faster vaccine distribution and continuous unemployment aid.

Across the Pacific Ocean, the National People’s Congress is held in Beijing this week, in which Chinese policymakers are setting the country’s development goal for 2021 and beyond. Some key highlights in the opening of the ‘two sessions’ include setting the GDP growth target for 2021 at above 6%, a level that is more conservative compared to most economists’ forecasts of above 8%. The government also aimed to increase research and development spending, address climate issues and expedite multilateral trade deals with regional partners.

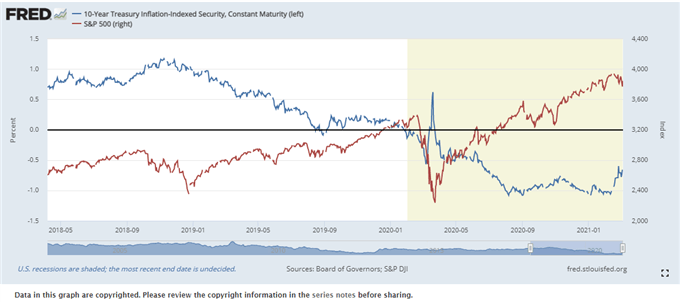

The closely-watched 10-Year US Treasury yield receded slightly after reaching a fresh 12-month high of 1.622% on Friday, alleviating pressure on risk assets. Longer-dated yields are usually moving in tandem with inflation expectations, which has been propelled by rising commodity prices and reflation hopes lately. Last week, Fed Chair Jerome Powell disappointed markets by reiterating that the Fed’s current monetary policy is appropriate without addressing any plan to rein in rising borrowing costs.

Rising yields have dented equity market sentiment and led to heightened market volatility recently. Therefore, this week’s US headline and core inflation data will be closely watched for clues about the pace of increase in consumer price levels, which could affect the market’s perception of the Fed’s future tapering route. With crude oil prices surging more than 80% over the last four months, the headline inflation rate is expected to climb to 1.7% YoY from the prior month’s reading of 1.4%, while core inflation (excluding fuel and food) is forecasted to remain unchanged at 1.4% YoY.

S&P 500 Index vs. 10-Year Treasury Inflation-indexed Security

Source: FRED

Australia’s ASX 200 indexopened up 1.13% and traded higher, setting a positive tone for other Asia-Pacific markets. Equity futures across Japan, Hong Kong, Taiwan, Singapore, Malaysia and India are pointing to a higher start as well. Gains in Australian stocks were led by materials (+2.58%), information technology (+2.25%) and healthcare (+1.38%) sectors. All 11 ASX 200 sectors were up at open.

Hong Kong’s Hang Seng Index (HSI) is poised for a rebound on Monday after suffering a global tech selloff last week. Technology companies namely Tencent, Alibaba, Xiaomi and Kuaishou may embrace a relief rebound amid improved sentiment.

Traders are facing a busy week ahead in terms of macro events: The European Central Bank (ECB) and Bank of Canada (BoC) interest rate decisions headline the economic docket alongside US inflation and University of Michigan consumer sentiment data. The ECB is widely expected to hold policy unchanged in the upcoming meeting on March 11th, but traders will closely scrutinize any hint about twisting the asset purchasing program to address rising longer-dated yields.

The BoC, on the other hand, will be closely watched for its response to the recent surge in housing prices and rising inflation expectations. There has been growing speculation that the central bank’s next move will be to taper its pace of asset purchases. For more macroeconomic updates, please clickDailyFX calendar.

Recommended by Margaret Yang, CFA

Introduction to Forex News Trading

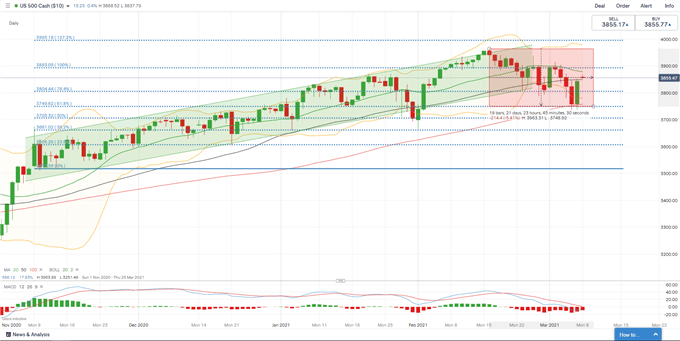

S&P 500 Index Technical Analysis:

The S&P 500 index entered a technical correction after breaking the “Ascending Channel” in the end of February. The index appears to have found a strong support at the 100-Day Simple Moving Average (SMA) line and has since rebounded from there. A daily close above the 50-Day SMA (3,847) would probably intensify buying pressure and carve a path for price to challenge another resistance level at 3,893 (100% Fibonacci extension). The MACD indicator is about to form a bullish crossover, suggesting that near-term momentum may turn upwards.

S&P 500 Index – Daily Chart

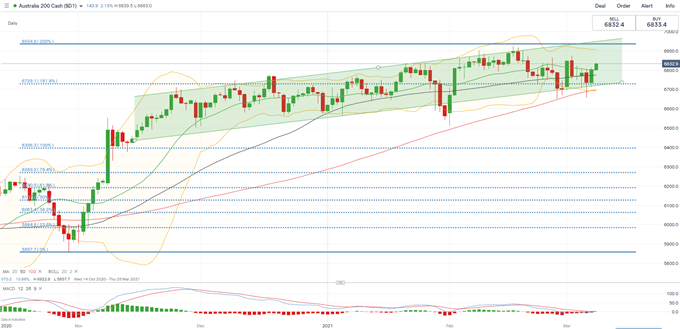

ASX 200 Index Technical Analysis:

The ASX 200 index remains in an “Ascending Channel” and has rebounded from the 161.8% Fibonacci extension level (6,730). The overall trend remains bullish as suggested by upward-sloped moving average lines, but a minor correction seems to be underway. Holding above 6,730 – the 161.8% Fibonacci extension level – may pave the way for further upside potential towards 6,935 – the 200% Fibonacci extension.

ASX 200 Index – Daily Chart

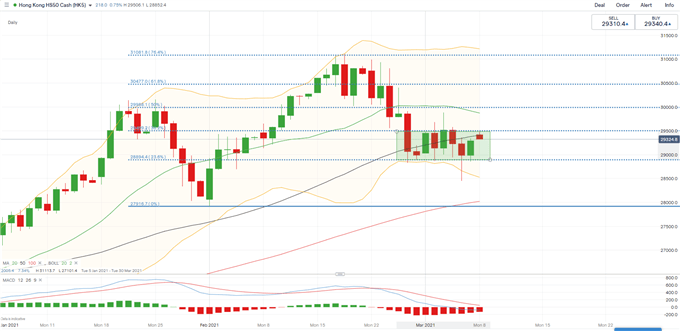

Hang Seng Index Technical Analysis:

The Hang Seng Index hit a strong resistance level at 31,080 (76.4% Fibonacci retracement level) in mid-February and has since entered a consolidative period. Price was mostly range-bound last week between 28,900 (23.6% Fibonacci extension) and 29,500 (38.2% Fibonacci extension). A daily close above 29,500 may intensify buying pressure and carve a path for price to challenge the 50% Fibonacci extension level at 29,990. However, a daily close below 28,900 will probably lead to a deeper pullback towards the next support level at 27,916 (previous low).

Hang Seng Index – Daily Chart

Recommended by Margaret Yang, CFA

Improve your trading with IG Client Sentiment Data

— Written by Margaret Yang, Strategist for DailyFX.com

To contact Margaret, use the Comments section below or @margaretyjy on Twitter

Be the first to comment