Zocha_K/E+ via Getty Images

Investment Thesis

It has been a while since I last covered Neogenomics (NASDAQ:NEO), the cancer testing specialist, and unfortunately, things have deteriorated rapidly since I gave the Fort Myers, Florida based company a “hold” recommendation back in March last year.

In January 2020 and June 2020 I had recommended Neogenomics as a buy, setting a share price target of $50 – a mark that the stock hit in December 2020, before accelerating to trade >$60 in early February 2021.

The following month in my note I sounded a more cautious note, commenting as follows:

The oncological testing sector is growing and Neo is almost uniquely well positioned within it, in my view, thanks in large part to the efforts of its CEO, Douglas Van Oort, who is set to retire in April. Meanwhile, the company has raised ~$500m via a convertible bond issuance and share offering this year, in order to pursue acquisition-led growth.

It could however be a challenging year for Neo as it seeks to restore lost revenues and prioritize its fast-growing Pharma Services business while introducing innovative new products. I think this could create some share price turbulence over the next six months so I remain neutral for now, given the present day valuation of the company anticipates growth ~25% per annum, based on my DCF analysis.

I did say that if things progressed well under the new CEO, Mark Mallon, who joined the company from Ironwood Pharmaceuticals (IRWD), replacing long-time (since 2009) CEO and Chairman of the Board Douglas Van Oort, a target of $80 may not be out of the question, but last week, announcing a cut to its Q122 revenue guidance, Neogenomics also announced that Mallon would step down immediately as CEO, with the share price trading at $14 – down ~70% since Mallon took the reins.

Earnings in Q122 are now forecast to be below the lower end of the forecasts laid out in Neo’s earnings presentation in late February, of $118m – $120m, and EBITDA loss is expected to be worse than the -$12 – -$15m projected in February, owing to “higher than anticipated Clinical Services cost of goods sold.”

Stepping into the shoes of a CEO who has played a long-term, and instrumental role in the growth of a company – Neo’s revenues grew from just $60m, in 2012, to $444m in FY20, before Van Oort stepped down – is often a thankless task, and surrounded by senior execs, most of whom have been at Neo for at least five years, that certainly proved to be the case for Mallon, who has been jettisoned after less than 1 year. According to a press release:

The Interim Office of the CEO will be comprised of Chief Financial Officer, William Bonello, Chief Strategy and Corporate Development Officer, Douglas Brown, and Chief Culture Officer, Jennifer Balliet.

Matters are further complicated by speculation that Neo could become a target for activist investors, such as Jana or Starboard, and news that Guardant Health (GH) was apparently on the verge of acquiring Neo in September last year, before opting against the deal.

Clearly, none of the above has been good news for Neo the business, or Neo the stock, although the activist interest at least brought an end to a brutal bear run, with shares rising ~15% in the past five days.

Neo has not necessarily become a bad company overnight – in 2021, revenues came in at $484m, which was a 9% year-on-year uplift, and 16% discounting COVID PCR test revenues from 2020, net loss was $33m, vs. a profit of only $17m in 2020, and the company’s cash position is still strong – $515m as of Q421 – despite Neo making two significant acquisitions last year – liquid biopsy specialist Inivata, for ~$390m, and precision oncology IT service provider Trapelo Health, for $65m in a stock and cash deal.

Initial guidance for 2022 was for $530 – $550m – an annual increase of 12% at the midpoint, and although we now know that Q1 forecasts will not be met, this was always likely to be trickiest quarter to negotiate, with Omicron headwinds continuing to impact the number of people taking cancer tests, as CEO Mallon discussed in detail on the Q421 earnings call, prior to his abrupt departure.

Perhaps more worrying is the FY22 forecast for net losses of $118m – $133m, which now looks likely to be significantly worse. A major concern is that, amid all of the turmoil, management starts to also lose the battle for market share, fails to integrate the new acquisitions, staff become demotivated, and the whole enterprise begins to unravel.

That is obviously a concern, but for the more optimistic minded investor, you could also argue that, with a current market cap of $1.73bn, even if revenues in FY22 come in at $500m, or $30m less than the lower end of guidance, the company is valued at <4x sales, and even a net loss of $150m can be quite easily absorbed by cash position >$500m.

Neo’s shares have not traded as low as they are now since late 2018, and it’s tempting to wonder if the market is reacting too strongly to missed earnings and revised forecasts, and some poor succession planning. Unfortunately, however, I’m not sure that is the case, and I think Neo may be quite significantly over valued at a market cap of $1.7bn.

In the rest of this post I’ll take a look at some of the fundamentals of Neo’s business, and try to discover if there is any genuine upside potential in Neo as an investment opportunity, or whether the company is struggling to survive without its long-term CEO and Chairman, or indeed whether the CEO and Chairman was bad for business himself.

Neo – The Bull Case – Strong Fundamental Business With High Barriers To Entry

NEO operates cancer-focused testing laboratories across the US with locations in Florida, California, Texas, Georgia and Tennessee, as well as in Switzerland and Singapore. In 2021, the company completed >1m tests, of >500k patients. As discussed in my last note:

Neo provides 6 distinct types of testing. Cytogenetics – a study of chromosome structure usually directed towards patients with hematological malignancies; Fluorescence In-Situ Hybridization (“FISH”) – used to identify gene alterations; Flow cytometry – which looks at the characteristics of cell populations in liquid samples, used in the study of tumors; Immunohistochemistry (“IHC”) and Digital Imaging – to analyse tissue cells and test for cancer; Molecular testing – a new field which analyses DNA using e.g. Sanger sequencing; and Morphologic analysis – which provides diagnostics by analysing cells under a microscope.

After the Inviata acquisition, we can now add liquid biopsy to the list – a quick check online suggests this is a ~$2.5bn market, estimated to grow to between ~$6bn – $10bn by 2027. All of these disciplines have high barriers to entry, and Neo has established a global presence, with 14 locations across three continents.

Neo quotes other statistics in its Q421 earnings presentation supporting growth across most its target markets, such as a projected >30% increase in cancer survivors, to 22.2m by 2030, and an increase in the number of precision oncology therapies that require biomarker testing from 17, in 2007, to 70 in 2019 – good news for Neo when we consider recently acquired Trapelo Health, a specialist in this field.

Clinical Services – where Neo acts as “a non-competitive partner to community-based pathology practices, hospital pathology labs, reference labs, and academic centers” (source: 2021 10K submission) is Neo’s bread and butter business division, that provided 83% of the company’s revenues in 2021. Despite COVID headwinds, these revenues have apparently continued to climb at a rate that is ahead of the overall market growth of 6%-8%.

Even during one of the worst bear markets the biotech sector has experienced, drug developers have continued to raise hundreds of millions in private markets, before raising even more via IPOs, which companies like Neo stand to benefit from significantly, while the large pharma sector has been thriving, generating tens of billions of dollars in operating cash flow, much of which is earmarked for R&D spending.

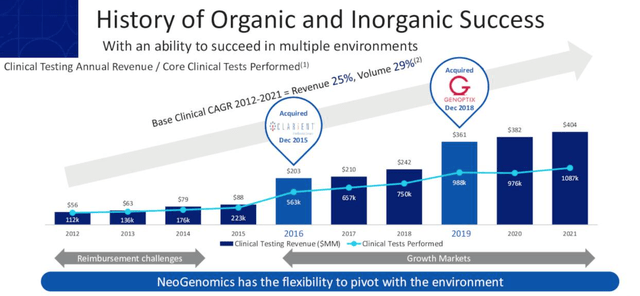

Neo has traditionally grown inorganically also, its growth punctuated by sizeable acquisitions, such as Clarient in 2015 (cancer diagnostics), Genoptix in 2018 (clinical oncology laboratory), and now Inviata and Trapelo, which, incidentally, appear to have been the work of long-time CEO Van Oort, rather than his short term replacement Mallon.

Neogenomics organic and inorganic growth (earnings presentation Q421)

In summary, then, there seem to be a few reasons why investors could be optimistic that Neo can address the share price slump it has experienced since the departure of Van Oort. Firstly, its longstanding presence in high growth markets, which continue to generate top line growth, even if FY22 forecasts have been revised downward.

Secondly, the new products and services – such as the RaDar tumor informed MRD test, which has detected circulating tumor DNA (“CtDNA”) in patients at “levels as low as 6 parts per million with lead times ahead of clinical confirmation ranging from 108 to 253 days,” analysts were told on the Q421 earnings call, and has received a CE mark in Europe and is close to securing reimbursement in the US – open up new and lucrative markets with high barriers to entry.

There’s also cash to cushion the blow of >$100m losses in FY22, and perhaps make further acquisitions, and a senior management team which has been together a long time, who may come to the fore after the appointment of a CEO which clearly did not work out. Even Van Oort remains on the Board of Directors.

Taken together, there is therefore some evidence to support share price growth in FY22, and arguably, $500m of sales and decent top line growth deserves a valuation of 4x sales, which implies there’s 10%-20% upside opportunity here in the short term. For me, however, the substantial losses Neo expects to make this year undermines the P/S valuation thesis, and I think the issues I am about to describe below outweigh the positives discussed above.

The Bear Case – Neo’s Empire Is Crumbling As Competitors Get Stronger and Industry Gets Tougher

As much as you can make a bull case for Neo, it’s easy to see why the share price has been in a downward spiral. Losing a figure as key as Van Oort has clearly had negative repercussions, but it’s also worth asking what kind of state the long-time CEO actually left the company in.

Had Van Oort been papering over the cracks in the business, and making sure he left when the company was at an all-time high point, leaving his successor to cope with a succession of bad business decisions?

In past notes I frequently referred to Neo’s razor thin profit margins, and it seems that the company generally struggled to grow organically. Arguably, acquisitions were made to disguise this fact, rather than for the good of the business, and when the new bolt-on companies started to underperform, a new acquisition was made.

Neo has also blamed pandemic headwinds for poor performance, but many companies have been able to shrug these headwinds off in 2022, while things seem to have been getting worse for Neo, which failed to build on its PCR testing opportunity.

Now there are no longer any profits at the company, and although revenues were initially expected to grow in 2022, perhaps this is entirely down to the new acquisitions, while the bread and butter Clinical Services division shrinks. If revenues fall in 2022, it doesn’t look good for Neo, after management spent nearly $500m on new business.

There is after all plenty of competition in the diagnostics space, and although Neo has tried to differentiate itself from rivals including Lab Corp (LH), and Quest Diagnostics (DGX), and new market entrants such as Illumina (ILMN) – whose Galleri early cancer detection test seems likely to become another major competitor – in reality Neo competes directly against these well resourced rivals, which are profitable, and whose valuations are growing.

Neo doesn’t just compete for market share, but also for staff, M&A deals, and specific clients, and when a well led company becomes a rudderless ship, as Neo seems to have become, it’s bound to have an impact on profitability. Neo does have the cash to cushion the blow of losses, but for not more than a couple of years, and if analysts and the market keep punishing the stock on missed earnings and lowered guidance, it will become increasingly hard to raise funds, investors will be diluted at lower valuations, and a vicious circle of underperformance is created which it is hard to escape from.

Although the departing CEO Mallon can shoulder much of the blame, his failure doesn’t really reflect well on a senior management team that clearly failed itself to gel with the heir apparent, and that arguably implies that something is rotten at the core of the business. If Neo is not coming at its markets from a position of core strength, it will be difficult to integrate the new businesses and even a promising product like RaDar could fail under such circumstances.

Conclusion – The Outlook for 2002 Is Bleak – Things Could Get Worse Before They Get Better

I could add to that conclusion that things may not ever get better, since there are some worrying signs at the company. The shrinking revenues, the fact that Guardant did not follow up on its initial interest in acquiring Neo, and the void at the CEO level.

Although Neo’s revenues are to some extent protected by the high barriers to entry that characterize the diagnostics industry, and its long-term presence within the industry, it could be the case that the company is beginning to be overrun by new market entrants, like Quest, and also now possibly Illumina and Grail.

It seems Neo’s usual response to flat or even shrinking growth is to spend its way out of trouble with a new acquisition, but its cash pool is beginning to shrink.

It’s difficult to know where the blame lies, whether it was with Van Oort, Mallon, or the supporting cast, now charged with finding the next CEO, but a scenario where Neo’s top line revenues shrink for the first time in more than a decade would lead to more share price pain, and that does seem to be the direction in which things are heading.

I’m making a bear case because ultimately, $1.7bn is still a pretty high valuation for Neo, in my view. It may not be much more than 4x sales, but the forecast >$100m losses concern me, despite adjusted EBITDA being lower, at $25 – $40m (although this could now end up significantly worse), and I wonder if, after Q1 results are released, the market cap valuation could start to sink below $1.5bn, and begin to fall <$1bn.

The key issue for me is that Neo still has much further to fall. The company will have quarters 2, 3 and 4 to show that it is headed in the right direction, and to find the right leader, but the pressure is certainly on.

The activist angle may turn out to be the best outcome for NEO, given that there may then be an opportunity to clear the decks and make more of the company’s assets – it still has many areas of business that are capable of performing well for shareholders, I believe. Even if that does happen, however, the turbulence will likely affect the share price in a negative way.

It looks as though matters are coming to a head at Neo, and what happens over the next 12 months may be crucially important to the company’s future. Whatever happens, I think the share price may suffer further, and it will take some time to resolve the issues and drive it back up again, so there may well be much cheaper price points upcoming at which to buy back stock at a cheaper valuation.

Be the first to comment