Douglas Rissing

The release this morning of October Producer Price indices brings yet more evidence that the inflationary pressures sparked by multi-trillion dollar Covid “stimulus” checks in 2020 and 2021 peaked earlier this year, as I have been pointing out for months.

Many factors have contributed to this: growth in the M2 money supply has been essentially zero since late last year, the stimulus checks have ceased, the dollar has been very strong, commodity prices have been very weak, and soaring interest rates have brought the housing market to its knees.

All of these developments mean that the supply of money and the demand to hold it have come back to some semblance of balance, and that is of course essential if inflation is to return to a low and steady rate of, say, 2%.

This all but guarantees that the Fed soon will be scaling back on its tightening agenda. For my money, the FOMC’s November 2 rate hike (from 3.25% to 4.0%) should be the last, but a hike next month of 50 bps (to 4.5%) is likely to be the Fed’s last move for the foreseeable future.

The Fed simply can’t react as fast as the market does to changing realities – unfortunately, the Fed is usually “behind the curve.” In any event, a 4.5% funds rate by year end is fully priced into the market and thus it should not be very impactful.

What will change though is the market’s expectation for where rates will be a year from now: lower than currently expected, and that is what is driving equity prices higher.

What’s most important is that the market is now beginning to see across the valley of uncertainty to a time when inflation comes back down to 2%. It may take up to a year for that to happen, however, but as long as we know that the worst is over, markets can anticipate a lower-inflation future and equity markets can drift higher.

And although it’s very good news that inflation has peaked and is now declining, the bad news is that thanks to the 2020-2021 explosion of M2, the general price level will have suffered a major increase that is unlikely to be reversed. Real incomes have suffered and it will take a long time for them to recover.

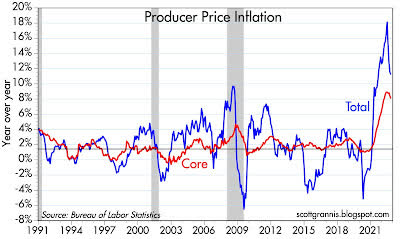

Chart #1

Chart #1 shows the year over year changes in the total and core (ex-food and energy) versions of the Producer Price index. Both peaked about six months ago, and that was about six months after M2 stopped growing.

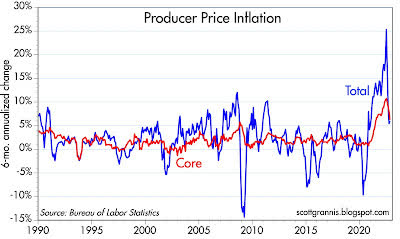

Chart #2

Chart #2 shows the 6-mo. annualized change in the total and core versions of the PPI; this highlights the degree of change that has occurred in the past six months.

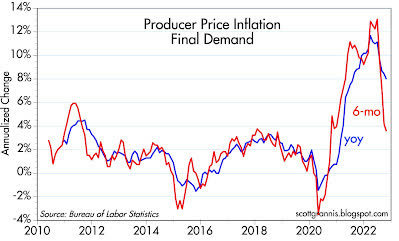

Chart #3

Chart #3 shows the year over year and 6-mo. annualized changes in the final demand version of the PPI (a version which began in 2009). Here the change is even more dramatic.

Overall, these three charts tell a story of a rapid deceleration in the growth of prices in the early stages of the supply chain. These changes are likely to be reflected in the months to come in a moderation of the growth of the CPI.

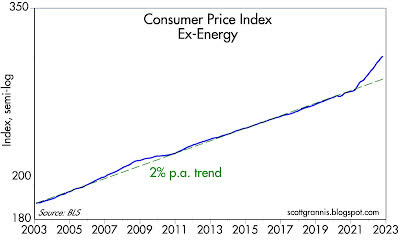

Chart #4

Chart #4 shows the ex-energy version of the CPI index (plotted on a log scale so that changes in growth rates can be more easily visible). This version of the CPI (which I think is best because it eliminates the extreme volatility of energy prices) has been growing at about 2% per year for a long time.

After March 2021, it suddenly picked up to a 7% rate of growth. It is likely to continue to grow faster than the former 2% annual trend for perhaps the next 12-15 months even as the year over year growth rate declines.

I’m guessing that when the CPI returns to a 2% annual growth rate, the index will be at least 10-12% higher than the original 2% trend, and that would be about 20% above the level of March ’21. Meaning, of course, that the price level will have experienced a one-time increase of at least 10% on top of its typical 2% annual rise.

Inflation will be with us for some time to come, but its rate of increase will continue to moderate. This doesn’t mean the Fed has to continue to tighten, however.

Just maintaining its current stance would probably be sufficient to get inflation back down to 2%. That assumes, however, that M2 growth continues to be essentially flat and the government avoids sending out another massive batch of checks funded with the printing press.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment