Editor’s note: Seeking Alpha is proud to welcome Value Ninja as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA PREMIUM. Click here to find out more »

Editor’s note: Seeking Alpha is proud to welcome Value Ninja as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA PREMIUM. Click here to find out more »

NCR Corp. (NYSE:NCR) is an attractively valued business undergoing a significant change with new management at the helm. The company will emerge from the current transition as a much better quality business with higher margins and more recurring revenues. Current valuations woefully undervalue this potential.

Market Sell-Off

The recent sell-off in equities has been brutal. The market seems to be trying to price in some kind of Zombie Apocalypse and has without doubt created many investment opportunities for long-term investors. This applies to all investment styles, be it “Growth” or “Value”.

I have been following NCR for a few months, and the stock has suffered greatly in the Coronavirus sell-off, falling from $35 to $25 in the blink of an eye…

The company is very much a “value” stock, and immediately this means one needs to tread with caution given how much disdain there has been in the market for such equities. But there is in fact a lot to like and much that suggests NCR is a mispriced security, and then some.

Company Background

NCR’s business is in the selling of hardware and software services to Banking, Retail and Hospitality customers worldwide. More specifically, it sells ATM machines to banks, self-checkout (“SCO”) and point-of-sale (“POS”) machines to retailers and hospitality companies, and associated software and services for the management of the networks and other applications.

NCR has a very strong position within the Banking vertical, with global market share of around 26% over its 838k installed machines (as of 2018). On the Retail and Hospitality side, NCR is also a major player in POS and SCO systems, though the market share is lower (14% share of POS installations in June 2017) and the market is more fragmented. Either way, the core of this business has been the selling and upgrading of machines while selling attached and unattached software and services into that installed base.

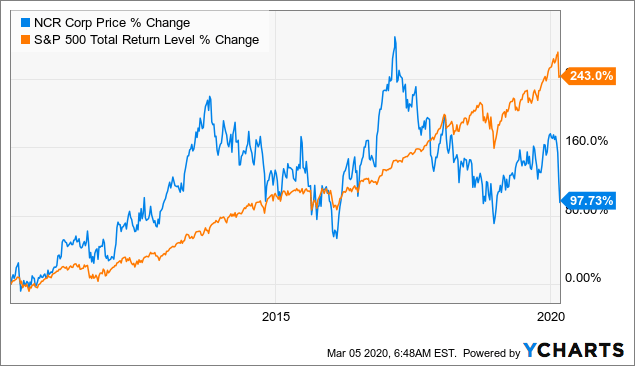

The model hasn’t really worked all that well for NCR over the past couple of decades. Certainly the shares have underperformed the S&P 500. In the last 10 years, for example, the S&P 500 has delivered investors a 243% total return while NCR has delivered only 98%. As evidenced in the following chart, there have also been booms and busts in this period.

Data by YCharts

Data by YCharts

I note too that NCR’s adjusted earnings have not grown over the last five years. Adjusted EPS was $2.81 in 2013 and ended 2019 at the same level (Source: Bloomberg). Throughout this period, the stock has seen its P/E fluctuate between 8x and 13x, and it is currently languishing near the lows.

NCR’s forward P/E:

Source: Bloomberg

Indeed, without any change, the significant discount to the market’s valuation is well deserved. But there has been change – quite significant change – and the future for NCR may well look significantly different to the more stagnant past.

Management Change

Blackstone (BX) got involved in NCR back in 2015, and to cut a long story short, this resulted in the hiring of Michael Hayford as CEO in April 2018, along with the Chairman Frank Martire in May 2018.

Frank and Mike have worked together in the past. They were CEO and COO respectively at Metavante, before selling the business to Fidelity National Information Services (FIS) and then taking on the CEO and CFO roles at FIS.

Suffice to say that Frank and Mike can be credited with creating significant value for shareholders over time, and their presence at a sleepy company like NCR can only be a good thing.

Impressively, since the duo regrouped at NCR, they have wasted little time implementing change. They have brought in a swathe of fresh blood to NCR, including many with whom Mike and Frank have worked before. If you look at the senior executive team, only 3 of the top 20 executives have been at the company prior to 2018! (Source: Bloomberg)

The culture is changing, and that is the most important development in my opinion. Management has changed the reporting structure from revenue lines (Software, Hardware and Services) to customer verticals (Banking, Retail and Hospitality), which demonstrates how the focus is now much more on the customer outcomes and far less on individual revenue silos.

In many ways, an investment in NCR today is very much an investment in the new management team and culture.

Recurring Revenues/Software Revenues

Having attracted some serious talent, one has to ask what NCR has that Mike and Frank saw as so attractive? In some ways, the answer is clear from looking at where they have come from.

FIS and other payment processing and banking solutions companies share the advantage of sticky recurring revenue streams. Looking at NCR, we see a large installed base of customers for ATMs, SCOs and POS machines from which the company generates service and software revenues. Much of these software and service revenues are attached to the installed base and considered recurring.

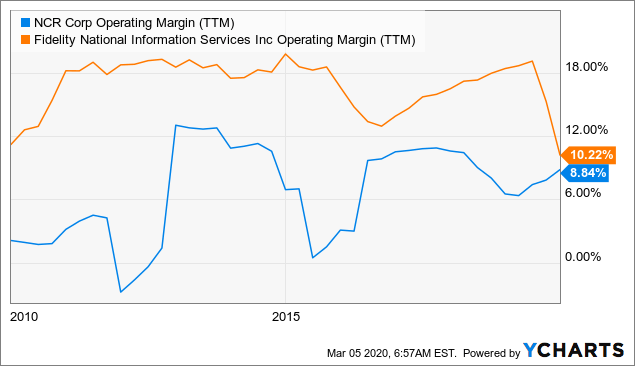

However, unlike FIS, NCR hasn’t been growing these recurring revenues at much of a pace at all and, more importantly, the overall company operates with only high-single-digit operating margins as compared to FIS’s margins in the high-teens (lower more recently due to an acquisition).

Data by YCharts

Data by YCharts

Mike and Frank believe that there is no reason why they can’t improve the growth in recurring software and service revenues, which would in turn drive margins and free cash flows much higher over the longer run. This would make NCR a more stable, durable, and better business, and that would subsequently be rewarded with a higher valuation multiple.

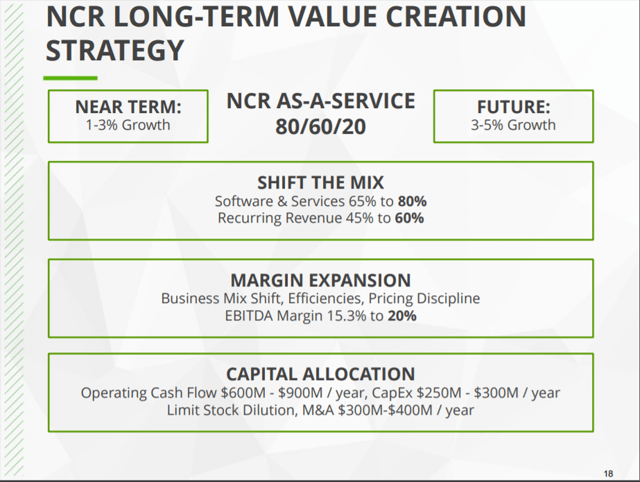

Indeed, the company is now targeting recurring revenues at 60% of revenues in the next few years, up from 45% today. Software and Services revenues, today representing about 65% of the mix, are targeted at 80%. These are big shifts in the business mix.

Acquisitions/Payments

Part of the strategy to shift the mix will include acquisitions, and indeed management has ear-marked $300-400 million a year in capital for such purposes. NCR has made a few acquisitions already since Mike took the role as CEO.

At this point, I do have reservations about the company’s ability to make future acquisitions without overpaying on valuation, particularly given where market valuations have been in the past couple of years. But so far, it has made some pretty good decisions. One of which is the acquisition of JetPay, which closed in December 2018. In my view, JetPay could be a potentially significant positive for the business in the next few years.

JetPay brings payments capabilities to NCR. Before JetPay, the company’s network carried significant transaction flow from which NCR generated no revenues. NCR will be monetizing more of these transactions going forward, and this has the potential to benefit both revenues and margins over time.

NCR is bundling payment capabilities into its new POS and SCO solutions. While management has provided little information for us to frame the size of the payments opportunity, I believe that the company could generate incremental transaction revenues of upwards of $100 million in the long run. This revenue carries high incremental margins, so the flow-through to earnings could be big enough to move the needle. If I assume a 50% margin on that $100 million, with a 24% tax rate, that would imply incremental EPS of 25c in three years’ time, or 8-9% of 2019 EPS.

Whatever the accretion will be – and we really don’t have enough hard information to work with – I would argue that there is upside optionality from acquisitions, such as JetPay, that is arguably not accounted for in the stock price today.

Hardware (Un)profitability

I was surprised to hear how much money NCR was losing on its hardware business. This has not always been the case, but for the last three years since 2017, the hardware business has lost $2 million, $125 million and about $60 million respectively.

Perhaps most striking is the loss made in 2019 despite the ATM hardware business undergoing a significant upgrade cycle driven by Windows 10. ATM revenues grew 33% on an FX-neutral basis in 2019 after declining 3% the year before and 18% the year before that! This more recent growth does not by any means suggest that the business is returning to growth. In fact, management fully anticipates flattish growth going forward in ATMs, with likely steady but slow declines in the out-years as cash becomes less and less important to consumers and banks. But this decline will take a long time, and innovation can help stave it off further. NCR is innovating around connectivity solutions in its ATMs, and banks are looking to new ATM products as a means to refresh and modernize the look of their branches. NCR is playing into the theme of the “Branch of the Future” at banks, or more broadly the digitization of the consumer retail banking experience.

There is growth in hardware on the SCO and POS side, though it is also quite choppy. SCO and POS hardware revenues grew 8% in 2019, fell 14% in 2018, and grew nearly 15% in 2017 on a currency-neutral basis. In these businesses, NCR is investing heavily behind innovation and growth, especially in the Hospitality vertical. As such, profitability will likely be worse than for ATMs at this point.

So what happened to profitability in the last two years? Well, the new management team sought to address the efficiency of this business in 2017 and completely restructured the supply chain. This inevitably led to disruption, which was worse than anticipated, and resulted in higher interim costs and a significant shortfall of supply to a market where demand was high. This in turn exacerbated the losses in 2018, but the recovery in capacity in 2019 has helped to improve things somewhat. More importantly, management is readdressing the cost structure and pricing strategy in hardware. Losses in 2019 were narrowed to ~$60 million, which was as planned, and it sees break-even in 2020. This is going to be achieved even in the face of 8-10% declines in ATM revenues on the tough comparisons from 2019.

I am assuming Hardware remains at break-even for the foreseeable future, but management clearly believes that profitability – albeit modest – is achievable. Either way a significant headwind to margins will be reduced.

Business model shift

Finally, with the shifting mix towards recurring software and services revenues, it is important to recognize that a substantial portion of perpetual software license revenues will eventually be replaced with subscription-like revenues. Think of it in this way: $100 of revenue recognized up-front in a perpetual license model could now be converted to revenues spread over a three-year subscription. As such the revenue recognized in year one would be cut by 2/3 in this case.

This shift creates (and is already doing so) a headwind to revenues, growth, EBITDA and earnings. For the first time, we have had some clarity from management in its guidance for 2020. The CFO highlighted a $100-120 million revenue headwind in 2020, equating to a $70-80 million EBITDA headwind and a $0.35-0.40 EPS headwind in the year. Clearly this is high-margin incremental revenue “lost” with an implied 67-70% EBITDA drop-through, but it also means we end up with a stickier and more stable revenue base.

By my estimates, it seems that around 12% of last year’s perpetual software revenues is being converted to rateable revenue streams. If I make the assumption that all new revenues in software are rateable, and that the perpetual license revenues from 2019 are all converted to rateable revenues over the next five years, my model suggests that revenue growth headwinds will be kept to a manageable level: 1.6% this year, 1.2% in 2021, 0.8% in 2022, and 0.2% in 2023. The headwind to EPS growth is likely to be 14.4% this year, ~10% in 2021, 7-8% in 2022 and <2% in 2023.

What this means is that we will see accelerating revenue and EPS growth each year (from a low level) from both continued growth in the core businesses and reduced headwinds from the model shift. The headwinds could keep EPS growth in the 0-5% range for three years, which is fairly uninspiring. However, when you consider the core growth obscured by the model shift, NCR’s EPS growth would be more like 10-15% per year.

As this reality emerges over the next few years, the stock’s valuation multiple should start to creep much higher.

End Game

Putting the above together creates a path to fulfilling the company’s long-term targets. The framework for management’s long-term goals are as follows (taken from its presentations):

Source: NCR 4Q19 Presentation

Based on my modeling and without help from acquisitions, NCR should be able to achieve these goals. Indeed, I estimate the following:

- Three-year FX-neutral revenue growth accelerating from 0.2% in 2020 to 3-4% in 2021 and 2022.

- Revenue growth from 2023 onward of around 5%.

- Software and services achieving 71% of the revenues by 2024.

- Recurring revenues hitting 65% of the mix by 2024.

- EBITDA margins stabilizing around 16%.

- Operating cash flow reaching $900 million in 2024.

With the help of acquisitions, I believe NCR could add a further 100bp of growth to revenues, shift the mix to recurring revenues by an incremental 100-200bp, and raise margins to ~18% or higher by 2024. Operating cash flow could in this case push above $1 billion.

With this I can build the valuation case.

Valuation

The most important variable for me is my FCF. I see FCF for NCR reaching $580-790 million in FY2024, depending on what acquisitions it makes. The $580 million can be achieved without any help from acquisitions.

Based on my 2020 numbers, NCR is trading on a FCF yield of 9.4% (6.3% on Enterprise Value), but looking to 2021 and 2022 the shares are on 10.6% and 13.4% yields respectively (7.1% and 8.7% on Enterprise Value). These are attractive yields, especially in light of the low bond yield environment today.

On DCF, the shares appear to be pricing in the combination of a perpetual 0% growth rate in FCF with a 9% WACC. The WACC itself seems to be pricing in a risk premium of 9.5%, which is high in my experience. Using a more typical 8% risk premium for a non-growth stock like this, and lifting the risk-free rate to 2% (bond yields are currently ~1%) while maintaining 0% long-term FCF growth, I still arrive at a fair value this year of $28.50, and closer to $30 for 2021. Add in acquisitions, and these fair values rise to above $40 each.

But this is DCF and we all know you can get any target by manipulating the inputs. A more interesting way to look at this is to decide what FCF yield I think the shares deserve to be on in FY2024. If I conservatively keep NCR at a 10% FCF yield in 2024, assuming no benefit from acquisitions, the shares would give me a 10% or higher compounded return per annum from today’s price. Given a 10% FCF yield seems very attractive in its own right, the 10% compounded return is, in my view, based on a relatively “bad” scenario.

More realistically, I think NCR should trade at a 6% FCF yield in the out-years. On this basis, the shares would offer a 22% annualized return from today’s price to a target of $67 at the end of 2024. That is a very attractive return in my book.

Risks

There are some risks to be mindful of with NCR. Net debt leverage is relatively high at 2.8-2.9x net debt/ EBITDA, though I believe this level of gearing is manageable given the stability and the cash flow outlook of the business. However, if management executes on its acquisition plans, the leverage may even creep a little higher on a temporary basis, and this may not be well-received by the market in its current jittery state.

Competition is also intense, especially in the faster growing verticals of hospitality and retail. On the ATM side, NCR’s primary competitor Diebold (OTCPK:DBD) has been struggling with mis-execution, share loss and an overly stretched balance sheet. This is to the benefit of NCR. However, in the faster growing verticals of retail and hospitality, there are many more competitors to battle off, such as Square (NYSE:SQ). NCR needs to focus on innovation to remain relevant, and to its credit, this seems to be recognized by the new management team.

Conclusion

Change is the key here, and if the new management team can execute on its goals and deliver on the financial model transition, I think there is significant upside opportunity for shareholders over a five-year period. Such transformations are never likely to be smooth, so investors should expect some volatility.

Sentiment appears to be very negative towards the stock today, but that has the potential to change as NCR’s business evolves. My work suggests that the downside risks look well-contained, making the risk/reward on NCR shares very attractive at these levels.

Disclosure: I am/we are long NCR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment