XH4D

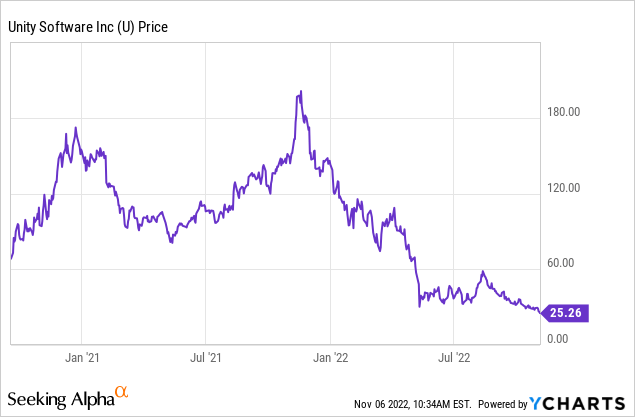

Like many tech stocks, Unity (NYSE:U) has seen its stock price get obliterated amidst the tech crash. While much of it was due to the egregious valuations at which the stock traded at prior to the crash, some of the fall was arguably warranted as the company’s execution issues led to poor growth rates in its Operate segment. There was initially some drama with regards to its proposed acquisition of ironSource (IS), but that deal now looks all but certain to close. I continue to rate U a strong buy as the stock price is not reflecting the strong secular drivers that caused the prior bubble in the first place.

U Stock Price

Once a tech darling, U stock has not been immune to tech beat down. In fact, its stock is one of the more beaten down names in the tech sector.

I last covered U in July where I discussed the company’s prospects after the proposed acquisition of IS. Since then, AppLovin (APP), a competitor of IS, made an unsolicited offer to buy U, but that offer has since been rescinded.

U Stock Key Metrics

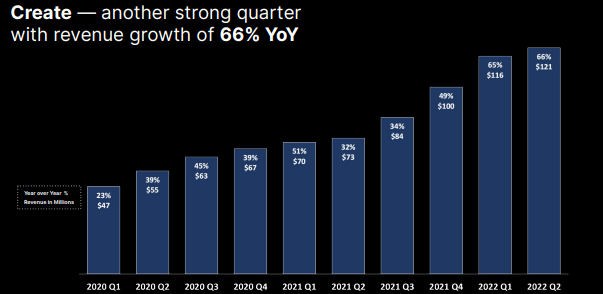

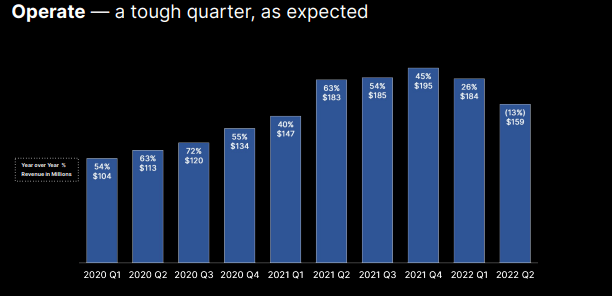

The latest quarter saw U generate only 8.6% overall revenue growth – a steep decline from the 36% number posted in the first quarter and the 48% rate of the prior year’s second quarter. U did see accelerating growth in its Create segment.

2022 Q2 Presentation

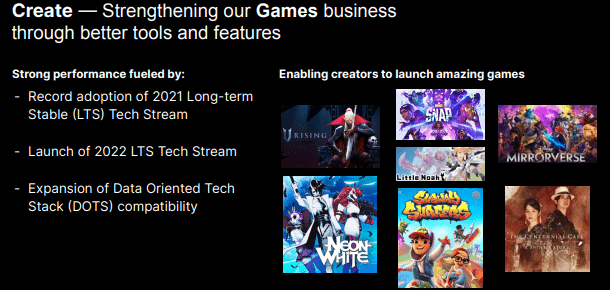

U has a dominant position in gaming where, as shared in the conference call, the company powers 70% of the top mobile games.

2022 Q2 Presentation

The Operate segment, however, saw growth not only decelerate but turn negative.

2022 Q2 Presentation

The company had been faced with not only a tough macro environment but also self-inflicted execution issues, as bad data ingestion of the prior quarter continued to impact results. Management noted that it has fixed the data issues and has also invested heavily in its audience pinpointer product.

The poor Operate results led to the 12-month trailing net dollar expansion rate declining to 121%, down from 142% last year.

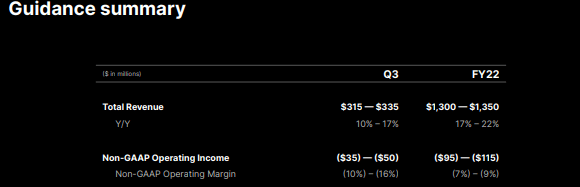

Looking ahead, U expects revenue growth to accelerate in the third quarter before accelerating again to 26% in the fourth quarter.

2022 Q2 Presentation

I agree with management that this should be a 30+% growing business over the long term but I wouldn’t be surprised if guidance gets cut again due to the near-term macro struggles.

Is U Stock A Buy, Sell, or Hold?

While U stock may look like discarded trash, the product remains relevant as ever. I’ve already mentioned that they power more than 70% of the top mobile games – as disclosed on the call they also made up 80% of the most popular games in July and 72% of the top selling games for the Oculus Quest.

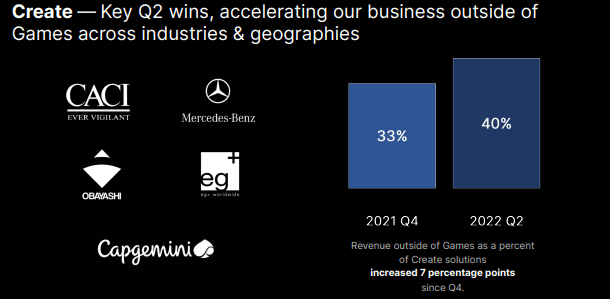

U has also been winning customers outside of gaming – after all, 3D modeling applies to more sectors than just gaming. 40% of Create revenue came from non-gaming sources in the latest quarters, and the company won key customers like Mercedes-Benz.

2022 Q2 Presentation

Regarding the Mercedes partnership:

And we continue to strengthen our partnership with Mercedes Daimler. This quarter, we announced that from 2024 forward, all Mercedes Daimler cars will be equipped with an HMI made with Unity. With this agreement, Unity is now an integral partner of one of the world’s leading and most storied automotive OEMs. Together, Mercedes-Benz and Unity are taking next-generation user interaction such as Maps, Avatars and AI Concierges, and in-car entertainment to a new level by implementing on a real-time 3D engine.

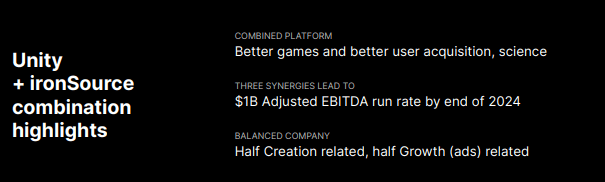

U will have the IS acquisition to digest over the coming years. U previously gave guidance for $1 billion adjusted EBITDA by 2024.

2022 Q2 Presentation

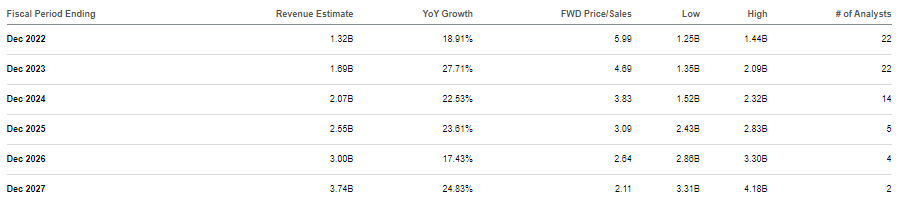

Consensus estimates no longer appear to believe in 30+% growth rates, but U stock is only trading at 6x sales.

Seeking Alpha

Assuming 25% growth, 30% long term net margins, and a 1.5x price to earnings growth ratio (‘PEG ratio’), I could see U trading at 11.3x sales, implying considerable upside over the coming years.

What are the key risks? U has not been a public company for that long, and it is not clear how much of its growth over the past few years was due to the pandemic. It is possible that the 3D modeling market is much smaller than anticipated, though I find that hard to believe. U’s net cash balance sheet has gradually evaporated over the past few quarters, but the IS acquisition should bring in around $441 million in cash. With turnaround stories, the most obvious risk is a failed turnaround – it is possible that management cannot fix the underlying issues in the advertising revenues. The projected upside would fall down considerably if growth does not return in full force, but at 6x sales, the stock is already pricing in a significant growth slowdown.

As discussed with Best of Breed Growth Stocks subscribers, a diversified basket of beaten-down tech stocks may be the best way to take advantage of the tech crash. I rate U a buy as a beaten-down secular growth story that fits right in with such a basket.

Be the first to comment