A big business starts small. – Richard Branson

The business prospects of Main Street Capital (NYSE:MAIN) are interlinked with the fortunes of the lower middle market. It is an efficiently managed company that has been paying monthly dividends since 2013. The company is so committed to its shareholders that it didn’t reduce dividend payouts during the 2008-09 recession. It gets access to favorable opportunities in the capital markets because Standard & Poor’s has assigned it a BBB/Stable rating, which is considered strong.

Though all seems good, the company has made an important assumption in its Q4 2019 earnings call on Feb 27, 2020, and that assumption may not hold good the way events are shaping up. My rating is neutral; however, you can consider buying it when its dividend yield spikes.

Here are the reasons why:

MAIN vs S&P 500 vs MDY

Image Source: Seeking Alpha

MAIN, the S&P 500 (SP500), and the SPDR S&P MidCap 400 ETF (MDY) have delivered flat returns since 2019. I have selected MDY because it is representative of the middle market sector.

MDY paid $5.04 dividend (at 1.52% yield) in 2019, and MAIN has paid $2.46 dividend (at 6.6% yield) in 2019.

MAIN is way better than MDY from the dividend yield point of view, but we still must compare it with its peers.

MAIN – Peer Comparison

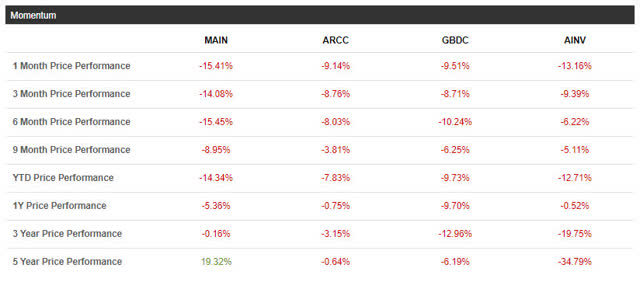

MAIN faces competition from Ares Capital (ARCC), Golub Capital BDC (GBDC), and Apollo Investment (AINV).

Image Source: Seeking Alpha

MAIN stands out as an investment that has delivered gains to its long-term shareholders (five years and above) both from the valuation and dividend perspectives. MAIN also has the lowest dividend yield (6.6%) amongst its peers, and that’s because it is fancied by investors.

However, the entire peer group has underperformed from a valuation perspective and looks set to underperform some more because the markets are reacting badly to the COVID-19 virus.

The COVID-19 Assumption that Went Wrong

At the Q4 2019 earnings call, MAIN’s management team was hopeful that the COVID-19 impact wouldn’t be significant. It felt that in the worst-case scenario, it would impact only the heavy electronics industry.

Well, it’s not even a week since the earnings call and we have seen how COVID-19 has shaken global economies. No one knows how it’s going to end, but the one certain thing is that it will spook people, lead to self-quarantines, and restrict consumer spend in the near future. No one even knows to what extent demand will revive when there is clarity on the epidemic.

All U.S. companies will be impacted in the near term, including MAIN’s clients. Goldman Sachs (GS) estimates that public companies will post a flat growth in 2020. How far down the virus will take us, no one knows.

Interest Rate Disadvantage

The interest rate on 73% of MAIN’s outstanding debt obligations is fixed. 74% of MAIN’s debt investments are made at floating interest rates.

When rates increase, MAIN’s net earnings rise, and vice versa. The COVID-19 impact will make Fed cut rates – this is a given. Wall Street estimates the rates will fall to zero.

A 100 BPS cut in rates translates to a loss of $8.7 million ($0.14 per share) to MAIN. This is another negative that shareholders have to live with.

The Verdict

MAIN faces disruption in 2020 mainly by the COVID-19 black swan. The Fed’s rate cut of 0.5% announced yesterday and its forthcoming rate cuts will reduce the company’s profitability. Plus, any adverse economic impact on the companies operating in the lower middle market sector will impact its portfolio quality.

Once things clear up, the company should be back where it belongs, but no analyst can estimate when things will return to normal. In the near term, consumer spending will take a knock, dragging down business.

MAIN is a dividend stock and therefore dividend chasers should wait for the yield to become more attractive – perhaps 8-10% – and then start adding the stock.

Till the yield becomes compelling, I’m neutral on MAIN.

*Like this article? Don’t forget to hit the Follow button above!

How To Avoid the Most Common Trading Mistakes

How To Avoid the Most Common Trading Mistakes

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.

Be the first to comment