alvarez/E+ via Getty Images

Investment Thesis

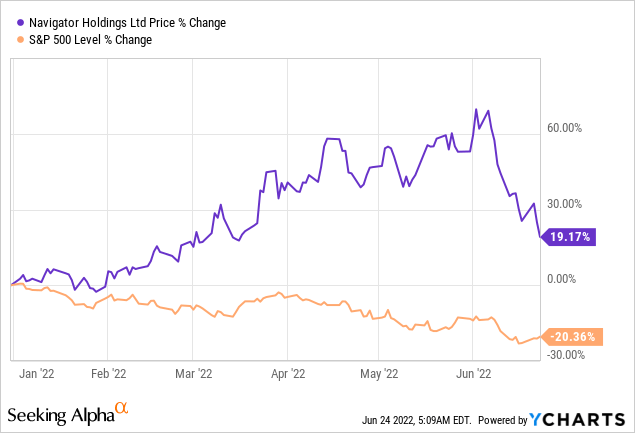

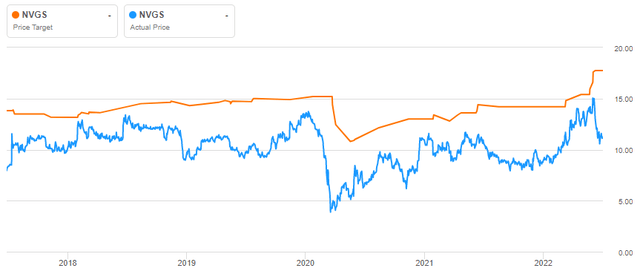

Navigator Holdings (NYSE:NVGS) stock has outperformed the market in the previous year and YTD but underperformed it at long-term performance marks. NVGS stock has lost about 25% of its share price in the previous month against the S&P 500’s loss of about 3.7%.

This has sweetened the valuation metrics below the company’s 5-year average but not enough for me to warrant a buy rating on the stock because it is still trading at a premium to its peers.

Even though the industry outlook is positive and the company’s financial statements are improving along the same lines, the stock doesn’t provide a favorable enough risk-reward dynamic for an investment with the current price tag.

The Company

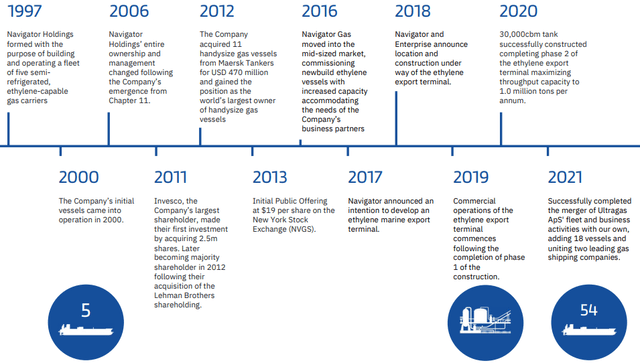

Navigator Holdings owns and operates the world’s largest fleet of handysize liquefied gas carriers, globally leading maritime logistics of petrochemical gases, such as ethylene and ethane, liquefied petroleum gas (LPG), and ammonia.

Capital Link’s Corporate Presentation

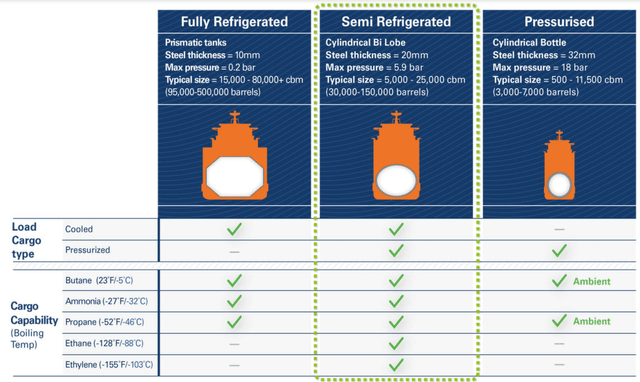

Navigator’s fleet comprises 53 vessels, including 21 Ethylene Capable vessels, 25 Semi-refrigerated vessels, and 7 Fully-refrigerated vessels.

Capital Link’s Corporate Presentation

It also owns an ethylene export marine terminal at Morgan’s Point, Texas, on the Houston Ship Channel, as part of a 50% joint venture with Enterprise Products Partners L.P. (EPD). The terminal has a 30,000-ton cryogenic storage tank capacity and the capacity to export at least one million tons of ethylene per year. The terminal has entered into offtake agreements, with minimum terms of five years for a committed 938,000 annual tons of ethylene through the terminal.

The company acquired Othello Shipping Company S.A and Ultragas ApS from Ultranav for approximately $370 million in August 2021. By the MRQ, these two entities owned and operated 16 semi-refrigerated LPG carriers sized between 3,770 and 22,000 cbm.

| Operating Vessels | Time Charter | Spot Market | Unigas operated |

| Ethylene/ethane capable semi-refrigerated midsize | 4 | 0 | 0 |

| Ethylene/ethane capable semi-refrigerated handysize | 2 | 7 | 0 |

| Ethylene/ethane capable semi-refrigerated smaller size | 0 | 0 | 5 |

| Semi-refrigerated handysize | 12 | 12 | 0 |

| Semi-refrigerated smaller size | 0 | 0 | 4 |

| Fully-refrigerated | 7 | 0 | 0 |

| Total | 25 | 19 | 9 |

| Percent | 47% | 36% | 17% |

The Market

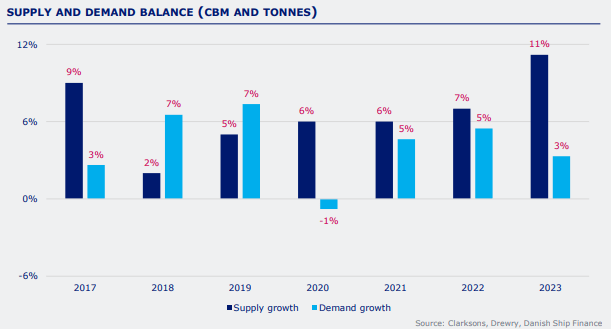

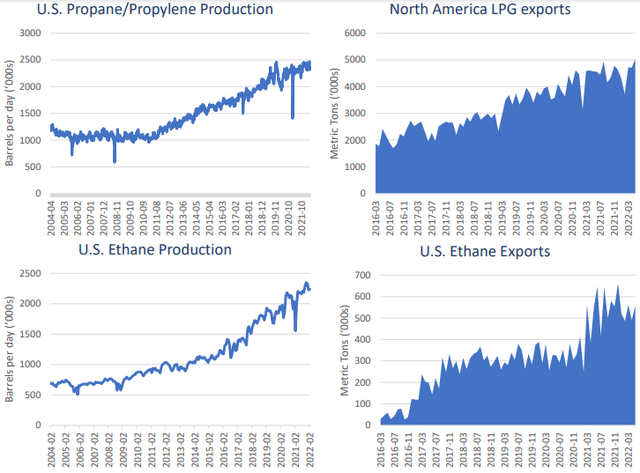

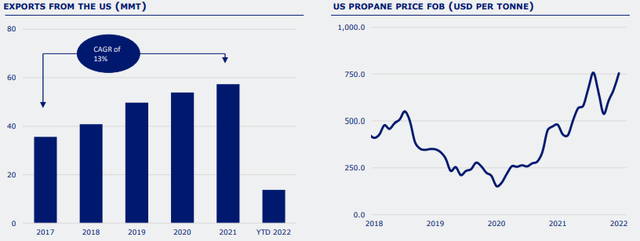

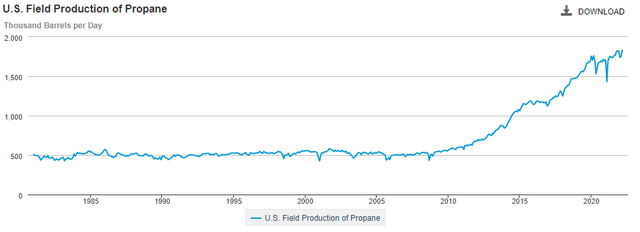

The recent shipping market review report published by Danish Ship Finance iterates that the seaborne LPG volume growth has been declining for the past 7 years. Still, volumes increased by 6.5%, and distance-adjusted demand grew by 11.8% in 2021. Vessels Value estimates an 8.55% cargo mile demand growth in the LPG segment in 2022, the strongest mile demand growth in the shipping industry YTD.

Subsequently, the global demand for LPG is expected to grow by 5% in 2022 and 3% in 2023, whereas the supply is expected to grow by 7% and 11%.

Danish Ship Finance

LPG shipping volumes from the US were already on the rise in the second half of 2021, and now the shipping rates have also benefited from the Russia-Ukraine situation with positive sentiment for the whole year as sanctions on Russia have created a higher demand for substitute LPG cargo from the United States. This higher demand has resulted in higher production and exports in Q2 2022, reflected in EIA data and forecasts, adding value to NVGS services.

Source: The Shipping Market Review Report May 2022

NVGS Q1 2022 Earnings Presentation

On the downside of the rising rates, Drewry Maritime Equity Research adds that sustained, higher LPG prices can dampen the demand for residential and petrochemical sectors, affecting global LPG trade and bringing down long-term freight rates.

The Danish Ship Finance’s conjecture facilitates this by iterating that the increasing regional production of ethylene in Asia is reducing the long-term demand for US ethylene long-haul carriers, likely resulting in surplus vessel capacity and lower freight rates in the years to come, especially as the fleet supply is expected to expand faster than the demand in the next 2 years.

However, a short-term window of opportunity is open owing to higher long-haul trade demand, mainly sourced from the US.

Growth and Profitability

NVGS has been enjoying inflated revenues because of these rising shipping rates throughout the previous year, as the company’s latest SEC filing states:

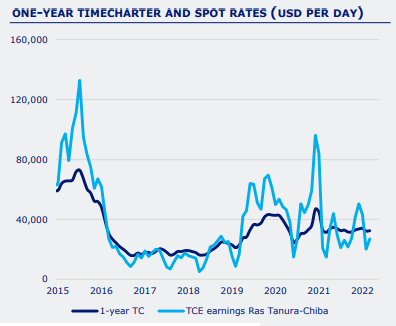

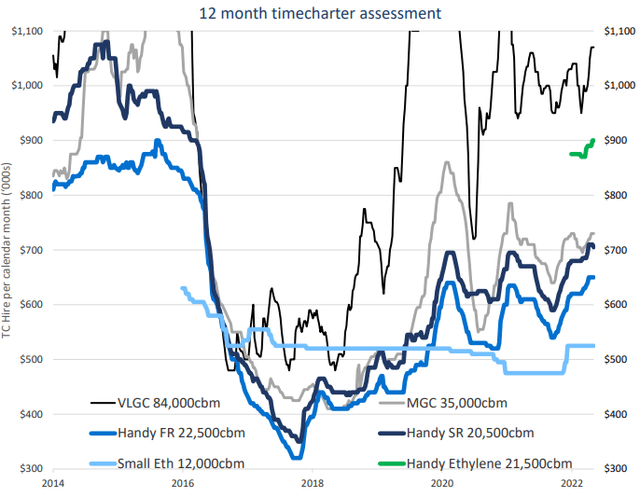

The handysize semi-refrigerated and fully-refrigerated 12-month time charter rate assessment increased by $5,000 per calendar month (“pcm”) and $15,000 pcm, respectively, during the first quarter of 2022, to $685,000 pcm and $635,000 pcm, respectively, with the most recent weekly shipbroker reports showing a further increase to $705,000 pcm and $650,000 pcm, respectively. The handysize ethylene 12-month time charter assessment has increased from $875,000 pcm at the beginning of 2022 to a current level of $900,000 pcm.

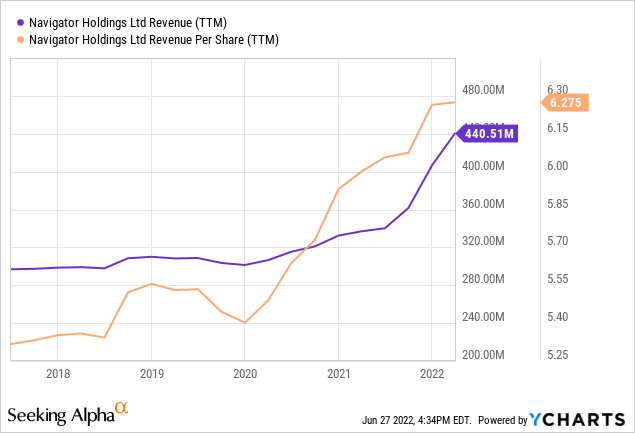

With 36% of vessels exposed to the spot market and 47% generating revenue through time charters, the company significantly benefitted from the rising spot rates while being amply secured against unfavorable volatility through its time charters. Resultantly, the company’s total revenues were up 39.7% YoY in the MRQ.

Danish Ship Finance

Net revenues were up 24.7% to $119 million, primarily due to a 15.8% increase in available vessel days of 529 days, resulting from the added vessels through the Ultragas transaction, a 4.45% increase in average monthly time charter equivalent rates from approximately $21,956 per vessel per day to $22,933 per vessel per day, a 1.3% rise in fleet utilization from 88.2% to 89.5%, and an increase of in pass-through voyage costs, associated with the additional vessels joining the fleet.

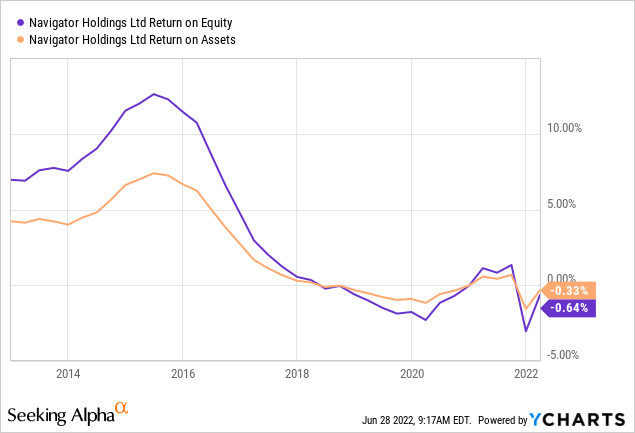

The company’s revenues have shown organic growth rather than solely relying on the increasing selling prices, a good sign for sustainable growth. It has also succeeded in translating these revenues down the line into profitability metrics above the industry averages, with a gross, EBIT, and EBITDA margin of 45%, 15%, and 35% in the trailing twelve months, almost in line with its 5-year average.

Still, its growth and profitability metrics need extensive improvements, considering its low resource utilization ratios, such as a negative annual ROE and ROTA and a low asset turnover ratio of 0.22%.

Valuation

Extrapolating a share price by applying the company’s figures to the industry medians of relative valuation ratios and taking their average conjures a fair value of about $10, revealing about 10% overvaluation. However, NVGS has historically traded at such valuations, and an average of the above based on its 5-year averages exposes a fair value of about $19.2, an upside potential of almost 73%.

The medians of these metrics are about $7.66, a downside of 40%, and $13.2, an upside of 18%. So the company appears expensive relative to its peers but cheaper than its 5-year average.

NVGS currently sports a strong buy rating on Wall Street and has a consensus analyst target price of $17.67. Still, these projections have proven to be overly optimistic, especially given the most recent dip, albeit experienced by the whole market.

Conclusion

The industry prospects are positive, and the company is going in the right direction with expansion plans for its export terminal in the second half of 2023, aimed at doubling its ethylene export capacity by 2025.

Investors willing to tie up their funds in NVGS shares will likely have capital appreciation in the long term. Still, the current risk-return trade-off doesn’t appear to be meaningfully favorable, and the funds would be better utilized elsewhere.

NVGS is overvalued compared to its peers and undervalued compared to its 5-year average, which drives me to take a closer look into its competitors and find a stock with a more rewarding dynamic than NVGS for a better portfolio allocation and fund utilization especially considering the promising industry outlook.

NVGS needs to be closely monitored for improving valuation metrics to make a worthwhile investment.

Be the first to comment