Jean-Luc Ichard

Microsoft Corporation (NASDAQ:MSFT), like most other tech names, finished last week strong with a gain of more than 10% spread over two days. Is this the start of a new uptrend for the stock? We believe so. This article presents a few reasons to support Microsoft as an investment both in the short term and the long term. Not many stocks offer relative short term safety, great long term potential, dividend yield (although small), and reasonable valuation. Microsoft is one such stock. Let us get into the details.

First In, First Out

Microsoft was one of the first large tech names to announce layoffs. They were not only amongst the first to react to the slow down but also one of the few that suffered minimal impact, with the layoff impacting just about 0.50% of the workforce. This shows two things: (1) they are quick on their heels and adapt to changes; and (2) that they did not get over-bloated in terms of head count. To put those two points into context, look at Meta Platforms, Inc (META). Meta was slow to react and was even adamant on increasing expenses. But when they finally reacted, they ended up slashing 13% of the work force.

Why is this important? It shows Microsoft management’s general awareness and their ability to act quickly. It also shows their discipline that watching expenses is not something you do one day all of a sudden but more an ongoing discipline.

Game On

Microsoft’s Activision Blizzard Inc, (ATVI) acquisition is on track for closure in summer of 2023. Whether it is Candy Crush or Warzone, Activision knows how to entice gamers. But the company ran into serious workplace crisis that perhaps accelerated the decision to sell. This is right up Microsoft’s alley, as CEO Satya Nadella expressed:

“Gaming has been key to Microsoft since our earliest days as a company. Today, it’s the largest and fastest-growing form of entertainment, and as the digital and physical worlds come together, it will play a critical role in the development of metaverse platforms.“

Everyone knows and talks about Apple Inc.’s (AAPL) ecosystem empire. But imagine Microsoft’s control over consumers with the:

- Operating System which makes these activities possible

- Productivity tools including but not limited to Office

- Devices (not their strongest point but still a presence)

- Hosting (Azure)

- Gaming Consoles and Content

- And last but not the least, Metaverse. Augmented Reality in the physical world may still be a concept in infancy but Virtual Reality in games is far more advanced. While Microsoft and Meta are partners for now, expect Microsoft to become a dominant player, if not the dominant player here.

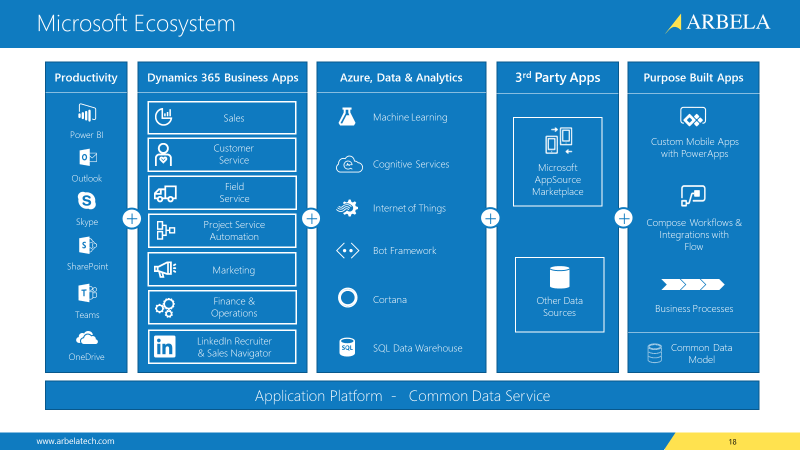

The sketch shown below is one of the best representations of Microsoft’s powerful ecosystem, as it shows how these silos not just provide value on their own but also cross-sell across platforms. To this, add Metaverse and Gaming potential and you can see Microsoft’s future dominance taking shape.

Microsoft Ecosystem (Arbelatech.com)

Not All Gloom In The Cloud

While the recent earnings report showed that Azure growth was slowing down, the report had plenty of positives:

- Microsoft beat on both EPS and revenue.

- Azure’s “disappointing” growth was still 24% YoY and accounting for currency fluctuations, was actually an impressive 31%.

- Google (GOOG, GOOGL) cloud gaining market share is impacting every other player, but Azure and Amazon Web Services (“AWS”) are operating at ridiculous profit margins still with Azure’s recent margin coming in at 70%.

- The COVID era accelerated the move to cloud for existing businesses as well as brought a flurry of new companies directly onto the cloud. This was bound to slowdown as the pandemic restrictions eased. Once the sudden excesses are adjusted, it will become more evident that the “digital tailwind” quoted by Satya Nadella is here to stay.

Grounded Expectations

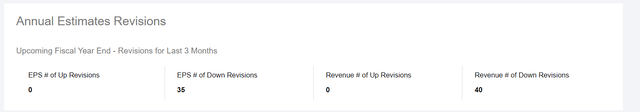

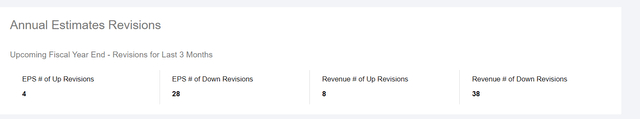

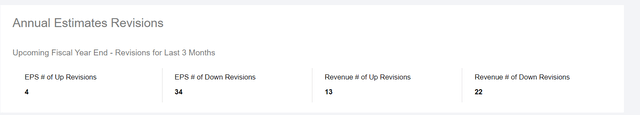

Although Microsoft’s forward multiple looks fairly healthy at 25, we must remember that investing and returns are all about expectations. If a company does better than expectations, it goes up generally and the other way around too. Microsoft’s revenue and EPS projections have all been revised downwards. To make sure this wasn’t a trend among mega caps, we looked up two other companies: one stronger than Microsoft in general reputation (Apple) and one weaker than Microsoft at present (Meta Platforms), and both fare better than Microsoft in this regard.

MSFT Earnings Revisions (SeekingAlpha.Com) Meta Earnings Revisions (SeekingAlpha.Com) Aapl Earnings Revisions (SeekingAlpha.Com)

Technical Setup

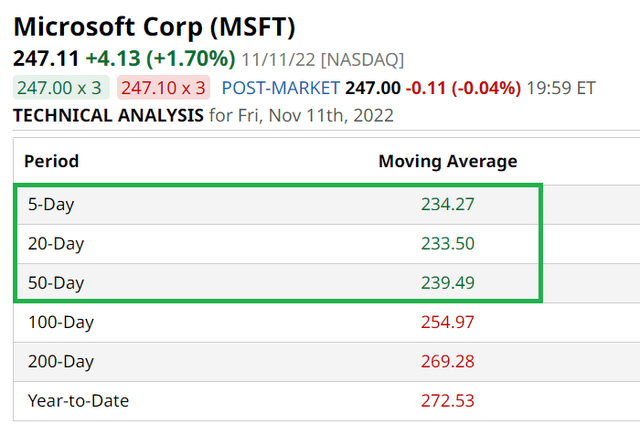

From a technical perspective, Microsoft has now broken above its 5, 20, and 50 day moving averages. This means the stock has been in an uptrend and is accumulating strength

And before you attribute this to the market moves on Thursday and Friday, not all mega caps have done this. Amazon (AMZN), for example, is still below its 20 and 50-day moving averages. Google is still below its 50 day moving average. The only comparable large cap that is matching Microsoft in this category right now is Apple and this may not be a coincidence. Apple and Microsoft are generally considered more well-rounded companies that can weather most storms due to their stickiness of their products and services. This means when things turn around for technology stocks in general, expect Microsoft to be among the strongest once again.

MSFT Moving Averages (Barchart.Com)

Conclusion

“This is not your father’s Oldsmobile” was a famous General Motors (GM) tagline when they introduced a new generation of cars. In hindsight, the same would have applied to Microsoft when Satya Nadella took over. The company has gone from being a boring returns killer to being a growing bellwether for all seasons. The fact that Microsoft stock is down “only” 26% this year speaks volumes.

We believe Microsoft stock has paid enough of its dues with its decline and is showing enough signs here that the bottom may be in. While we believe this is the start of an uptrend, irrespective of what happens over the next few months, Microsoft is a juggernaut that deserves a position in any portfolio.

Be the first to comment