JHVEPhoto/iStock Editorial via Getty Images

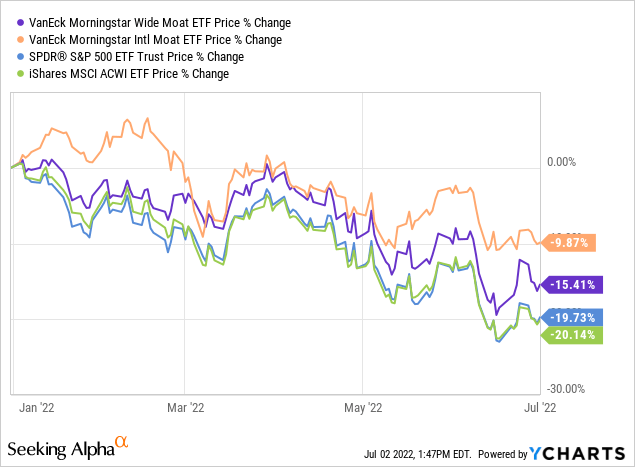

It’s been several months since our previous review of the MOAT ETF (BATS:MOAT), and now is the time to check how the ETF’s strategy fared during the volatile first half of 2022. A look at the charts suggests that, while MOAT experienced a 15% retreat YTD, it did slightly better than the broader market – and so did its international counterpart MOTI (measured against the ACWI global stock index).

Of course, our intent here is to look beyond MOAT’s performance as an ETF, and, instead, look at the individual constituents for indications of where Morningstar currently sees buying opportunities in wide-moat companies.

It’s important to keep in mind that wide-moat investing and value investing do not always go hand-in-hand. Another author rightfully pointed out that MOAT includes several high P/E stocks, in this piece. This is true, but also perfectly in line with the ETF’s strategy: if a high-growth tech stock is considered to have a strong competitive advantage – say, from a network effect – it will be a potential MOAT candidate.

With changes to macro factors such as interest rates, it’s logical that Morningstar lowered many of its fair value targets. As we will see at the end of this article, the discounts to fair value are equivalent to what they were three months ago, despite the market trading 10% lower – implying that fair values themselves have been revised 10% downwards.

In terms of sectors, Morningstar sees attractive discounts in the financial universe, with BlackRock (BLK), Schwab (SCHW) and State Street (STT) all added during the mid-June reconstitution. Heading the other way were a number of defensive stocks, including Coca-Cola (KO) and tobacco giants Altria (MO) and Philip Morris (PM) among others, on valuation grounds. Big Tech, meanwhile, was mostly unaffected by the recent changes.

The MOAT ETF: An Overview

Note: Investors already familiar with the MOAT ETF and Morningstar’s methodology may want to skip this part and move directly to the June rebalance section.

The way the MOAT ETF works was well summarized by fellow contributor George Fisher in an earlier article:

[MOAT] owns 40 to 50 stocks with wide moats and that are trading at a discount to fair value, usually in the 15% to 25% discount range. When moat ratings change or the discount to fair value becomes comparatively noncompetitive with others, the position is replaced. Not only do the components change based on moat rating and discount to fair value, but the portfolio is re-balanced to an equal weighting as well. This creates a relatively high annual portfolio turnover of around 25%.

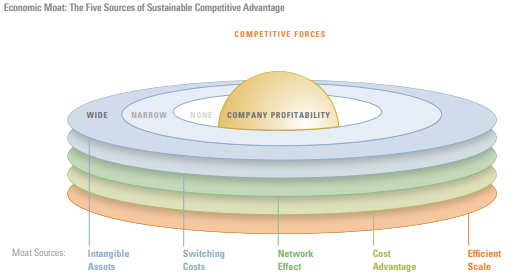

The ETF, managed by VanEck, is based on the Morningstar® Wide Moat Focus Index, which includes only U.S. stocks and, as the name suggests, only companies that possess wide economic moats. But what exactly does Morningstar mean by “economic moat”? As per VanEck:

Economic Moat ratings represent the sustainability of a company’s competitive advantage. Wide and narrow moat ratings represent Morningstar’s belief that a company may maintain its advantage for at least 20 years and at least 10 years, respectively. An economic moat rating of none indicates that a company has either no advantage or an unsustainable one. Quantitative factors used to identify competitive advantages include returns on invested capital relative to cost of capital, while qualitative factors used to identify competitive advantages include customer switching cost, cost advantages, intangible assets, network effects, and efficient scale.

Morningstar

This strategy has enabled MOAT to outperform the S&P 500 since its inception in 2012, as analyzed by contributor The Sunday Investor in his article How MOAT Beats The S&P: A Performance Attribution Analysis. With this in mind, let us now discuss the latest moves as part of the recent June reconstitution.

June Rebalance: The Removed Constituents

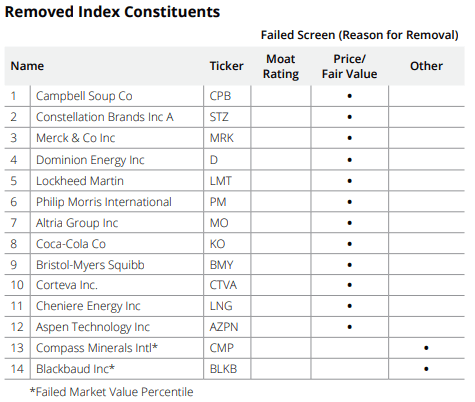

The recent mid-June reconstitution – affecting the sub-portfolio whose previous rebalancing was in December – saw the removal of 14 stocks:

VanEck

(see VanEck’s full document here)

It’s worth noting that none of these stocks were removed as a result of the weakening of their economic moat. Some of the changes are a continuation of the trend seen in the March reconstitution: the likes of Lockheed Martin (LMT) and Cheniere Energy (LNG) had already been cut from the other sub-portfolio, on valuation grounds.

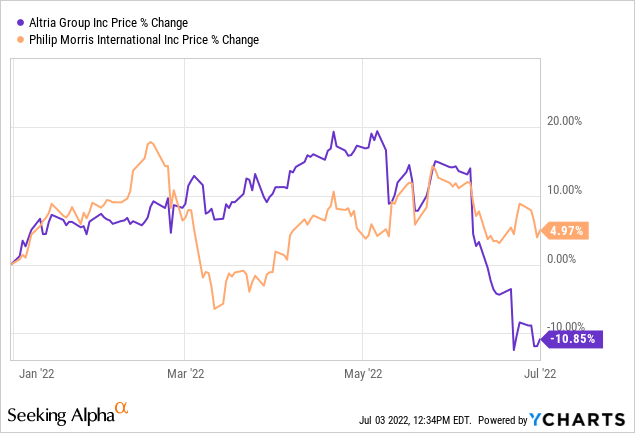

One conspicuous change is the removal of both Altria and Philip Morris (though the latter is still part of the second sub-portfolio). Of course, Altria has been having issues with its investment in Juul Labs (JUUL), but this is not the reason for the MOAT removal. In fact, Morningstar still sees a fair value of $52 for the stock, irrespective of Juul:

We have long been skeptics of Juul’s outlook, and our $52 per share fair value estimate of Altria assumes Juul would barely be profitable throughout our forecast period. Therefore, the removal of Juul’s contribution to Altria’s earnings, which Altria reports as equity income, has no impact on our valuation.

Source: Morningstar

This fair value estimate implies a discount to fair value of c. 20% at the current Altria share price of $42. However, Morningstar identifies plenty of undervalued moated stocks in the current market (see New Entrants section below), and this is the actual reason for the removal of Altria and Philip Morris: relative valuations.

Generally speaking, defensive stocks were considered to offer insufficient discounts to fair value, with food & beverage blue chips Coca-Cola and Campbell Soup (CPB), as well as big pharma stocks Merck (MRK) and Bristol-Myers (BMY), exiting the sub-portfolio. Exposure to the agriculture space was also cut with the removal of Corteva (CTVA) and Compass Minerals (CMP).

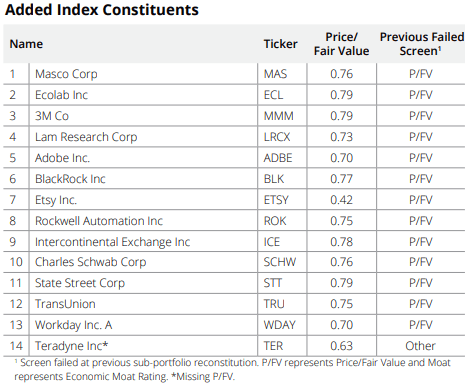

June Rebalance: The New Entrants

The 14 names removed from the sub-portfolio gave way to another 14 wide-moat companies:

VanEck

The financial industry is well-represented among the new entrants, with BlackRock, Charles Schwab, State Street, and Intercontinental Exchange (ICE), seen to be trading at Price/Fair Value ratios ranging from 0.76 to 0.79 (equating to 24% to 21% discounts to fair value).

The inclusion of Adobe (ADBE) – already part of the March reconstitution – and Workday (WDAY), shows that Morningstar sees lasting competitive advantages in select software stocks. In the same way, the presence of Lam Research (LRCX) and TransUnion (TRU) shows Morningstar’s confidence in these two companies’ ability to remain key players in the semiconductor value chain. Finally, let us mention Etsy (ETSY), which is considered almost 60% undervalued according to Morningstar’s methodology.

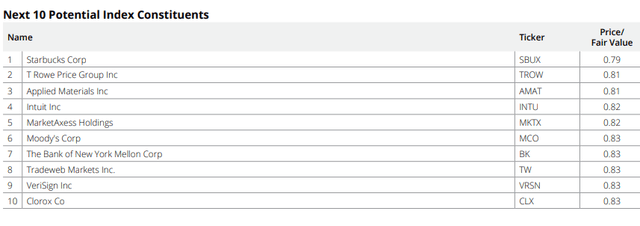

Those Waiting On The Sidelines

As always, VanEck provides a list of stocks that could be included as part of the next rebalance, should their valuations warrant it at the time. More financials could be added, since the shortlist includes the likes of Moody’s (MCO) and Bank Of New York Mellon (BK). The presence of Tradeweb (TW) confirms Morningstar’s favorable view of marketplaces, already illustrated by the inclusion of Intercontinental Exchange and Etsy.

VanEck

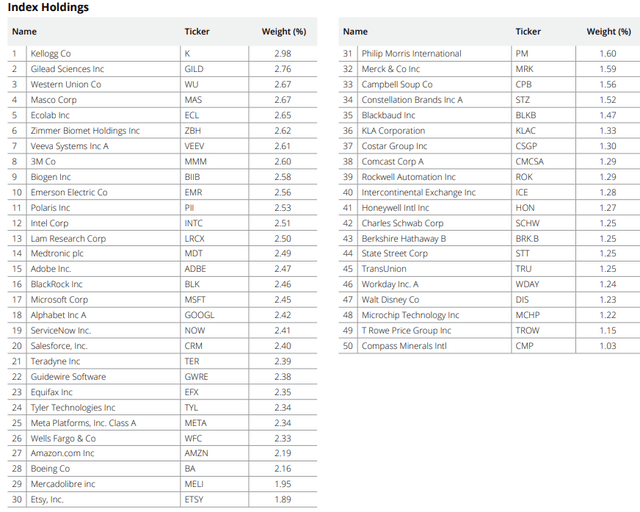

Below is the full list of 50 names currently included in the MOAT ETF. At the moment, Kellogg (K) is the largest position, with a weight of 3% of the portfolio – showing that Morningstar does see significant value in a few food & beverage names.

VanEck

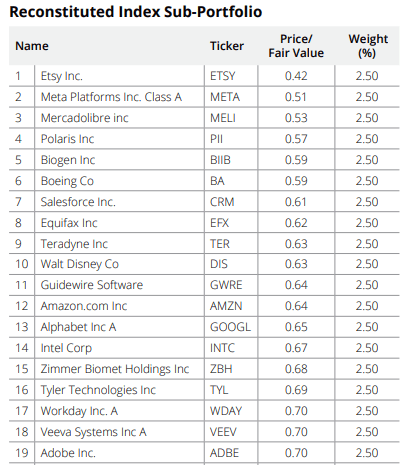

This list can be used as a source of ideas for investors looking for wide-moat stocks trading at reasonable valuations in the wake of the Q2 selloff. In this respect, the Price/Fair Value ratio is a helpful metric:

VanEck

(see this document for full detail)

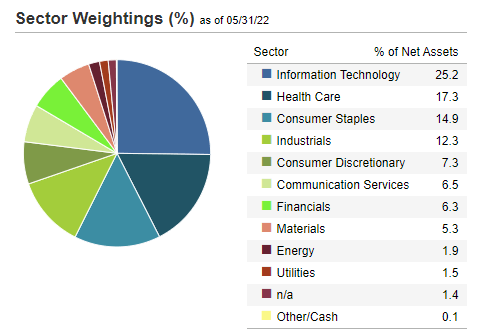

In terms of sector allocation, the breakdown at the end of May was as follows:

VanEck

Takeaway

In my opinion, the MOAT ETF is worth a look both from index investors and stock pickers:

- ETF investors focused on U.S. blue chips with solid competitive advantages, and who are in agreement with Morningstar’s methodology, can save time and effort by simply buying the MOAT ETF.

- Meanwhile, stock pickers who want to take advantage of weakness in particular market sectors, or individual names, can use the ETF’s holdings to identify quality stocks potentially trading at a cheap valuation.

Be the first to comment