Andrii Dodonov/iStock via Getty Images

Navient Corporation (NASDAQ:NAVI) faces some significant headwinds over the next year or so as 2023 approaches, with interest rates continuing to climb, inflation remaining high, the recession likely to deepen, and the ongoing threat of Biden’s student loan forgiveness program remaining in the background.

Add to that the decision to extend the pause on Federal student loan debt through June 30, 2023, and you have a perfect storm of negative catalysts that could put a lot of downward pressure on the performance of NAVI through much of 2023, and possibly longer.

With the headwinds the company is facing, and the primary reason for investing is for income, I think it’s highly probable that investors will seek safer places to put their money to generate income.

In this article, we’ll look at some of the latest numbers from its earnings report, what the company is doing to mitigate some of the risk and how the next year or two is likely to play out.

The company appears to have found a bottom in the mid-$12s, but in light of the headwinds it faces, I’m wary of where it can go from here now that it’s hitting a triple top at a little over $17.00 per share.

Some of the numbers

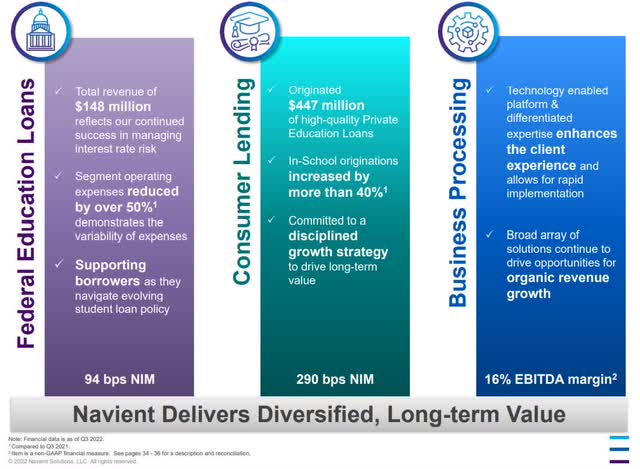

Revenue in the third quarter was $148 million, down 17.39 percent year-over-year, and missing by $12.33 million.

Net income in the reporting period was $105 million, or $0.75 per share, down from $173 million in net income, or $1.04 per share in the third quarter of 2021.

Net income in the first nine months of 2022 was $540 million, or $3.67 per share, dropping from net income of $728 million, or $4.15 per share in the first nine months of 2021. The company maintained its EPS guidance range for the full year at $3.35 to $3.45.

There are concerns over the upcoming $1 billion in maturities in January 2023, but management said with liquidity of $1.4 billion in cash on hand, $1.8 billion in private unencumbered loans, $150 million in FFELP unencumbered loans, and cash flow from the current quarter, it has more than enough to pay the maturity.

Headwinds

Since NAVI has executed well on earnings even as revenue has come under pressure in the recent past, the question heading into 2023 is what the company has left in the tank as it faces ongoing uncertainty over loan forgiveness, elevated inflation, high interest rates, and a probable deepening recession.

In preparation for increasing loan delinquencies and pressure on the top and bottom lines, the company has set aside reserves to help mitigate the effects of the strong headwinds it faces in 2023. For private loans, it set aside $15 million, and for FFELP, it set aside $13 million.

Management is positioning itself to operate in more of a defensive mode next year, as even in the best-case scenario inflation will remain high and interest rates will increase – at least through the first half of the year, in my opinion. That will without a doubt hit its refinance business.

In the worst-case scenario, there will be a significant form of student loan forgiveness and the economy will go into a much deeper recession than it is in now. There is a strong probability that all of these will happen. If they do, NAVI will most likely continue to operate in a defensive posture until the economy improves, inflation and interest rates start to come down, and student loan forgiveness is finally decided. What’s informative about NAVI is a company considered an income generator would usually be a good play in times like these, but the headwinds it faces are detrimental to its business model, and those looking for income would probably do better seeking out companies with a stronger revenue outlook and less susceptibility to a recession, inflation, and higher interest rates, not to mention the overhanging student loan debt forgiveness the company possibly faces.

One way or the other, once the courts clear up the loan issue, at least there will be more clarity as to how investors will be able to more accurately analyze the company than there is at this time.

In the near term, there is still the fact that there is a pause on student loan payments through June 2023.

Refi loans could underperform in 2023

I separated the refi loan business of NAVI from other headwinds because I see it as a potential long-term positive catalyst for the company, but in 2023 it’s likely to underperform based upon high interest rates alone.

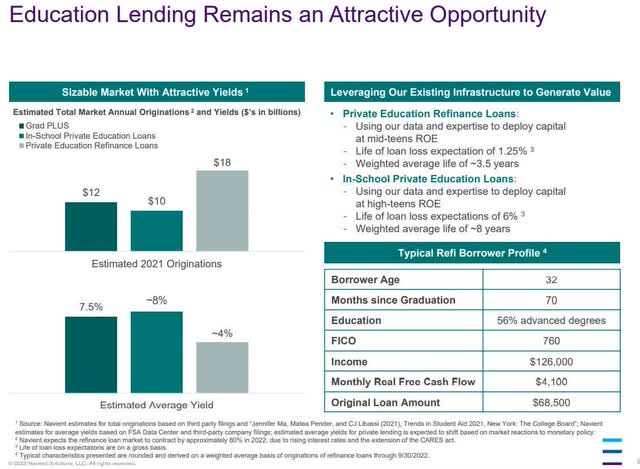

According to NAVI, the typical refi borrower has attractive characteristics. Their average age is 32; they have a FICO of 760; their monthly free cash flow is an average of $4,100; have an annual income of $126,000, with an average original loan amount of $68,500.

Obviously, these are excellent candidates for refinances and a consistent revenue stream for NAVI, but in the current rising interest rate environment, this business is going to slow down, resulting in lower revenue and earnings over the next several years, based upon an average of 3.5 years in duration.

It’s important to consider this because it’s a valuable part of the company’s performance, and it’s going to be under pressure throughout the next year at least; possibly further out if interest rates remain high.

The reason for the decline is original loans have interest rates lower than refi rates in the current environment, taking away the incentive for refinancing in the first place. It’s going to take some time for this to work out.

Conclusion

Within the conditions handed it, NAVI has been doing fairly well, all things considered, but there are far more headwinds the company faces in 2023, with little in the way of tailwinds to offset the effects.

The company has done most of what it can do to mitigate the impact they’ll have on the company and still has to wait to see what the decision will be on forgiving student loan debt, something it can do nothing about.

So, with high inflation, rising interest rates, and a weakening economy, NAVI has transitioned to defensive mode, and I don’t expect much if any growth in the near term from the company; in fact, I believe the pressure is not only going to be on the top line in the year ahead but will also move to the bottom line.

Taking all this into consideration, it would be better to wait and look elsewhere for income until the headwinds subside and the company can look at ways to grow once again. That isn’t going to happen any time in the near future, in my opinion.

Be the first to comment