Justin Sullivan

Is Facebook Old News?

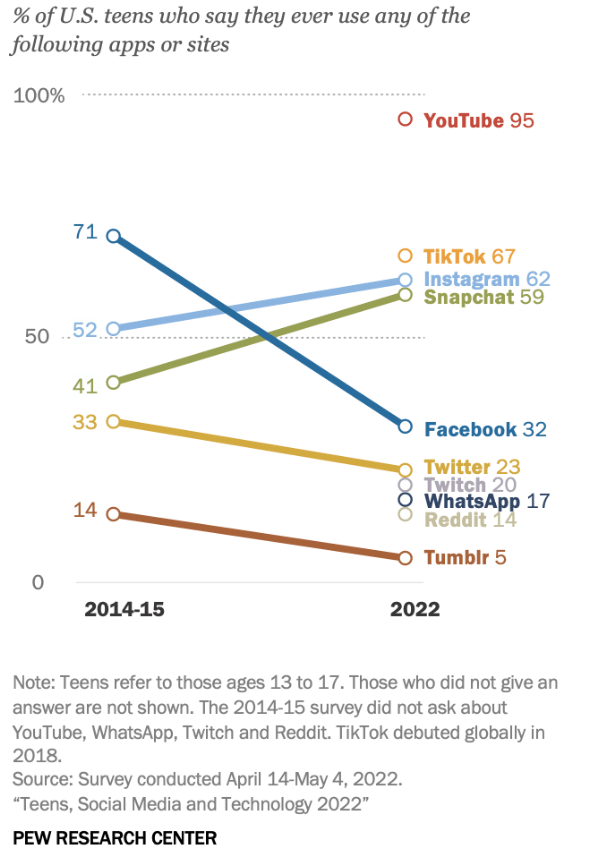

Meta stock has fallen nearly 70% YTD. If I had told you at the beginning of 2022 that Meta would fall 70%, you would have slammed the door in my face. You might be thinking the same thing right now despite the common theme among headlines highlighting ‘what is going on at Meta?’ Why is Zuckerberg investing billions and billions in technology that no one wants to use? I stumbled across an article titled Don’t Buy Meta Platforms Until There is Fundamental Change. The article included PEW Research showcasing how the “Teen use of Facebook has more than halved from 71% in 2014-2015 to just 32% in 2022.”

Teens and Social Media Use Survey (PEW Research)

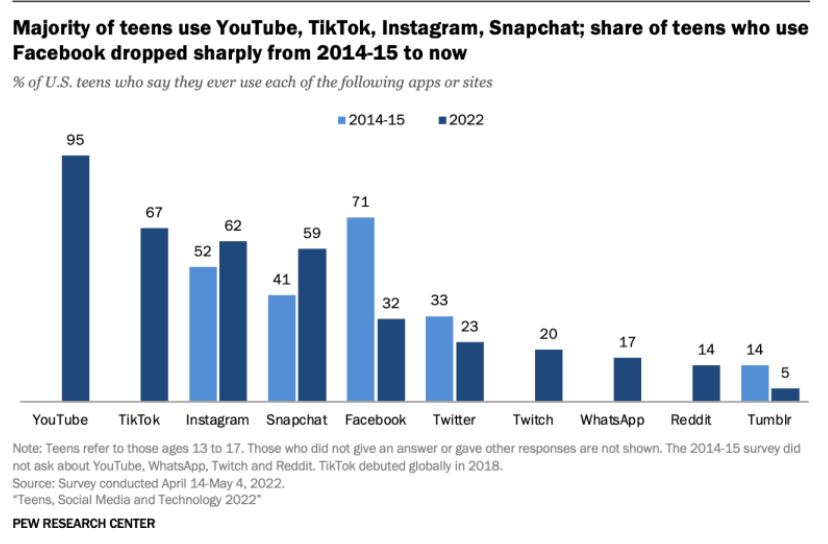

And although Meta continues to experience user growth, many of its users belong to other social networks like Snapchat (SNAP) and TikTok, which are capturing more of Facebook users’ time and engagement. When comparing teen usage from 2014 to the present, Facebook has experienced a severe decline.

Teens Social Media Usage Chart (PEW Research)

And Meta’s rival TikTok is luring users away. Less engagement for Meta means fewer advertising dollars, and Meta’s high dependence on advertisers, whose digital dollar decline has led to falls in revenue and one of the catalysts to the 11,000 layoffs, could be an indication of things to come.

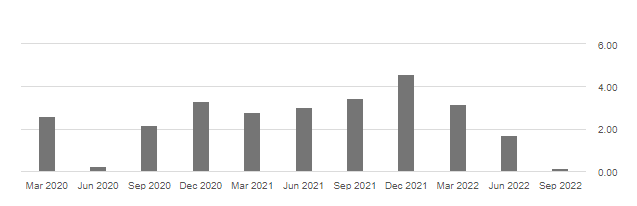

Meta has struggled over the last few quarters as it attempts to reposition itself in the newly created metaverse. Highlighting the struggle is a complete crash in the company’s cash flow per share.

Meta’s Free Cash Flow Per Share Catastrophe

Meta’s Free Cash Flow Per Share Catastrophe (S&P Global, Seeking Alpha)

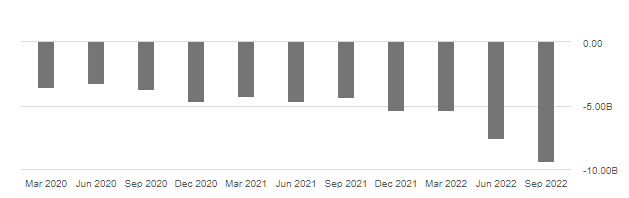

Focusing on VR and artificial intelligence does not appear to be the most intelligent investment. The metaverse business spent nearly $4 billion in Q3 and more than $10B this year in virtual reality, which is on pace to exceed $12 billion. On top of this, Meta’s next-gen $1,500 Quest Pro headset has been a flop, leaving nothing to the imagination but people wondering why Zuckerberg is continuing to invest billions in technology no one wants?!

Net Capital Expenditure Rabbit Hole

Net Capital Expenditure Rabbit Hole (S&P Global, Seeking Alpha)

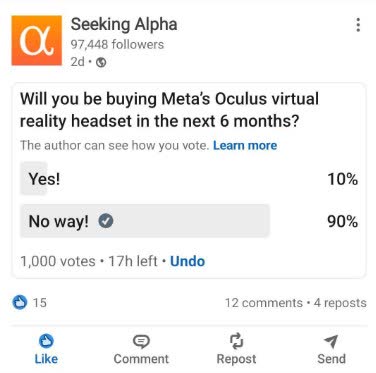

With the upcoming holiday season and this brewing question, I created a LinkedIn poll to see how many people plan to purchase the Oculus Quest Pro headset in the next six months. The results after 1000 votes indicate that 90% of respondents do not intend to purchase the VR headset.

LinkedIn Poll (LinkedIn)

Zuckerberg spent billions on VR in just a few months and continues to move forward with the metaverse buildout. To date, the Oculus headset is not paying off, so how much more will Meta invest in its virtual reality?

Metaverse Madness

No one seems to have an answer for what’s going on with Meta, the former $1T giant formerly known as Facebook. Why the name change? What is the Metaverse? The competitive landscape is stiff, especially with Apple as its major competitor, but why virtual reality and headsets? Sometimes fixing what isn’t broken can break it! The combination of a post-pandemic world mixed with a metaverse is proving too much for our digital lives. While some may have bought into the metaverse, a place parallel to the physical world, not enough buy-in has resulted in massive layoffs.

Meta Cuts 11,000 jobs

In a move to be “leaner and more efficient,” Zuckerberg announced a cut in discretionary spending that included a 13% cut in staff, or over 11,000 employees, plus a hiring freeze. While these moves do not change the Q4 revenue outlook, in line with consensus estimates of approximately $31B, investors may finally feel that operations and strategies are being adequately reevaluated. On the heels of the news, Meta stock climbed 5%. However, Zuckerberg did not mention that Meta was changing its Metaverse strategy. This is simply a move to stop the hemorrhaging. Although this could be a positive turnaround for the company, the number of headwinds facing Meta is why I believe this stock is a Strong Sell. Additionally, “cycles of boom and bust are incredibly destructive within organizations because people employed there feel like they don’t know where they stand,” said Sandra J. Sucher, Harvard Professor. Whether in the metaverse or back to reality, Meta could see another 70% decline in 2023.

Meta Platforms, Inc. (NASDAQ:META)

-

Market Capitalization: $255.79B

-

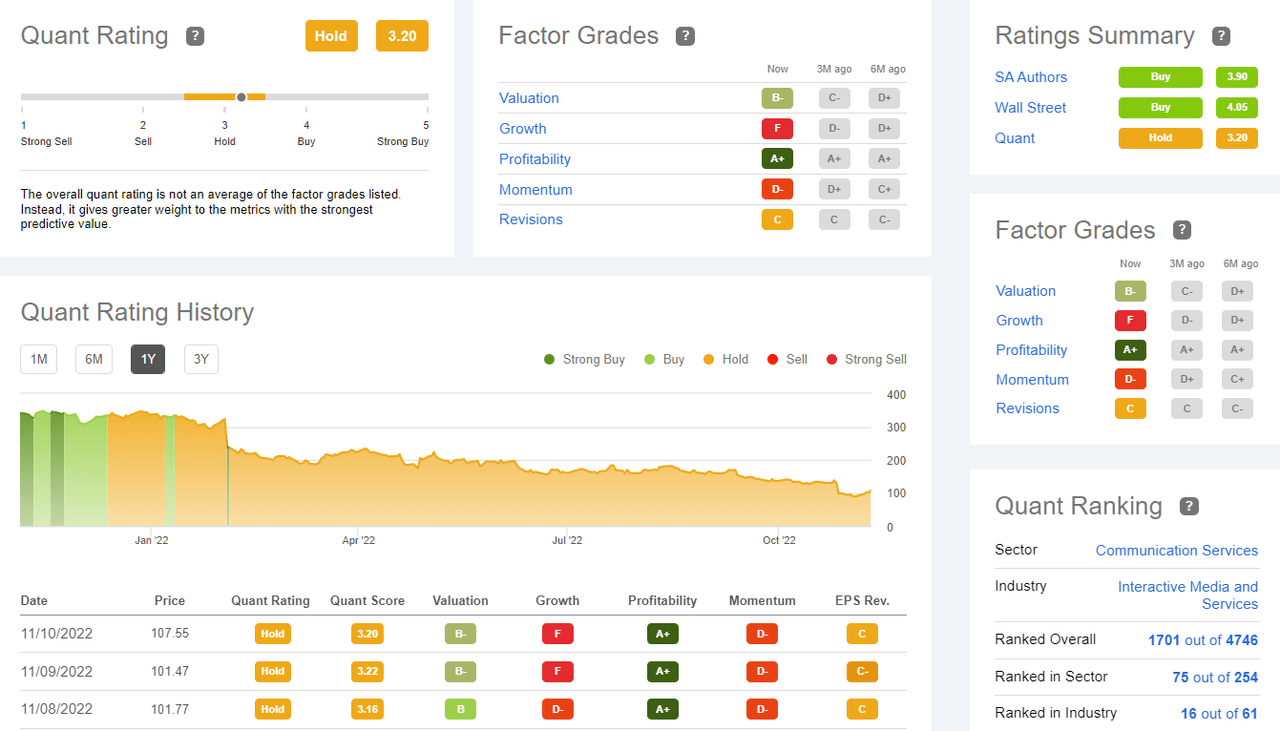

Quant Sector Ranking (as of 11/10): 75 out of 254

-

Quant Industry Ranking (as of 11/10): 16 out of 61

Multinational technology company Meta Platforms, Inc., formerly known as Facebook, is the owner of popular applications like Instagram and WhatsApp, messaging applications for people to connect. Operating in two segments: Family of Apps and Reality Labs, the reality labs segment is a newer virtual reality-related division offering VR hardware and software, including its latest headset that includes the Oculus Quest. For many investors – especially at its current price point approaching $100 per share – this popular FAANG stock was a cash cow with tremendous momentum for many years. With more than $54B cash from operations and excellent growth profit margins, one would think Meta is on solid ground to weather the current economic storm while being innovative and looking to the future to continue championing over the long term. But competition, a slowing economy, and consumer demand, falling digital advertising(its primary source of revenue) have created a shift within the company. And where I normally stick to my quant ratings, I’m putting my analyst hat on to say this stock, now quant-rated a HOLD, is a Strong Sell.

I believe it is a Strong Sell given its underwhelming Q3 earnings and several factors outside of pure data and financials that include macroeconomic factors affecting this stock. Using the all-important Price to Growth ratio, Meta is extremely overvalued, given its near-term and long-term growth rate. The Price to Earnings Growth multiple at 3.88x is at a 236% premium to the Communication Services sector median at 1.15X. If the multiple dropped to the sector median, the stock could fall 70% in 2023. Typically, an investor would not look at one ratio to determine or project a stock’s target price. However, this stock is incredibly overvalued when I combine the valuation framework with the growth scenario. Meta faces several macro headwinds, including slowing consumer demand. The outlook is bleak, with quarterly profits having fallen 50% and a second consecutive decline in sales. However, Meta is likely to withstand an economic slowdown and the hurdles it faces, given its balance sheet strength and amazing profitability. Lacking growth, slowing momentum, and a slew of downward analyst revisions as the year unfolds, Meta is facing headwinds that, in my opinion, make this stock a Strong Sell.

META Stock Quant Rating & Factor Grades (Seeking Alpha Premium)

Although Meta experienced a surge in online commerce during the pandemic, the spikes in revenue have come down and are now costing the company. Zuckerberg believed the rapid acceleration in online commerce would sustain and therefore increased Meta’s spending to grow, resulting in 28% more employees. “Unfortunately, this did not play out the way I expected…I got this wrong, and I take responsibility for that,” wrote Zuckerberg in a letter to employees. With 11,000 layoffs, falling sales and stock prices, and an uncertain outlook, a shift in the metaverse is taking place that is likely to affect.

Meta Stock Valuation & Momentum

The IT sector is highly concentrated in a few stocks with stretched valuations. Purely using Price to Earnings, Meta comes at a discount, with a forward P/E ratio of 11.20x compared to the sector’s 15.71x, a -28.67% difference to the sector. However, its forward D- PEG of 3.88x is a more than 236% difference to the sector. Dwindling growth figures and free cash flow that’s all but disappeared are why Meta Platforms are becoming The Bad, The Ugly, And The Disaster!

META Momentum Grade (Seeking Alpha Premium)

With its most significant revenue streams coming from digital advertising, the downturn in the ad market is significantly affecting Meta, showcased in its Q3 4.5% year-over-year decline in total revenues and FY2022 EPS forecasts expected to decline approximately 30% YoY. These figures indicate the longer-term bearish trend we’re seeing, where the stock’s declining 200-day moving average continues to lag the S&P 500 (-16%) and Nasdaq (-30%), evidenced in its quarterly price performance that is severely underperforming its sector peers. As the landscape changes, is Meta a value trap, or are its layoffs positioning the company for greater growth and profitability?

Meta Stock Growth & Profitability

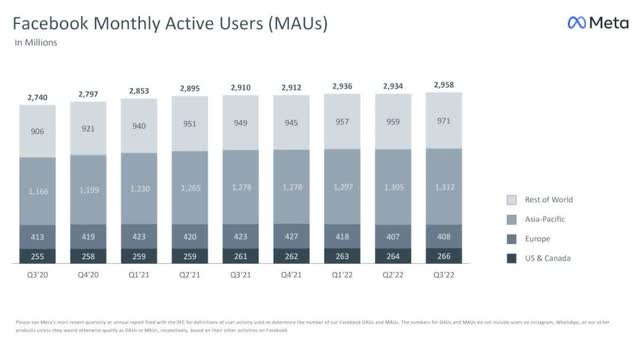

Despite possessing the largest social network in the world, Facebook, WhatsApp, and Instagram’s collective platforms amount to more than 3B monthly active users. And although the company’s platform is attractive for advertisers and its ability to generate leads and views, Meta reported disappointing and mixed Q3 results.

Facebook Monthly Active Users (Meta Q3 Investor Presentation)

Although revenue of $27.71B beat by $313.82M, EPS of $1.64 missed by $0.21. The social media platforms’ user count and engagement metrics remain positive, yet, ad sales have fallen, which taps into the company’s ability to monetize and grow through newer channels like virtual reality, as profits are under pressure amid OPEX and CAPEX. Mark Zuckerberg continues to invest billions of dollars in its Metaverse strategy to grow his one-trick pony to the next level. As you can see in the growth grades below, Meta’s growth just isn’t there. Macroeconomic issues, especially from competitor Apple (AAPL), pose challenges, along with the strengthening dollar and regulations surrounding data usage and privacy.

META Stock Growth Grade (Seeking Alpha Premium)

Meta experienced a decline in cash flow on the heels of capital expenditures that included principal payments on finance leases and investment in servers, data centers, and network infrastructure. Coupled with its D- PEG ratio, this spending appears to be going into a rabbit hole.

Although the Q3 Family of Apps revenue was down 4% from $27.4B when factoring in currency fluctuations, the challenging environment still allowed for strong click-to-messaging ads, with the strongest growth in the Asia-Pacific region at 6%. Meta maintains an A+ profitability grade with over $54B cash on hand. It’s likely to withstand recession concerns and muted upside potential, given the headwinds and analysts forecasting little revenue growth over the next couple of years. The problem is the billions continuing to be invested in artificial intelligence discovery for Meta’s Reality Labs investment.

“Three of the primary areas we are going to focus on are our AI discovery engine that’s powering Reels and other recommendation experiences, our ads, and business messaging platforms, and our future vision for the metaverse…So I think that we should keep investing heavily in these areas. As I have shared before, our goal is to grow Family of Apps operating income such that even with our AI infrastructure and Reality Labs investments, we can still meaningfully grow our overall company operating income in the long-term. Our current surge in CapEx is largely due to building out our AI infrastructure, and we would expect CapEx to come down as a percent of revenue over the long-term. We expect Reality Labs expenses will increase meaningfully again in 2023, with the biggest drivers of that being the launch of the next generation of our consumer Quest headset and hiring that has been done in 2022, but for which we are going to be paying the first full year of salaries next year.

More broadly, beyond 2023, we expect to pace Reality Labs’ investments to ensure that we can achieve our goal of growing overall company operating income. Our capital allocation philosophy over the long-term is to allocate a portion of the profits generated from the Family of Apps towards these future-focused areas while enabling a greater return of capital to shareholders.” –Mark Zuckerberg, Meta CEO.

One of Meta’s biggest concerns is an economic downturn, and Q2 and Q3 results have already disappointed. Wall Street and Main Street appear to be confused about Meta’s vision, and so far, the changes have not worked to Meta’s benefit. The impacts of data privacy continue to change, and unless you currently own shares of Meta, I do not believe the current risk of investing in this stock will be worth the reward.

One of the primary ways I gauge potential winning stocks is through EPS, which calculates a company’s profit and divides it by the outstanding shares of common stock to indicate profitability. Meta’s Q2 EPS of $2.46 was missed by $0.09, and Q3 EPS of $1.64 missed by $0.21. Meta’s forward Long-Term EPS growth has a grade of D at 2.88%, 73.86% below the sector. Typically, the higher the EPS, the higher the company’s value. Given its low Long-Term EPS figure and grade, many other IT stocks offer better fundamentals. Given the impacts of fewer ad dollars, fluctuations in currency, and billions being invested into the metaverse that may not see fruition, it may be time for Meta to “face” reality. Sometimes change isn’t good.

Conclusion: Lay-off Meta

Our primary warning of a 70% decline in share price is largely based on the Price to Earnings Growth multiple at 3.88x trading down to the Communication Services sector median PEG ratio at 1.15X. Meta has a lot of firepower to alter this outcome and potential negative fate. They are sitting on $54 Billion in cash from operations and can absorb a lot more pain with zero debt. In terms of fantastical speculation, Meta could pay a dividend or buy back half of its common stock. They could cut bait on the Metaverse to focus on its core business or aggressively go after Tik Tok market share – maybe even change their name back to Facebook. There is a lot Meta can do to prevent another down 70% year in the share price. However, they are facing major headwinds.

Meta is quant-rated a HOLD, but its growth is severely stunted. Competition and a slowing environment are just a few of the concerns. Layoffs, downward revisions, and mixed Q2 and Q3 earnings on the heels of billions being spent on the metaverse make the future outlook for Meta uninspiring, which is why I believe one should reconsider or lay off investing in the stock in the near future.

Meta lacks strong long-term growth and faces considerable obstacles. Professional analysts estimate Meta’s 3-5-year forward long-term earnings per share CAGR growth at 2.88% compared to 11% for the sector. Where the tech sector (XLK) is -26% YTD, Meta is -67% YTD, offering little growth. Investing billions and billions into new technology nobody wants can be detrimental to a stock’s health. Many tech stocks offer a good balance of growth, profitability, and value in the current environment. It’s great to diversify portfolios with alternative technology stocks. Although Meta is currently rated Quant Hold, I believe this stock will fall to a Sell rating given the market environment and headwinds Zuckerberg faces. Many Communications Stocks are in far better shape than Meta. Seeking Alpha offers a list of Top Technology Stocks with strong growth, attractive valuations, solid profitability, and positive upward analysts’ earnings revisions. Consider some of the alternatives for your portfolio.

Be the first to comment