naphtalina/iStock via Getty Images

There are some names we have watched fall for a year, waiting for signs of a bottom. Those signs are in for some stocks, but it may be because the market, especially tech, has had a great few weeks. Thus, we are prepared to buy today’s featured stock every five-ten points lower over the next 3 months, with a target exit of $135, unless disaster strikes and our average cost gets well under $100, in which case we will sell once our position is up 10%, regardless of what the stock price may be. Today we are looking at a little company called Five9 (NASDAQ:FIVN). Maybe you have done some business with them, maybe not. It is an interesting company. Founded in 2001 and based in California, Five9 offers intelligent cloud software for contact centers. It does so in both the United States and internationally. It has a virtual contact center cloud platform that delivers a suite of applications that enables its clients to manage customer interactions across various channels. Five9 works with a lot of different sectors. It is an impressive company. We like the outlook here.

Why we like the company in the medium-term

This company solves problems for companies that they may not even know they have. Bottom line is that there is a need for business to be efficient and one way this happens is by automating manual tasks. This is a need of businesses particularly in a time when budgets are tight and labor is scarce. By automating a lot of these processes for companies, they will save money. That said, while operations in the United States are strong from what we can tell by looking at the numbers, there is a massive opportunity internationally. For the reasons, along with exceptional growth metrics, we want to start buying FIVN on pullbacks.

That is the key… on pullbacks. We will start buying now, and if the stock shoots higher, then awesome. Cool. High quality problem. We made some money. But otherwise we will build the position and wait until we are up at least 10% should our average basis dip under $100.

The play

Entry 1: $110 (20% of position)

Entry 2: $102 (20% of position)

Entry 3: $95 (20% of position)

Entry 4: $85 (20% of position)

Entry 5: $75 (20% of position)

Target exit, assuming cost basis does not reach an average under $100: $135

We are not using a stop loss on this trade given its structure. The company is growing and profitable already, no need to worry the stock will go too far south.

If our cost average falls below $100, then we will continue to buy as prescribed, but look to sell with a 10% gain from our basis.

Discussion

The company is growing like crazy. The major highlights of the just reported quarter show the strength of the company, which already boasts great growth grades.

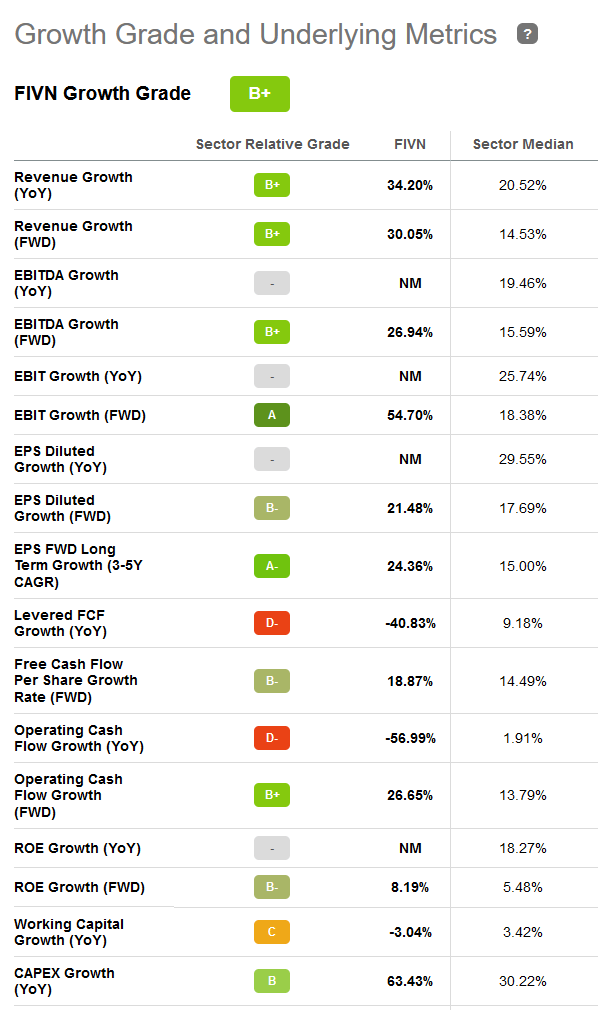

Seeking Alpha FIVN Growth Metrics

This growth is quite strong. The reason this tech excites me is that not only is the growth there, it already has profitability. While the profitability is average compared to the sector, when you factor in the growth, future profit is likely to ramp hard.

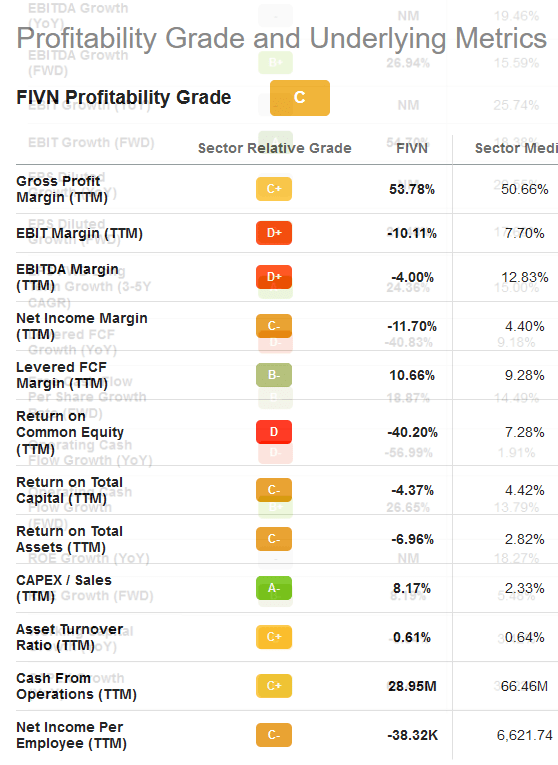

Seeking Alpha FIVN Profitability Mertrics

That said the results of the recent quarter were strong and we are comfortable buying here as prescribed. While it may take a month, or 3 months, maybe a few quarters (very unlikely) for the trade to play out, we really like this company. The growth in Q2 was so good.

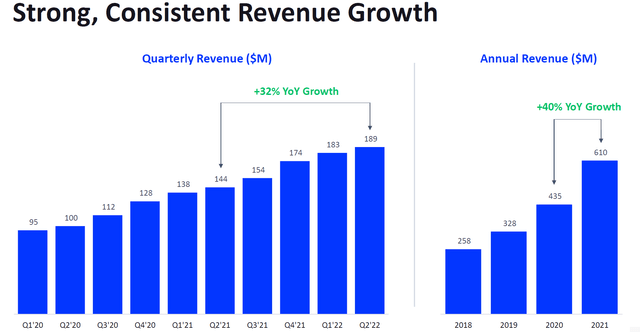

FIVN Q2 slides

As you can see, revenue for Q2 2022 increased 32% to a record $189.4 million, compared to $143.8 million for Q2 2021.

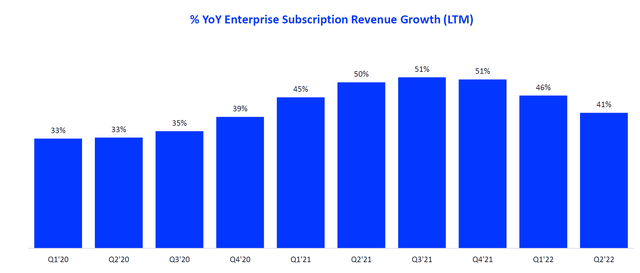

FIVN Q2 slides

This growth continues to be driven primarily by the strength of the Enterprise business, where last 12 months or LTM subscription revenue grew 41% year-over-year.

FIVN Q2 slides

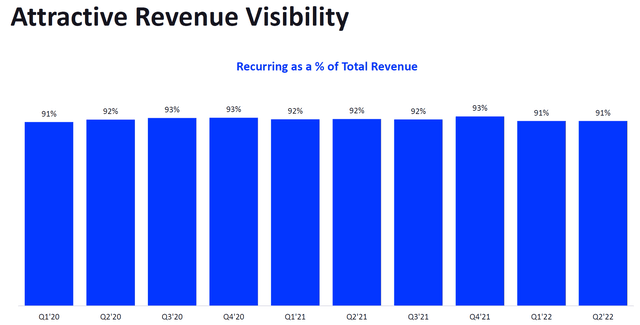

Most revenue is recurring and this recurring revenue stream as a percentage of total revenue has been stable for many quarters. This helps forecast expectations.

FIVN Q2 slides

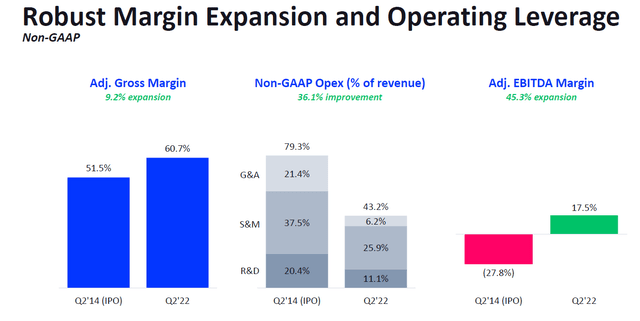

There has been solid margin expansion generally speaking over time as you can see above. It does not always grow of course. In Q2, the GAAP gross margin was 53.4% compared to 55.2% for Q2 2021. Adjusted gross margin was lower to at 60.7% compared to 63.3% a year ago.

Profitable company

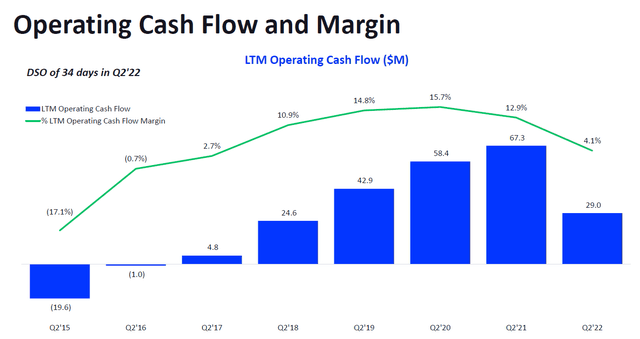

The company makes money on an adjusted basis as well. Adjusted net income was $24.3 million in Q2, or $0.34 per share, way up from $16.2 million, or $0.23 per share a year ago. On top of that, adjusted EBITDA for Q2 was $33.1 million, or 17.5% of revenue, compared to $24.0 million, or 16.7% of revenue, last year. That is great, and operating cash flow has been strong.

Seeking alpha

This is a great trend, although GAAP operating cash flow was in the red, losing $3.1 million, compared to GAAP operating cash flow of $11.4 million for Q2 2021. Over the LTM, operating cash flow was $41 million, excluding $12 million of one-time items. Let us be clear. This company now has managed to deliver 24 consecutive quarters of positive LTM operating cash flow. Solid. That is solid. What is more management expects LTM operating cash flow to increase in the second half and to increase meaningfully in the longer-term given their demonstrated ability to expand adjusted EBITDA margins.

Translation: Buy this stock because it has a great underlying company and a competent management team!

Earnings are improving. For the full year 2022, Five9 in the press release indicated that it “expects to report revenue in the range of $780.5 to $782.5 million”. At the same time adjusted net income per share should be in the “range of $1.38 to $1.40”. Now, make no mistake, at $110 a share, this is a crazy 79X FWD EPS. But the growth in earnings is projected to more than justify this price.

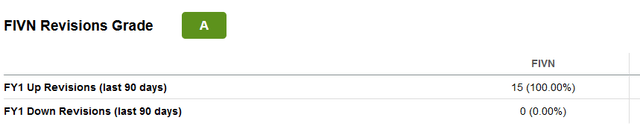

Earnings are being revised higher:

Seeking Alpha

In addition, our early 2023 reads appear to see EPS growing from 1.40 to possibly $2.00 or more, which would be 43% EPS growth. Not too shabby if it holds. We think you buy on the dips.

Final thoughts

We think you buy now and average down in equal blocks here if the market allows. We believe strongly this trade will not result in a cost basis below $100, but if it does, our plan is to simply keep the 7-10 point drop levels in mind and buy each time, but sell as soon as we have at least a 10% gain, which is a good win. But I think we get more in the long term, much more, so investors should feel confident buying up shares.

Be the first to comment