Photon-Photos

With third quarter results expected, this is a good time to review our initial bullish thesis on Natural Resource Partners LP (NYSE:NRP). We shall see that the company’s fundamentals remain strong, and that broader industry trends provide a path to strong future returns and improved market performance.

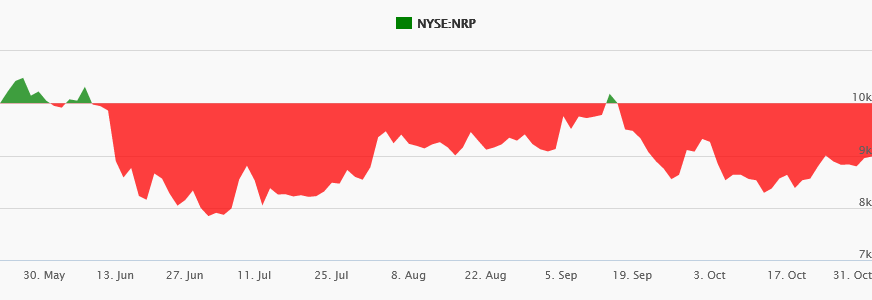

Since we first discussed Natural Resource Partners, the share price has fallen nearly 10.2%, despite our bullish thesis. Year-to-date, the stock is up more than 27%.

Source: Natural Resource Partners LP

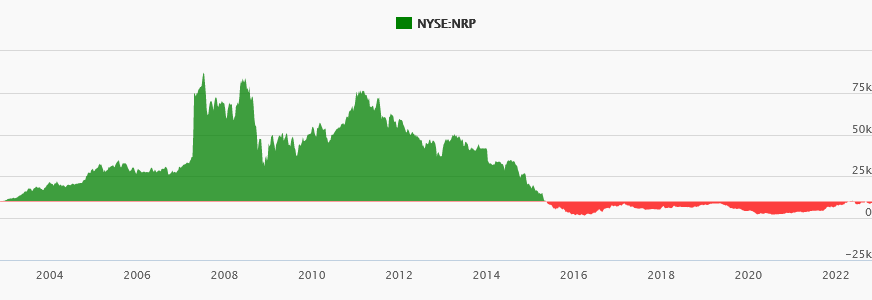

As we pointed out, the company has, across its life, been a terrible investment. Since listing in 2002, shareholders have earned a total return of -8.51%, at a compound annual growth rate of -0.44%.

Source: Natural Resource Partners LP

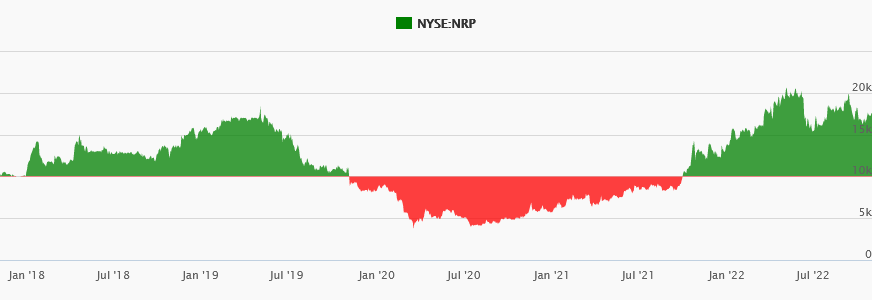

In the five-year period, the company has given investors a total return of 75.86%, for a five-year CAGR of 11.97%.

Source: Natural Resource Partners LP

Natural resource Partners’ strong performance over the last five years reflects its underlying economics and broader trends in the industry.

Metals And Mining Are Thematically Correct

The framework underpinning our first thesis is that the asset growth effect drives returns in commodity businesses. Discovered in 2007 by Michael J. Cooper, Huseyin Gulen, and Michael J. Schill, the effect refers to how asset growth predicts future abnormal returns. This is true at the business level and the industry level. Marathon Asset Management refers to how the asset growth effect manifests itself across time as the capital cycle. The capital cycle is particularly strong with commodity companies, which are price takers, and whose capital expenditure decisions occur years, sometimes decades before prices can be observed. This leads to under or overshooting of supply, and when capex decisions are taken during boom periods, the tendency is toward oversupply and declining future returns.

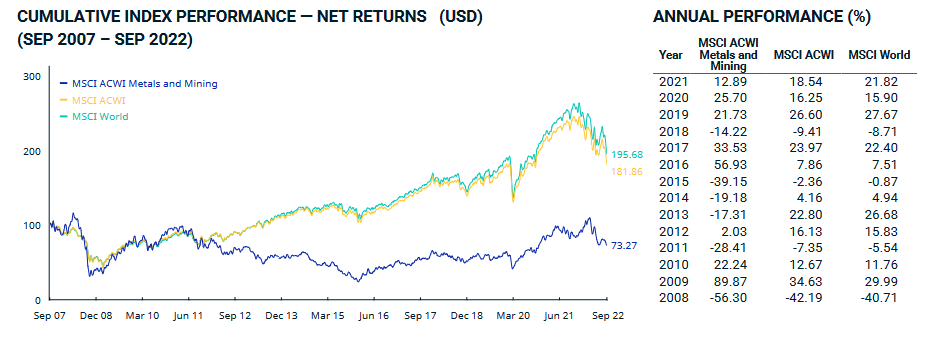

Basically, because commodity firms are price takers, they have a tendency to chase the direction of market prices when they make capex decisions. When prices rise, capex expands, when prices fall, capex plummets. An inverse relationship is created between the supply of capital and future returns. Thus, Natural Resource Partners’ results are unremarkable once you consider the performance of the MSCI ACWI World Metals and Mining Index. Look at the chart showing Natural Resource Partners’ returns since IPO, and the chart below, and they’re clearly strongly correlated. In the last decade, the MSCI ACWI World Metals and Mining Index has returned 0.78% a year, compared to 7.28% for the MSCI ACWI, and 8.11% for the MSCI World Index. In the year-to-date, the MSCI ACWI Metals and Mining is down 17.97%, while the MSCI ACWI is down 25.63% and the MSCI World is down 25.42%. Recent results show that the industry as a whole is down, but, it’s performing better than the general market. While not a perfect match – the asset growth effect does not suggest that – we are reinforced in our belief that metals and mining are the right theme for an investor.

Source: MSCI ACWI World Metals and Mining Index

Natural Resource Partners’ results for the year are strongly positive. The question is, is the company still an attractive investment?

Strong Financial Performance

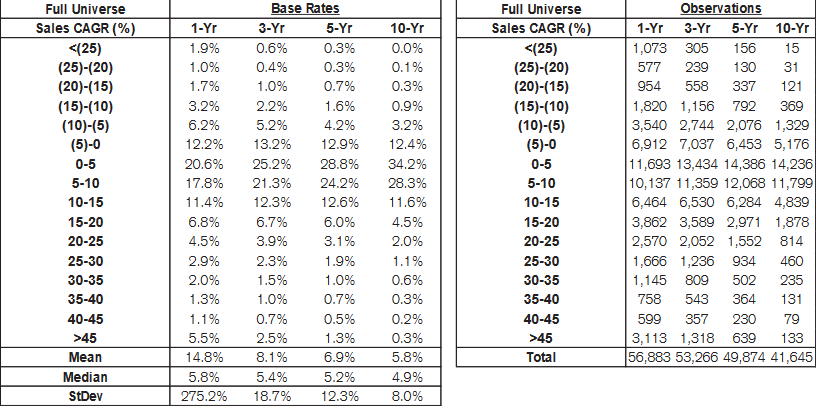

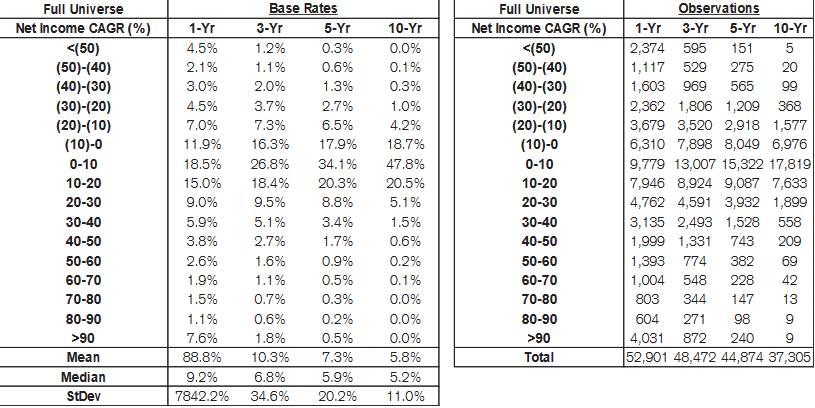

In the last five years, revenue has declined from $378.017 million in 2017, to $216.364 million in 2021, for a five-year revenue CAGR of -10.56%. In the period between 1950 and 2015, just 1.6% of firms achieved similar levels of revenue decline, according to Credit Suisse’s The Base Rate Book. This decline reflects the secular decline of coal usage across the world. In the trailing twelve months, revenue was $330.35 million, reflecting the boom in commodity prices in the wake of Russia’s invasion of Ukraine.

Source: Credit Suisse

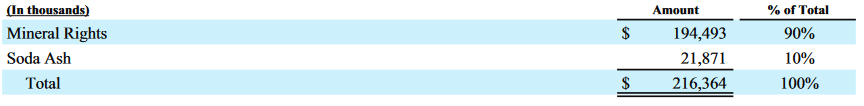

Revenue derives from two segments: mineral rights and soda ash.

Source: 2021 Annual Report

The mineral rights segment is dominated by coal revenues. Of the $194 million the company earned from the segment, $104 million came from coal. The decline in revenues over the last five years is not anomalous. It reflects the secular decline in the use of coal. However, this is not necessarily an impediment to profitability, and, for Natural Resource Partners, it has not been.

Gross profitability, meanwhile, has risen marginally from 0.18 in 2017, to nearly 0.2 in 2021. This is during a period when revenue declined markedly. Referring to the asset growth effect, it’s notable that total assets declined from nearly $1.39 billion in 2017, to nearly $954 million in 2021. While the company’s profitability has improved, it’s still far from the 0.33 threshold that marks a stock out as attractive, according to Robert Novy-Marx’s research. In the TTM period, gross profitability has risen to 0.29, inching toward 0.33.

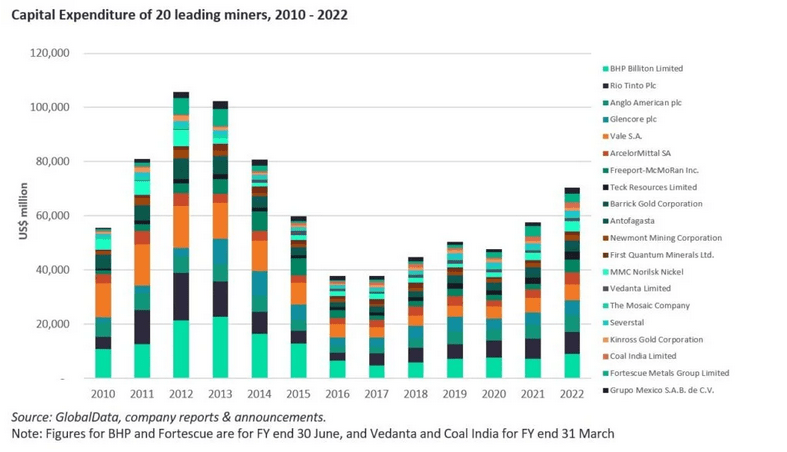

Natural Resource Partners’ shrinking asset base reflects broader trends in the metals and mining industry. Globally, the 20 largest miners have significantly reduced their capital expenditure over the last decade. Although capex has risen since the pandemic, it remains well below the high levels of a decade ago. The effect of contracting capex has been to improve returns, and, so far, that has held. In 2023, capex growth is expected to fall, with capex expected to rise more than 20% in 2022. Once again, Natural Resource Partners’ must be understood in relation to the broad market.

Source: Mining Technology

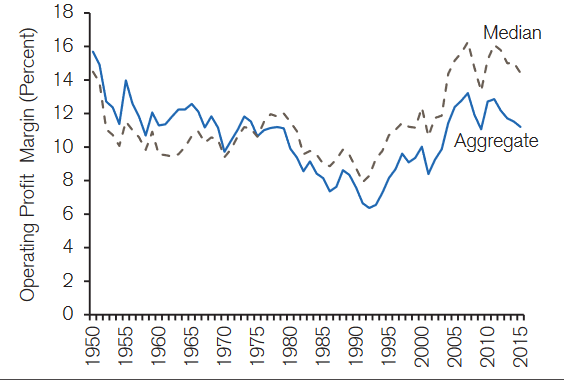

Operating margin in 2017 was 48.67%, rising to 68.3% in 2021. In the TTM period, operating margin rose to 77.7%. This is higher than the aggregate and median operating margin for the 1,000 largest firms in the United States, during the 1950 to 2015 period.

Source/ Credit Suisse

In 2017, the company reported net income attributable to common unitholders of over $61.95 million, which rose to $75.75 million in 2021, for a five-year net income CAGR of 4.1%. That gives us a base rate of 34.1% of companies. In the TTM period, net income attributable to common unitholders has risen to $183.44 million.

Source: Credit Suisse

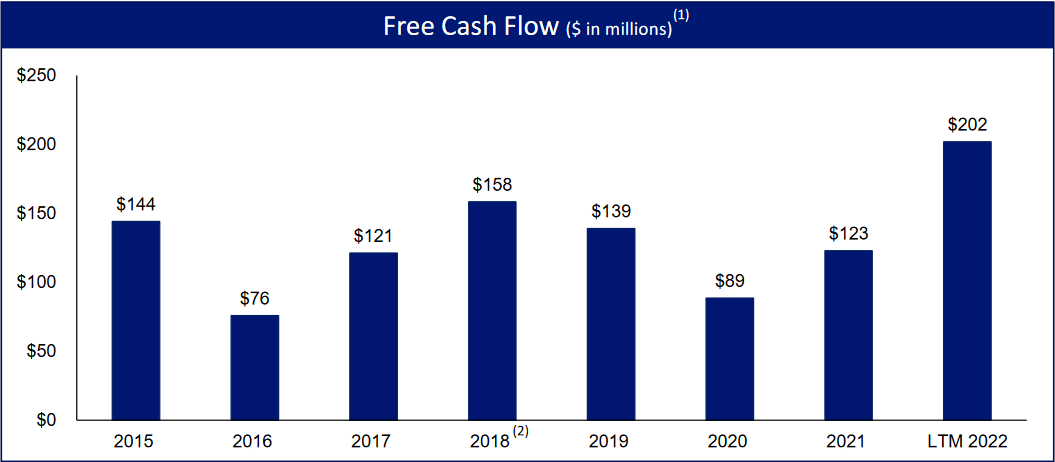

Free cash flow rose marginally from over $121 million in 2017, to nearly $123 million in 2021. In the TTM period, FCF is $202 million.

Source: Natural Resource Partners’ Citi One-On-One Midstream/Energy Infrastructure Conference Presentation

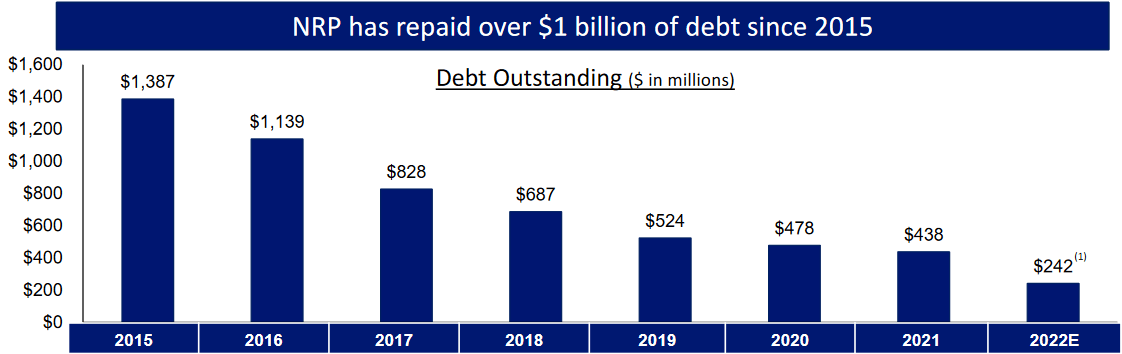

The company has used its ability to generate meaningful FCF to pay down its debt, de-risk its capital structure, and increase shareholder equity. Since 2015, Natural Resource Partners has repaid over $1 billion in debt. At the end of the year, the company expected to have just $242 million in debt outstanding. Once again returning to our asset growth effect thesis, there’s an inverse relationship between asset size and future returns, and the company’s actions bode well for the future.

Source: Natural Resource Partners’ Citi One-On-One Midstream/Energy Infrastructure Conference Presentation

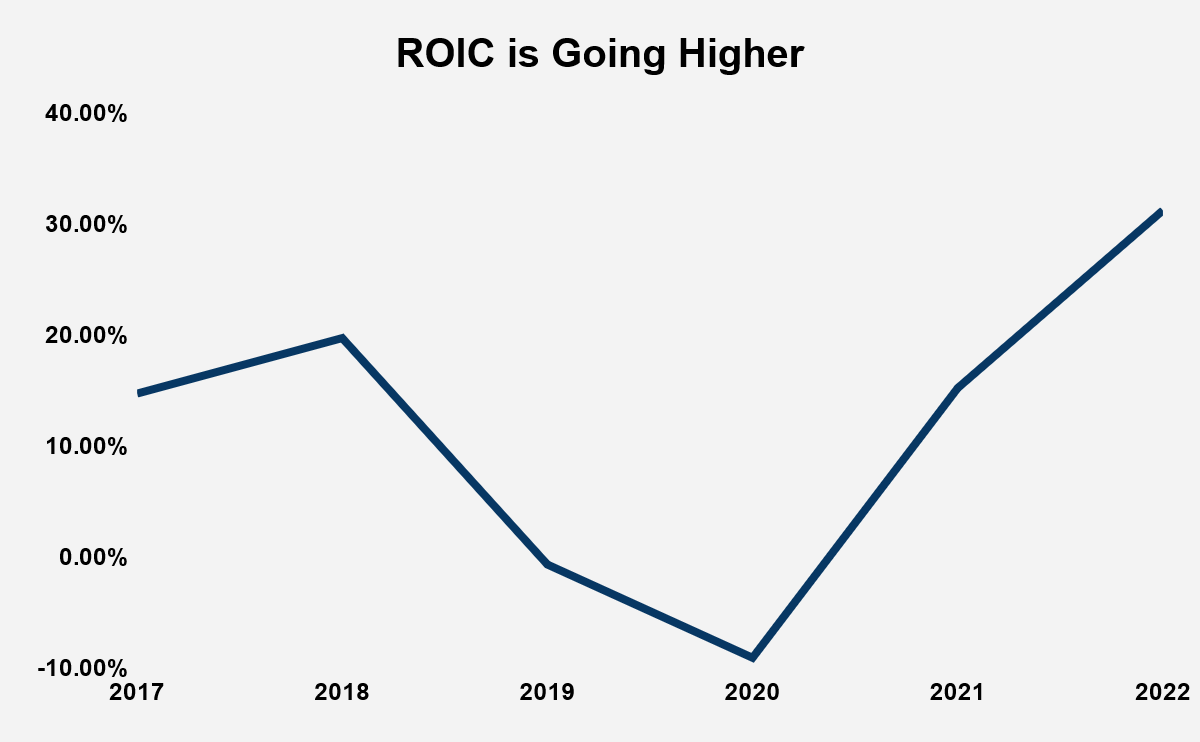

Natural Resource Partners’ return on invested capital has risen from 14.8% in 2017, to 31.3% in the TTM period. The chart below shows that this evolution has not been smooth, and, indeed, reflects the volatility of the sector. Nevertheless, ROIC does appear to be rising, suggesting the possibility of superior future returns.

Source: Author’s Calculations

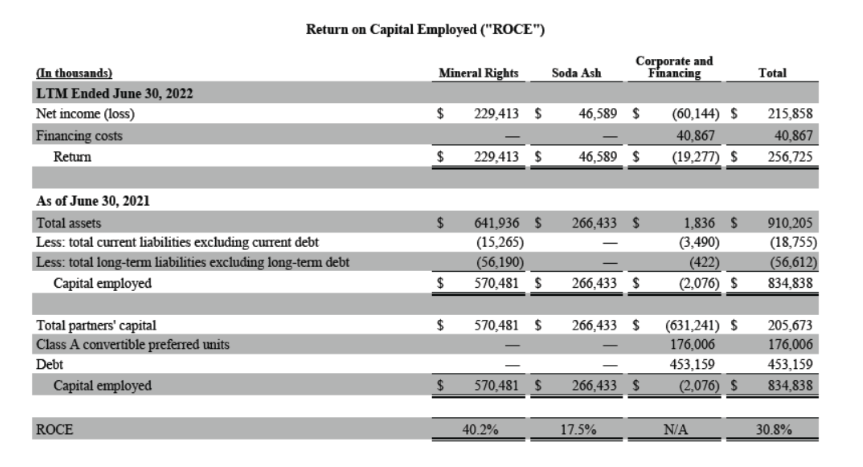

The attractive ROIC is synonymous with the company’s own measurement of its return on capital employed (ROCE), which it calculates at 30.8% for the TTM period.

Source: Natural Resource Partners’ Citi One-On-One Midstream/Energy Infrastructure Conference Presentation

One of the four elements of the partnership’s strategy is to maximize FCF and ROCE, a goal which aligns with what investors want from a business.

The Buy Signals Remain

With an enterprise value of $761.14 million, Natural Resource Partners has an FCF yield of 26.53%. This is a very attractive signal for investors. In addition, the company has a price to (diluted) earnings ratio of nearly 8.87, pointing to its very attractive relative valuation.

Conclusion

Natural Resource Partners’ performance over the last five years has been very good. Year-to-date, the partnership has led the market. The fundamentals that drove the improvements in the share price performance remain, despite the price falling since the first thesis was outlined. With the industry expected to reduce capex in 2022, we can expect future profitability and returns to rise. Investors should, then, brave the storm, and see the FCF yield as a great signal to invest.

Be the first to comment