YelenaYemchuk/iStock via Getty Images

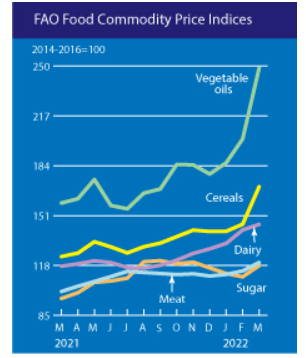

During times like these, when inflation is running rampant (and not so transitory as predicted) there is one way to add some portfolio protection that involves food. Food, utilities, energy, consumer staples and healthcare are frequently cited as being the most inflation-resistant areas of the economy based on past history, with food, energy, and vehicles seeing the highest recent inflation rates. After all, people still have to eat even if everything keeps getting more expensive. The prices of food, and in particular cereals, dairy, and vegetable oils, have been rising the most over the past year according to this report from the FAO (UN Food and Agriculture Organization) on the world food price index.

FAO World Food Prices (FAO World Food Situation)

With food prices reaching all-time highs due to soaring inflation, one stock to consider that is likely to benefit from those rising prices is Natural Grocers by Vitamin Cottage (NYSE:NGVC).

Rising food prices generally lead to higher profits for grocers and food retailers as they pass along those price increases to their customers. Those grocers that have been streamlining operations, increasing revenues and margins, adding new stores, and growing their customer base, are the most likely to benefit the most from continued inflation.

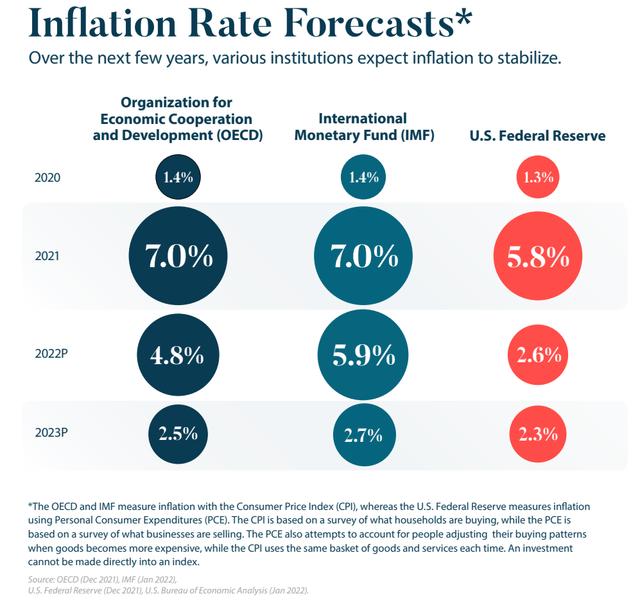

In January of this year, inflation was expected to rise in 2022 by much less than the 7% rate that it increased in 2021. According to this report from New York Life Investments, the expected rate of inflation for 2022 at the start of the year was around 4.8%, however, given that we are already past the first quarter and now inflation has increased to about 8.5% as of March 2022, that estimate may have been overly optimistic.

U.S. Inflation: Past, Present, and Future (New York Life Investments)

With the impacts of the war in Ukraine and expected shortages of wheat, corn, barley and other grains, the food prices that have been rising quickly over the past year, and especially in 2022, are most likely going to continue to see an increase for the foreseeable future:

From the moment Russia invaded Ukraine, it was clear the ripple effects on world hunger would be severe. That’s because the two countries provide a massive share of the world’s supply of key foods like wheat, corn, barley and more. And aid organizations warned that as the war drove up prices, people around the world would no longer be able to afford these foods. Now, less than two months into this war, it looks like those fears are coming true.

In addition, and compounding the problem is the higher energy costs that we are experiencing globally, and increasingly since the start of the Ukraine war. In developed countries especially, the increase in energy prices is the primary factor influencing higher food prices. The food supply chain, from farm processing to transportation, storage, and eventual delivery at retail locations relies heavily on energy.

Covid Pandemic Impacts

Many grocery chain outlets benefitted substantially from the impacts of the lockdowns, work-from-home environment, and lack of dining options that led to increased traffic at grocery stores across the country and globally starting in March 2020. One of those grocers that realized a huge positive impact from the Covid lockdown is NGVC. In this December 2020 article from SA author Josh Arnold, he describes how NGVC realized substantial benefits from the pandemic with same-store sales growth in Q4 2020 of 13% with a gross profit margin of 27.4% compared to 26% in Q4 2019. Net income was $3.7M with $0.16 diluted EPS in Q420 versus $1.4M and $.06 EPS in Q419.

At that time, as of November 2020, Natural Grocers was operating 160 stores (162 as of February 2022) in 20 states. The company is a specialty retailer of natural and organic groceries as well as dietary supplements and body care products. With a market cap of $476M the company is a very small grocery chain compared to some of its larger peers like Whole Foods, which is now owned by Amazon (AMZN), or Sprouts Farmers Market (SFM) with a $3.5B market cap. The smaller size offers significant growth opportunities and Natural Grocers has been taking advantage of their organic growth very effectively.

The NGVC organic growth that occurred in 2020 and then continued into 2021 is now stronger than ever in the first quarter of 2022. From the Q1 2022 earnings results on February 3, Co-President Kemper Isley had this to say:

We delivered a strong performance in the first quarter as the momentum we experienced in the fourth quarter continued into fiscal 2022. Net sales of $277.3 million increased 4.6% compared to a year ago, driven by a 3.8% increase in daily average comparable store sales, with higher transaction counts and basket size. Diluted earnings per share increased 143.8% to $0.39, reflecting favorable sales growth as well as expense leverage.

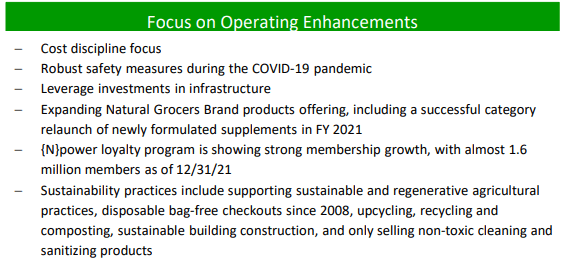

The company’s focus on operating enhancements over the past five years has helped fuel the growth and positions them to deal efficiently with the ongoing impacts of inflation and higher energy and food prices. From the company overview sheet on their investor website, these are the focus areas that have been working:

NGVC Operating Enhancements (Natural Grocers Investor Relations)

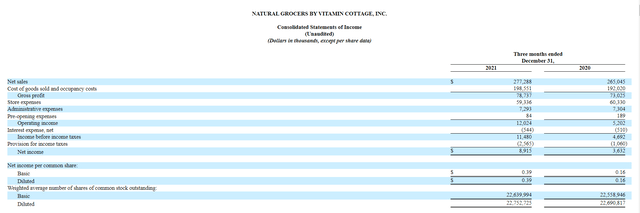

Gross margin increased from 27.6% in Q121 to 28.4% in Q122 driven by improved product margin and store occupancy leverage. Store expenses as a percentage of net sales decreased from 22.8% to 21.4% in the first quarter. Net income increased 145% to $8.9 million.

In addition to the strong performance the company ended the quarter with $25M in cash and no outstanding borrowings on its $50M revolving credit facility and $21.7M outstanding on its term loan.

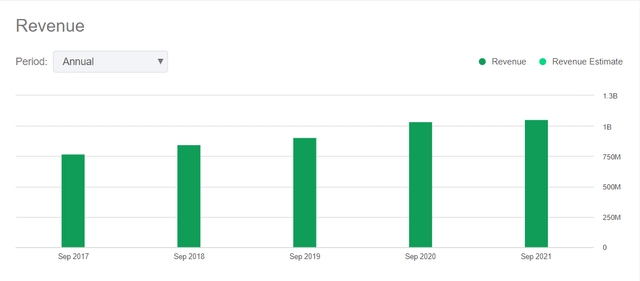

Revenues have been steadily increasing over the past 5 years to more than $1B annually as profit margins have increased and expenses have been controlled by the operating enhancements including leveraging of existing infrastructure and sustainability practices described above.

NGVC Valuation and 2022 Outlook

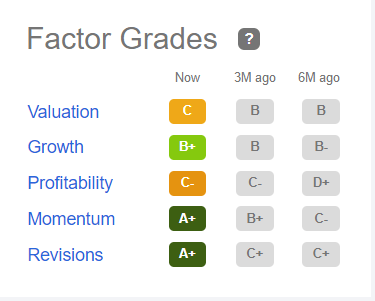

The Quant ratings for NGVC on Seeking Alpha place the stock at #1 in the Food Retail sector and #3 out of 169 in Consumer Staples. The factor grades include a C for Valuation, and that is likely due in part to the increase in share price since the start of the year.

NGVC Quant factor grades (Seeking Alpha)

The non-GAAP forward P/E sits at 21.4 as of 4/19/22 and a trailing twelve-month GAAP P/E of 18. The YOY (year over year) operating cash flow growth shows a disappointing -21.6%, however, that is due to 2020 resulting in a strong year for cash flow growth, so the slowdown from such a high level is not necessarily a danger sign. Revenue growth YOY also slowed slightly at -0.38%. Levered free cash flow currently stands at $19.3M with $1.07B in TTM revenues.

Net Income increased from $3.63M for the 3 months ending December 2020 to $8.9M in Q421.

Form 10-Q for Q4 2021 (Natural Grocers)

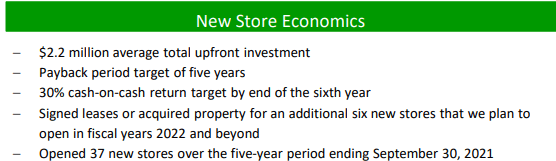

The company expects to open 4 to 6 new stores in fiscal year 2022 and capital expenditures are planned to be in the range of $28-35M with diluted EPS of $0.75 to $0.87 expected.

During the 5-year period ending September 2021, Natural Grocers opened 37 new stores. This snippet from the company overview highlights the new store economics that have enabled them to leverage that investment.

New Store Economics (Natural Grocers Company Overview fact sheet)

With a focus on quality natural products, nutrition education (the stores offer classes on various nutrition and organic food topics), affordable pricing, community involvement, and a focus on teamwork (“good4u crew”) with good employee benefits, Natural Grocers has developed a solid business model to support future growth and earnings potential that should withstand inflationary pressures.

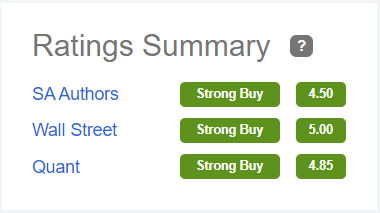

Ratings and Strong Buy Recommendation

Authors on Seeking Alpha, Wall Street analysts, and the Quant ratings all agree that NGVC is a Strong Buy at the current share price, currently trading in the $20-$21 range.

NGVC Ratings Summary (Seeking Alpha)

There is not a lot of Wall Street coverage with just 1 analyst giving NGVC a Strong Buy rating. Several authors on SA have written bullish articles about NGVC, including this one from February that suggests a 3-5% revenue growth rate in the next 5 years due to the business model that I described above.

I am personally both a shareholder and a loyal customer of Natural Grocers and have been a customer for the past 15 years or longer. I have watched the company grow and the stores evolve to offer more and better products beyond the traditional natural and organic foods that they started with back in 1955. Store shelves are well stocked, and prices are reasonable, in my opinion, compared to Whole Foods or Sprouts. The employees are typically friendly and helpful and seem to generally enjoy working at the store locations that I frequent, which include two locations in the Denver metropolitan area.

Risks

From the annual report, Form 10-K there are quite a few risk factors described. The primary risk factors that I believe are relevant to an investment decision now include:

- Newly opened stores may have short-term negative financial impacts or may not achieve the level of sales and operating levels consistent with more mature stores.

- Changing market trends and/or consumer preferences could impact sales if not responded to in a timely fashion.

- Food and commodity price inflation could cause quarterly financial performance to fluctuate, along with other factors such as inventory control, general slowing in the natural and organic sector, timing and effectiveness of marketing activities and other factors.

- Adverse economic conditions (e.g., recession) and political instability could adversely affect the business.

- The ongoing Covid pandemic has impacted operations and future pandemics, or outbreaks could similarly impact operations.

- The market is highly competitive which could impact the ability to continue to improve margins and open new stores.

Many of these risks are ongoing and standard risks of the natural and organic retail grocery business and thus far the company has navigated successfully through many of the recent challenges in the past couple of years. I believe that the core business model and the momentum that they have built up since the start of the Covid pandemic will help them minimize the risks going forward and allow them to continue to grow and remain profitable for the next several years unless a full-scale global conflict breaks out and changes everything.

Be the first to comment