GaryMuth

National Storage Affiliates Trust (NYSE:NSA) is a real estate investment trust (“REIT”) that operates in the self storage industry predominantly within the top 100 metropolitan statistical areas (“MSAs”) throughout the United States.

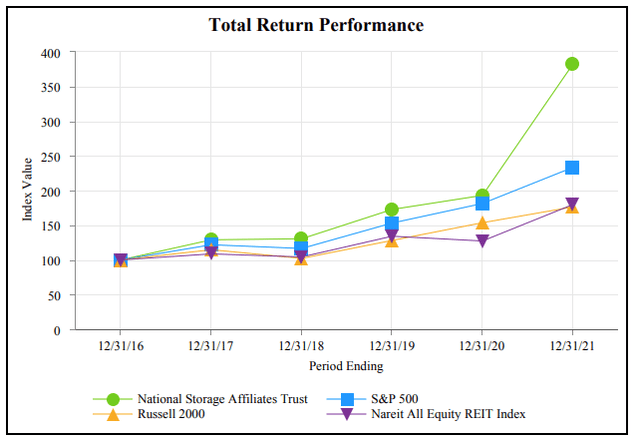

Since its founding, the company has significantly grown their portfolio to over 1,000 properties and has realized earnings growth that has exceeded not only their peers within the sector but also the broader equity indexes. This outperformance has been particularly notable since 2020.

2021 Form 10-K – Total Shareholder Returns Of NSA Compared To Index Averages

YTD, however, the stock is down nearly 40%, which is significantly worse than both the sector and broader market average.

Seeking Alpha – NSA Trading Metrics

Though shares have tracked higher in recent days, they are still trading at markedly lower levels than they have over the past one year. For investors seeking a bargain addition to their portfolios, NSA offers an attractive opportunity for upside. In addition to share price appreciation, NSA also offers a steadily growing quarterly dividend that is now 45% higher than the second quarter of last year and is yielding over 5% at current pricing. While opportunities abound in the current market, sufficient storage room should be left for shares in NSA.

National Storage Has A Diversified Portfolio That Has Grown By Over 900%

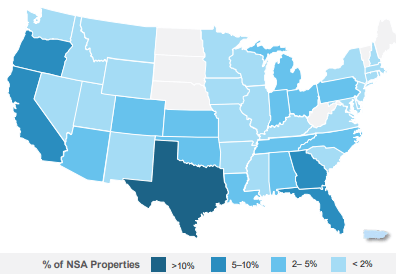

NSA has an interest in over 1,000 properties that are geographically dispersed across the country in the top 100 MSAs, with a higher concentration of assets in the Sunbelt states of Texas, Georgia, and Florida. In addition, the company has a sizeable presence in Oregon and California. Overall, these five states account for approximately 60% of the company’s total net operating income (“NOI”).

September 2022 Investor Presentation – Map Of Geographic Concentration

Since their founding in 2013, the company has grown their portfolio by over 900% and have expanded far more rapidly than their peer set in recent years. In the three period from 2019 through 2021, for example, NSA’s wholly owned square footage has grown 81.5%. This is compared to average growth in the mid-20% range reported by several of their peers, such as Life Storage, Inc (LSI) and Public Storage (PSA).

Despite significant portfolio growth, their market share of total facilities is still just 2%. In fact, public operators as a whole account for just a fifth of the total market, with the remainder dominated by private operators, resulting in a highly fragmented industry, with a total of 50K self storage properties and 30K operators.

Fragmentation Creates Opportunity

This presents an attractive consolidation opportunity that would align with the company’s differentiated growth strategy. This strategy is modeled on a structure that relies on participating regional operators (“PROs”), who are essentially existing property managers that have extensive market expertise in their operating regions.

To integrate these PROs into their business, NSA entices the operators to join the company rather than sell their properties for cash consideration. In exchange for their properties, these PROs are provided with an equity stake in the company via a combination of OP and SP units. This permits their operators to continue serving as regional property managers of their managed portfolios, while also directly participating in the potential upside of those properties.

At present, NSA is comprised of nine PROs that operate throughout the company’s operating markets. And as part of their strategy, NSA intends on acquiring an additional one to three PROs to complement their existing geographic footprint. Given the highly fragmented composition of the market, there is ample opportunity to recruit new PROs that would be attracted to an offer of a lower cost of capital, better scale, and greater operational efficiencies, all while retaining the rights to continue managing their properties. In the current market, this deal could be especially enticing for struggling operators that have fallen behind on rising cost challenges.

In recognition of this opportunity, NSA is forecasting an acquisition pipeline of approximately 130 properties totaling +$1.4B. When including the potential buyout of their joint venture (“JV”) partner interest that includes 184 properties, the pipeline is +$1.6B greater. All considered, their potential acquisition pipeline includes over 300 properties with an estimated total cost of around +$3.0B. This is significant and is likely to be a primary driver of growth in future periods.

Further consolidation is especially vital for future growth due to the current supply outlook, which still faces multiple barriers such as zoning restrictions against new construction and other unfavorable cost/benefit considerations. With new supply likely to remain imbalanced in their target markets, NSA will need to continue acquiring existing properties and continue to drive rates higher to support current earnings growth.

Moderating Rental Rates And Declining Occupancy Are Two Headwinds

Over the years, NSA has realized significant gains from acquisitions and rental rate growth. Over the past five years, for example, the company has outperformed their peer set in average growth in same store revenues, NOI, and core funds from operations (“FFO”), with upper single-digit growth in both revenues and NOI and a double-digit growth rate in core FFO that was over 300 basis points (“bps”) better than Extra Space Storage, Inc (EXR) and well over the 8.3% rate reported by PSA.

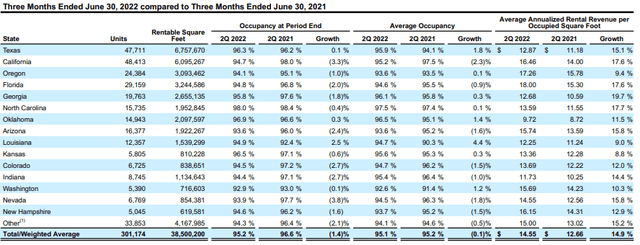

In Q2FY22, the strong rate of growth continued, with both same store revenues and NOI up 14.6% and 17.3%, respectively. Additionally, all their top operating markets posted double-digit revenue growth, except for Oregon and Kansas, who both logged upper-single digit growth rates. On the other hand, every market posted gains in the upper teens in NOI, with some stronger markets, such as Georgia and Florida, even seeing gains of more than 20%.

There are indications that the rate of growth will begin to moderate, however. While occupancy is holding at around 95%, it was down in Q2 by 140bps from the same period last year. Leading the decline was California, which was down 330bps. Some of this is likely due to outbound migration to other states. Yet other states that have benefitted from population growth, such as Florida and Georgia, also saw declines during the quarter. Texas was one exception, with 10bps of growth, perhaps due to being a beneficiary of net move-ins from nearby California.

Q2FY22 Investor Supplement – Portfolio Metrics Summarized By State Of Operations

During the earnings call, management did note that there may have been pushback from their tenants on their rate hikes. And this was clearly not a surprising reveal. Since they place a greater priority on rates, however, the occupancy losses didn’t seem to be a concern for leadership.

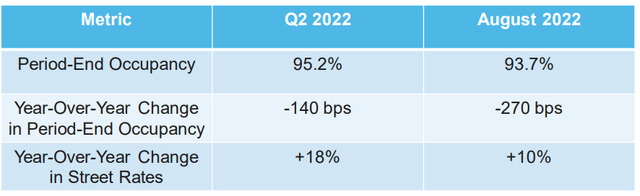

Guidance also reflected weaker occupancy levels in the periods ahead, with levels ultimately settling in the low 90s, which is still above historical averages but measurably lower than their most recently reported August figures of 93.7%, which is already down 270bps from the end of Q2. Furthermore, the declines in August came despite rate growth of just 10% compared to 18% in Q2. NSA could thus be facing a significantly moderated outlook in the periods ahead.

September 2022 Investor Presentation – Occupancy Updates For Q2FY22 And August 2022

Offsetting weakness in occupancy is continued strength in average length of stay, which remained stable at 16 months in the most recent quarter. In addition, even though rates have increased at double-digit rates, rent is still more affordable relative to their peers. In EXR’s markets, for example, annual rent on a typical 10×10 unit is about 2.5% of the median household income. In NSA’s markets, on the other hand, it’s just 2%. This is not only indicative of the value proposition in NSA’s markets, but it’s also suggestive of the inherent affordability of the sector at large.

At just around 2% of the median household income, rents represent just a small portion of a consumer’s disposable income. As such, it’s unlikely to be an expenditure that is cut from most budgets, especially since storage is often considered a needs-based necessity. Still, that doesn’t mean a customer won’t shop for better rates when they can. With average terms lower than most other property classes, it’s therefore important for NSA to find an appropriate balance between occupancy and rate growth.

NSA Is Worth Storing In Any Long-Term Portfolio

NSA is a leading operator and owner of self storage facilities in the U.S, who over the years has expanded significantly, growing their total portfolio by over 900% since their founding, with over 80% growth in their wholly owned portfolio from the three-year period between 2019-2021, alone.

Along with this expansion came significant financial growth that has outperformed their respective peer sets. Presently, the company logged nearly 30% YOY growth in FFO/share in Q2. And for the year, FFO/share is expected to be up 25% at the midpoint.

The strength in earnings is further bolstering their balance sheet, which is already conservatively positioned with ample liquidity and a lower debt profile with manageable maturities. This flexibility will provide the necessary firepower to capitalize on opportunities in their anticipated acquisition pipeline, which totals approximately +$3.0B.

It also provides the cushion to continue growing their well-covered quarterly dividend payout, which was last increased by 10% and is now growing at a five-year compound rate of 15%. For income investors, the current yield of 5% would be in addition to significant upside potential in the share price, which is currently trading at a FFO multiple that is unreasonably discounted to their peer set.

Given current growth rates and their positioning within the market, it wouldn’t be a stretch to affix a 17x multiple to forward FFO. At that valuation, implied upside would be over 10% and they would still trade at a discount to several of their industry peers. For long-term focused investors seeking both share price upside and dividend growth, NSA is one worth storing in any long-term portfolio.

Be the first to comment