PeopleImages/iStock via Getty Images

As the S&P moves in and out of the bear market territory and with the Nasdaq still in the thick of it, I have continued to look for income plays at attractive valuations. I have a 5% dividend rule for investing in REITs as they are, first and foremost, an investment focused on generating income with a secondary objective of generating capital appreciation. I am willing to deviate from the 5% threshold when an opportunity presents itself, just as it had done with Realty Income (O) previously. Federal Realty Investment Trust (FRT), which I wrote about the other day, and National Retail Properties (NYSE:NNN) both found themselves on my radar recently. FRT had many aspects that were attractive, but I felt the valuation was still a bit rich for me. After comparing NNN to its peers per Seeking Alpha and adding in some additional REITs from the retail sector, it’s looking very attractive to me.

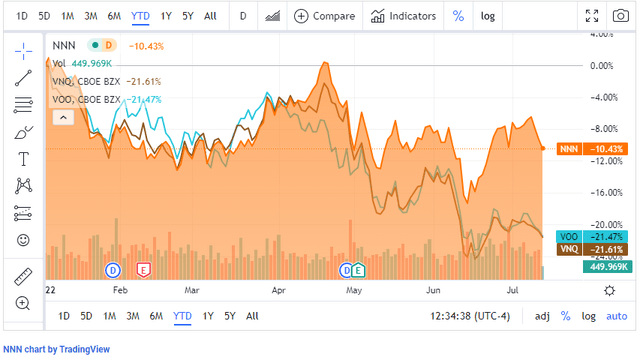

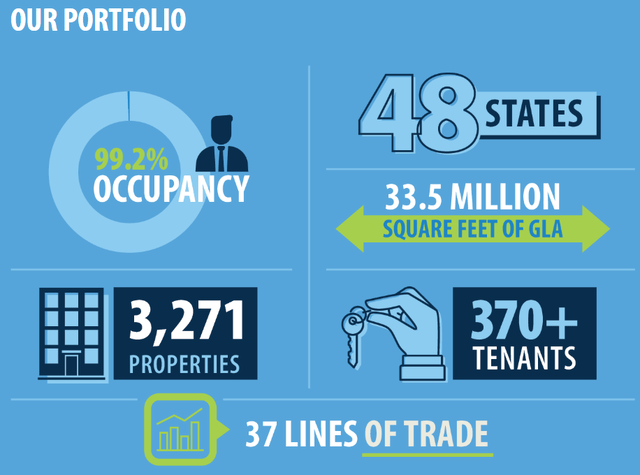

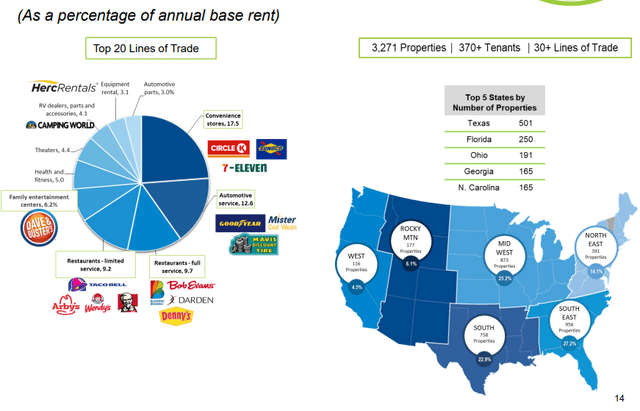

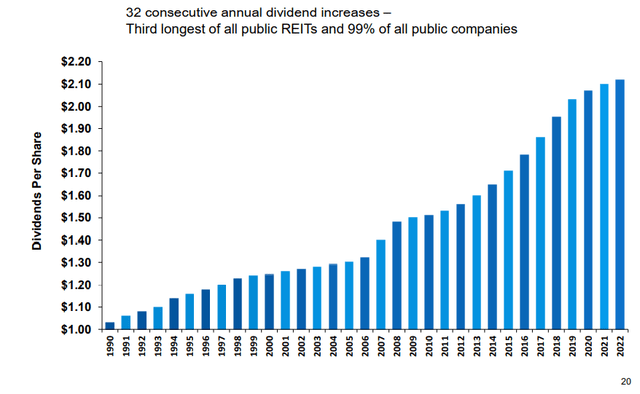

Everyone has been living through a down market, and we may not have bottomed; only time will tell. Looking at 2022, NNN has declined by -10.43% compared to -21.61% for the Vanguard Real Estate ETF (VNQ), which is often regarded as a benchmark for the REIT sector and -21.47% for the Vanguard S&P 500 ETF (VOO). REITs provide me with exposure to the real estate market without having to deal with tenants or property management. NNN has 3,271 properties spanning 33.5 million sq. feet with a 99.2% occupancy ratio. NNN’s dividend yield is a breath under my 5% threshold at 4.95%, and they have provided 32 years of consecutive dividend increases for their shareholders. After looking through NNN’s investor information and comparing its metrics to its peers, I believe NNN is a buy and will be adding them to my Dividend Harvesting portfolio next week.

What I Like About NNN’s Business

NNN focuses on investing in real estate and utilizing triple net leases, which are my favorite in the REIT sector. Triple net leases typically require the tenant to pay property operating expenses such as insurance, utilities, repairs, maintenance, capital expenditures, real estate taxes, and assessments. They are generally longer leases, with initial lease terms of 10-20 years. NNN will hold each property until it determines that the sale is advantageous to NNN’s investment objectives. NNN is a national REIT with 3,271 properties across 41 states.

I love diversification, and NNN has a well-rounded portfolio of properties throughout the country with an attractive mix of tenants across 37 industries. NNN’s largest tenant is 7-Eleven, which makes up 4.9% of their annual base rent across 138 properties. Some of their other recognizable tenants are Camping World, LA Fitness, AMC Theatre (AMC), BJ’s Wholesale Club (BJ), Sunoco, Best Buy (BBY), and Bob Evans. In total, NNN has 370 unique tenants with a weighted average of 10.6 years remaining on their lease terms, and only 5.4% of their current leases expire before 2024.

In Q1 of 2022, NNN maintained a 99.2% occupancy level, invested $210.8 million in properties with an average 6.2% cap rate, and sold 10 properties for $20.1 million. Since 2003, NNN’s occupancy rate never fell below 96.4%, which has allowed them to grow their dividend for 32 consecutive years, which is the 3rd longest dividend increase streak of all public REITs.

As an income investment, the dividend is a critical aspect for me. Looking back over the previous 32 years, NNN has provided increases throughout the dot-com burst, mortgage crisis, financial crisis, and pandemic. This is a testament to their viable business model. NNN pays a dividend of $2.12 per share, which is a 4.95% yield broken out into quarterly payments. On the Q1 2022 conference call, NNN increased its 2022 core FFO guidance from $2.93 to $3 per share to a range of $3.01 to $3.08 per share. Their 33rd consecutive should be announced soon, as the August dividend is normally where the annual dividend increase is reflected.

How National Retail Properties Stacks Up Against Its Peers

I have expanded NNN’s initial peer group as I wanted to add Realty Income as they are regarded as the standard when it comes to retail REITs and Kimco Realty (KIM). Earlier in this article, I referred to my 5% dividend yield rule for REITs, and I have only broken this rule for Realty Income. REITs in my opinion, are always going to be income-first investments. In today’s environment, I can find yield in many places. JPMorgan Chase (JPM) yields 3.57%, while Citigroup (C) yields 4.48%, Southern Company (SO) 3.74%, and Intel yields 3.83%. This is why when I look at REITs, I want to generate at least 5% from their dividend as they are less likely to appreciate than other asset classes, and I am strictly looking at them as income plays.

My extended peer group for NNN is:

- Agree Realty Corp (ADC)

- Brixmor Property Group (BRX)

- Federal Realty Investment Trust

- Kimco Realty

- Philips Edison & Company (PECO)

- Realty Income

- Regency Centers Corporation (REG)

- Spirt Realty (SRC)

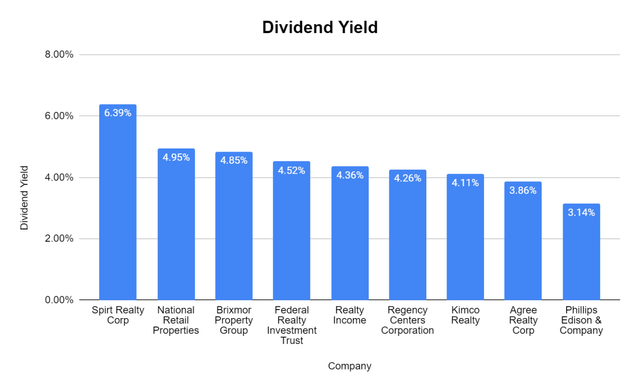

Since income is my primary investment focus with respect to REITs, I am starting with the Dividend Yield.

NNN has the 2nd largest dividend yield at 4.95%, which is close enough to my 5% rule to bend it a little. The average yield from the extended peer group is 4.49%, so NNN is significantly above the curve. Prior to giving NNN the nod, I want to see how it stacks up to its peers in the following metrics:

- FFO coverage ratio

- Price to FFO

- EBITDA to Total Debt

Steven Fiorillo, Seeking Alpha

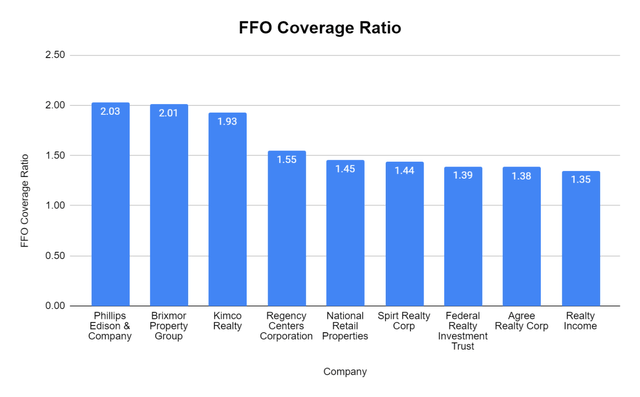

NNN has an FFO coverage ratio of 1.45x. They have a forward FFO of $3.08 and pay an annual dividend of $2.12. The peer group has an average coverage ratio of 1.61x. While NNN is under the group’s average, having a 1.45x coverage ratio is fine by me as there is more than enough room to continue its streak of annual dividend increases.

Steven Fiorillo, Seeking Alpha

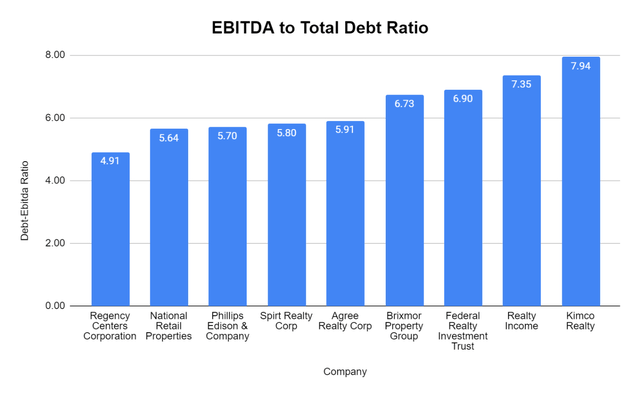

I want to make sure that a REIT’s debt level is manageable, so I look at the EBITDA to total debt ratio. The range from the peer group is tight as the lowest ratio is 4.91x while the largest EBITDA to Total Debt ratio is 7.94x. NNN has the 2nd lowest EBITDA to total debt ratio at 5.64x and is significantly under the group’s average at 6.32x.

Steven Fiorillo, Seeking Alpha

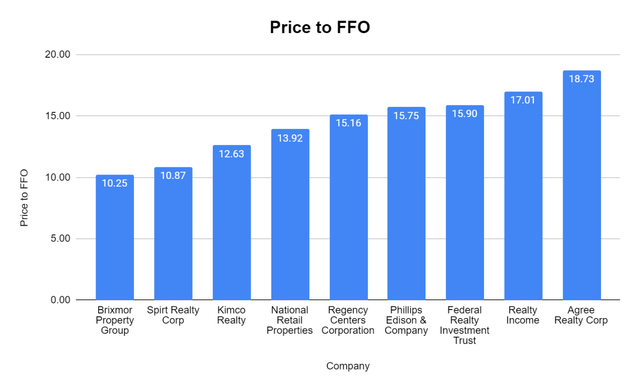

Now that I know NNN has a strong coverage ratio for its dividend and hasn’t gone off the reservation by taking on too much debt to fund its growth, I want to make sure I will be paying a good price for NNN. FFO is arguably one of the most important numbers when looking at REITs as this is the pool of money where dividends are paid from. In the same way, I would look at a company’s price to free cash flow, I look at the price to FFO for REITs. NNN is trading at 13.92x FFO, which is just under the group’s average of 14.47x. Looking at the Peer group, NNN looks to trade at a respectable buy level.

Steven Fiorillo, Seeking Alpha

If you read this article, you may wonder if physical retail is in trouble and if NNN will maintain its occupancy rate?

I can’t answer NNN’s future occupancy rates, but I can provide some statistics on the retail sector. Living in NYC, I see more Amazon Prime, FedEx, UPS, and USPS trucks on the road and packages in my building as the month progress. The state of retail may surprise you, as I was not expecting the statistics I read.

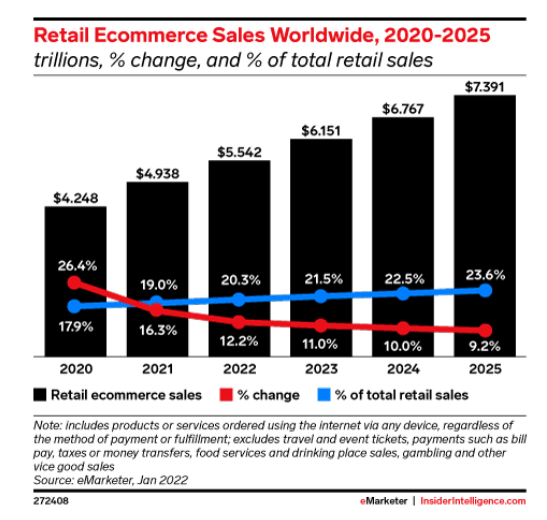

In 2022, global e-commerce is expected to break the 20% barrier of total retail sales for the first time. Over the next 4 years, e-commerce is expected to grow by $2.35 trillion, or 49.67%. In 2022, e-commerce is projected to grow by $604 billion or 12.23%, then by $609 billion in 2023 (10.99%), $616 billion (10.1%) in 2024 and by another $624 billion (9.22%) in 2025. It’s not just e-commerce that will grow. Retail sales, in general, will grow from $26.03 trillion to $31.27 trillion over the next 4 years as well. These statistics are coming from Insider Intelligence eMarketer, which was used in the Shopify (SHOP) Plus report.

InsiderIntelligence

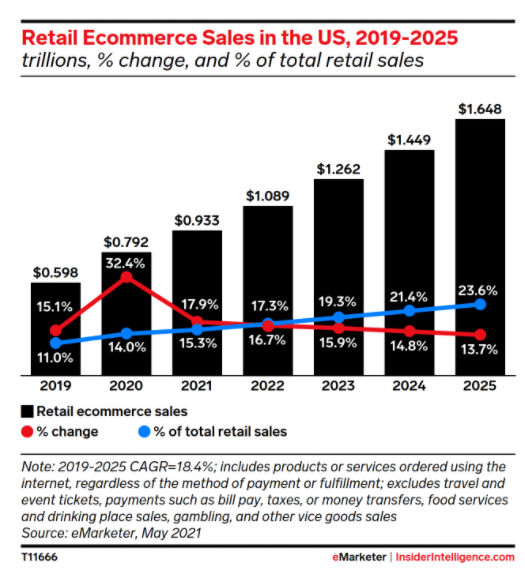

Getting a bit more granular into just U.S. metrics, over the next 4 years, e-commerce sales in the U.S. are expected to increase by $715 billion or 76.35%. E-commerce is projected to break $1 trillion for the first time for U.S. sales in 2022. In 2022 e-commerce will have a 16.2% YoY growth rate which will continue to be in the double digits through 2025. If these projections are correct, e-commerce will finish 2022 with 17.3% of total retail sales and grow to 23.6% in 2025. These projections show total U.S. retail growing by $559 billion through 2025 and e-commerce growing from $194.93 billion to $388.93 billion. The $194 billion of growth in e-commerce will eliminate growth in traditional brick-and-mortar locations. Traditional retail will grow by $365 billion from 2022 to 2025, which should be a positive for occupancy rates. Looking at the e-commerce metrics is important, and I do not see the death of traditional retail that I have often read about.

InsiderIntelligence

Conclusion

There is a lot to like about NNN. This is diversified across 370 unique tenants throughout 3,271 properties with a 99.2% occupancy rate. NNN has increased its dividend for 32 consecutive years as they have operated through the dotcom bubble, the mortgage crisis, the financial crisis, and the pandemic. Physical retail stores aren’t disappearing any time soon, as e-commerce is projected to represent 23.6% of the retail sector in 2025 for the United States. NNN trades under its peer group average at a price to FFO and EBITDA to Total Debt methodology, and its dividend yields 4.95% with a 1.45x FFO coverage ratio. NNN’s dividend yield is close enough to my 5% rule to provide some flexibility, as I believe NNN is undervalued and should continue to increase its annual revenue and FFO.

Be the first to comment