JHVEPhoto/iStock Editorial via Getty Images

Author’s Note: All figures are in Canadian dollars unless otherwise noted

Investment Thesis

I have recommended National Bank of Canada (OTCPK:NTIOF) in the past for its sector-leading dividend growth and total return profile. In the current climate of rising interest rates and with the prospect of a recession in 2023, National Bank is notable for its geographic concentration in the domestic Canadian market. Despite being domestically focused on the Canadian market, National Bank has avoided significant exposure to the segments of the Canadian housing market that are most vulnerable to rising interest rates. With 85% of revenue derived from the domestic market, National Bank will be a beneficiary of Canada’s above-average GDP growth in 2023.

Company Profile

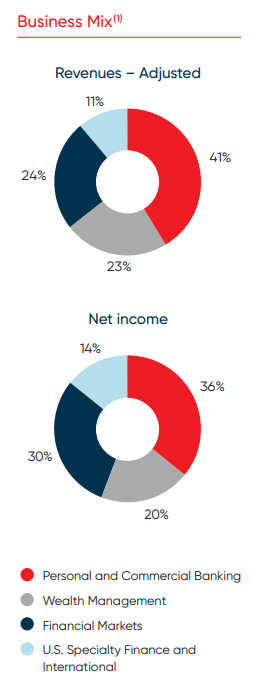

National Bank operates in four main business segments: Personal and Commercial, Wealth Management, Financial Markets, and U.S. Specialty Finance and International. National Bank offers personal and commercial banking and investment solutions as well as a securities brokerage, insurance and wealth management services. As of Q3 2022, National Bank has assets under management or administration of approximately $700B, and total assets of $387B. Headquartered in Montreal, National Bank is the dominant lender in the province of Quebec. Serving approximately 2.7 million clients and operating 460 branches, the bank has a growing presence in other Canadian regions as well as an expanding U.S. and international footprint.

Business Mix (National Bank)

With a market capitalization of approximately $29B, National Bank of Canada is the smallest of the six systemically important banks in Canada. National Bank trades on the Toronto Stock Exchange with daily average trading volume of 1.55M shares under the ticker “NA.TO” and over the counter as “NTIOF.”

Shares of National Bank are down 11% YTD and offer a dividend yield of $0.92/quarter. National Bank’s current yield of 4.25% is above its 5-year average yield of 3.78%.

Recent Results

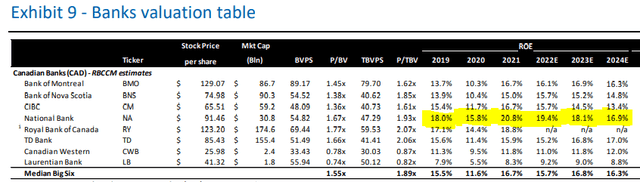

In the most recent quarter, National Bank improved its efficiency ratio to 54.1%, up from 53.0% in Q2 2022. National Bank continues to have the best ROE among the Canadian banks. In this most recent quarter, National Bank achieved a return on equity of 22%.

Bank Table ROE (RBC Capital Markets)

National Bank continues to diversify its geographic base. In 2020, the province of Quebec, Canada’s second-largest with approximately 8 million people, accounted for 54% of revenue. As of Q3, 2022, expansion into Atlantic and Western Canada has brought this down to 52%.

Driven by a strong wealth management segment, Morningstar estimates non-interest income growing at 3% annually for the next few years. This growth is highlighted by assets under management and fee-based revenue up 17% and 22% respectively over the previous year. Even as interest rates climbed through 2022, National Bank achieved strong total loan growth of 12.9% YoY.

Less Exposed to Canada’s Hottest Housing Markets

On National Bank’s recent Q3 2022 earnings call, President and Chief Executive Officer, Laurent Ferreira spoke to the advantages of National Bank’s geographic concentration in the Quebec mortgage market.

Several factors continue to support the Canadian housing market, including strong immigration and unemployment at historical lows. We also expect Quebec’s housing market to be resilient given better relative housing affordability, consumer savings and debt levels in the province.

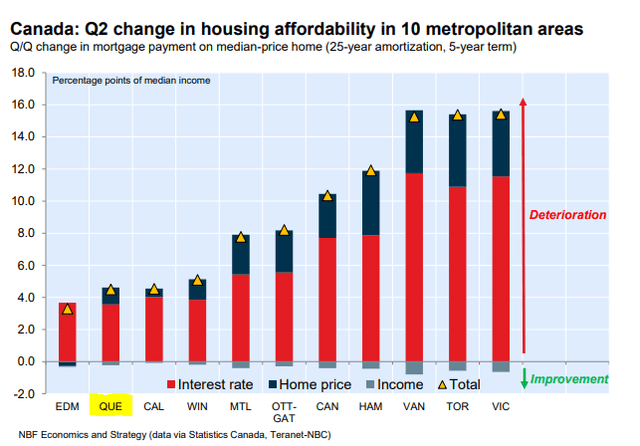

In Q3 2022, National Bank reported commercial loan growth up 17% YoY and retail mortgage loans up 8% YoY. Much of this growth continues to be in the bank’s primary market of Quebec, which represents 55% of National Bank’s mortgage portfolio. This heavy weighting in the Quebec market limits National Bank’s exposure to Canada’s most unaffordable cities including Vancouver, Victoria and the Greater Toronto area.

Housing Affordability Monitor (National Bank Housing Affordability Monitor)

Ontario and British Columbia, home to two of Canada’s hottest housing markets account for 65% of Royal Bank of Canada’s (RY) residential mortgage portfolio and 74% of Toronto-Dominion Bank’s (TD) mortgage portfolio. National Bank’s exposure to BC and Ontario mortgages is just 34% of its mortgage portfolio.

To be sure, geography is not the only factor to assess for lending risk profile in the Canadian housing market. National Bank tends to have a higher ratio of insured mortgages across its book when compared to other Canadian lenders. TD’s residential mortgage portfolio is approximately 22% insured as of Q1 22, while RBC’s is 26%. This compares to 30% insured for National Bank’s mortgage portfolio. Uninsured mortgages and HELOC in the Greater Toronto and Greater Vancouver areas represent 12% and 3%, respectively, of National Bank’s total mortgage portfolio. These two large metro areas represent almost a quarter of Canada’s population and are, therefore, represented more heavily in most Canadian banks’ mortgage books. Furthermore, National Bank has maintained a prudent risk profile on these loans, with an average loan to value of 44% for both the Vancouver and Toronto housing markets.

Economic Outlook in Canada

I have written often about the stability of Canada’s well-regulated banking system and the strong market positions of Canada’s six Domestic Systemically Important Banks (D-SIBs) banks. These six (Bank of Montreal (BMO), Royal Bank of Canada, Toronto-Dominion Bank, Canadian Imperial Bank of Commerce (CM), The Bank of Nova Scotia (BNS), and National Bank together account for over 90% of the Canadian market. These incumbents are protected from foreign competition by the Bank Act, which has created a protected oligopoly in the domestic banking sector. Historically, Canadian banks have used their above-average earnings from the domestic retail banking markets to expand into other geographies and capital markets.

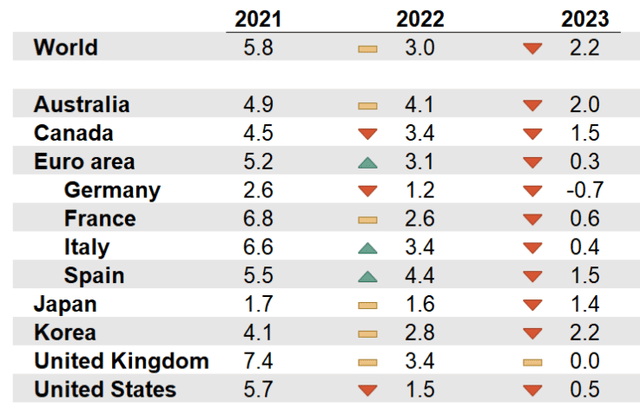

The Canadian economy is forecast to outpace the U.S., UK and Eurozone economies into 2023. National Bank’s domestic concentration should advantage it over its more geographically diversified peers. National Bank of Canada derived 85% of revenues from the domestic Canadian market in 2021. This compares to Canadian retail banking segments representing 60% at Royal Bank, 56% at TD Bank and 44% at the Bank of Nova Scotia.

Looking to 2023, Canada still appears attractive relative to other developed markets. According to the latest interim forecast from the OECD, Canada is set to trail only Australia and South Korea in YoY GDP growth. As a net exporter of energy and many materials and commodities, Canada’s economy will be more resilient than peers in the event of prolonged inflation or high energy prices.

In anticipation of slowing economic activity, National Bank boosted its provision for credit losses from $3M to $54M in the latest quarter. There will likely be more to come as banks across the sector prepare for the possibility a recession in 2023. While banks will be beneficiaries of improving net interest margins, they could see a slowdown in loan growth in the short to medium term. National Bank has prepared for an economic downturn by maintaining a solid balance sheet with a CET1 capital ratio of 12.8%, above its peer average of 12.4%. In addition to being well capitalized, it has maintained a stable trend with credit ratings agencies: Moody’s: Aa3 S&P: A DBRS: AA (LOW) Fitch: AA.

Investor Takeaways

As higher interest rates take hold across the developed world, banks are ratcheting up provisions for credit losses. The prospect of a recession in Canada has weighed on financial stocks, with the S&P/TSX Capped Financials Index down 16% YTD. For long-term investors, this is a great opportunity to consider initiating or adding-to positions in high-quality dividend-paying stocks such as the Canadian banks.

National Bank’s domestic profile will ensure it is a beneficiary of Canada’s strong economic growth forecast relative to other OECD economies. National Bank is less exposed to Canada’s most unaffordable housing markets than its peers. Should interest rates continue to climb, National Bank’s geographic concentration in Quebec will shelter it from loan delinquencies.

National Bank continues to deliver strong results and execute on its revenue diversification and efficiency metrics. National Bank’s geographic profile makes it an attractive choice relative to other Canadian financials within the current macroeconomic context.

Be the first to comment