ozgurdonmaz

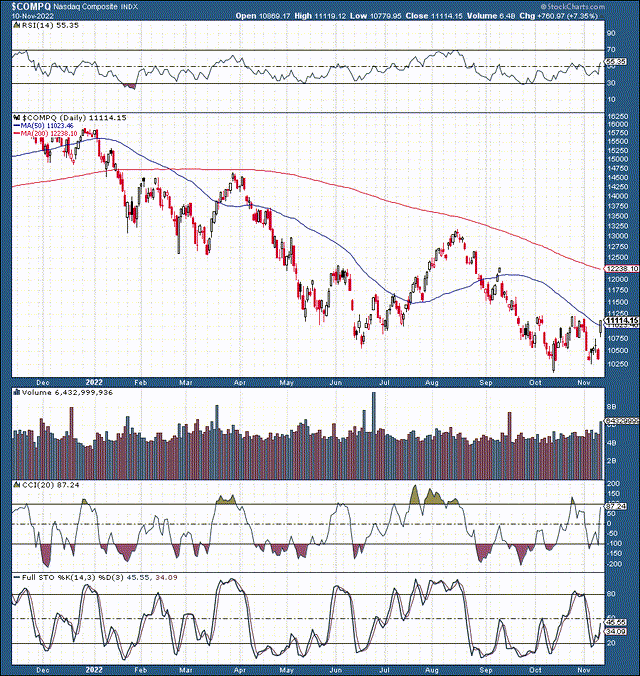

The Nasdaq (COMP.IND) skyrocketed by 761 points (7.35%) on Thursday following a better-than-expected CPI reading. The 7.7% CPI increase provides the Fed with the necessary ammunition to be more dovish moving forward, a bullish development for stocks (especially badly beaten-down tech names). Before the excellent inflation reading came out, there was about a 50/50 probability for another 75 basis point increase in December. Yet, after the report, the odds for a less hawkish 50 basis point hike increased to about 80% for December. The market took off as the combination of short covering and FOMO pushed the major index up by more than 700 points, the most significant single-day point increase in the Nasdaq’s history.

The Nasdaq 1-Year Chart

Amongst the leading names in the index, Apple (AAPL) surged by 9%, Microsoft (MSFT) appreciated by 8.3%, Alphabet (GOOG) (GOOGL) gained 7.75%, Amazon (AMZN) skyrocketed by 12%, and other significant components of the tech index rose sharply. So, after about a 38% peak-to-trough decline, is the bear market finally over for tech stocks, or is there more pain ahead?

Signs of Capitulation are Finally Here

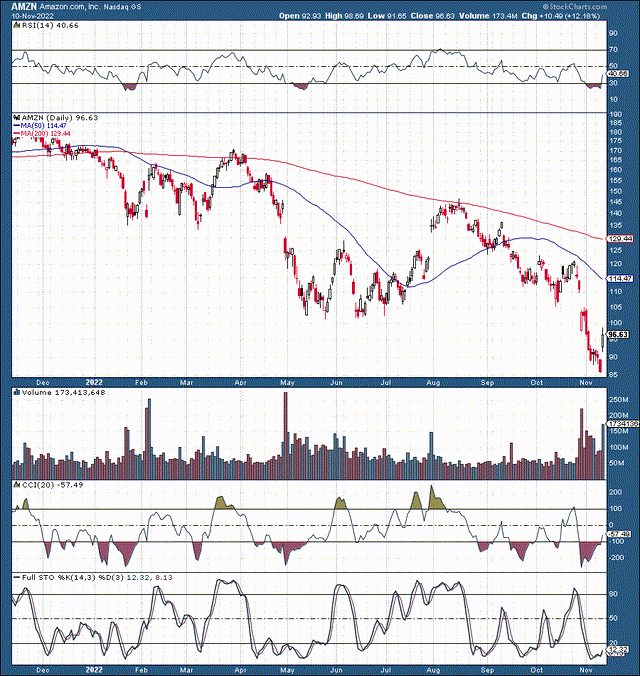

After numerous months of steady and relatively orderly declines, we finally witnessed some signs of capitulation recently. The brightest example may have been Amazon, as the company’s stock dropped from $120 to $85 in just a few days. The latest leg of the decline brought the e-commerce giant’s shares down by 50% from their top in 2021.

Amazon 1-Year Chart

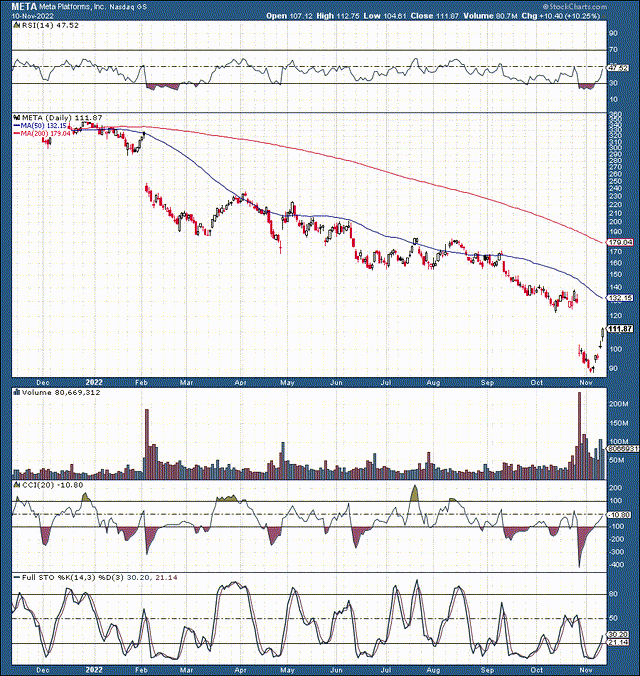

Meta Platforms (META), another tech titan, recently saw its shares drop from $140 to below $90 in another capitulation-style selloff. Meta’s total peak-to-trough decline equated to a whopping 77% in this bear market.

Meta 1-Year Chart

These extreme declines and others imply that we may have achieved a bottom in tech and may be entering a long-term recovery phase in the Nasdaq.

Other Notable Peak-to-Trough Figures

Many top stocks in the Nasdaq experienced brutal 40-70% plus declines during the bear market phase, and now is likely an excellent time to start getting back in for a long-term recovery. The lower-than-expected CPI report implies that the Fed’s plan is working, inflation is declining, and the Fed will likely be more dovish as we advance. Therefore, high-quality tech stocks may have seen the bottom, and while we may see more volatility in the near term, they should move substantially higher in the coming years.

Seven Tech Stocks To Consider For The Next Decade

Despite transitory difficulties, top technology companies should get their growth stories back and have immense profitability potential. Moreover, many tech companies are so badly beaten down that they appear remarkably cheap, and their stock prices should appreciate considerably in the coming years. There are many great tech stocks to choose from, but here are seven of my favorites for the years ahead.

1. Meta Platforms: 2025 consensus EPS estimate – $10.72, forward (2025) P/E ratio – 10, 2025 anticipated revenue growth rate – 10%, forward 2025 PEG ratio – 0.8.

2. Nvidia: 2025 EPS estimate – $6, forward (2025) P/E ratio – 26, 2025 anticipated revenue growth rate – 18%, forward 2025 PEG ratio – 1.

3. AMD: 2025 EPS estimate – $6.60, forward (2025) P/E ratio – 10, 2025 anticipated revenue growth rate – 23%, forward 2025 PEG ratio – 0.27.

4. Amazon: 2025 EPS estimate – $5, forward (2025) P/E ratio – 19, 2025 anticipated revenue growth rate – 12%, forward 2025 PEG ratio – 0.6.

5. Tesla: 2025 EPS estimate – $10, forward (2025) P/E ratio – 18, 2025 anticipated revenue growth rate – 16%, forward 2025 PEG ratio – 0.78.

6. Block (SQ): 2025 EPS estimate – $3.50, forward (2025) P/E ratio – 19, 2025 anticipated revenue growth rate – 16%, forward 2025 PEG ratio – 0.68.

7. Alphabet: 2025 EPS estimate – $7.60, forward (2025) P/E ratio – 12, 2025 anticipated revenue growth rate – 12%, forward 2025 PEG ratio – 0.8.

The Takeaway

The top seven tech stocks are trading at relatively low forward multiples. This dynamic implies that once revenue growth stabilizes and earnings potential returns, the underlying stocks should move much higher. Moreover, due to the pessimistic market conditions and significantly lowered EPS and revenue estimates, future projections may be lowballed at this point. This dynamic implies that analysts may need to raise many EPS and revenue projections in coming years, suggesting that many top tech stocks are even cheaper than they appear.

Be the first to comment