piranka/E+ via Getty Images

The Chinese Communist Party has recently announced to push the country’s infrastructure modernization and vowed to step-up investments in cloud-computing and data-centers. That said, I argue it is a good opportunity to look at VNET (NASDAQ:VNET), one of China’s leading internet data center provider in China. VNET is poised to benefit from structural tailwind towards cloud computing and the increasing government support. Moreover, the company’s stock is arguably also undervalued, according to a Residual-Earnings valuation with $10.82 price target. Buy.

About VNET

VNET Group, Inc. is a leading Internet Data Center provider and service company in China. The firm offers solutions in three key verticals: Managed Hosting Services (IDC), Cloud Services and VPN Services. That said, in more casual terms, VNET hosts and manages clients’ servers and provides the infrastructure for clients to deliver data across the internet. According to the company, VNET operates a dual core strategy, differentiating operations addressed to retail industries and hyperscalers (wholesale). The retail market is best described as industry-specific focus on high-growth verticals in relation to data/connectivity such as mobility, manufacturing and Finance/Fintech. VNET’s hyperscaler strategy addresses customers which require tremendous data storage and computing power in order to support massive scaling needs. Notable hyperscaler customers of VNET are JD.com (JD) Tencent (OTCPK:TCEHY), Alibaba (BABA), Huawei. As of early 2022, VNET has approximately 11% market share of China’s data center services market and serves more than 6.500 enterprise customers. VNET’s top 20 customers account for approximately 40% of the firm’s total revenues.

Structural tailwinds support strong growth

VNET group is well-positioned to benefit from multiple strong structural tailwinds, including accelerating enterprise digitalization, increasing demand for data storage and higher cloud-computing workload. There are multiple growth verticals where VNET data-center solutions could benefit, including IoT, smart cities, autonomous driving, cloud migration, online games, streaming and e-commerce.

In addition, while many Chinese equities have suffered regulatory crackdown in China for the past 12-15 months, the IDC industry is a market that has seen regulatory support. As China State Council announced the party’s 14th 5-year plan in January this year, the plan highlighted the importance of digitalization and modern IT infrastructure. Only recently, after the Chinese economy suffered multiple economic headwinds, the CCP reaffirmed its supportive stance toward IDC recently and vowed to support infrastructure investment in the digital economy. According to the China Academy of Information and Communications Technology (CAICT), the market size of data center in China is estimated to jump to $60 billion by 2025, which would imply a >30% CAGR and 400% cumulative growth as compared to 2020.

Solid financials and strong outlook

As the industry overview indicates, VNET has enjoyed strong growth in the past few years. Revenues increased from $514 million in 2018 to $959 million in 2021, representing a 3-year CAGR of approximately 25%. Respectively, EBITDA almost tripled from $128 million to $305 million, growing at a >40% CAGR. However, as of December 2021, the company is still writing losses, yet at an acceptable -0.6% net income margin.

As of Q1 2022, VNET held $480 million of cash and cash equivalents and $1.195 million of total debt. To support business growth, VNET recorded capital expenditures of $417 million in 2021. Cash from operations was $215 million.

To condense the financial information for decision-making, investors might look at analyst consensus estimates: Consensus estimates indicate revenues for 2022, 2023 and 2025 of $1.11 billion, $1.32 billion and $1.5 billion, representing a 3-year CAGR >10% (Source: Bloomberg Terminal, June 2022). Personally, I find these assumptions are very reasonable.

Residual earnings valuation

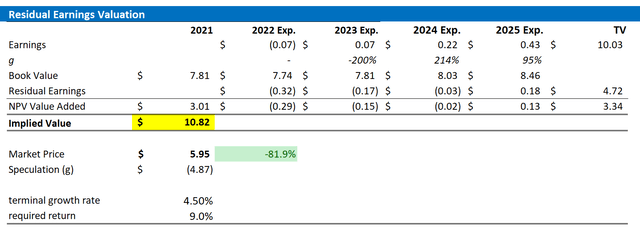

To value VNET, I propose to use a residual earnings valuation and anchor on the following assumptions:

- I base my EPS estimates on the analyst consensus until 2024. According to the Bloomberg Terminal, as of June 2022, consensus indicates earnings per share for 2022, 2023 and 2024 of $-0.07, $0.07, $0.22.

- I use a WACC of approximately 10%.

- For the terminal growth rate, I apply expected nominal GDP growth at 3.5% plus one percentage point to reflect the gaming industry’s potential (thus, 4.5% in sum).

Based on the above assumptions, my calculation returns a base-case target price for VNET of $10.82/share, implying 80% upside potential.

Analyst Consensus; Author’s Calculation

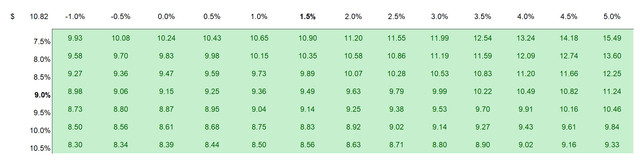

Investors might have different assumptions with regards to VNET’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus; Author’s Calculation

Risks

I would like to highlight a few risks that may cause VNET stock to substantially deviate from my target price of $10.82:

First, VNET’s business activities are strongly connected to the health of the Chinese economy. A significant economic slowdown in China, due to COVID lockdowns, the real estate crisis and inflation, could significantly impact enterprise investments in digitalization–and thus VNET’s business monetization opportunities.

Second, investors are well-advised to not underestimate competitive pressures in China’s IDC market. VNET is competing with the country’s telco players such as China Telecom, China Unicom and China Mobile. That said, investors might want to closely monitor industry capex spending and margins to infer VNET’s profitability outlook.

Third, much of VNET’s share price is currently driven by investor sentiment towards risk assets, ADRs, and China equities. Thus, investors should closely monitor the market sentiment when taking buying/selling decisions for the stock.

Conclusion

VNET is poised to benefit from multiple tailwinds, including accelerating enterprise investments in digitalization, outsourcing of cloud services/data center management and government support from infrastructure spending. Moreover, the company is valued cheaply with >80% implied upside as indicated by a valuation based on residual earnings.

Be the first to comment