salarko/iStock Editorial via Getty Images

The entire cryptocurrency space has been largely in freefall over the last several days. While declines have been large and widespread, one of the biggest drawdowns has been in the native coin of popular Layer 1 blockchain Solana (SOL-USD).

SOL Daily (TradingView/Binance)

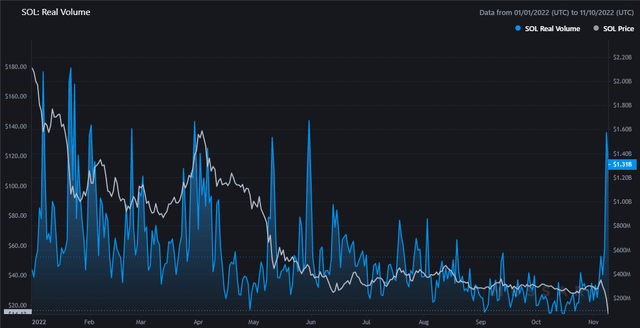

While most of the coins in the top 10 by market cap have seen 10-25% declines over the last 7 days, Solana has a 6 day haircut of 45% on immense volume as of writing; and that’s after a sizeable relief rally that has seen the coin move up from $12.37 Wednesday to nearly $19 at yesterday’s intraday peak.

Why the chaos?

What has pushed the coin over the cliff this week after what was actually a pretty good technical setup heading into the weekend was the news that crypto exchange FTX was dealing with solvency concerns. I covered that saga in detail on Tuesday and you can read about it here. But the point that’s likely most relevant to this article is FTX founder Sam Bankman-Fried’s other company Alameda Research had a SOL position greater than $1.1 billion according to a leaked copy of the company’s balance sheet.

When word got out that Alameda Research had a massive position in FTX Token (FTT-USD), there was sell pressure on FTT from Binance (BNB-USD) founder Changpeng Zhao, and Alameda was forced to defend its FTT position by selling off other assets; Solana included. Solana and FTX do have a history as the exchange is built on Solana’s blockchain and Bankman-Fried was also an investor and very bullish the token in August:

Of course, SBF is not totally impartial as he has invested in the Solana network-either through his companies or directly. Alameda Research, a trading shop founded by Bankman-Fried, participated in a $314 million funding round for Solana Labs in June 2021. He is also building Serum, a decentralized exchange, on Solana.

With the collapse of FTX, the pressure on Solana developed very rapidly as price fell from $38 to the low teens in less than a week. Much of this was likely triggered by Alameda Research and Sam Bankman-Fried dumping whatever Solana they could. But the decline in SOL’s price was likely also from the rest of the market simply anticipating Alameda’s continued selling of its very large SOL position.

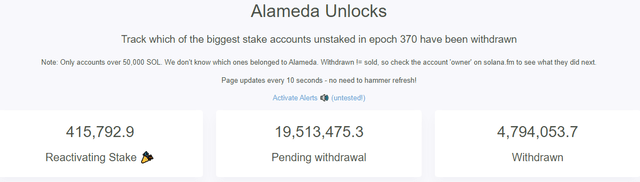

The problem for Alameda at the time was that 75% of the company’s SOL was locked in stake and couldn’t immediately be liquidated. In the addition to what the company has already sold, it is speculated that the company still has over 19.5 million SOL that many believe will be dumped on the market when the withdrawal from stake is finalized.

If those accounts that have been attributed to Alameda do indeed sell the SOL at market, it would be roughly $332 million in Solana that needs to find a new home. That would be a tremendous amount of selling pressure by a business that is without too many other options. It could in theory trigger a bottom, but I’m actually not too sure.

Bad network trends

It would be easy to point to the market carnage caused by Alameda Research and FTX and say now is the time to buy Solana because forced selling by Alameda will eventually come to an end, but the reality is the network metrics have been very poor on Solana for a few months now. The real volume as measured by Messari has been declining all year.

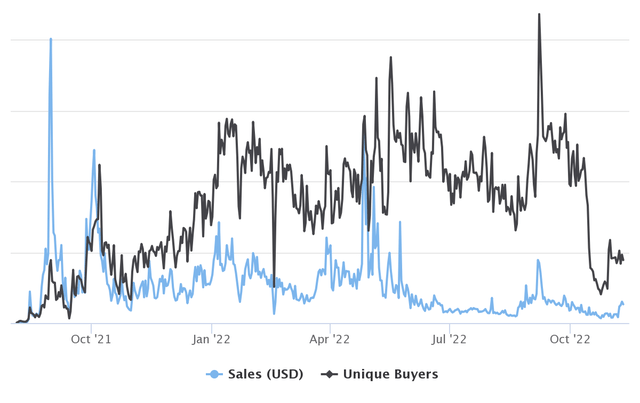

This is indicative of a general lack of interest in the chain. Some of these volume declines can be attributed to the collapse in NFT buyers and sales that happened in mid-October.

You can see a strong trend of higher highs and higher lows in NFT buyers throughout most of the last year on Solana. This was something that hasn’t been seen on all chains this year. For instance, unique NFT buyers on Ethereum (ETH-USD) peaked in February. Solana’s peak happened in September and essentially collapsed soon after. While buyers on Solana were often very high, the sales figures themselves haven’t been overly impressive since early summer.

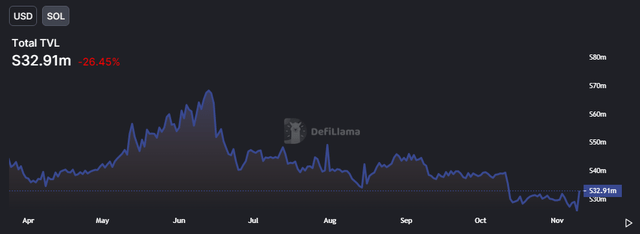

The DeFi footprint for Solana has been very concerning most of the year. Even when adjusting Solana’s TVL figure from dollars to SOL, at roughly 33 million coins the TVL is down more than 50% from its peak back in June. For comparison, Ethereum is off a little under 23% from its January peak when measured in the native currency. The main takeaway from this section is that Solana’s on-chain metrics have become quite poor.

Summary

Solana is a coin that I’ve had a generally favorable outlook on for awhile but I’m very quickly losing conviction in the thesis. I could certainly entertain just getting out of this one and waiting for the dust to settle. But I have treated Solana as a staked asset in the BlockChain Reaction portfolio and I have decided to un-stake those funds while I decide what to do with them longer term. I don’t currently plan to sell but that could certainly change. I would like to see some of the on-chain metrics like TVL and transactions improve considerably before I’d entertain buying this enormous decline.

The reality is there is an incredible amount of competition for fast, high throughput Layer 1 blockchains and I think we’re getting to the point where Solana is running out of chances. The network has a poor history of stoppages and has seen key activity metrics come well off highs even before the FTX-related collapse in price. I think Solana’s connection to Sam Bankman-Fried and the FTX exchange is just the latest example of bad PR for the network. I’m not going to call it a sell after such a massive decline over the last week because a lot of that selling pressure was an attempt to front-run Alameda, but I’m not prepared to add to my position either. For now, Solana is a hold.

Be the first to comment