lucky-photographer/iStock Editorial via Getty Images

Introduction

I’ve been looking forward to writing this article for a number of reasons. First of all, I have never covered Nasdaq, Inc. (NASDAQ:NDAQ) since buying it this year. My most recent article was published in February when I discussed the many qualities this company brings to the table. In this article, I will re-iterate the long-term bull case for owning this tech/finance hybrid using just-released quarterly earnings as well as other numbers that convinced me to make this stock a part of my portfolio.

Essentially, what we’re dealing with is a high-dividend growth stock with a decent yield and the potential to deliver outperforming capital gains. It’s what I like to call a stock for both younger investors and investors closer to retirement as it’s the perfect mix between growth and value.

Allow me to elaborate.

Nasdaq Is The Perfect Growth/Value Hybrid

On Twitter, I changed my handle to @Growth_Value_ for one reason: I’m fascinated by some companies that bring both growth and value to the table. Especially after the 2021/2022 sell-off among loss-making tech stocks and the outperformance of my own portfolio, I’m convinced that finding a mix between growth and value is the way to go.

In this case, I have to say that the definitions of “growth” and “value” are somewhat vague. In general, I would make the case that “value” is a company’s characteristic to pay a sustainable dividend using free cash flow. Once a company is at a stage where its business supports internal growth and shareholder distributions, it brings value to the table. Growth is a bit more straightforward as it’s basically a company’s ability to grow – imagine that. After all, I try to avoid companies that pay a high yield without the chance to see meaningful growth. I also avoid companies that grow but are unable to turn a profit.

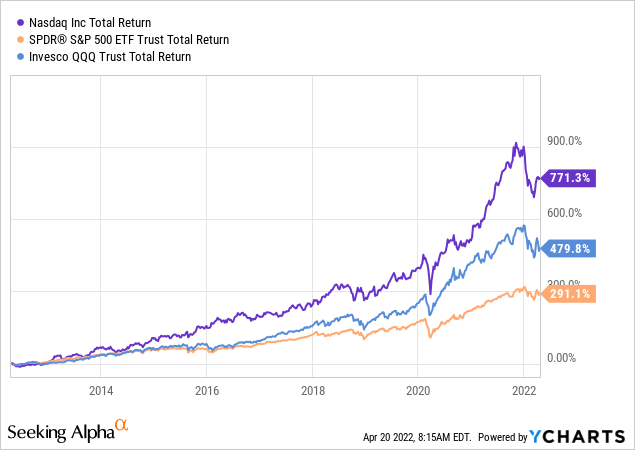

Nasdaq offers both growth and value. Over the past 10 years, it has returned 771% including dividends. That’s roughly 300 points above the tech-heavy Invesco QQQ ETF (QQQ) and more than double the performance of the S&P 500.

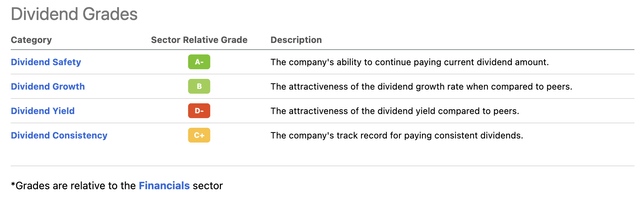

However, in this case, it’s not just a high-flying stock but a company that brings a lot to the table. This brings me to the Seeking Alpha dividend scorecard of Nasdaq. Believe it or not, the company is actually providing a decent yield given its high-growth nature – I come to that in a second.

Today (April 20), the company announced an 11.1% dividend hike. This results in a $0.60 quarterly dividend per share. That’s $2.40 per year or 1.4% based on the $174 stock price. That’s the same yield the S&P 500 is currently offering.

As the table below shows, both dividend safety and dividend growth score high. Dividend yield scores a big fat D-, which is only the case because the company is being compared to the financials sector. This sector is filled with banks – both money center banks and regional banks – which have often much higher yields, but much lower growth.

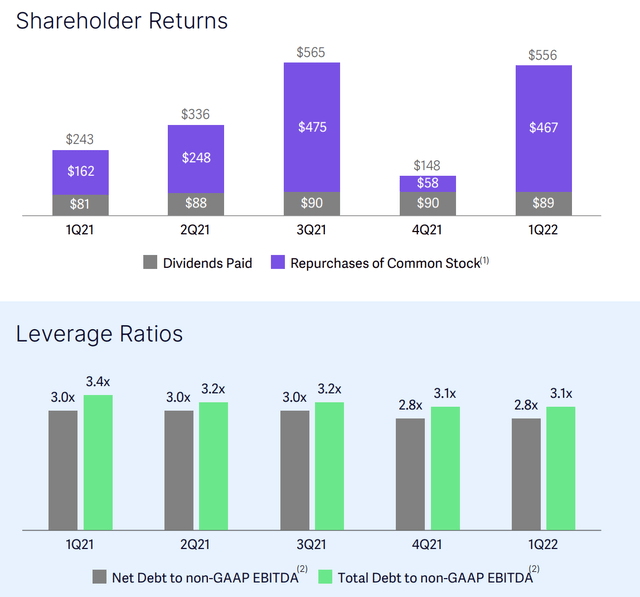

The beauty of NDAQ is that the company maintains a very accommodative cash distribution policy, which is mainly based on share repurchases and constant dividend growth.

Over the past 5 years, the company’s dividend has been raised by 11.0% per year – on average. Given the just-announced hike, the company is maintaining this very satisfying growth streak. The company paid its first dividend in 2012. Back then, it was $0.39. In 2022, it’s likely going to be $2.40, which implies roughly 18% annual compounded dividend growth since 2012. In 1Q22, Nasdaq spent $89 million on dividends. Share buybacks were boosted to $467 million. Note that the company is maintaining a very healthy and consistent leverage ratio while distributing cash, which adds to the safety of the company’s dividend.

The reason why the company is able to pay a rapidly rising dividend is that it’s backed by strong growth. What got me into NDAQ is the fact that it combines traditional operations like making money on Nasdaq exchange transactions, IPOs, as well as with SaaS (software as a service) and other data-focused services. In my February article, I wrote the following using input from Morgan Stanley:

As a matter of fact, the entire Market Technology segment has grown its sales by 17% per year between 2017 and 2021. The company has a terrific position thanks to its ability to fight money laundering, offer trade surveillance solutions, and risk management tools for the insurance industry. After all, the company runs the world’s biggest stock exchanges and has more data than most of us can imagine. Now it turns data into products.

Morgan Stanley gives the company an overweight rating with a $238 per share base case valuation.

The investment bank bases this on the company’s under-appreciated structural growth and shift to more recurring revenues along key structural growth zones that should support 6% annual revenues growth. Higher margins are expected to provide 8% annual EBITDA growth over the next five years, which I believe is reasonable. I believe the company can beat that number given strong data demand and NDAQ’s ability to structure its products. Moreover, because of acquisitions, the company can capitalize on a number of secular growth trends in information services and improve recurring revenues even more.

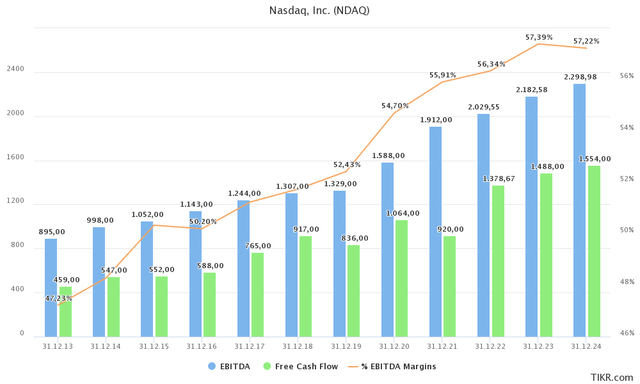

Between 2013 and 2024 (expected), the company is running the following annual compounding growth rates:

- EBITDA: 8.1%

- EBITDA margin: 47.2% -> 57.2%

- Free cash flow: 10.9%

Funny enough, the free cash flow growth rate is more or less equal to the average dividend growth rate, which makes sense as the company maintains a healthy balance sheet while boosting buybacks. The problem is that buybacks in the past have only led to an unchanged number of shares outstanding as they offset shares issued as a way to compensate management and employees. In 2017 the company had 166.4 million shares outstanding. It ended the 2021 fiscal year with 165.9 million shares outstanding. That’s a 0.3% decline since 2017. Not worth getting excited about.

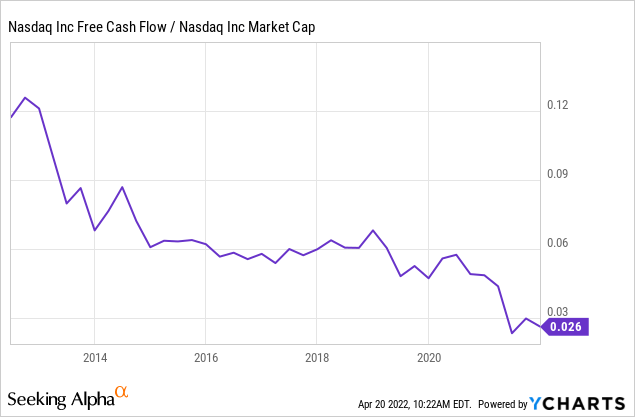

What does get me excited, however, is that free cash flow is not only rising, but also indicating a high free cash flow yield. Bear in mind that free cash flow is basically net income adjusted for non-cash operating items and capital expenditures. It’s cash a company can spend on buybacks, dividends, and debt reduction. This year, the company is set to do $1.4 billion in free cash flow. Next year, that number could rise to $1.5 billion.

Using the current market cap of roughly $28.8 billion, we’re dealing with a 4.9% implied free cash flow yield for 2022, which is absolutely remarkable. It’s similar to some of the numbers reported by railroads that I own or some mature defense companies. Using 2023 numbers, we could be looking at a 5.2% free cash flow yield. Even *if* the company misses it by a mile, these numbers almost guarantee that dividend growth will remain high. After all, the company does not need to prioritize balance sheet health, which is very important to mention as well (again).

With that said, high (expected) free cash flow makes the stock look extremely attractive.

Valuation & Recent Events

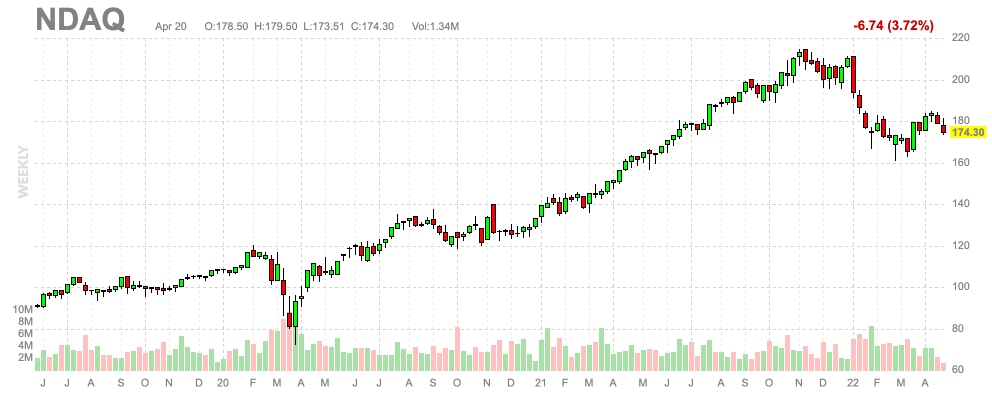

I bought NDAQ at $172.95, which means I’m more or less breakeven. The stock is 3.4% of my total dividend growth portfolio. I’m looking to expand the position and I believe that I will get to average down given the pressure on “tech” stocks.

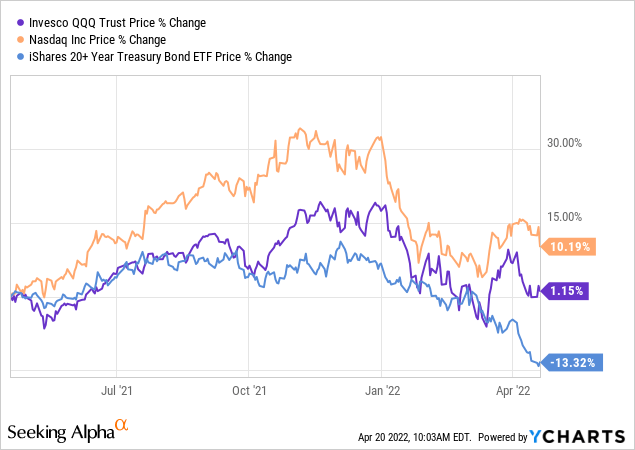

The macro-environment isn’t that supportive of the “tech” trade right now. Yields are rising rapidly as a result of high inflation and expectations that the Fed is about to start an aggressive hiking cycle. To display the surge in yields, I’m using the iShares 20+ Year Treasury Bond ETF (TLT). When rates rise, the price of bonds falls. As a result, the drawdown in NDAQ and tech stocks has been guided by higher yields as the graph below shows.

When rates rise, investors need to take that into account when valuing companies. For example, buying a growth stock that is expected to generate positive free cash flow 10 years from now is much more attractive when rates and inflation are close to zero. When inflation and rates rise, it’s more attractive to buy companies that generate value now. Hence, tech is in a somewhat tricky spot while value stuff like energy has done very well.

Nasdaq is neither a pure growth stock nor a value stock as I explained in this article. The company benefits from trading activity on the Nasdaq and it offers an average yield. Hence, NDAQ performs best when tech stocks get some love as well as it works as an incentive for people to buy “the house” as well. The good news is that thanks to its qualities, sell-offs are somewhat limited. While NDAQ is down 20% from its all-time high, a lot of stocks that did well in the past are down much more.

NDAQ was roughly 20% below its all-time high when I bought the shares that I own now. It was to get a foot into the door knowing that we could see lower prices. I think NDAQ has room to fall to $160, maybe $150 if things get volatile on the stock market. I would welcome such a move lower as I think that getting this stock at a 1.4-1.6% yield with a strong free cash flow yield is a fantastic deal on a long-term basis.

FINVIZ

Historically speaking, the stock has traded at a free cash flow yield of 6% prior to the pandemic. After the pandemic, the implied yield dropped as the stock price outperformed free cash flow growth. In this case, a 6% yield target would fit into my own expected trading range. If the stock were to fall to $160, we would be back in that 6%ish yield range.

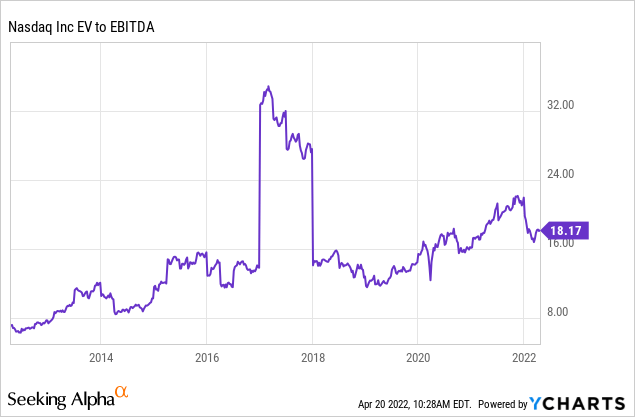

Another way to calculate the valuation is the enterprise value/EBITDA ratio, which incorporates net debt. In this case, we need the company’s $28.8 billion market cap and $4.7 billion in 2023 expected net debt. This way, we get to price in higher free cash flow, which is almost certainly going to lead to lower net debt. These two numbers give us an enterprise value of $33.5 billion.

This is 15.2x 2023 expected EBITDA of $2.2 billion. It’s a good deal as well as the valuation has come down from recent highs backed by the 20% decline in the stock price and a strong outlook.

After all, the company continues to do a great job growing its business. The just-released quarterly numbers show $892 million in 1Q22 revenues. That’s in line with expectations and 4.8% higher compared to the prior-year quarter. Annualized recurring revenue was up 9%. Annualized SaaS revenues were up 12%, representing 34% of recurring revenues. Solutions segments’ revenue rose by 15% year on year.

As a result, non-GAAP EPS came in at $1.97, which is $0.02 higher than expected. The company also announced a 3-1 stock split. In other words, existing shareholders will soon have 3x as many shares in their portfolios (the price will be -66.7%). The company is currently busy getting approval for this move, but I don’t see any obstacles. If anything, I think it’s a great thing to do as it makes reinvesting dividends easier for investors who do not have access to fractional shares.

Takeaway

Nasdaq Inc. has become one of my favorite investments. Not because of its performance – right now I’m breakeven – but because the company offers a perfect mix between growth and value. It achieves high growth rates thanks to its service-focused business model and it generates high free cash flow due to high margins and the mature stage of its business.

Free cash flow growth and the implied free cash flow yield are high enough that I expect the dividend to grow by double-digits on a long-term basis, which will more than likely result in outperforming capital gains as well. Moreover, the 1.4% dividend yield is a good deal as it will quickly turn into a satisfying yield on cost if I’m right about the dividend growth rate going forward.

The only “problem” is that tech stocks are in a somewhat tricky place right now. Rising rates and economic uncertainty have caused people to dump tech stocks and everything related to tech and “growth”.

I think that NDAQ has room to fall to $160, maybe $150 if economic growth takes a beating. While I’m neutral for now, I think current prices offer buying opportunities. The best way to play this for investors who have no exposure is to break an investment into pieces. Buying a part now followed by regular purchases over the next 2-3 months divides the entry “risk”. If you buy now and the stock takes off, you have a foot in the door. If you buy now and the stock drops to $160, investors can average down.

Then, keep buying weakness on a long-term basis. I think that’s the way to deal with NDAQ. If everything goes right, it should continue to be a tremendous source of both income and capital gains.

(Dis)agree? Let me know in the comments!

Be the first to comment