Neilson Barnard/Getty Images Entertainment

A Quick Take On The Duckhorn Portfolio

The Duckhorn Portfolio (NYSE:NAPA) went public in March 2021, raising $300 million in an IPO for the company and selling stockholders that priced at $15.00 per share.

The firm sells a variety of premium quality wines in North America and overseas.

While NAPA has been growing impressively, I’m not convinced of its continued fast growth potential as its distribution channel mix changes until I see more evidence in the next reporting figures, so I’m on Hold on NAPA over the near term.

Company

Saint Helena, California-based Duckhorn was founded to own vineyard production facilities and produce wines ranging from $20 to $200 per bottle, originally bringing the Merlot varietal to prominence.

Management is headed by President, Chairman and CEO, Alex Ryan, who has been with the firm since the early 1990s when he started with the firm as Vineyard Manager.

The firm says it is the ‘eleventh largest wine supplier by sales value overall in the United States.’

NAPA sells its wines direct-to-consumer as well as through a network of wine distribution companies in the U.S. and abroad.

Duckhorn operates under at least ten different wine brands and sells both through a direct-to-consumer model as well as through retail accounts and the above-mentioned distributor network.

Market & Competition

According to a 2020 market research report, the global wine industry was an estimated $327 billion in 2020 and is forecast to reach $434 billion by 2027.

This represents a forecast CAGR of 4.2% from 2020 to 2027.

Also, the still wine segment is projected to reach $167 billion and grow at a similar CAGR of 4.2%.

Notably, the Sparkling Wine sector is expected to grow at a faster 4.8% CAGR through 2027.

Major competitive or other industry participants include:

-

E&J Gallo

-

Constellation (STZ)

-

Trinchero

-

Jackson Family Wines

-

Ste. Michelle

-

The Wine Group

NAPA’s Recent Financial Performance

-

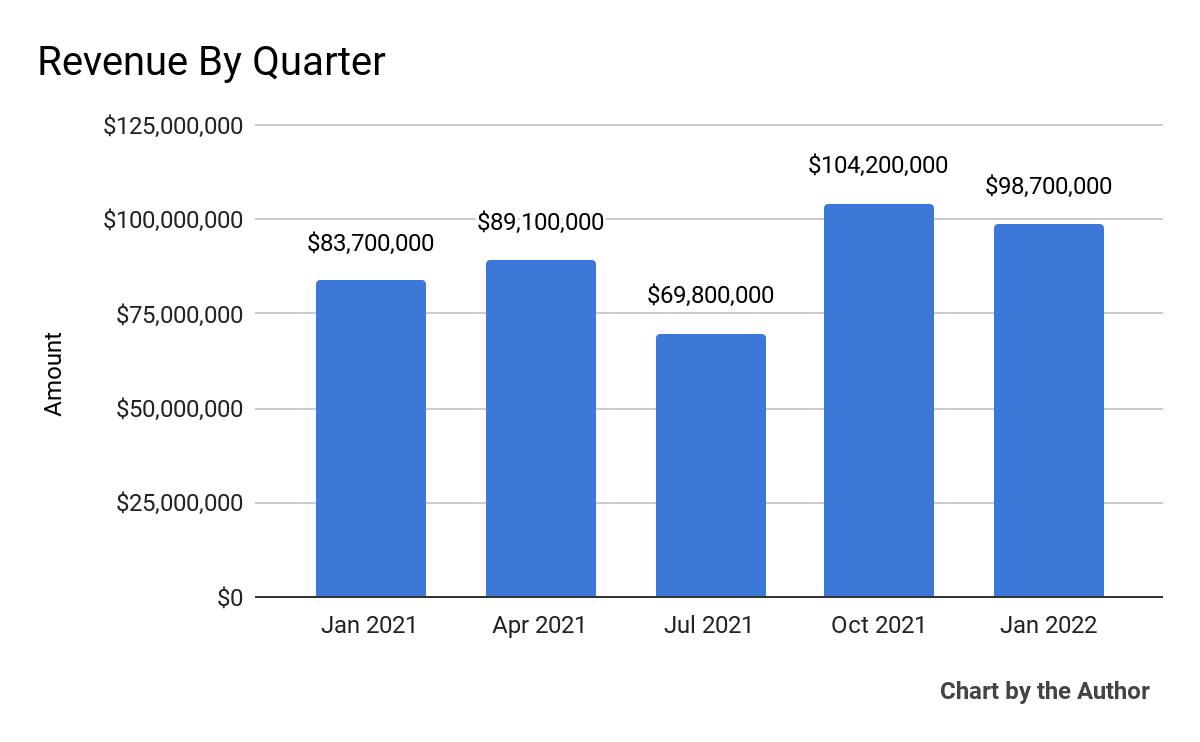

Topline revenue by quarter has been uneven but trending higher over the past 5 quarters:

5-Quarter Total Revenue (Seeking Alpha and The Author)

-

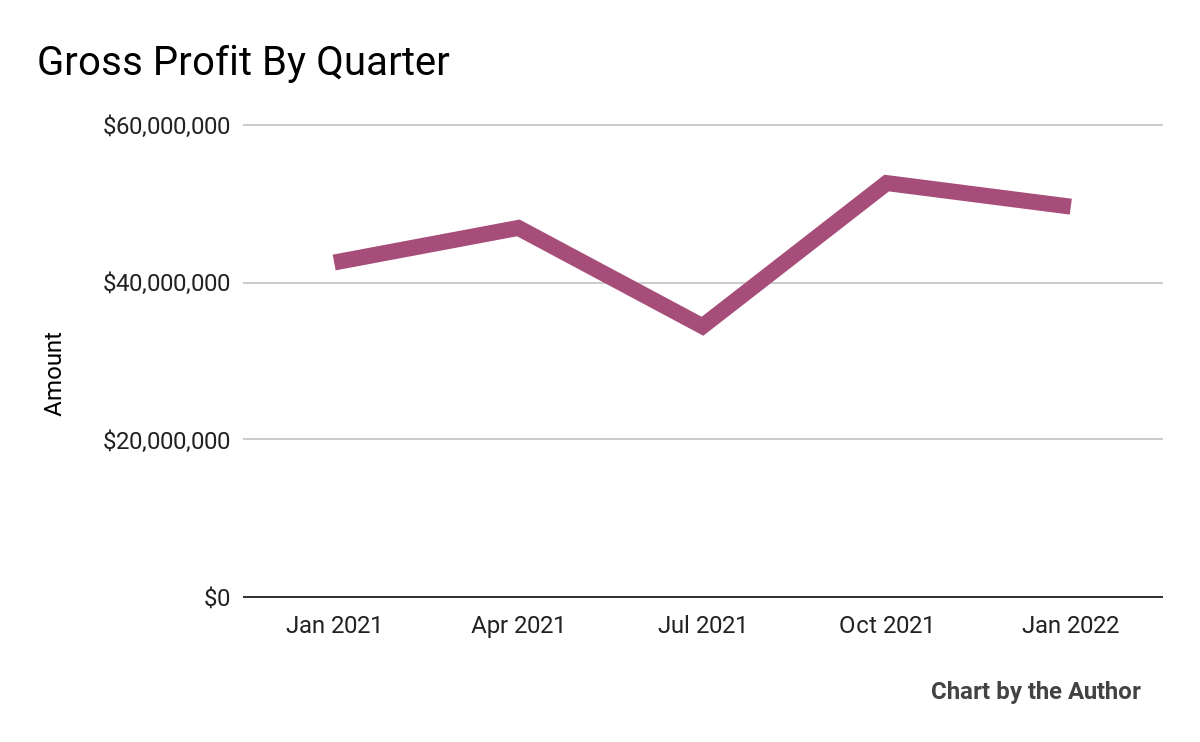

Gross profit by quarter has followed approximately the same trajectory as total revenue:

5-Quarter Gross Profit (Seeking Alpha and The Author)

-

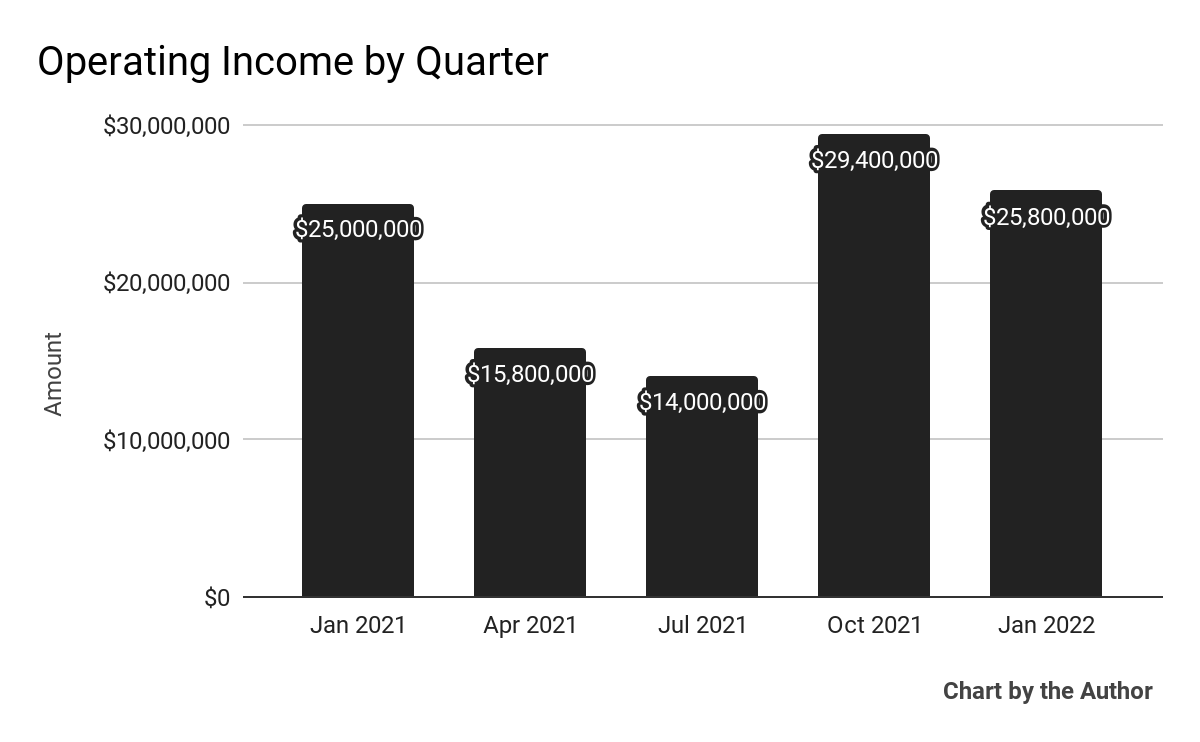

Operating income by quarter has also varied but produced better results in the past two reported quarters:

5-Quarter Operating Income (Seeking Alpha and The Author)

-

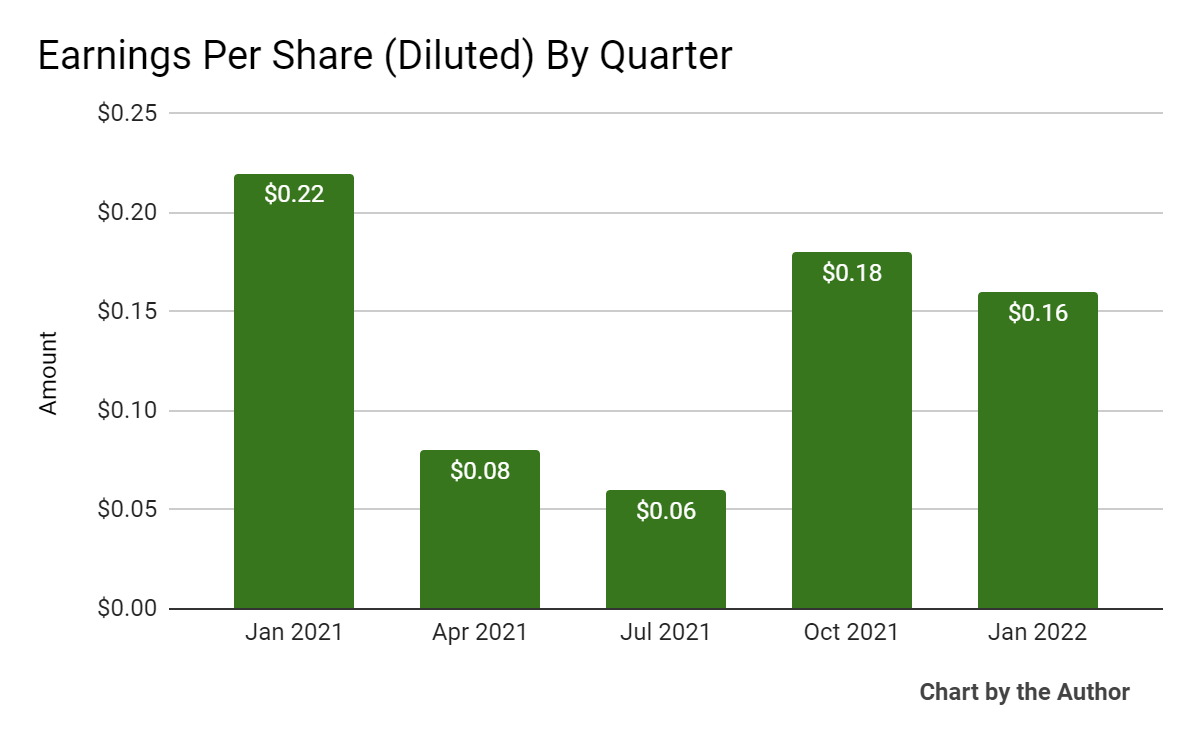

Earnings per share (Diluted) have followed a similar pattern as that of Operating Income results:

5-Quarter Earnings Per Share (Seeking Alpha and The Author)

(Source data for above GAAP financial charts)

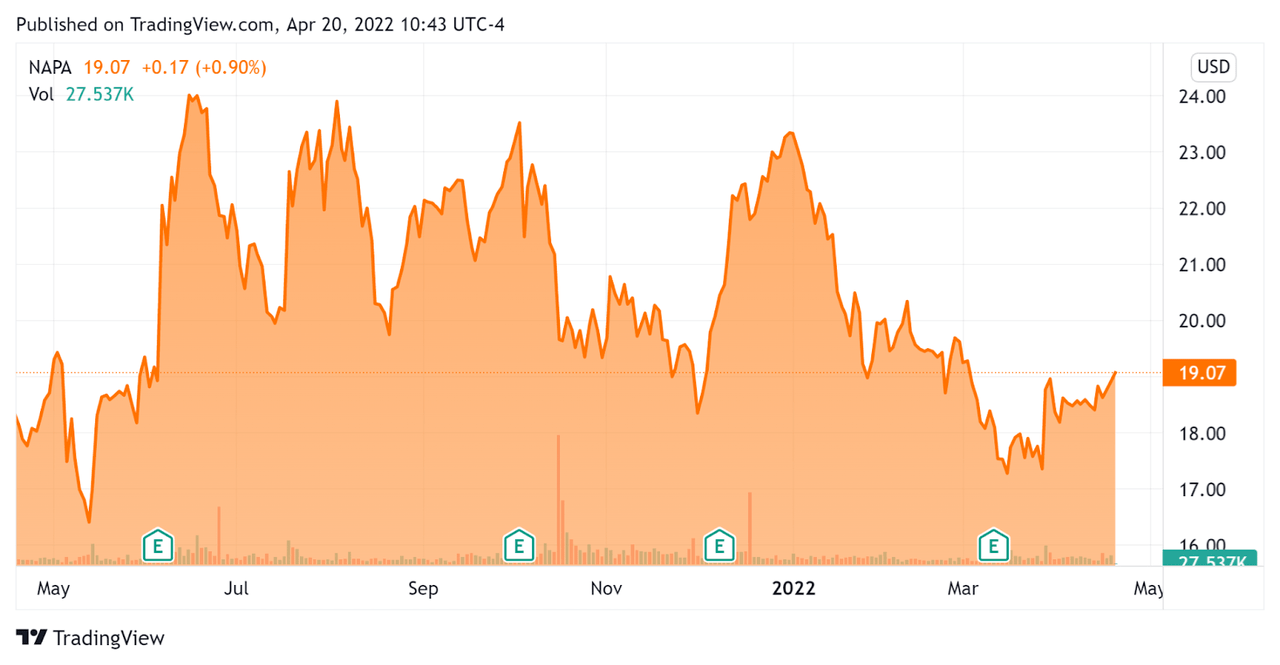

In the past 12 months, NAPA’s stock price has risen 4.1 percent vs. the U.S. S&P 500 index’ rise of 7.7 percent, as the chart below indicates:

52-Week Stock Price (Seeking Alpha)

Valuation Metrics For NAPA

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$2,160,000,000 |

|

Enterprise Value |

$2,410,000,000 |

|

Price / Sales |

5.89 |

|

Enterprise Value / Sales |

6.70 |

|

Enterprise Value / EBITDA |

19.38 |

|

Unlevered Free Cash Flow [TTM] |

$7,810,000 |

|

Revenue Growth Rate [TTM] |

21.91% |

|

Earnings Per Share |

$0.48 |

(Source)

As a reference, a relevant public comparable would be Constellation Brands (STZ); shown below is a comparison of their primary valuation metrics:

|

Metric |

Constellation Brands (STZ) |

Duckhorn Portfolio (NAPA) |

Variance |

|

Price / Sales |

5.07 |

5.89 |

16.2% |

|

Enterprise Value / Sales |

6.64 |

6.70 |

0.9% |

|

Enterprise Value / EBITDA |

17.88 |

19.38 |

8.4% |

|

Unlevered Free Cash Flow [TTM] |

$2,890,000,000 |

$7,810,000 |

-99.7% |

|

Revenue Growth Rate |

-4.8% |

21.9% |

-556.5% |

(Source)

Commentary On NAPA

In its last earnings call, covering FQ2 2022’s results, management highlighted its recently upwardly revised outlook despite an unpredictable operating environment.

CEO Alex Ryan said that demand for its luxury wines ‘remains robust’ and said the firm was ‘the fastest-growing wine supplier among the top 15 wine suppliers in the U.S.’

Notably, on-premise sales have continued to recover as hospitality venues see renewed consumer patronage as the pandemic wanes in fits and starts.

Of its two flagship brands, Duckhorn Vineyard and Decoy, it has been the Decoy brand (and Decoy Limited) that has provided the highest growth in the over-$15.00 bottle price point, possibly as a function of its appeal to younger demographics.

On the inflation front, CEO Ryan stated that the firm’s operations have been ‘somewhat insulated from recent cost pressures observed across the supply chain,’ and that its highest cost of goods element is grapes, which may be independent of other inflationary forces.

As to its financial results, net sales grew 18% over the prior fiscal year’s same quarter while volume growth was up 24.8%, with the resulting 6.8% difference due to a price mix reduction.

Gross margin was up 20 basis points due to a ‘favorable sales mix shift in brand,’ while G&A expenses were lower than expected but still up 36.3%, in part due to equity compensation as part of its now-public company status.

Looking ahead, management raised its fiscal 2022 guidance for net sales to around 8.75% growth at the midpoint of the new expected range.

Regarding valuation, compared to partial competitor Constellation Brands, the market is valuing Duckhorn at similar EV/Sales multiple of around 6.7x, despite Duckhorn’s higher revenue growth rate, though at a much smaller scale than that of Constellation.

The primary risk to the company’s outlook is the unpredictable effect of inflation on its results. Management estimates that price changes as a result of inflationary pressures will not ‘have a material impact on our fiscal year 2022 results.’

However, management sees significant growth potential for its various Decoy labels in the major-scaled luxury segment, both in terms of price rise potential and for distribution growth.

The question for investors is whether NAPA’s recent strong growth has reached a plateau of sorts or whether there is materially significant growth still available as the pandemic wanes and the firm’s product distribution mix changes to a more on-premise focus.

Of course, the answer is that we don’t know until the firm reports results. I would be on the lookout for any signs of inability to pass along price increases as well as loss of volume growth.

I’m not convinced of NAPA’s continued fast growth potential as its distribution channel mix changes until I see it in the next reporting figures, so I’m on Hold on NAPA over the near term.

Be the first to comment