cyano66/iStock via Getty Images

Subscribers, Subscribers, Subscribers

There are 3 simple reasons why shares of Netflix, Inc. (NASDAQ:NFLX) were down >30% after earnings: subscribers, subscribers, and subscribers. For 1Q22, Netflix reported a disappointing loss of 200k subs to reach 221.64m global subs vs. 221.84m in 4Q21, the first QOQ decline in company history. At the end of the day, it doesn’t matter that GAAP EPS of $3.53 beat street expectations, as all eyes are on whether Netflix can continue to grow its subscriber base.

While net adds would have been 500k ex-Russia, the streaming giant still missed guidance of 2.5m net adds for the quarter. Is it just a blip because of Russia, or that supply chain issues are preventing consumers from buying new smart TVs? Not really, because 2Q22 guidance calls for a loss of another 2m subs vs. +2.6m consensus. Clearly, the decline in subs is structural vs. temporary, as Netflix has likely reached full penetration as the industry leader.

Disappointment aside, management deserves respect for being incredibly direct and transparent about the situation in the 1Q22 shareholder letter.

Our revenue growth has slowed considerably as our results and forecast below show. Streaming is winning over linear, as we predicted, and Netflix titles are very popular globally. However, our relatively high household penetration – when including the large number of households sharing accounts – combined with competition, is creating revenue growth headwinds.

What Now?

Netflix’s subscriber base has reached a state of maturity, so ARPU now becomes the next leg of growth. Based on its 222m paid memberships, Netflix has identified over 100m non-paying users who share the service with currently paying members. These are people who piggyback off of their friends’ and families’ accounts (yes, I’m talking about you!). In the U.S. and Canada, there are over 30m users who belong to this group, representing 40% of Netflix’s 74.6m subscriber base in the region. As a result, Netflix will likely monetize these users by asking their paying counterparts to pay up.

So if you’ve got a sister, let’s say, that’s living in a different city, you want to share Netflix with her, that’s great. We’re not trying to shut down that sharing, but we’re going to ask you to pay a bit more to be able to share with her and so that she gets the benefit and the value of the service, but we also get the revenue associated with that viewing. – NFLX 1Q22 call

While it’s unclear how Netflix will make this work (e.g., what if you move/travel to the same city as your sister?), Netflix has actually been testing this for couple of years already, and management expects another year of fine-tuning to launch this new subscription model. For perspective, suppose Netflix is able to convert 20% of non-paying users into paying, say, $5 a month to share the same accounts with their sisters, this should translate into $1.2 billion of incremental revenue. This doesn’t seem very exciting considering Netflix is already a $30-billion empire.

A Cheaper, Ad-tolerant Plan?

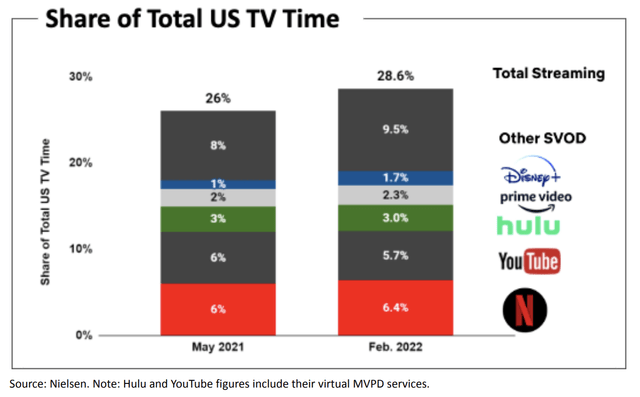

Netflix has long been against the idea of monetizing users through advertising, but that view is changing as the company has reached full penetration. Besides making someone’s sister pay for the service, another cost-effective way to increase ARPU is to offer a cheaper plan with in-program advertising.

Those who have followed Netflix know that I’ve been against the complexity of advertising and a big fan of the simplicity of subscription. But as much I’m a fan of that, I’m a bigger fan of consumer choice. And allowing consumers who would like to have a lower price and are advertising-tolerant get what they want makes a lot of sense. – CEO Reed Hastings on NFLX 1Q22 call

Management expects to launch an ad-supported version in the next 1-2 years and acknowledges that going too fast will likely see certain subs moving to this lower pricing tier immediately. However, it’s clear that advertising is the inevitable path to better account monetization, and as a leader in streaming, Netflix is likely to do very well. Disney (DIS) has already announced an ad-supported tier coming later this year, so I’d expect Netflix to have more or less the same timeline given it has no plan to build its own DSP like Roku’s OneView platform.

What to Do With the Stock?

Overall, it was surely a disappointing quarter, and 2Q22 guidance did more harm than good. However, the good news is that Netflix will not slowdown in creating wonderful original content, as management’s goal is to have an Adam Project and Bridgerton every month. While I believe Netflix will remain competitive in the streaming world, it remains to be seen how much ARPU can grow from here as the company gradually pivots away from a subscription model. For now, I’d expect the next few months to be filled with lots of noise and would advise investors against bottom-fishing the stock unless they have pockets the size of Bill Ackman.

Be the first to comment