RussieseO/iStock via Getty Images

Diamondback Energy, Inc. (NASDAQ:FANG) is a mid-size oil producer that like most other shale companies had a difficult past month, with a more than 20% decline. The company’s current market cap is just over $21 billion. However, the company has one of the strongest operations in its peer group, with a disciplined focus on margins, that we expect will enable substantial shareholder returns.

Diamondback Energy 1Q 2022 Results

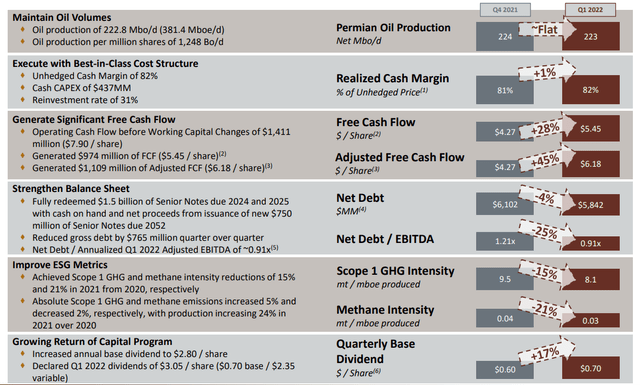

Diamondback Energy had impressive 1Q 2022 results, as the company focuses on maintaining production and driving returns.

Diamondback Energy is focused on maintaining oil volumes at roughly 220 thousand barrels/day in production. The company expects to slightly increase cash margins on this flat cost structure, while rapidly and opportunistically increasing FCF for shareholders. As we’ll see later in the article, the company has a substantial FCF yield.

Financially, the company is working to improve its balance sheet with $5.8 billion in net debt, it’ll be able to continue improving to save on interest expenditures. That, combined with growing EBITDA, will support the company’s overall balance sheet. The company is continuing to focus on returns and improving ESG metrics.

Diamondback Energy 2022 Guidance

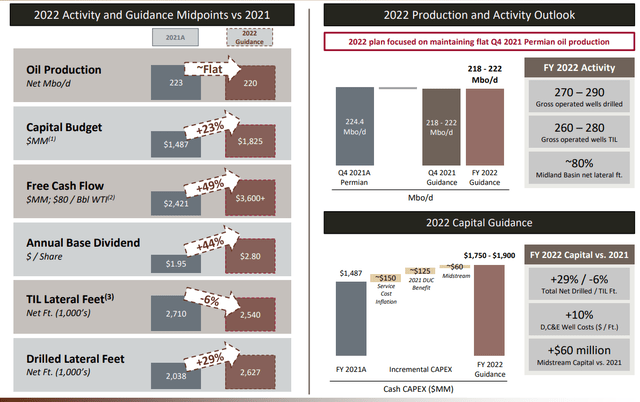

The company’s 2022 guidance, combined with strong first quarter execution, should enable continued returns.

The company’s guidance is for keeping production flat with almost 300 drilled wells, and so far, the company is operating within that guidance. The company is ramping up its capital spending to catch up with both inflation, midstream cost improvements, and other growth to roughly $1.825 billion as the midpoint capital budget.

A 29% improvement in drilled lateral feet will also help the company minimize costs. The company’s FCF forecast is for a 49% increase to a minimum of $3.6 billion and as we’ll discuss later in the article, we expect the company to comfortably increase that guidance, with incredibly strong 2022 performance.

Diamondback Energy Balance Sheet

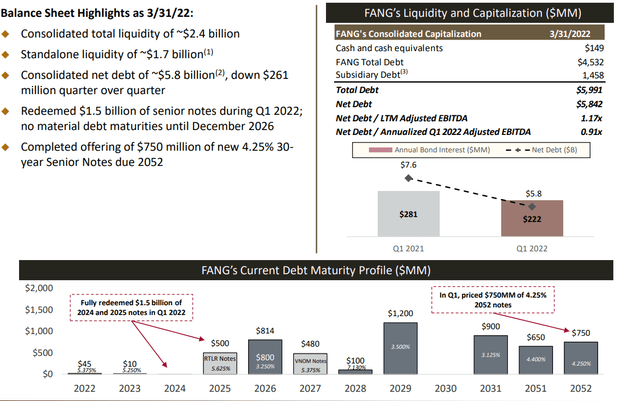

Combined with flat production and a strong balance sheet, Diamondback Energy is looking to increase shareholder returns further.

The company has net debt of $5.8 billion and total liquidity of $2.4 billion. Its liquidity means it can handle any debt due until the end of the decade, and the company’s annual interest payments of roughly $222 million are manageable and can decrease as the company continues to pay down debt. The company’s FCF means it can comfortably pay down debt as it comes due.

The company managed to issue $750 million in 30-year debt @ 4.25%, although we’d like to see it continue to opportunistically repurchase debt with its strong FCF. However, either way, the company’s balance sheet is more than manageable.

Diamondback Energy Shareholder Returns

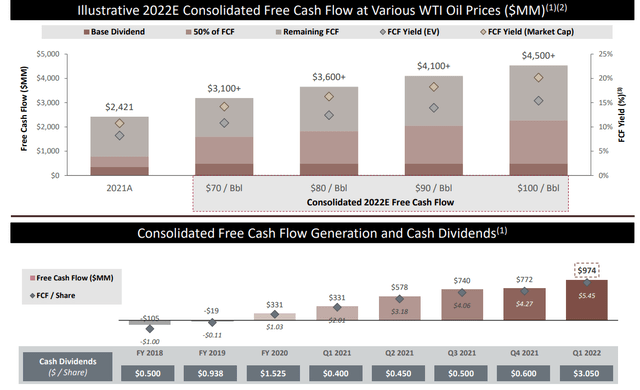

At current share prices, Diamondback Energy has the ability to drive incredibly strong shareholder returns.

Current WTI prices are roughly $110/barrel. At that price, the company should be able to generate an FCF yield comfortably above 20% at almost $5 billion of FCF for the company with a market capitalization of less than $22 billion. At that level, the company’s dividend guidance implies a double-digit dividend yield for the year.

Even after that, the company will have billions of dollars left over. It’ll be maintaining production, but it’ll be able to use that money for buybacks, even more dividends, or debt paydown. The company has a $2 billion share repurchase program to repurchase almost 10% of shares, although we’d like to see the company expand that.

Thesis Risk

The largest risk to the thesis is oil prices. The company is at a comfortable valuation, even off of 2021 FCF the company had a double-digit yield and, at $70/barrel WTI, that yield is more like 15%. That strong FCF will have an almost 8% dividend yield with other shareholder returns. Buybacks will save on dividends, and debt paydown will save on interest expenses.

However, prices have spent substantial time below $70/barrel WTI and that could return driving down prices. That would make the company overvalued in such an environment.

Conclusion

Diamondback Energy is one of the strongest mid-stream shale companies. The company has been consistently improving its balance sheet and has an incredibly manageable $5.8 billion in net debt and an even more manageable interest payment. The company has the liquidity to cover all debt maturities until the end of the 2020s.

The company’s current guidance implies a double-digit dividend yield for 2022, with numerous other rewards. We’d like to see the company expand its share buybacks, however, regardless of how it spends the money, 2022 will be a transition year as its balance sheet continues to improve, enabling even stronger rewards and growth next year.

Be the first to comment