Solskin

I had previously written several cautious articles on Nano-X Imaging Ltd. (NASDAQ:NNOX), as the company has been years late in getting FDA approval for its multi-source Nanox.ARC scanner.

However, recently, the company finally filed its 510(k) submission with the FDA and scheduled a demo day for the Nanox.ARC ecosystem. While the positive developments have boosted the stock, I remain sceptical and prefer to wait on the sidelines.

Brief Company Overview

A quick refresher for those new to the Nano-X story, Nano-X Imaging Ltd. was a hot circa-2020 IPO that promised a revolutionary low-cost x-ray scanner called the multi-source Nanox.ARC. The multi-source Nanox.ARC scanner was designed using silicon-based Micro-Electro-Mechanical Systems (“MEMS”) technology that promises to be much lower cost than existing x-ray machines (Figure 1).

Figure 1 – Mockup of the Nanox.ARC scanner (NanoX website)

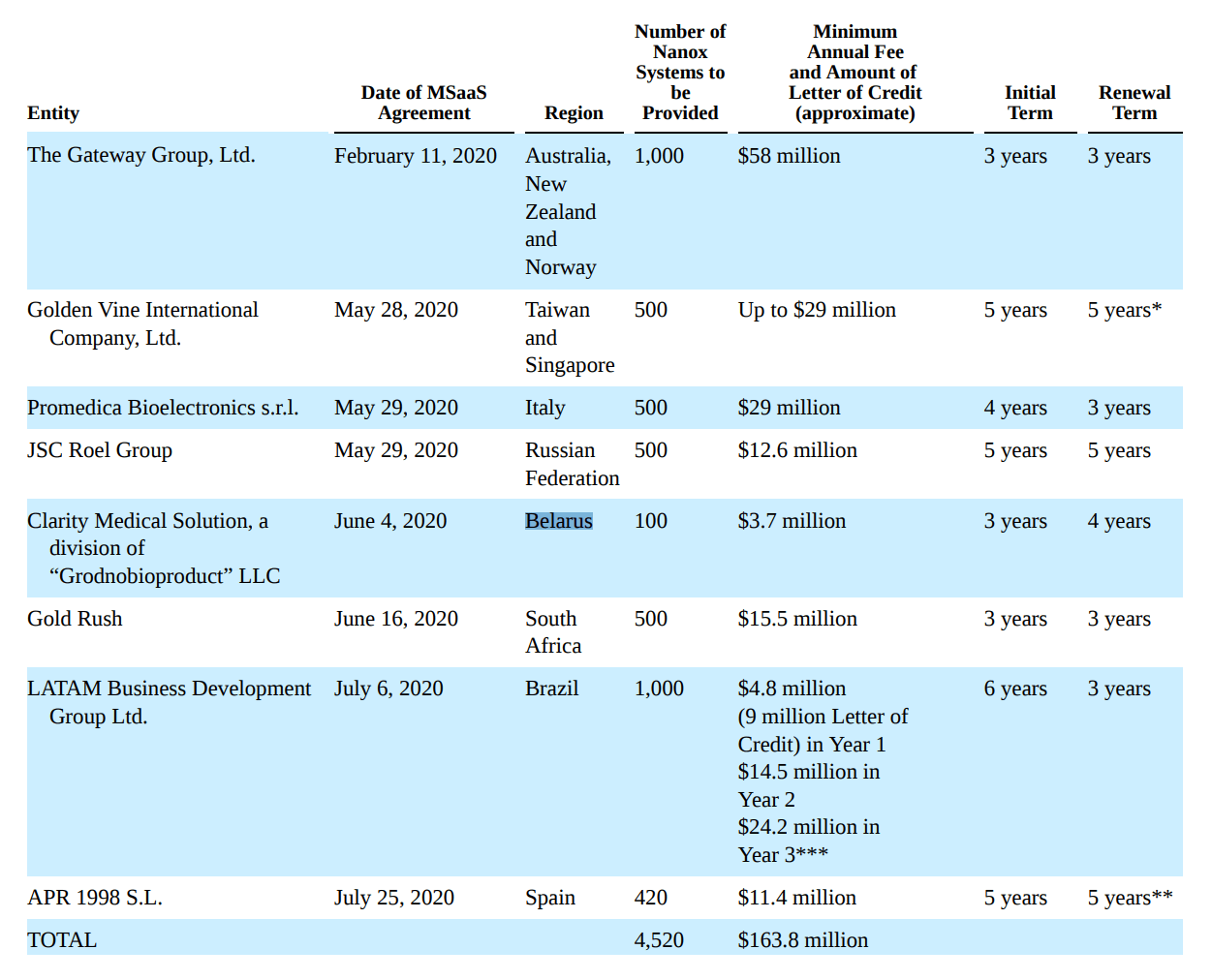

The company IPO’d to much fanfare, as the company had seemingly secured thousands of orders before the scanner was even approved by the FDA (Figure 2).

Figure 2 – Nano-X pre-IPO orders (Nano-X F1 Filing)

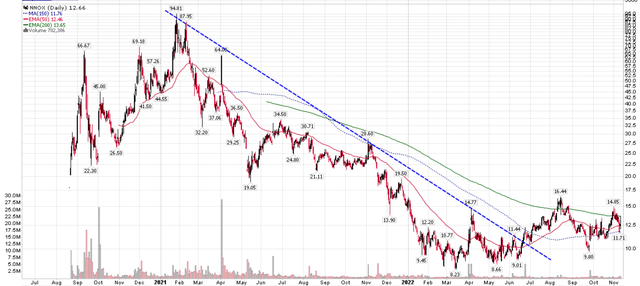

From its August 2020 IPO, the stock quickly raced to over $5 billion in market capitalization by early 2021, swept up in the bull market frenzy. However, as the company kept delaying the submission of its multi-source Nanox.ARC scanner to the FDA for approval, the stock began to decline, falling to a low of $8 / share earlier in 2022 (Figure 3).

Figure 3 – Nano-X stock has declined by over 85% from the peak (Author created with price chart from stockcharts.com)

From an initial estimated approval timeline of Q4/2020 when NNOX IPO’d, the company kept pushing back the 510(k) submission date, citing a need to do more prep work and engage in more dialogue with the FDA. Many analysts, myself included, had given up on Nano-X because of the unending delay.

FDA 501(k) Submission In September

To my surprise, on September 28th, 2022, the company announced it had submitted its long awaited 510(k) submission to the FDA for its multi-source Nanox.ARC scanner. The stock reacted very favourable, adding 20% in pre-market trading on the news.

The sharp stock reaction was one of the reasons I have recommended against shorting NNOX’s stock, despite my misgivings about the company’s prospects. The company was so unloved that any tiny piece of positive news could cause a massive short-squeeze.

Third Quarter Was Another Non-Event

Recently on November 10, 2022, Nano-X reported their fiscal third quarter results. As expected, the actual Q3/2022 earnings was another non-event as Nano-X generated minimal revenues from its teleradiology services and AI solutions. Revenue for Q3/2022 was only $2.4 million vs. $1.8 million YoY, and the company reported a net loss of $19.1 million vs. a $13.5 million net loss in Q3/2021. The company had $88 million in cash and securities as of September 30, 2022, which should last them for another year or two at the current burn rate.

I think the highlight of the quarter was the quarterly earnings call, where analysts had a chance to speak with management regarding the recent 510(k) submission and business outlook.

Earnings Call Continues To Muddy The Waters

Unfortunately, the earnings call failed to provide any clarity for me. First, when asked about how many scanners have been manufactured in anticipation of deployment to Nigeria (management highlighted that Nigeria would be one of the first deployment sites), we get this interesting exchange: (note, I have highlighted the relevant sentences):

Jeffrey Cohen

Hello, Erez and Ran. How are you? Just fine. So, a few questions for you. I guess firstly, as far as Nigeria and units that may be available for replacement, could you give us a sense of manufactured mark units as they stand at the moment.

Erez Meltzer

In terms of manufacturing, we are as we say in the process, we have all the materials which is available, we are making actually, we work with hand to hand with the regulatory approvals. So once we get all the paperwork, we can start to ship the units. And it goes the same with the other countries when we get the all the regulation approvals. Just to complete the answer about Nigeria. The next step is, send the first unit for demonstration. The demo center is ready already over there. And then to engage with those customers who are expecting to get the machines to do the training. As you know, we’ve indicated the work that we do with BVDH for the deployment and the training in Nigeria. So that’s the process that we do.

Jeffrey Cohen

Can you give us a sense of the size of the order over the coming year? Specific to Nigeria.

Erez Meltzer

We don’t, as you know and I’m going to stick to it until further or later or future other indications. We haven’t given numbers so far. The main reason, of course, was a relation. But we haven’t given numbers so far, and we make changes in the future.

– Jeffrey Cohen is an analyst at Ladenburg Securities and Erez Meltzer is the CEO

For a system that is supposedly ready for deployment (the CEO said in his prepared remarks that Nano-X wants to “begin to deploy the multi-source Nanox.ARC system in 2022.”), the CEO could not quantify how many units have been manufactured, nor the number of systems to be shipped to Nigeria in 2023 except for an expected demo-system. How is deployment in 2022 even possible, with only 7 weeks left in the year, if no systems have been manufactured yet?

Next, the same analyst asked about the timing of the FDA approval:

Jeffrey Cohen

Got it, and then finally, for [inaudible] review, where things stand at the FDA as far as the permutations that we should expect going forward. Do you anticipate that, obviously, a clearance would be one option. The second would be that they would be back with additional questions, what are the few permutations that we could see?

Erez Meltzer

Okay, the one thing that I don’t bet or indicate is the timing of the process from the FDA and we saw it in the last three years and I think the whole world, the whole business world, but we see it as we see it right now. What we are saying that we have done the utmost or everything that we could in order to increase the likelihood of the clearance from the FDA. Having said that, as I think that we spoke about it and we have emphasized it that this year none of says changed a little bit its regulatory strategy from the single step FDA submission process to a stepwise approach using Q submission path for questions and answer with the FDA team priority to the 510 (k) submission. And, frankly speaking, we intend to continue to use this dialogue with the FDA as we develop the next generation of the Nanox.ARC system, as well as the future products that Nanox will generate.

More than 6 weeks have passed since Nano-X’s 510(k) submission on September 28th and the earnings call on November 10, 2022. Since Nano-X have spent years working on this 510(k) submission, including 8 months on a Q-submission dialogue with the FDA, I cannot understand where the current delay is coming from.

From my understanding, a 510(k) approval is not that difficult to obtain. The applicant only needs to show and prove that the intended device is as safe and effective as a legally marketed device. Per the FDA:

A 510(k) is a premarket submission made to FDA to demonstrate that the device to be marketed is as safe and effective, that is, substantially equivalent, to a legally marketed device (section 513(i)(1)(a) FD&C Act). Submitters must compare their device to one or more similar legally marketed devices and make and support their substantial equivalence claims. A legally marketed device is a device that was legally marketed prior to May 28, 1976 (preamendments device), or a device which has been reclassified from Class III to Class II or I, a device which has been found SE through the 510(k) process, or a device that was granted marketing authorization via the De Novo classification process under section 513(f)(2) of the FD&C Act that is not exempt from premarket notification requirements. The legally marketed device(s) to which equivalence is drawn is commonly known as the “predicate.” Although devices recently cleared under 510(k) are often selected as the predicate to which equivalence is claimed, any legally marketed device may be used as a predicate. Legally marketed also means that the predicate cannot be one that is in violation of the FD&C Act.

For context, an Australian competitor, Micro-X, filed a 510(k) for their Rover Mobile X-Ray machine on June 11, 2020 and received FDA approval by July 20, 2020, a turnaround of 6 weeks.

Nano-X Schedules Virtual Demonstration On November 16th

Not to be too bearish on the story, there are some positive developments happening at Nano-X. In a hopeful sign for the bulls, Nano-X scheduled an ‘ARC Day 2022‘ for November 16th, 2022 where the company hopes to demonstrate the Nanox 3D medical imaging ecosystem (Figure 4). I have already registered for the event and will hopefully have more details to share afterwards.

Figure 4 – Nano-X ARC Day 2022 (Nano-X website)

Conclusion

In summary, the Nano-X story remains an enigma for me. While the company have made some positive advancements in recent months, including a 510(k) submission to the FDA for its multi-source Nanox.ARC scanner, there are still a lot of question marks surrounding the company. Hopefully, we will not have to wait long until we hear back from the FDA, as peers have gotten their devices approved in a matter of weeks. The upcoming demo day could be a positive catalyst for the stock. I continue to recommend a wait and see approach to Nano-X.

Be the first to comment