Justin Sullivan

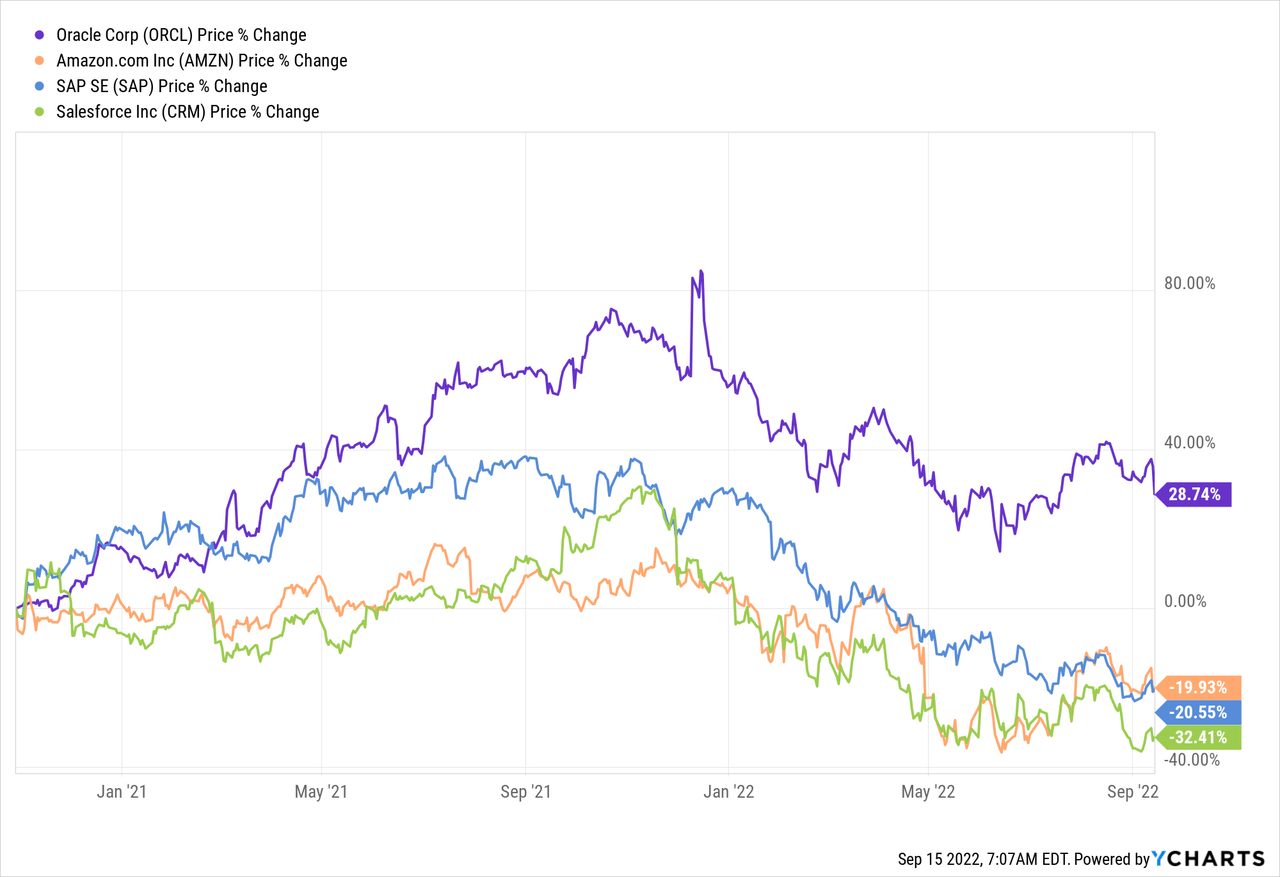

Almost two years ago, I showed why high quality businesses, such as Oracle (NYSE:ORCL) are not necessarily coming at exceptionally high valuations.

The mood back then was predominantly that Oracle is slowly falling behind its peers, that the company is irrelevant in our day and age and that Oracle will most likely continue to deliver sub-par revenue growth and with that it will continue to underperform the market.

To many it might look surprising and some it will probably sound like a one-off event or pure luck, but the fact of the matter is that oftentimes the market is too focused on the recent past and fails to acknowledge the strong corporate strategy, positioning and competitive advantages of certain businesses that refuse to manage their strategy in favour of meeting or beating quarterly numbers.

The results since my first analysis, however, speak for themselves. At a time when many high-flying and high-growth stocks struggled alongside the overall market, Oracle delivered nearly 30% return.

That is why, aside from all the issues associated with today’s market extreme short-termism, we should always review quarterly results within the bigger picture of the long-term corporate strategy and should not succumb to short-term noise.

A Closer Look At Oracle’s Recent Earnings

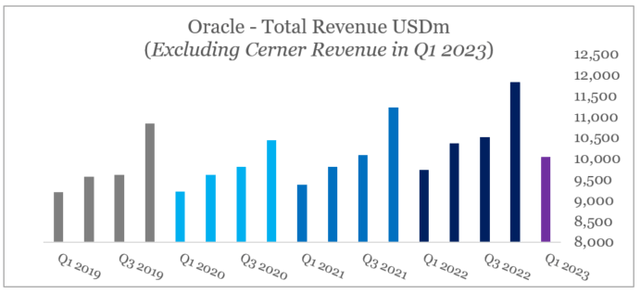

As expected, topline growth remained strong as Oracle’s high growth segments continue to increase in share.

Even without Cerner, our total revenue grew 8% in constant currency driven by Oracle’s rapidly growing applications and infrastructure cloud businesses

Source: Oracle Q1 2023 Earnings Release

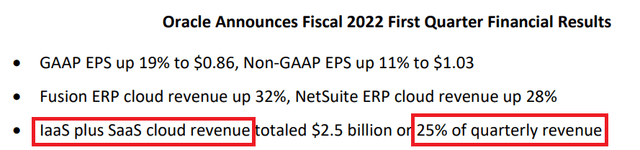

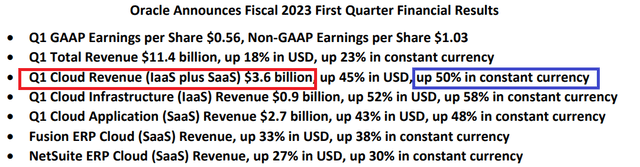

For comparison, the cloud related revenue (IaaS and SaaS) was roughly $2.5bn during the same quarter last year. This made around 25% of total revenue.

Oracle Q1 2022 Earnings Release

For the first three months of fiscal year 2023, however, this part of Oracle’s business is now $3.6bn or now close to 32% of the quarterly revenue.

Oracle Q1 2023 Earnings Release

I have shown before, how this fast-growing part of Oracle’s business, where the company also has exceptionally strong competitive advantages, is being obscured by Oracle’s legacy businesses, but will soon start to make a meaningful impact on the overall topline.

prepared by the author, using data from SEC Filings

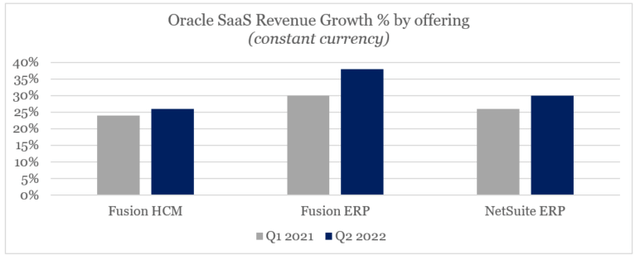

More specifically, SaaS business continued its momentum on the back of the company’s leading Enterprise resource planning (ERP) offering.

Our strategic back office cloud applications now have annualized revenue of $5.8 billion and grew 33% in constant currency, including fusion ERP, which was up 38%. NetSuite ERP up 30% and Fusion HCM up 26%.

Safra Catz – Chief Executive Officer

The ERP is where Oracle has one of the strongest competitive advantages and is recognized as an absolute leader.

In addition to the ERP offerings, Oracle’s Human Capital Management (HCM) have also accelerated its growth over the first quarter of FY 2023, when compared to a year ago.

prepared by the author, using data from Oracle Quarterly Earnings Transcripts

The infrastructure part of Oracle, which for a number of years has been an area of scepticism for most commentators, recorded 58% growth in constant currency.

Q1 cloud infrastructure or IaaS revenue was $0.9 billion, up 52% in USD, up 58% in constant currency, again, with no contribution from Cerner.

Safra Catz – Chief Executive Officer

Source: Oracle Q1 2023 Earnings Transcript

This has also been a supply-constrained area for Oracle for some time as demand accelerated in recent years. Not only that, but Oracle continues to narrow down the gap between its OCI and offerings by AWS, Microsoft (MSFT) and Google (GOOGL).

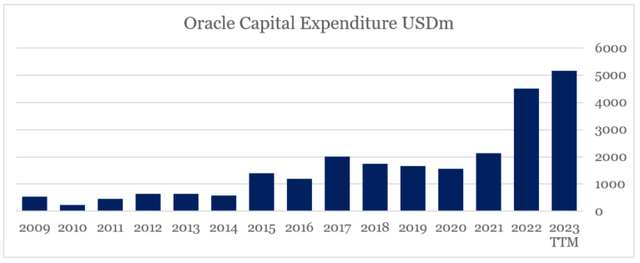

This also explains the recent ramp up in Oracle’s capital expenditure as it now fully capitalizes on the beginning of the multi-cloud era.

prepared by the author, using data from SEC Filings and Seeking Alpha

In addition to all the cross-selling opportunities, Oracle also excels in its geographical coverage in the infrastructure space.

In addition, we now have cloud regions in more countries and cities than AWS and Azure, giving our customers more choices for their sovereign data.

Safra Catz – Chief Executive Officer

Lastly, as more and more clients opt for a multi-cloud approach, Oracle’s database is now available not only on Microsoft Azure, but also on AWS – the two largest cloud vendors.

In Q1 we expanded our relationship with Microsoft by providing all versions of the Oracle database directly to Microsoft Azure customers. Now all Microsoft customers can directly access the Oracle Exadata Cloud Service, the Oracle Autonomous Database and every other Oracle Database version directly from the Azure Cloud. Today we are also announcing that Amazon Web Services customers can directly access Oracle’s MySQL HeatWave database running in the Amazon Cloud. This enables AWS users to run transaction processing, real-time analytics, and machine learning on the single unified MySQL service.

Source: Oracle Q1 2023 Earnings Release

Investor Takeaway

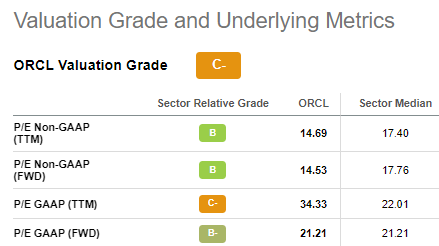

Contrary to the strong operational performance of Oracle and what in my view is a superior long-term strategy, the company now trades at very conservative multiples.

Seeking Alpha

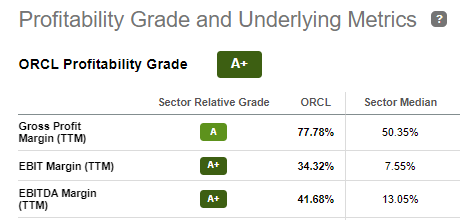

While margins have declined slightly, Oracle also remains one of the most profitable enterprises in the sector that is now also in a phase of accelerating topline growth.

Seeking Alpha

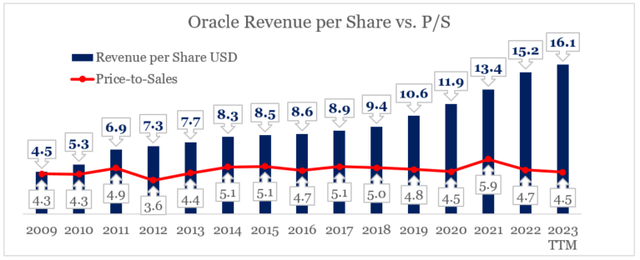

It’s worth mentioning that on a historical basis, Oracle now trades at one of the lowest sales multiples, while sales per share are skyrocketing due to the strong organic growth and large share buyback program.

prepared by the author, using data from SEC Filings and Seeking Alpha

Finally, we should also acknowledge that the company enters in its higher growth phase and as a result is also increasing leverage in order to fully capitalize on this opportunity. Of course, this is an area that investors should watch closely, however, I am personally taking advantage of the recent drop and I am adding to my positions.

A Note for roundabout investors

The analysis above follows my strategy of finding roundabout investments. These are reasonably priced, high quality companies with strong competitive advantages where the management is focused on managing the business with a solid long-term view.

In The Roundabout Investor service I will focus on my highest conviction ideas and will also present the readers to a concentrated all-equity portfolio and potential ideas to keep on their watchlists.

The service is scheduled to launch next Thursday, on the 22nd of September. I will also feature an early subscriber discount, so stay tuned.

Be the first to comment