Andrii Chagovets/iStock via Getty Images

Investment Thesis

Nano Dimension (NASDAQ:NNDM), an Israeli Additive Manufacturing Electronics [AME] company, recently announced its preliminary results for the 3rd quarter after a very quiet period. Preliminary revenues came in at about US$10M, which is down from the US$11.10M reported in Q2, indicating a possible slowdown in revenues.

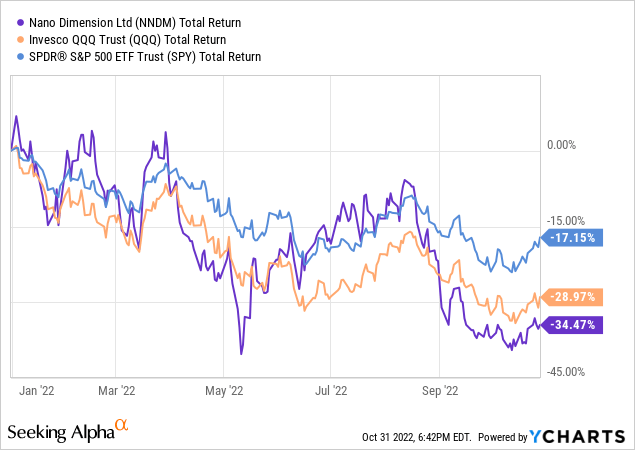

The stock is down about 34% YTD and has given back most of its alpha that it was able to generate above the S&P 500 (SPY) and Nasdaq-100 (QQQ). Nonetheless, we still think it is a good time to hold the stock given that we believe it is still undervalued for a host of reasons that we will outline in a moment.

Downside Protection

On May 17, Nano Dimension announced that it was launching a share buyback program, to support shareholders with up to $100 million in share repurchases. This came after shares plunged 68% from Jan. 1, 2021, until the announcement. The plan was given the green light by the Israeli court on Aug. 3.

This means that Nano Dimension still has until August 2023 to buy back more shares, if management sees fit. When the CEO, Yoav Stern, was questioned about the buyback during the Q2 earnings call, he told investors that he “will consider a buyback, absolutely.” We understand that Yoav Stern in his Q2 earnings call alluded to the performance of 13 other Additive Manufacturing companies YTD to justify a share repurchase.

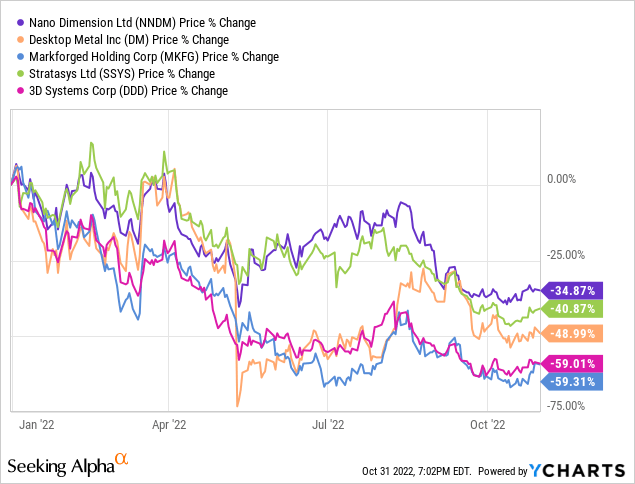

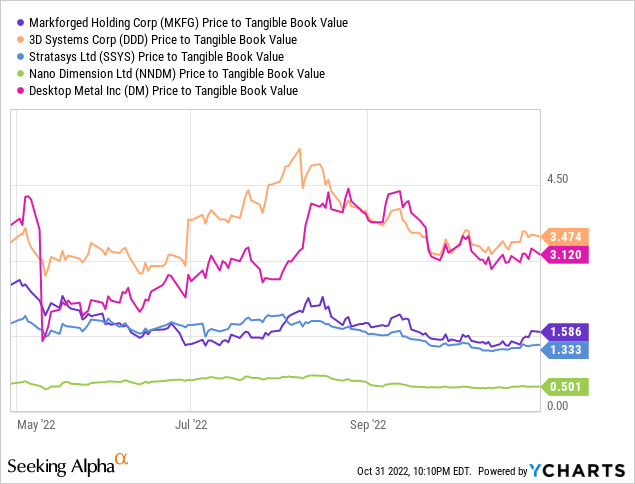

That means management is likely to proceed with a buyback if its performance in terms of share price is lower than that of its competitors, which we also believe is why investors are currently ahead of Nano Dimension. Compared to its competitors, Nano Dimension could offer shareholders downside protection.

If the company underperforms its competitors, we can expect management to step in and buy back shares if deemed necessary. Currently, Nano Dimension is still outperforming most of its industry peers, as shown in the chart above.

The Balance Sheet

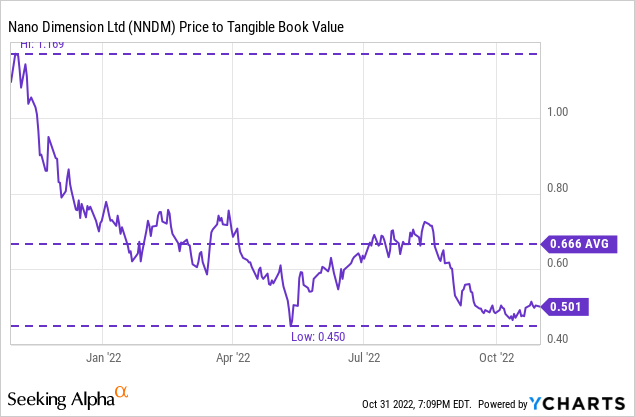

Another major reason why the stock still seems undervalued to us is its huge balance sheet, which currently contains US$1.34BN in assets and almost no liabilities (US$50.46M). Currently, Nano Dimension is trading at a price/tangible book value of just 0.5.

In its preliminary results, the company also disclosed that it had consolidated cash, trading securities and deposits worth about US$1.19BN as of Sept. 30. This compares with Nano Dimension’s market capitalization, which currently stands at US$638 million. In essence, the company is trading US$549,620,000 below its cash value/tangible book value.

The lowest price Nano Dimension has ever traded against its balance sheet was a price to tangible book value of 0.45x, or $2.17 per share, which is also why we believe the stock is seemingly in a bottoming process.

Just to put that in perspective, according to their cash flow statement, the company suffered -US$21.94M in losses from its operations in the second quarter. At that rate, the company could go on for more than 6 years before it even reaches its present value or a price-to-tangible-book value of 1.

The Macroeconomic Picture

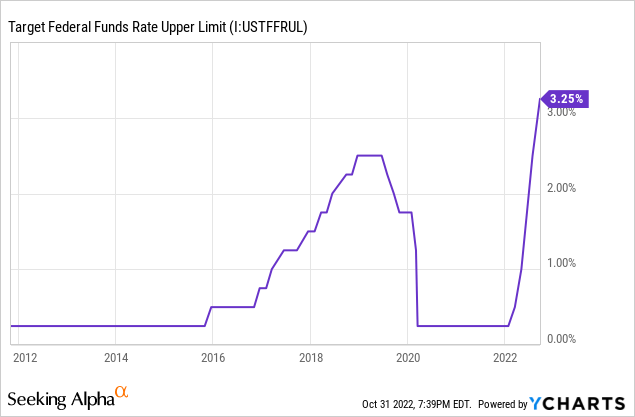

The company is also quite privileged in that regard, as the Federal Reserve is currently raising interest rates at a record pace not seen since the 1980s. As liquidity dries up, and it becomes more difficult for companies to raise capital, Nano Dimension already has more than enough cash on hand to continue its operations in the coming years.

The excess cash could be paid out as dividends, or used for buyback programs if the company recognizes that it has raised too much money, perhaps for its current investment needs. Or in the meantime, the company could earn a serious return on its balance sheet in the fixed-income market, with a 2-year yield currently at 4.49%. If they decided to invest $550 million in excess cash, that would generate $24.7 million a year from Treasury bonds alone.

Safe companies with large balance sheets and low burn rates could become more attractive as the Fed continues to tighten its monetary policy. The Fed rate currently stands at 325 bps. According to Fed Fund Futures, the Federal Funds Rate is expected to be around 500-525 bps next May. That means there is still 2% monetary tightening to come.

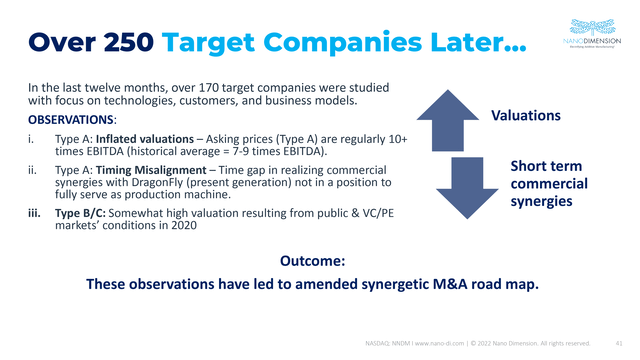

Higher interest rates also put pressure on equity markets, as this usually means higher discount rates and lower valuations for the companies involved. Nano Dimension has reportedly been looking for 2 years and has made a large number of acquisitions during that time.

However, management said it was kept from certain acquisitions because the companies in question demanded too high multiples. As some of these companies get into difficulty and valuations come under pressure, management might be able to make acquisitions at a lower price.

Nano Dimension IR

Financial valuation

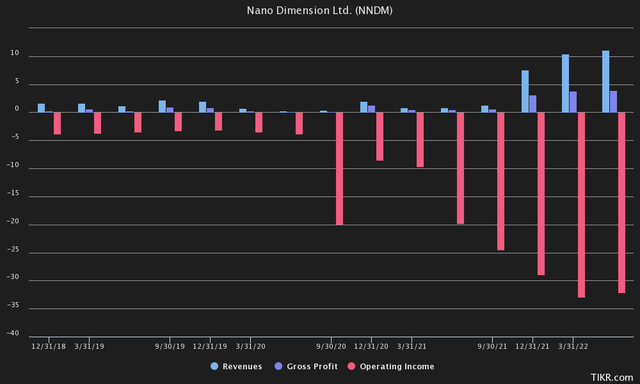

The main reason why we are currently refraining from a “buy” rating and maintaining our “hold” rating is the fact that the company may face headwinds in the near future. This is evident from the announcement of the company’s preliminary results, which have been quite stagnant for the past 3 quarters.

However, we believe the company has made tremendous progress, as it is still on track to increase its revenues more than 10x between 2020 and 2022. In 2020, Nano Dimension’s revenues were US$3.4 million, compared to an estimated US$40 million for the full year 2022.

TIKR Terminal

However, the company is still losing money, mainly due to operating costs. Currently, about half of its operating costs are R&D, which we believe is also front-loading. Nano Dimension is currently still pushing heavily on R&D as it develops new machines, software, etc.

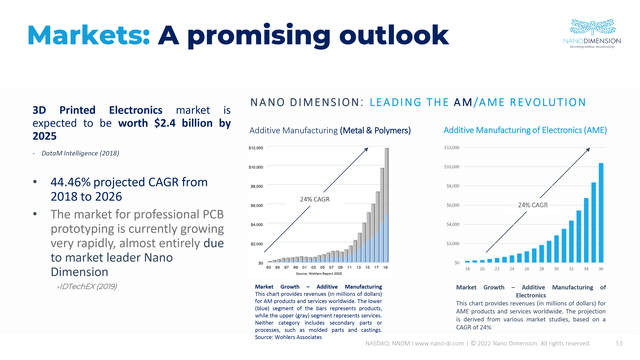

However, that means that once the company is fully developed and able to provide sufficient value to its target audience, those R&D costs should decrease as the company moves toward profitability. But currently, the focus still seems to be on revenue growth and R&D. The Additive Manufacturing Electronics market itself is expected to grow at a CAGR of 44.46% between 2018 and 2026, and at a CAGR of 24% through 2036, which seemingly still gives the company plenty of prospects for revenue growth. Especially since the market is almost exclusively dominated by Nano Dimension itself.

DataM Intelligence, for example, expects the AME market to reach $2.4 billion by 2025. Our estimate is that this is more likely to be reached by 2030, as we also see Nano Dimension struggling to reach R&D targets and developments in a timely manner, which we will discuss later. Since the AME market is quite small and completely dominated by Nano Dimension, we believe it will be able to take at least a 25% market share by 2030. Should serious competitive threats be identified, Nano Dimension also has the advantage of proposing a buyout thanks to their huge cash balance worth US$1.18BN+.

Nano Dimension IR

A 25% market share would translate into revenues of $600 million, or a CAGR of 38.23% over the next 8 years. Over the past 4 years, Nano Dimension has been able to grow revenue at a CAGR of 56.58%. Although the growth was mainly focused on the last 2 years, where they achieved a CAGR of 243%, growing US$3.4M to an estimated US$40M for FY 2022.

The average P/S ratio for the semiconductor equipment sector is 6.01, while the average P/S ratio for electronics is 2.70. We think a P/S ratio of 3 is reasonable, as it is closer to the overall P/S ratio of 2.91 in the equity markets. At a P/S ratio of 3, the company would be valued at US$1.8BN or a share price of about US$7. This implies a CAGR of 13.85% of the share price, which should exceed the average historical benchmarks.

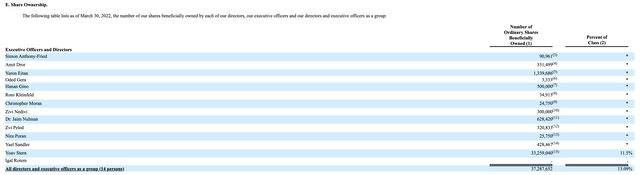

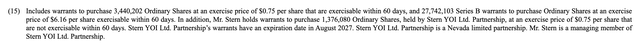

Management must also be serious about getting the company’s share price above $6.16, because according to their 20-F SEC filing, Yoav Stern has most of his upside in warrants that expire in August 2027. He owns 27,742,103 series B warrants, and a total of 11.5% of the voting rights, which are almost exclusively in those warrants. If the stock closes below $6.16, the warrants should become worthless.

Edgar, SEC

On the other hand, if the share price reached more than US$10.16, that would mean nearly $4 in profit per warrant, or a bonus of more than US$100M+, as Yoav Stern owns more than 27.74M warrants on March 30, 2022. He also showed his confidence in the company, as he bought more than US$500K worth of shares on the open market when the shares were trading at around US$4.

Edgar, SEC

The Risks

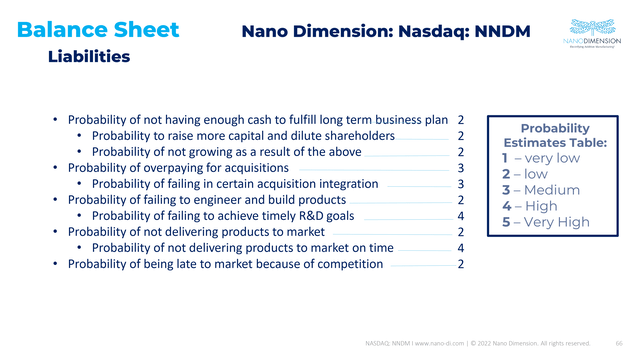

Nano Dimension is obviously still a company in its early stages and involves quite a few risks, and remains more of a speculative play. The company itself outlined a number of risks/obligations in its presentation, with the biggest risks being “failure to bring products to market on time” and “failure to achieve R&D targets on time.”

We believe these risks are also the most important, and could affect revenue growth in the near term. Especially since Europe and the U.S. are almost certainly entering or already in recession. In the second quarter, however, we got news of new products, which should go into beta by the end of this year and into production next year.

That means the darkest days may already be behind us, especially since much of the money already spent on R&D has not yet turned into revenue, but may do so once those products are released.

Nano Dimension IR

A slowdown in revenues is certainly also on our radar in terms of risk, but we believe we need to see more evidence that revenues are actually slowing for several quarters before making an accurate assessment. The current preliminary revenues could very well be the result of a macroeconomic slowdown, with companies rather sticking to their CapEx budgets as interest rates rise.

Finally, we also see a risk in holding onto the company’s cash reserves, coupled with inflation at record levels (8.2% y/y), which could reduce Nano Dimension’s purchasing power over time. We believe that if the company has excess cash reserves that it will not use in the near future, it should return them to shareholders or at least invest them at a risk-free rate of 4.04% in the meantime.

The Bottom Line

Nano Dimension may be down for the moment, but could break the silence quite a bit by the end of this year and next, and surprise upwards with new products/R&D in which they have invested heavily over the past few quarters.

The darkest days may already be behind us, as the share price to tangible book value is near record lows, and the company still seems to have good growth prospects.

Be the first to comment