SDI Productions Myovant

The need for patience if big profits are to be made from investment. – Phillip Fisher (Warren Buffett’s Mentor)

Author’s Note: This article is an abridged version of an article originally published for members of the Integrated BioSci Investing marketplace on October 04, 2022.

One of the most exciting times in biotech investing is when a company received an offer from a potential acquirer. Any news (or even rumors) about an acquisition can get investors excited. After all, the purchase price is typically a premium to the market price. Despite potential acquisitions news, the deal is sometimes either not consummated or completed beyond the initial offer.

That being said, I’d like to revisit the latest developments surrounding Myovant Sciences Ltd. (NYSE:MYOV). That is to say, Myovant recently received an offer from a potential acquirer which saw a 45% rally in the past 5-days. In this research, I’ll feature an analysis of Myovant while focusing on that potential deal. Moreover, I’ll share with you my expectations of this stellar growth equity.

Figure 1: Myovant Sciences chart.

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the subsequent section. Operating out of Basel, Switzerland, Myovant is laser beam focused on the innovation and commercialization of novel medicines to serve the high unmet needs in women and men’s health. Powering the pipeline is relugolix — a novel oral gonadotropin-releasing hormone (GnRH) receptor blocker.

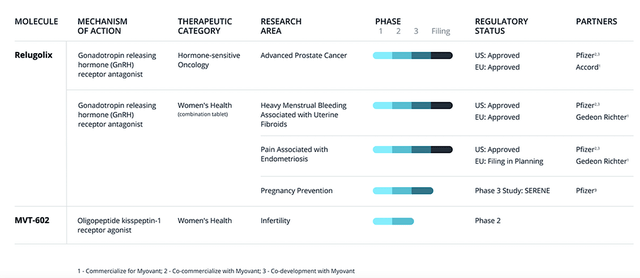

Viewing the figure below, relugolix is already launched for three indications with powerful partners like Pfizer (PFE). The first is as an antigen-deprivation therapy (i.e, ADT) under the Orgovyx brand for advanced prostate cancer (i.e., APC). Under the Myfembree brand, relugolix is marketed for heavy bleeding associated with uterine fibroid and pain due to endometriosis. That aside, the company is set to file for regulatory approval of Myfembree in the EU for endometriosis. To maximize growth, Myovant is expanding relugolix’s label for pregnancy control. There is also a younger asset (MVT402) in development for women infertility.

Figure 2: Therapeutic pipeline

Partnership

Of partnership, Myovant has a stellar partner for its co-launch and co-development in the USA: Pfizer. As a global powerful biopharma, Pfizer has vast sales/marketing/regulatory resources to help Myovant fully unlock the values of both Orgovyx/Myfembree in the US soil. Interestingly, Pfizer is also co-developing relugolix for pregnancy prevention.

In the European Union, Myovant engaged Accord as the commercialization partner for Orgovyx. The other partner (Gedeon Richter) handles the launch of Myfembree for both endometriosis and uterine fibroids there.

Sumitomo Offer

Shifting gears, you should check into the latest acquisition offer. On October 02, Myovant reported that Sumitovant Biopharma and Sumitomo Pharma (i.e., collectively known as Sumitomo or Sumi in short) offered to acquire the remaining shares of Myovant in cash for $22.75 per share. Interestingly, Sumi currently holds 52% of all shares outstanding. Here’s what the press release stated,

The Company’s board of directors has formed a special committee of independent directors comprised of the members of the Audit Committee of the Company (the “Special Committee”) to evaluate and consider the Proposal and any alternatives thereto, with the assistance of its financial and legal advisors. The Special Committee, in consultation with its financial and legal advisors, has carefully reviewed the Proposal and determined that it significantly undervalues the Company and, therefore, is not in the best interests of the Company or its minority shareholders.

You can see that the Board believes that it’s a “lowball” offer and thereby rejected it. Nevertheless, it seems like Myovant is not walking away. Based on the language of the release, you can anticipate that there is a very good chance that the acquisition would occur. According to Myovant,

The Special Committee remains open to considering any improved proposal that reflects the full and fair value of the Company and is otherwise in the best interests of the Company and its shareholders, and is prepared to engage further with Sumitomo regarding any such proposal.

I believe that mentioned language strongly suggested that Myovant want to sell the company: they essentially asked for a higher acquisition price. Else, the company would have completely walked away rather than saying they are “open to considering any improved proposal.”

As you can imagine, the SEC has strict regulations on news a company can disclose relating to a potential acquisition. Therefore, Myovant cautioned their language to comply. That is to say, I believe that Myovant would not comment on the aforesaid development further until they come to terms with Sumi. Per the company,

There can be no assurance as to whether an agreement relating to any proposed transaction will be reached or as to the terms thereof if an agreement is reached. The Company does not intend to comment further or disclose any developments regarding the Special Committee’s consideration of the Proposal unless and until it deems further disclosure is appropriate or required. The Company’s shareholders do not need to take any action at this time.

Reading The Tea Leaves

Though Myovant won’t comment further, you can read the tea leaves to come to your own conclusion. First, Sumi is a “majority shareholder” of Myovant. Nowadays, most corporate action would favor the majority shareholders. Consequently, Sumi has the power to remove any board member to push the deal forward.

Even when Sumi can change Myovant’s management, you should ask whether they would do so? In my view, I doubt they’ll do a hostile takeover because doing so would jeopardize their relationship with the Myovant’s management.

As Sumi expressed a strong interest in Myovant, you can bet that they won’t give up. That explained why Sumi continued to build more shares over time to become the majority shareholder. Looking ahead, the most reasonable next step is that Sumi would come back with a higher offer.

Based on my market observation over the years, an acquirer usually pays at least 40% higher than the average closing price of the past 30-days. Even paying at 100% a premium for Myovant, I believe that Sumi would still get a deep bargain.

Financial Assessment

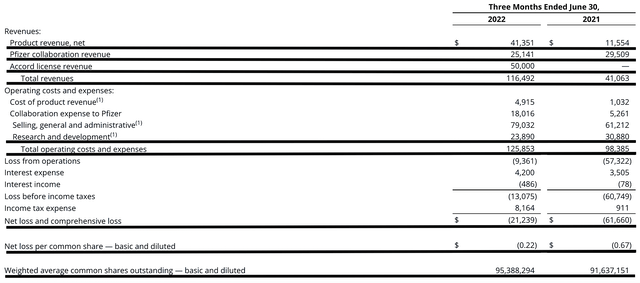

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 1Q2022 earnings report for the period that ended on June 30. Don’t be alarmed by the different dates, Myovant simply chose June 30 as the ending for its 2Q.

As follows, the company procured $116.4M in revenue compared to $41.0M for the same period a year prior. Of that figure, the product revenue, Pfizer collaboration revenue, and Accord licensing revenue registered at $41.3M, $25.1M, and $50.0M, respectively. Hence, the total revenues generated the 183.9% year-over-year (YOY) increase. Coupled with the recent Myfembree approval for endometriosis, you can project that total sales would quickly ramp up beyond blockbuster. After all, Pfizer has a very powerful sales/marketing force.

That aside, the research and development (i.e., R&D) for the respective periods registered at $23.8M and $30.8M. I viewed the 29.4% R&D increase positively because the money invested today can turn into blockbuster profits tomorrow. After all, you have to plant a tree to enjoy its fruits.

Additionally, there were $21.2M ($0.22 per share) net losses versus $61.6M ($0.67 per share) declines for the same comparison. You can see that the bottom line substantially improved by 67.1% YOY. As sales increase, Myovant can leverage the “economy of scale” to improve its bottom line.

Figure 3: Key financial metrics

About the balance sheet, there were $400.0M available under the Sumi Loan Agreement. In addition to the $100M milestone payment by Pfizer, the cash position is increased to $500.0M. On top of the $116.4M quarterly revenue and against the $125.8M quarterly OpEx, there should be adequate capital to fund operations for many years without worrying about the cash flow constraints. Simply put, the cash position is strong relative to the burn rate and revenues.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Myovant is whether the company can quickly ramp up both Orgovyx and Myfembree sales. There is always a risk that the launch won’t be a success.

The other significant risk is that the Sumi acquisition would either be non-consummated or executed at an unfavorable price. That is to say, Sumi and Myovant might just be playing mind games with investors to artificially inflate the share price. If that is not the case (and an organic offer is in play), Sumi can still either muscle forward the lowball offer or another offer that is only slightly higher.

Conclusion

In all, I recommend Myovant as a strong buy with the 5 out of 5 stars rating. Myovant is a story of investment success. As you know, the approved relugolix label for ACP and uterine fibroids alone already garnered significant sales with a huge uptrend. Despite the volatility, the stock is posting solid gains (i.e., a 50% rebound) since the last month. The Sumi offer to acquire the rest of the outstanding shares is a strong indication that Myovant shares are trading at a deep bargain. Moreover, it indicates that the recent Myfembree FDA approval is a game changer for Myovant. Specifically, it signaled that revenue would be galvanized quickly beyond blockbuster.

Be the first to comment