Jian Fan

Investment Thesis

Rackspace (NASDAQ:RXT) has an impressive revenue profile. The company has a robust recurring revenue base and generates strong free cash flow. But the business is experiencing severe margin pressure. Its debt burden is also extremely high. For these reasons, I recommend avoiding the stock right now.

Stable Revenue And Moderating Growth

Rackspace’s last quarterly results were mixed. The business reported results on the high end of its previous guidance. But forward guidance was negative.

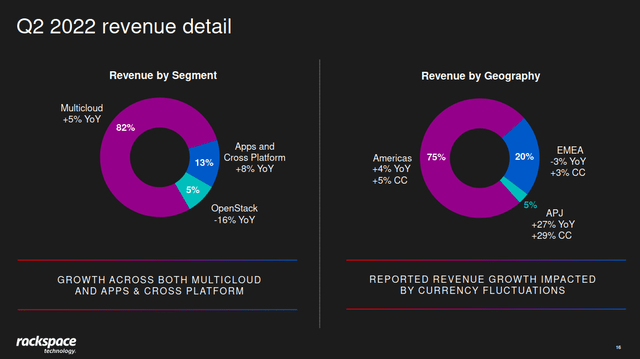

The business’s legacy OpenStack segment is an ongoing top line growth headwind. The company made the decision to stop selling the service in 2017. It’s still generating some residual revenue. Year over year, revenue from this segment declined by 16%, and gross profit declined by 20%. Excluding this segment, the company’s core growth was 5%.

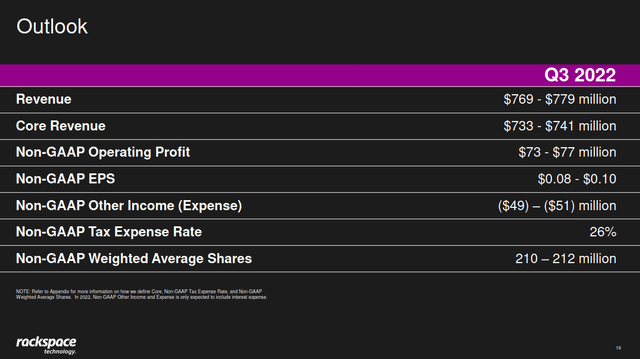

This is a large slowdown from Rackspace’s previous growth trends. The company had reported strong top line growth in prior years. It grew by 11% from 2019 to 2020 and by 11.1% from 2020 to 2021. But the outlook is moderating. The company expects only 1.5% year over year top line growth for the next quarter.

Rackspace Q2 2022 Earnings Presentation

The company has a solid revenue profile. Rackspace’s business centers itself around recurring revenue and long term customer relationships. At the end of last year, Rackspace had almost $3 billion in ARR. This should help protect the business’s top line from an economic slowdown. Rackspace’s services also tend to save money for its customers, further reducing the risk.

Management reported that they’re still seeing strong demand. The company is positioning its business to capture secular cloud computing growth trends. Gartner (IT) expects public cloud spending to grow over 20% this year. This sets the business up for continuing stability. On their last earnings call, management discussed the demand environment.

I’ll give you a little bit of color on our bookings performance for the second quarter. So look, first of all, — it was the third highest bookings quarter in the history of the company. Bookings in the quarter continued to be highly diversified by geography, by industry, by market segment. There are over 5,600 individual deals closed in the second quarter. We saw strong performance in our tip of the sphere professional services business in both the Americas in the EMEA regions, and we had good traction with sales in our public sector business… We’re seeing increased deal sizes as customers are bringing larger workloads and purchasing multiple services. And our focus on higher-margin deals, balancing revenue and profitability. Our focus there is driving good results. So overall, I’m very pleased with the quality of the bookings… So our pricing, I think one of the things that — because the demand environment remains rich, we are not seeing any kind of pricing pressure, so to speak. I think this is a good market from that perspective.

Revenue growth is clearly slowing down. But I think that the company’s existing revenue is likely to be stable. This could be important since the business is trading at a relatively cheap valuation.

Declining Profitability

The company’s profitability is suffering. Management forecast just $0.08 to $0.10 EPS in the third quarter. Adjusted EBIT expectations are $73 million to $77 million. At this rate, Rackspace’s earnings per share would be down by over 60% year over year. This would be the company’s worst quarterly result since its IPO.

Rackspace Q2 2022 Earnings Presentation

The company blames these profitability issues on a variety of headwinds. These include the decline in its legacy OpenStack business. Employee expenses are another headwind. The business is still heavily investing in personnel for its cloud business. Expanding headcount is a risky move in this environment. But management believes it is important to capture long term growth. The company also mentioned increasing energy costs as an issue for its data centers.

Consistent restructuring expenses are likely to further harm the company’s GAAP profit. In normal cases, I think it is fair to exclude restructuring costs from adjusted metrics. But the company has been consistently incurring transformation and restructuring expenses for years. These have averaged over $27 million per quarter over the last three years. In the last quarter, these charges were equal to 70% of Rackspace’s adjusted net income.

The company is realigning its business to reflect its shift towards cloud computing. Starting in the next quarter, management will split its results into public and private cloud segments. This should provide more clarity on Rackspace’s business trends.

Financial Health And Valuation

Shares are trading at a cheap valuation. The business is trading at a P/E of 8.1 times and a LTM P/FCF of 4.2 times. Rackspace has solid profitability and is growing revenue at a low single digit rate. This seems cheap for a business that isn’t forecasting a major decline in its fundamentals.

The most interesting part of the business is its strong free cash flow. The business generated $221 million in free cash flow in the last twelve months. At the current valuation, that’s a 24% free cash flow yield. This should help fund the company’s transformation and boost long term growth.

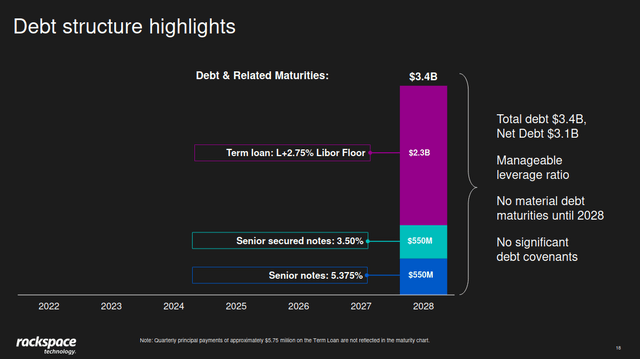

Rackspace Q2 2022 Earnings Presentation

But the business is very highly levered. Rackspace has about $3.5 billion in debt and about $4 billion in total obligations. This is 6.6 times last year’s EBITDA and over four times the company’s market capitalization. This is an extremely high debt burden. Adjusting for this debt, Rackspace has a forward EV/EBITDA of 41 times and a LTM EV/FCF of 21 times.

The business has refinanced all its debt to 2028 maturities. But $2.3 billion of this debt is floating rate. Rackspace’s interest expenses are already over $50 million each quarter. These costs will only grow as the Fed continues to raise rates. In the near term, Rackspace has decent liquidity. The business has $261 million in cash on hand and a $375 million revolver.

The very high debt burden is an issue. It is likely to reduce the company’s ability to return free cash flow to shareholders. If growth doesn’t improve, it could even compromise Rackspace’s financial health.

Final Verdict

Rackspace is set to benefit from some secular cloud trends. Its revenue profile seems solid. But I’m concerned by the company’s declining margins and high debt burden. I think that Rackspace could eventually be an interesting investment based on cloud growth trends. But I don’t think there’s a compelling catalyst in the near future, and the risk to reward isn’t favorable enough. I recommend avoiding the stock right now.

Be the first to comment