Panuwat Dangsungnoen/iStock via Getty Images

Disclosure

Within this article, the company Novo Nordisk A/S (NVO) will be mentioned. For the reader, I’d like to disclose that I’m an employee of the company. The nature of my position is an office job that does not concern sales.

Looking back at the previous year

It’s been a bit more than one year ago since I first published a piece concerning my own portfolio consisting of my everyday savings for the past decade, give or take. As I prepared to write the 4th instalment, I glimpsed back at it to see what has transpired. Days go by quickly and we often forget the progress we make, and I was quite surprised to see how my portfolio has changed since then even though it’s only been a year.

Here are a few stats, to exemplify the change

- Back in March 2021, my total invested capital stood at $93.926 with a market value of $130.013

- As of April 2022, my total invested capital stands at $126.533 with a market value of $178.870

- Back in March 2021 my forward annual dividend income stood at $3551 compared to $5071 today

During that period, I’ve offloaded three companies which were part of the original portfolio, being Coca-Cola (KO), Danske Bank (OTCPK:DNSKF) and most recently also Walgreens (WBA). I’ve published articles as to why I decided to rid myself of both Coca-Cola and Danske Bank, with the first being a situation of the company’s financials starting to erode, and the other being a result of having lost my patience with management and the general story surrounding the company. In the case of WBA, when I picked it up, I was under the impression it could appreciate greatly as it appeared significantly undervalued but being three years in, with Mr. market still disagreeing with me, I decided my money was better allocated elsewhere. As such, I took the small loss, pocketed my dividends, and said goodbye.

On a net basis YoY, I’ve added $32.607 to my portfolio and if I break it down, it comes out the following

- $22.452 added in “growth companies”

- $5.333 added in ETFs (A recent addition)

- $4.822 added in traditional blue chips with a focus on dividend paying companies

My portfolio has for many years consisted mostly of traditional blue chips with some of them being mature companies and other having a strong growth trajectory in front of them. I made the conscious choice to add more high-risk given I don’t plan on touching this portfolio for decades. As I see it, I’m planting seeds, and while some will turn out to be weeds, others will be major portfolio winners looking years and decades ahead.

I’m conservative in my nature as an investor and it took me a long while to finally persuade myself to increase risk in my portfolio, so I made up for lost grounds with the heavy allocation to high-risk growth companies. Looking at my portfolio today, and the $22.452 is currently down by $6.369. I’m okay with that, I’ve done my due diligence in the process and I’ve added to a couple of my positions recently as I’m confident in those specific companies and their management teams. It will require years if not decades for those companies to play out their full story, and I’m in no rush.

The Portfolio

We are all undergoing lifelong investment journeys, where we learn and adjust along the route. As such, my own principles for investment will not be considered universal nor perfect, but I don’t expect them too either. Summarizing, it boils down to the following concepts, from which I deviate at my own discretion.

- Mature dividend payers, meaning those with medium to high payout ratios and a long track record of dividend payouts, must trade with a yield of 2.5% or higher when a position is initiated.

- Payout ratio should be below 70% when measured on a free cash flow basis, high yielders being the exception.

- Growth is added to the portfolio when I consider it a reasonable price, striving to reach 15-20% of my portfolio. You can see my portfolio sector allocation for what I label ‘growth’.

- Maintaining a mix of mature dividend payers and companies with low yields but great potential in terms of future dividends.

Striving to add minimum $6000 to the portfolio annually which is a stretch target for my financial abilities in a long-term perspective.

The Numbers

Year to date I’ve managed to add $4600 to my portfolio meaning I’m well ahead of the $6000 for the full year. It’s evident I also managed more than that the past year, where I also benefited from a net cash position, I could decrease to make up most of the new portfolio funds, but I prefer to establish a conservative target that will still allow my portfolio to grow strongly over time. After all, time is the best weapon for compounding so I’m stretching my finances to add as much as possible during the earlier years on route to retirement or financial freedom.

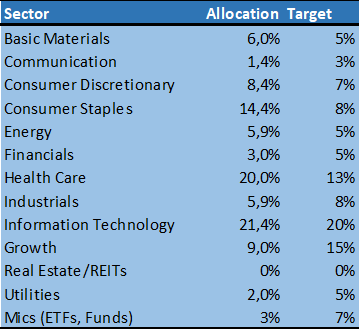

Well, here it is, the full portfolio.

Authors Own Creation

As a result of the recent additions and movements within my portfolio, my current division looks like the following. I don’t take these targets too literal, but I do glance over them whenever reviewing cases to decide where I could place my cash. Not wanting to muddy the picture too much, I’ve labelled my recent growth-orientated additions exactly that, growth, as opposed to having a whole range of sub-sectors in the overview. It serves the specific purpose of reminding me exactly how much of my portfolio I’ve put into the high-risk bucket.

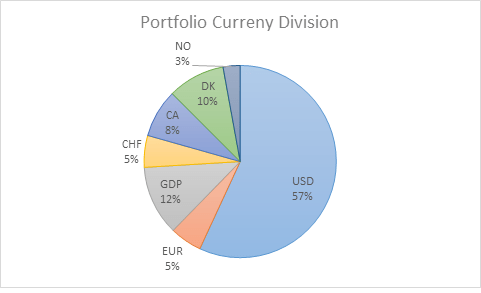

Sector Allocation

Authors Own Creation

Since my last portfolio update, I’ve adjusted my targets slightly as I’ve finally managed to introduce ETFs to my portfolio. Adding ETFs has been part of my target allocation for a very long time, but apparently, I needed a specific event (kick in the butt) to finally make me do it. Last year, I added Alibaba (BABA) to my portfolio upon having completed my due diligence, but as with many others I clearly underestimated the impact from local regulators and everything else that surrounded the company. The stock was trading at around $125-130 when I published my thoughts here on Seeking Alpha, admitted my mistake and cut my losses allowing me to harvest the tax loss. As was expected the comments section wasn’t that nice and the argument supporting a cheap valuation came to surface and I still agree it appears cheap from a valuation standpoint, but speaking of ESG investments a lot these years, we must recognize the importance of the ‘G’ for governance in any investment, and in this instance, the market lost trust in the governance surrounding Alibaba. Since then, the stock has plummeted another 24% and I learned the lesson that for some markets, I’ll have to pursue an ETF as there are elements I can’t fully uncover or analyze in a due diligence process such as how local actors can influence the investment case. Simply put, I’m too far away from the culture and societal structures to fully appreciate the details that may impact the thesis. Therefore, I finally established an ETF position focusing on the Asian region. In this case, a low-cost passive ETF, which will be my investment vehicle to ensure exposure towards one of the growing regions of the world. Naturally, Alibaba is one of the major holdings, and I would be very surprised if Alibaba doesn’t have a role to play in Asia going forward, but this way, I’m spreading my risk.

On top, I’ve added two other ETFs with one of them related to my own pond, Denmark, and the tech scene in the US. In the case of Denmark, we have a set of world class companies, including some of the leaders in pharmaceutical niches such as Coloplast (OTCPK:CLPBF) and Novo Nordisk (NVO), one of the top four brewers in the world in the shape of Carlsberg (OTCPK:CABGY), the world’s largest shipping container company, Maersk (OTCPK:AMKBY) and two renewable energy leaders in form of Vestas (OTCPK:VWDRY) and Ørsted (OTCPK:DNNGY) which the ETF secures exposure towards – this is just to name a few. It’s always difficult to observe things from the outside when you are a native but being a country with less than 6 million citizens, Denmark contains some real heavy hitting corporations in their respective industries, meaning I see value on ensuring exposure.

The growth tech ETF is part of the storyline related to increasing risk in a portfolio that has decades ahead of it, and where I can’t possible cover all the relevant companies. In all three instances, I’ve gone with passive low-cost ETFs.

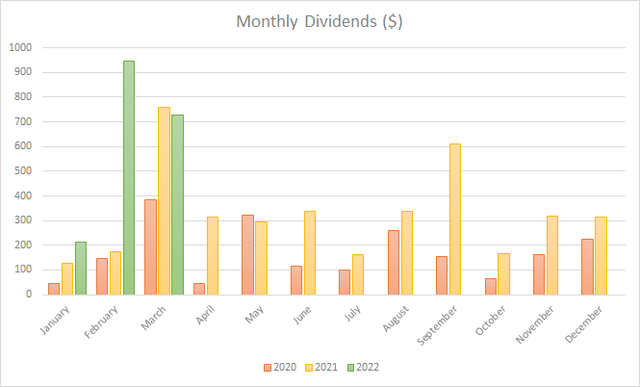

These ETFs pay a dividend once a year, which takes place in February, and as I established most of my positions prior, it’s also very evident in my dividend tracker below, having already received $1885 in total dividends as of 1st of April. My portfolio is exposed to the exchange rate of the USD, and I expect to receive a higher amount in dividends for April.

Authors Own Creation

The reason my total dividends for March is slightly lower for 2022 compared to 2021 is that my sold positions in form of Danske Bank and WBA both paid a dividend during March, and in the case of Danske Bank, it was the single annual dividend worth $64 last year. On top, I list my dividends related to the actual receival date and while I received my quarterly dividend from Broadcom (AVGO) of more than $50 in March last year, this year I received it on April 1st. On the plus side, I didn’t have Tyson Foods (TSN) at the time, which paid $18 in dividends for March this year.

Portfolio Update

Since my last update back in December, not a whole lot has happened to my portfolio. As already mentioned, I picked up three different ETFs which I expect to continue growing. In general, I haven’t had a lot of cash available as I had a planned vacation during February.

I’ve had to consider something else, that hasn’t been required for a long time, and that is the USD exchange rate. The USD isn’t my native currency, meaning the exposure matters for my returns as well as dividends received, meaning that in a best case scenario both the USD and stock price is at a low point during the moment I pick up a stock to maximize my acquired amount of shares. As of right now, with the interest rate movements and global uncertainty, the USD is appreciating towards other currencies meaning it’s currently at twenty year high in comparison to my native currency. As such, I could expect to take a cut related to my portfolio once the world returns to normal or the interest rate spread between US-EU narrows and with the stocks not being down in a similar fashion, I’m not being compensated as the USD appreciated.

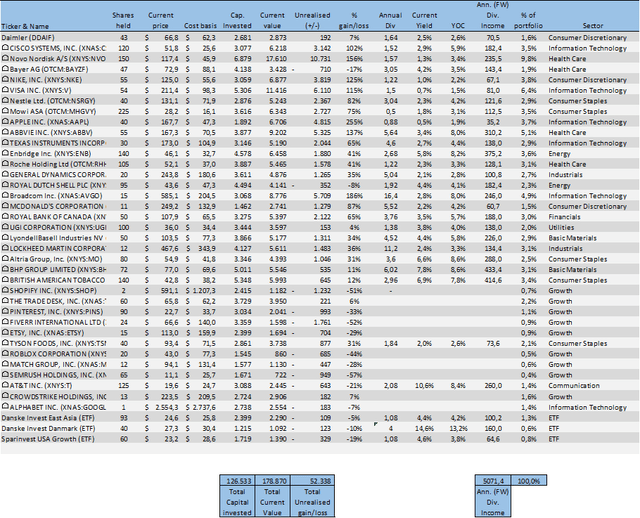

Currently I have a 57% exposure to the USD in my portfolio, and with the currency currently where it is, I’m holding back on prioritizing USD denominated listings. That doesn’t mean I’m excluding the possibility of picking up US listed companies, but just that I consider it a second time before pressing the button.

Portfolio Currency Split

Authors Own Creation

Positions Sold

My position within Daimler (OTCPK:DDAIF) made a split, separating one of its business units, providing me with a new stock besides my core holding. This was related to their truck business, Daimler Truck Holding (OTC:DTRUY), I sold my stocks soon after the split.

Positions Added

High growth tech stocks have taken a serious beating YTD and I allocated a bit of cash to strengthen my existing positions within both Fiverr (FVRR) and Etsy (ETSY) during April. However, as I’m still building cash it was only minor allocations measured in dollar amounts, also with respect to the exchange rate dilemma mentioned above.

New Holdings

The only actual new stock holding was a single stock of Alphabet (GOOGL) acquired back in early January. Of the big tech companies, I currently see most value in Alphabet and Microsoft (MSFT). I listed Alphabet as one of my top ten priorities for 2022 and while the other nine continue to evade me, I at least locked in Alphabet.

On top came the already mentioned ETFs

What I’m Currently Considering

One of the stocks I listed on my watchlist for 2022 was Starbucks (SBUX) who is currently trading at a starting forward yield of 2.47% and therefore getting very close to my own threshold of picking up companies with a starting yield of 2.5% or above. In the instance of Starbucks, I could make an exception as the payout is hovering around 50% which provides safety. Further, that while the company only has an eleven-year dividend hiking streak behind it, it has been hiking it consistently. An easy to understand business model with a global brand and reach, it’s worth a look at this point seen from a valuation standpoint. However, inflation and global tension should be considered not least as its growth opportunities currently lie in China. Having said that, it’s a company I’ll give a closer look in the coming period.

Besides that, I’ll continue to strengthen my ETF positions slightly as time passes in combination with setbacks in current holdings, such as UGI (UGI) who has seen its stock price tank a lot lately.

Wrapping Up

All in all, a fairly uneventful past quarter, however with continued strength and growth in portfolio value and total dividends measured on a forward annual basis. I’m content.

I’d like to thank you for reading this piece concentrated on updating my portfolio overview. I believe in transparency and sharing what I’m doing myself.

If there is anything else you would like for me to add to these updates or discard, please say so in the comments section and I’ll consider adding or removing it for future posts.

Be the first to comment