marchmeena29/iStock via Getty Images

Following the market narrative around gold has been a foolish game. On one hand, there are the narratives that gold is in reverse relationship with real interest rates and since the latter is expected to increase, hence gold makes a poor and risky investment. There are also narratives like those that gold is an inflation and geopolitical risk hedge and as such should closely follow most recent news in these areas or like the ones that gold should skyrocket to $5000 on the back of the so-called “money printing”.

As an investor with exposure to the precious metal, not falling victim to those narratives has been the most sensible course of action. However, one should not forget that these narratives are partially true and as such are not totally irrelevant for one’s thesis of having exposure to gold.

Holding Gold, Without Being A Gold Bug

Before we proceed, I should clarify that I don’t like holding gold.

Something that I am good at is valuing businesses, their intangible assets and evaluating their strategy, management and competitive advantages. In doing so, I am sifting through the weaker businesses and allocate my capital to the ones that I believe are the best-of-breed.

As a result, these enterprises have a good chance of creating not only shareholder value, but also value for their customers and the society as a whole. On the contrary, holding a shiny pet rock locked in a safe somewhere does neither of that. I have written a number of thought pieces on why I prefer to have exposure to the precious metal, but for the most thorough explanation check: “Gold – The Currency Of Last Resort“.

In a nutshell, the level of unprecedented monetary and fiscal intervention into the capital markets has made the valuations we see today unsustainable for someone with an investment horizon of 10+ years. That is why, I resort to gold as the best way to preserve purchasing power, while at the same time having available liquidity for investment opportunities as they arise.

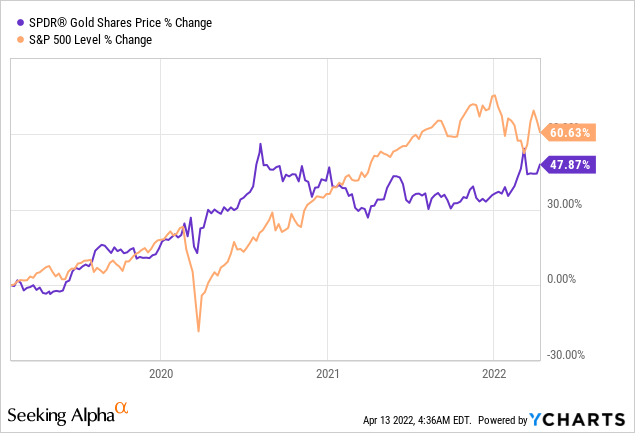

So far, the precious metal has been a terrific addition to my equity portfolio. Since I first laid out my investment thesis in an article called “Why Caution Is Required As Never Before And The Case For Investing In Gold“, the SPDR Gold Trust ETF (NYSEARCA:GLD) has returned nearly 50%, while also exhibiting a negative correlation with returns of the broader equity market.

Needless to say that my returns measured in British Pounds or Euros (which are the currencies I use) have been far better over the period.

Reducing Equity Portfolio Variance

As I said earlier, high returns are not necessarily what I am after when purchasing gold, provided that my cash holdings are not losing purchasing power.

Protection against risks for the current financial system and overall risk reduction is by far the main reason why I have exposure to the precious metal. As we see below, for the most part since 2014 the correlation between GLD and the SPDR S&P 500 Trust ETF (SPY) remained negative.

prepared by the author, using data form Yahoo!Finance

Naturally, holding bonds for that purpose would serve one’s investment objectives even better, but in the current environment of financial repression the traditional 60/40 portfolio is far less attractive.

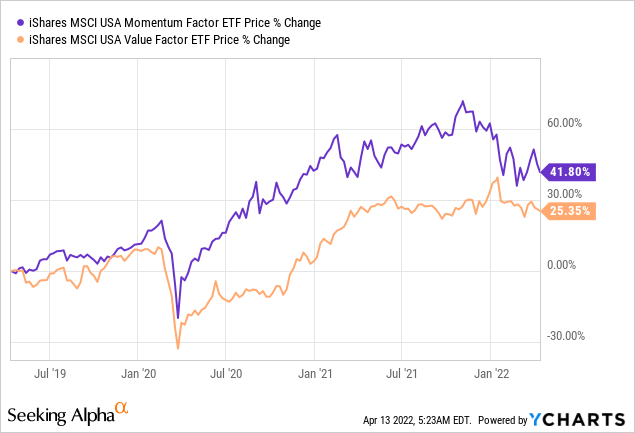

To more clearly illustrate the benefits of holding gold as part of an equity portfolio in recent times, we could also distinguish between high momentum stocks and value companies.

In the graph above, we could see that the 6-month rolling correlation between GLD and SPY reached peak levels on the 25th of August 2021. That seems to coincide with the time when the gap between momentum and value stocks also reached peak levels.

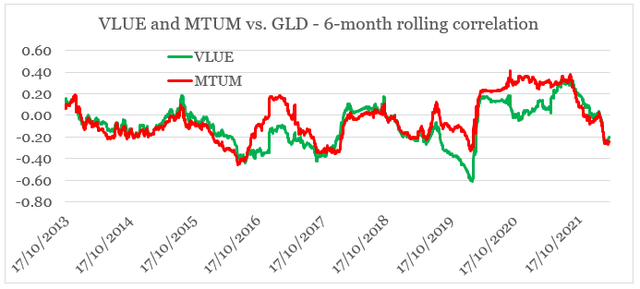

This supports the thesis that holding gold as part of a predominantly value (lower duration) portfolio has greater benefits to an equity portfolio focused around high growth (high duration) stocks. This is illustrated by GLD’s historically lower correlation with iShares Edge MSCI USA Value Factor ETF (VLUE) when compared to iShares Edge MSCI USA Momentum Factor ETF (MTUM).

prepared by the author, using data form Yahoo!Finance

Avoid The Narratives

Whether it is preserving purchasing power, reducing equity risk or even speculating, one should clearly understand the long-term drivers of gold prices and avoid falling victim to narratives.

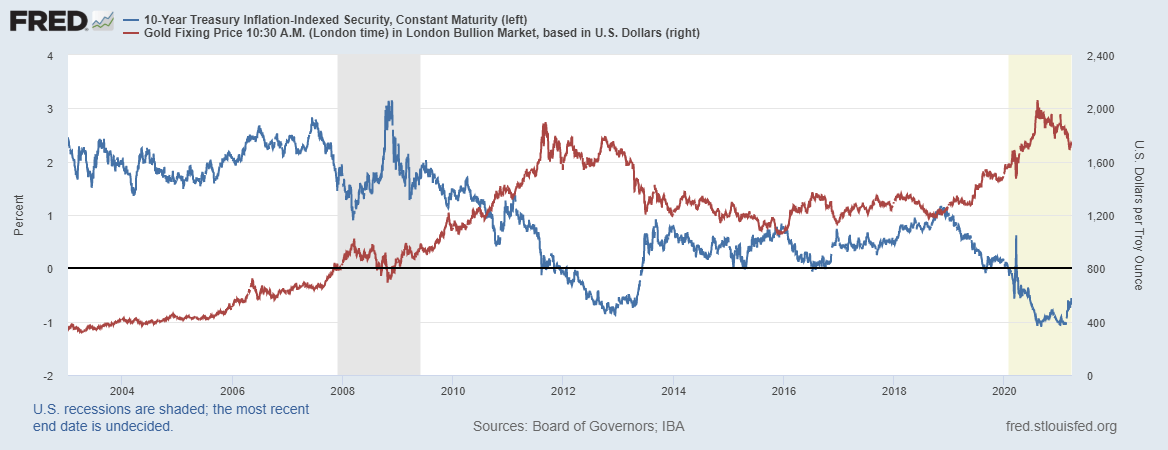

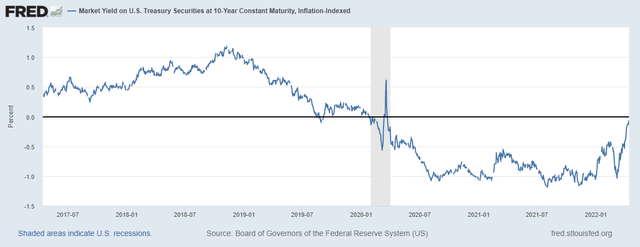

One of the most often quoted reasons for avoiding the precious metal is its reverse relationship with real interest rates (see graph below).

FRED

Extremely low nominal and negative real interest rates are seen as unsustainable over the medium to long-term. Therefore, the graph above looks scary and is a reason enough to dissuade many from buying gold.

Although this reverse relationship is indeed strong over short-term periods, it is not the sole driver of gold prices, especially when the risks for the current monetary system are running high. I explain this process in detail in my thought piece called “Gold: Still Haunted By Misconceptions“, which I highly recommend for anyone interested to learn more about the long-term drivers of gold.

The yield on U.S. Treasury Inflation-Protected Securities (TIPS) is now just shy of the zero bound, a level that we last saw in mid-February of 2020 (right before the pandemic hit).

FRED

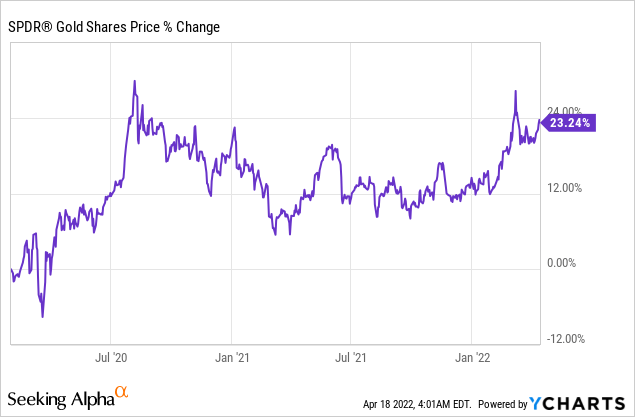

At the same time, GLD is 23% higher than its February 2020 levels.

As we are reaching the end of the line for the current monetary regime, the gold price will likely further detach from real interest rates. No matter what the future holds, whether it is the creation a global digital currency, a system based on a “Bancor” like currency as proposed by Keynes as an alternative to Bretton Woods or the creation of an alternative monetary system gravitating around Russia and China, the risk for the current monetary system will likely continue to increase and with that the demand for safe haven assets.

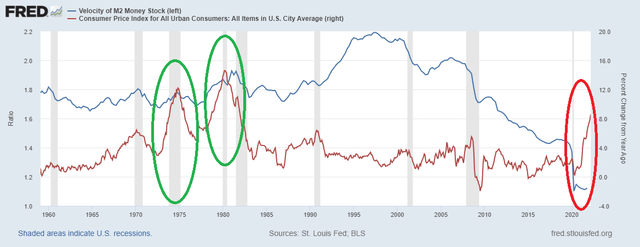

This also helps to explain why the price of gold has not skyrocketed in the face of the very high inflation we are witnessing. In the graph below, we could see that during the 1970s, the increase in inflation was also accompanied by an increase in velocity of money.

FRED

On the contrary, the current spike in inflation is less of a monetary phenomenon. It is largely caused by the fiscal stimulus during 2021, supply chain issues and geopolitical risks. This, however, does not necessarily mean that we cannot witness a spike in money velocity in the coming years which will keep inflationary pressures high. Should that happen, the price of gold will have yet another tailwind on its back.

Conclusion

Gold continues to perform exceptionally well while also being an excellent addition for an all-equity portfolio from a risk point of view. While most narratives around gold have some merit, relying on rising real interest rates, high inflation or geopolitical risks as a reason to invest in or avoid gold is to say the least – suboptimal behavior. Similarly, holding gold with the expectation that it will hit $5000 per ounce and make you rich is also a folly. Where the precious metal really shines is preserving purchasing power through periods of high risk and uncertainty around the existing monetary system. A period we are most certainly currently living in.

Be the first to comment