golfcphoto

Disclosure

Within this article, the company Novo Nordisk A/S (NVO) will be mentioned. For the reader, I’d like to disclose that I’m an employee of the company. The nature of my position is an office job that does not concern sales.

The Current Market

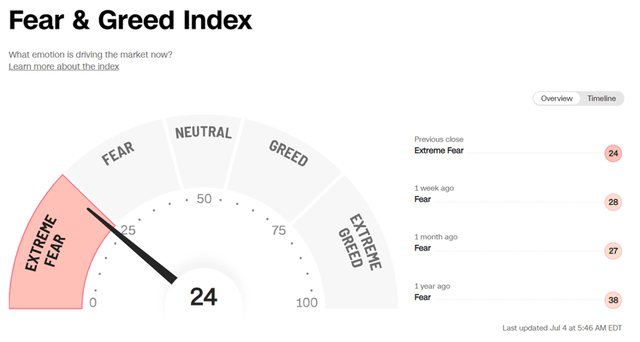

As of writing this, the S&P 500 is down more than 20% YTD, while the Nasdaq is down 30% YTD. The CNN fear & greed index is indicating extreme fear while one of the most trusted safe harbours in these circumstances, gold, is barely holding its own YTD. The next market test will be when companies report upcoming earnings, as we will then be exposed to profit warnings and reduced guidance, while overall having a better understanding whether we are already in a recession or still pending the verdict. The market may very well not be done falling despite having just produced the worst first half year performance in several decades.

Most of us are getting hammered, but it’s during moments such as these, where our fortitude and resilience is truly tested. If the main street investor can avoid acting out of pure emission, they will be doing their portfolio a favour.

Don’t forget that

- 100% of bear markets have been followed by markets reaching new highs

- Strong returns are created during bear markets as markets enter the early stages of a new bull market – stay invested

- The average bear market length is 289 days compared to average bull market length of 991 days – with the Covid-19 crash being the shortest bear market in history, but also a great setup for having created strong returns since

- The stock market has historically represented the greatest wealth generation vehicle for those able to show patience and consistency

As investors, we must try to stay level-headed, and make good use of the opportunities presented during bear markets. Naturally, if one is close to retirement and the point in time where they start relying on their portfolio, this moment will indeed be very ill timed. However, if you are still accumulating, it’s an opportunity to initiate strong long positions.

The portfolio described here is my brokerage account, not my 401(k) equivalent, which I don’t manage myself, simply because I’m not allowed to. Given my age, I have a very long runway ahead of me, and I intend on not having to withdraw funds from this portfolio during the many coming decades. As such, I view the current market as an opportunity, even though it’s never pleasant to observe one’s portfolio sink substantially. From my standpoint, it’s all about long-term wealth creation.

What’s that smell? Opportunity!

My Market Activity

Keeping it brief, I’ve made use of the market to trim a position within my largest holding, added two new holdings and accumulated within a couple of existing holdings, including broad based ETFs.

- I previously held 150 Novo Nordisk shares, where I’ve sold a third of my position in two tranches, at around $105-110 per share. I’m a long-term holder and continue to believe in a strong outlook for the company. However, at these levels, I find the company is trading above fair value, so I’ve locked in some gains. It’s very seldom I sell with such a purpose as I don’t mind my winners growing into large positions within my portfolio. Already at 10% of my total portfolio and overallocated towards the health care sector, I found the moment opportune to offload some of my existing shares in order to invest in undervalued companies. My Novo Nordisk holding now makes up 7% of my portfolio compared to the previous 10%.

- I’ve initiated a new position, buying 38 shares of Starbucks (SBUX), something I laid out in my article titled “Starbucks: A Very Appealing Opportunity For Dividend Growth Investors“, which was published on April 22nd. So far, the S&P 500 is down 10.5% since then, with Starbucks being up 1.7%. I’m still planning on adding additional shares, with my total cost basis for this position being at $2900. I don’t have a specific level, but my position will most likely top at $4000. I would like for the stock to come down a little, to provide a more opportune moment.

- I’ve initiated a new position, buying 26 shares of T. Rowe Price Group (TROW) in a couple of tranches, something I laid out in my article titled “T. Rowe Price: An Obvious Investment Opportunity And Why I Just Went Long“. My article was published on June 6th, with TROW being down an additional 9% since then, while the S&P 500 is down 7.8%. Same as with Starbucks, I intend on adding more shares as the market develops. TROW has reacted rather strongly during negative headlines, so I wouldn’t be surprised to see the stock test its previous low over the coming weeks and months, especially as we get a better understanding as to the state of the global economy. Here, my cost basis stands at a total of $3174, again willing to add up to the $4000 mark for now. Being underweight in financials, I feel very good about having added TROW, a company that has weathered many recessions and downturns, only to come out stronger on the other side.

- When it comes to existing positions, I’ve added in my broad-based ETFs. Those are based out of Denmark, and therefore wouldn’t be of interest for my readers residing elsewhere, but I find that today is a great opportunity for building positions in both company specific stocks as well as broader ETFs. If we end up in a recession, I will consider adding a small cap ETF to my list of holdings, especially in a scenario where the market goes considerably lower than it is today.

- Since my last update back in April, I’ve added $5257 of fresh funds to my portfolio, and I’ve allocated roughly $1000 of those to beaten down growth companies. The two companies in question are Shopify (SHOP) and CrowdStrike (CRWD). I’ve recently published articles covering both instances of having added to my positions, titled “Shopify: I’m Buying The Dip, Again, Here Is Why” and “CrowdStrike: I’m Buying The Dip, Again, Here Is Why“. These companies represent some of the strongest conviction plays I have within growth. When it comes to investing in individual hyper-growth companies such as these, I maintain a time horizon of decades, to allow the companies to play out their full thesis. Right now, I’m of course down massively, but I’m taking the opportunity to add to the companies where I believe strongly in the underlying thesis. One thing to keep in mind when investing in this segment is that a vulnerable global economy requires a more stringent focus on individual company balance sheets, and here both companies pass the test with substantially more cash on the balance sheet than debt. Further, that CrowdStrike is cash flow positive, while Shopify shows a bit more erratic behaviour in this regard.

When it comes to prioritisation, due to my risk profile and investment mindset, I do add solid dividend growth companies before growth, but as you will see later on, I plan on my portfolio being made up of roughly 15% growth, where I’m currently at 8%, meaning I still have plenty to add.

What I’m Keeping An Eye On

During my last portfolio update, I highlighted Starbucks as a company on my watch list, and as the price kept coming down, I eventually acted on the opportunity. With another $3000 available to deploy, I’m keeping an eye on a couple of opportunities.

Authors Own Creation

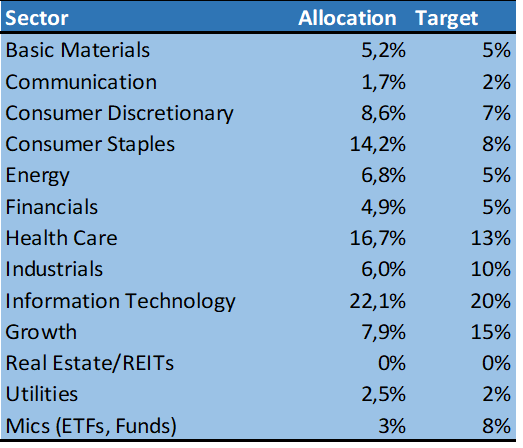

I often look towards my current portfolio sector allocation, when considering where I could pursue opportunities. My allocation towards industrials is underweight as of today, and my current holdings within the sector are not pure-play industrial companies, meaning I’m interested in making up for that fact.

I’ve covered several of the household names, including Deere (DE), which I still find overvalued. Another one I’ve reviewed is Union Pacific Corp (UNP), a company I’d love to own given its incredible moat. Earnings is only a couple of weeks away, expected on July 21st, and I’ll be awaiting those as Union Pacific could be one of the companies suffering at the hands of input costs, negatively impacting margins. I’ll be keeping an eye on their forward guidance. Union Pacific has an incredible moat, so any short-term weakness, could be an opportunity for long-term investors. Another industrial company I’m keeping my eyes on is Cummins (CMI), already trading at a very attractive forward dividend. Similarly, Stanley Black & Decker (SWK) as well as Caterpillar (CAT) are in my scope.

Besides those, I’m also looking the way of Home Depot (HD) and Lowe’s (LOW) as well as adding to my position within Alphabet (GOOG) (GOOGL).

In the growth arena, I’ve already added to the extent I wanted in the case of Shopify and CrowdStrike, unless significantly better discounts present themselves. My current focus would be on adding to my very small Semrush (SEMR) position, as well as my position within Trade Desk (TTD). Both companies are examples of holding stellar balance sheets.

In short, there are many great opportunities as presented by the current market, and being in the accumulation stage, I’m squeezing my personal economy to the greatest extent I can, in order to grow my portfolio.

It’s summer and that also means vacation expenses, meaning I’ll have to prioritise amongst the companies mentioned above. Having to prioritise is naturally a healthy exercise, but I wouldn’t mind having more cash available in the current market. There is no guarantee we will not experience lower markets, but as already mentioned, it’s an accumulation opportunity in my own situation.

The Portfolio

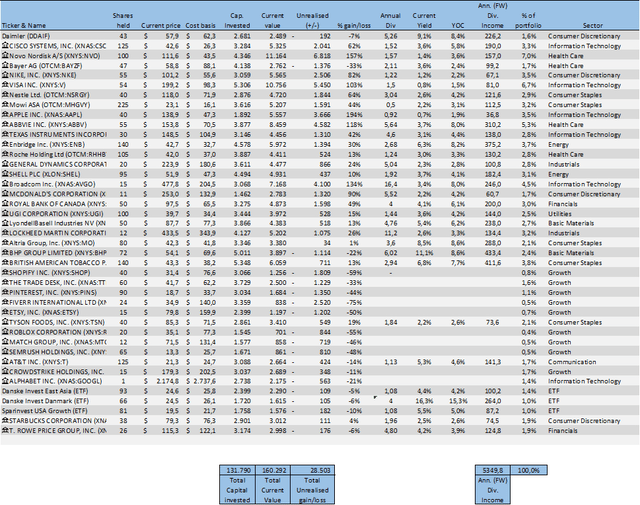

The portfolio continues to undergo a positive development – in the sense that I continue growing it on a share basis. It is however, down almost $19,000 since my last update back in April. Total value now stands at $160,292, with a forward dividend income of $5349 on an annual basis. Back in April it had grown to $180,000 and I have to admit I was beginning to eye the next big mark, which is now quite far away.

As always, I lay it all out there, and while my portfolio was more or less in complete green a year ago, the picture has changed drastically. Naturally, the holdings dating back the longest, are still in green, while newer additions have a higher likelihood of being in red.

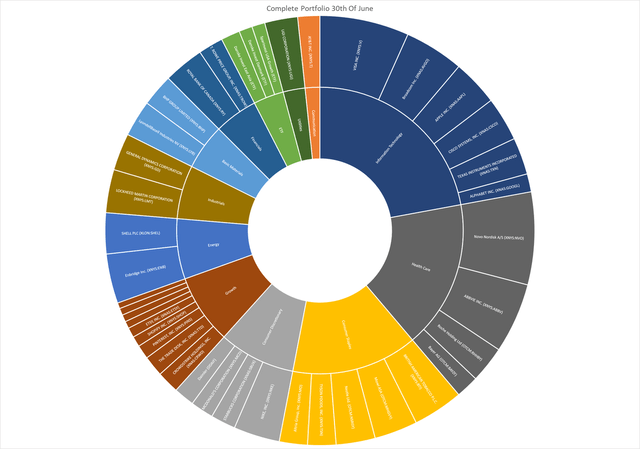

The visual illustration above provides a much cleaner overview of how I’ve decided to allocate my funds. The focus is largely on dividend growers, but my “growth” exposure has increased significantly over the last year as I’ve utilised pullbacks to build positions. Looking one year ahead, and I believe my ETF position will grow to make up a larger part of the total picture.

Reflecting upon my diversification, and I’d ideally prefer at least one more holding within finance and basic materials, while I’d prefer a couple more industrial holdings. Beyond that, and I see satisfactory diversification on a sector level.

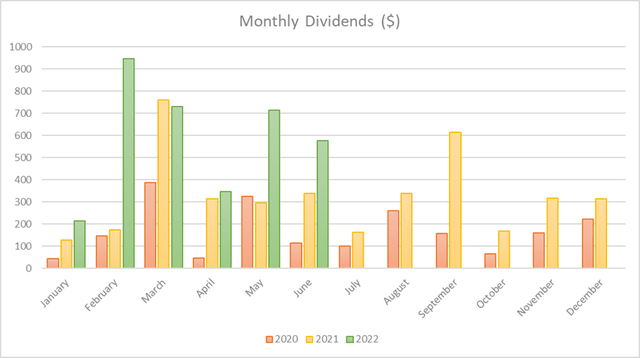

First half of 2022, I’ve received $3524 in dividends (currency adjusted for non-USD holdings). In 2021, the amount was $2005 for the same period, and in 2020 the amount was $1057. The development is staggering, but also came to life as a result of having a cash pile I wanted to invest back in 2020. Still, I’m very pleased with the development.

September 2021 was driven by an extraordinary dividend paid by BHP (BHP), meaning that I’m in no way certain that will take place again this year, however, this June, LyondellBasell (LYB) paid out an additional one-time dividend of $5.2 per share, meaning I received a total of $319 from the combined ordinary and extraordinary dividend in June.

Beyond an expected lower dividend for September, I expect the remaining months to perform better than last year.

Wrapping Up

While the first quarter of 2022 was fairly uneventful, I really did put some cash to work during the second quarter.

I was content with the development during first quarter where my portfolio managed to appreciate, and I’m equally content this quarter with my portfolio being hammered. I’m building this portfolio with a focus measured in decades, not years or months.

I’d like to thank you for reading this piece concentrated on updating my portfolio overview. I believe in transparency and sharing what I’m doing myself.

If there is anything else you would like for me to add to these updates or discard, please say so in the comments section and I’ll consider adding or removing it for future posts.

Be the first to comment