Sitthiphong

A Quick Take On Backblaze

Backblaze (NASDAQ:BLZE) went public in November 2021, raising approximately $100 million in gross proceeds from an IPO priced at $16.00 per share.

The firm provides cloud-based storage and recovery software to businesses and individuals.

Given BLZE’s slower-than-expected revenue growth, increasing operating losses and worsening negative earnings, I’m on Hold for BLZE until it can produce a meaningful turn toward operation breakeven.

Backblaze Overview

San Mateo, California-based Backblaze was founded to develop a cloud-based SaaS storage service suite for businesses and consumers wishing to easily back up and store their critical data.

Management is headed by co-founder, Chairperson and CEO Gleb Budman, who has been with the firm since its inception and was previously in various senior positions at SonicWall, MailFrontier and Kendara.

The company’s primary offerings include:

-

B2 Cloud Storage

-

Computer Backup

The firm seeks customers primarily through online marketing, social media and word of mouth.

BLZE operates a self-serve website that enables users to sign up for a free trial and convert to a paid subscription.

Backblaze’s Market & Competition

According to a 2020 market research report by MarketsandMarkets, the global market for cloud storage services was an estimated $50.1 billion in 2020 and is forecast to reach $137 billion by 2025.

This represents a forecast CAGR of 22.3% from 2020 to 2025.

The main drivers for this expected growth are the growing demand for enterprises for ever larger amounts of data and a rising number of remote-located employees and contractors needing access to relevant data stores.

Also, a key challenge for the industry is to effectively defend against security threats and improve data privacy for corporate and personal data.

Major competitive or other industry participants include:

-

Amazon (AMZN)

-

Microsoft (MSFT)

-

Dell EMC (DELL)

-

iDrive

-

pCloud

-

Dropbox (DBX)

-

Icedrive

-

NordLocker

-

Others

Backblaze’s Recent Financial Performance

-

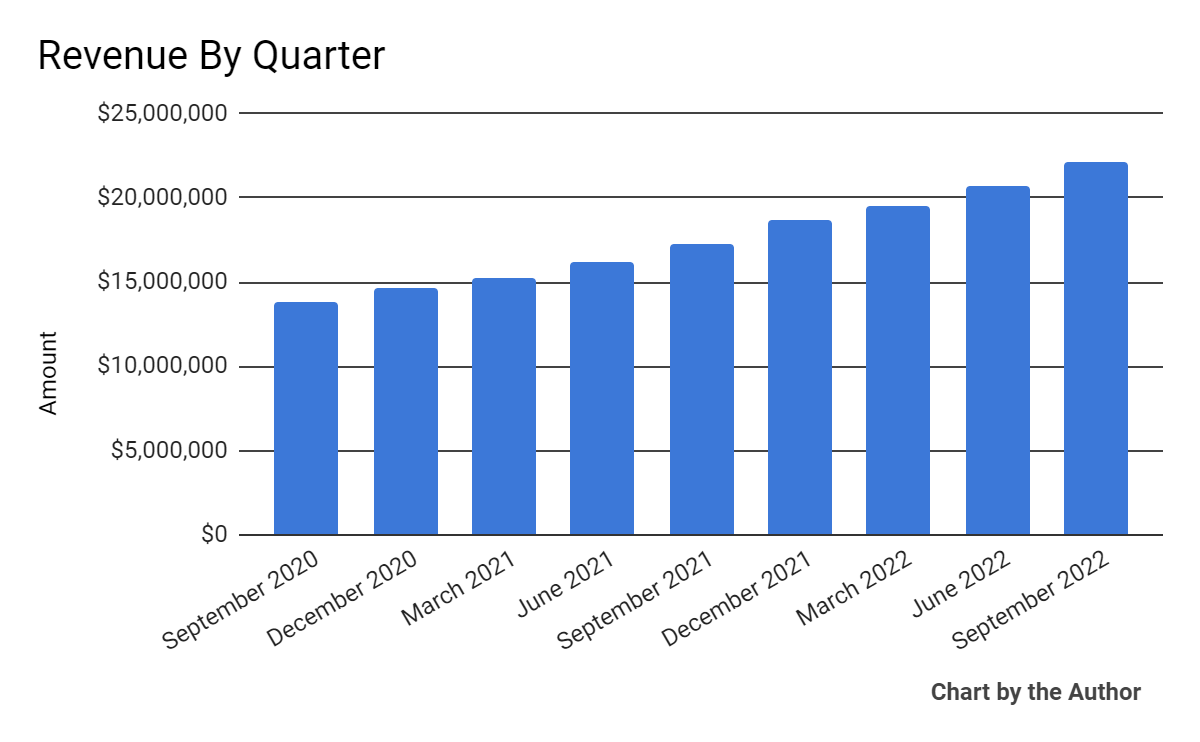

Total revenue by quarter has risen per the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

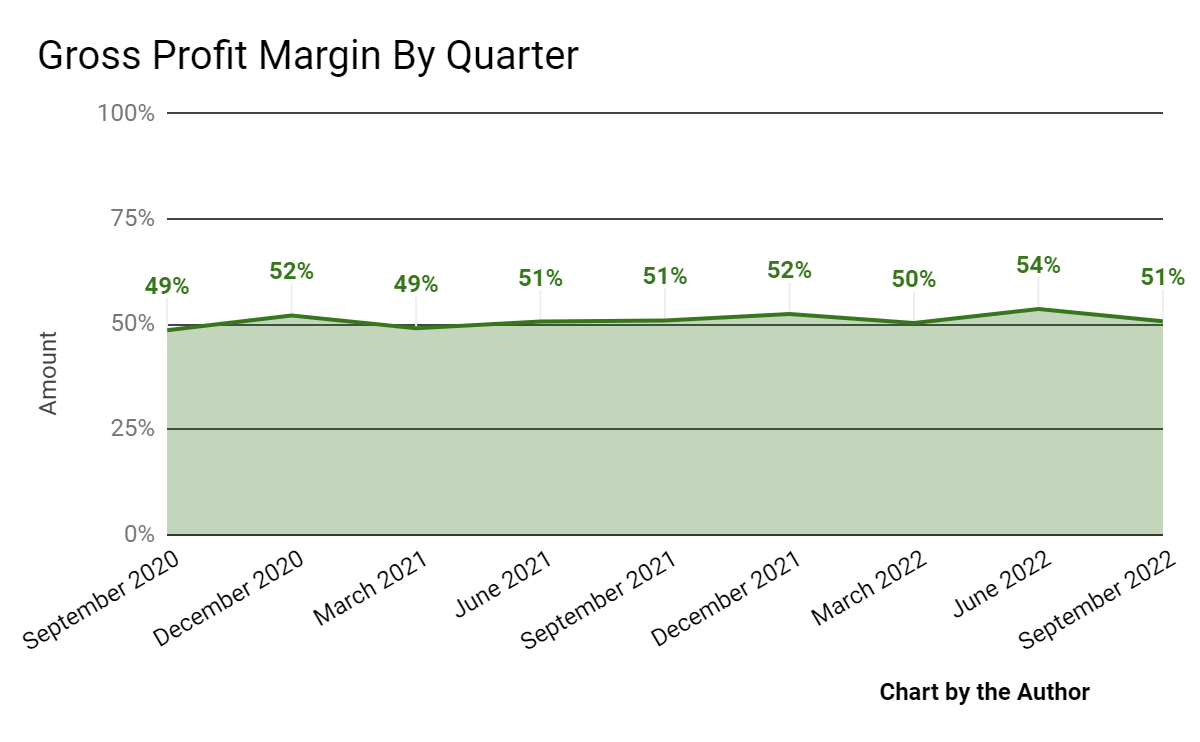

Gross profit margin by quarter has peaked in recent quarters:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

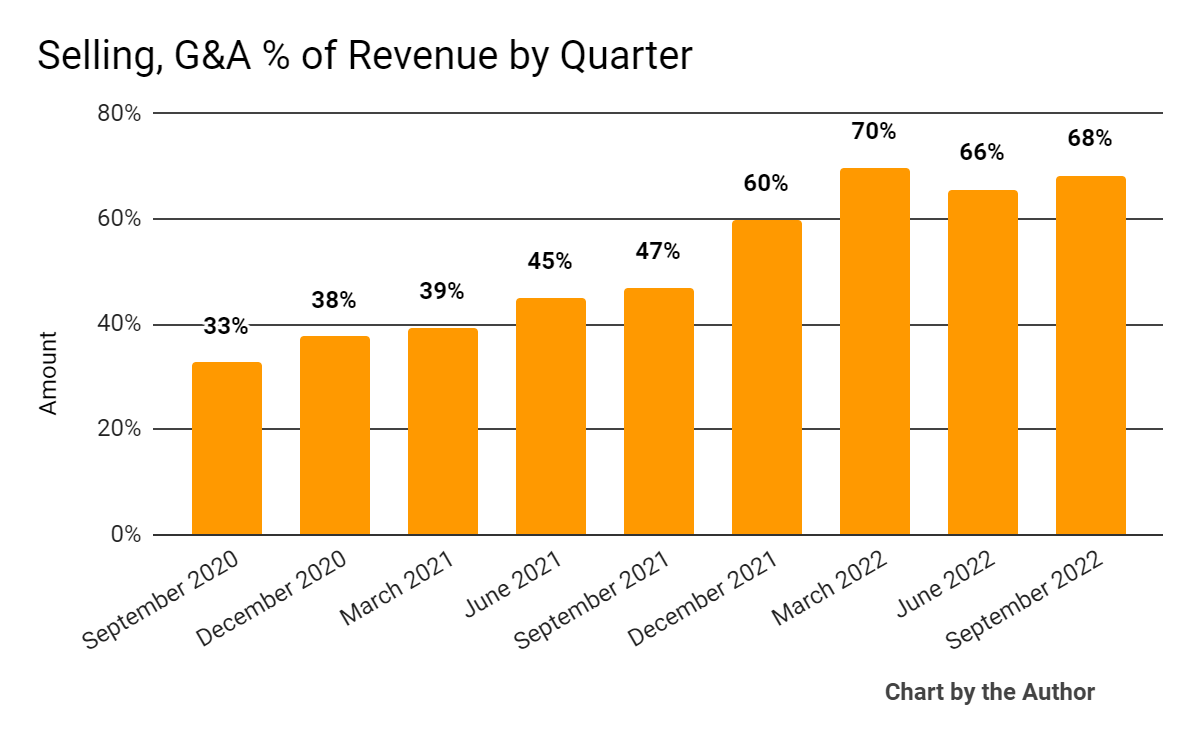

Selling, G&A expenses as a percentage of total revenue by quarter have risen markedly in recent quarters, a negative sign:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

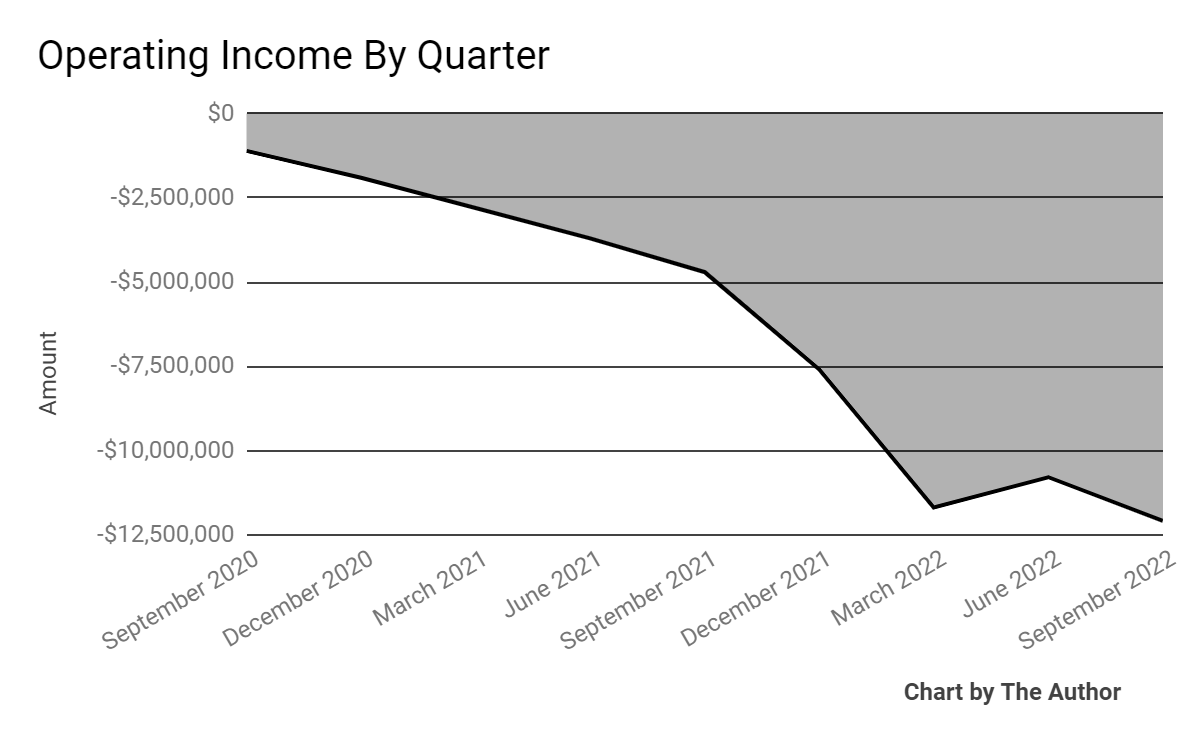

Operating losses by quarter have worsened sharply in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

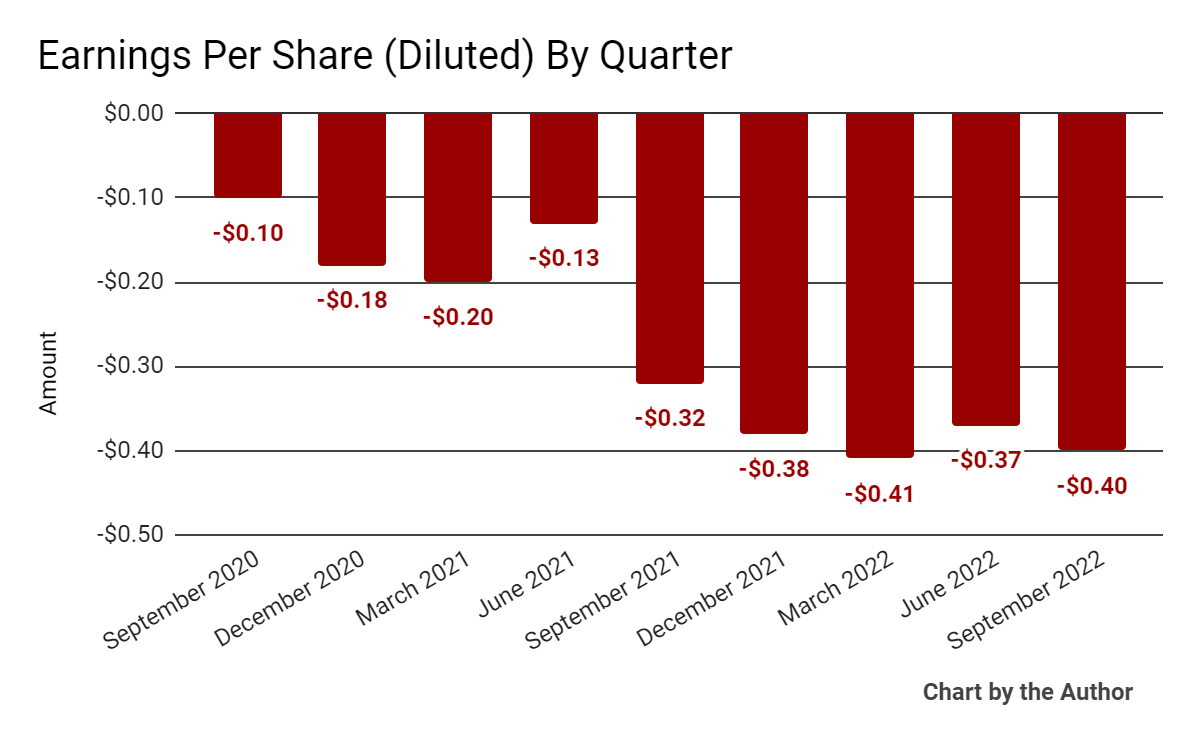

Earnings per share (Diluted) have worsened substantially into negative territory in recent quarters, as the chart shows here:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

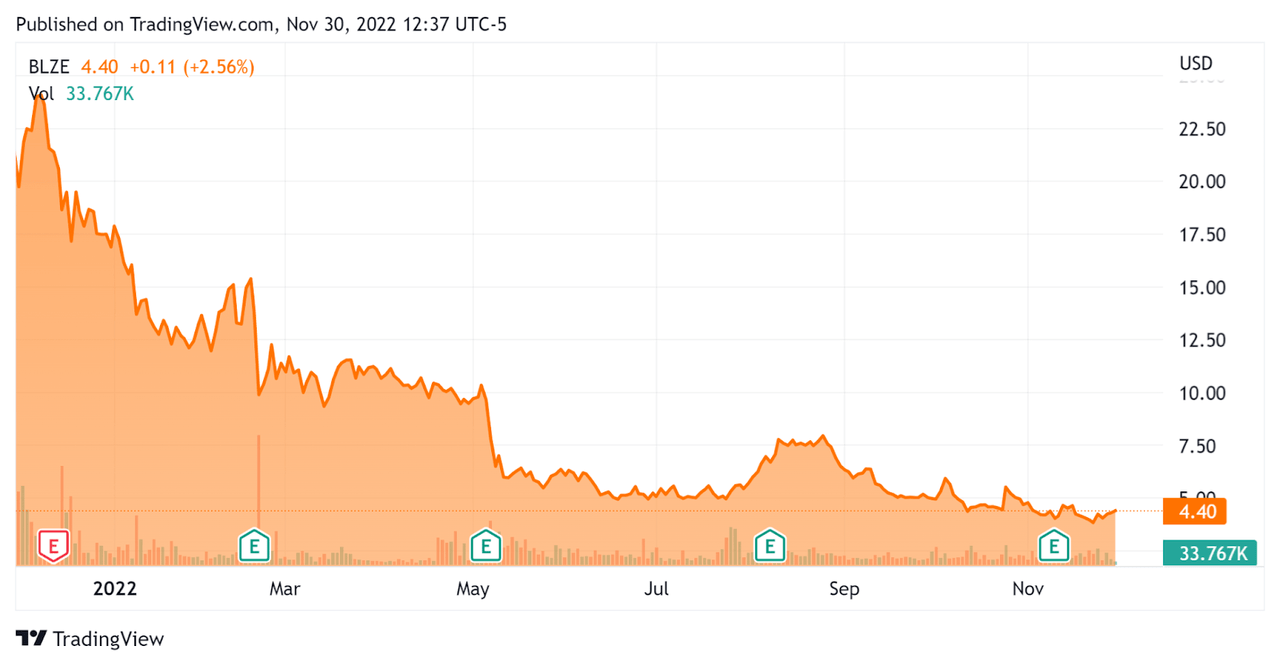

Since its IPO, BLZE’s stock price has fallen 79.5% vs. the U.S. S&P 500 index’s drop of around 15.3%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For Backblaze

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.3 |

|

Revenue Growth Rate |

27.7% |

|

Net Income Margin |

-57.5% |

|

GAAP EBITDA % |

-31.2% |

|

Market Capitalization |

$138,670,000 |

|

Enterprise Value |

$105,470,000 |

|

Operating Cash Flow |

-$13,090,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.56 |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

BLZE’s most recent GAAP Rule of 40 calculation was negative (3.5%) as of Q3 2022, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

27.7% |

|

GAAP EBITDA % |

-31.2% |

|

Total |

-3.5% |

(Source – Seeking Alpha)

Commentary On Backblaze

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the success of its B2 Cloud Storage strategy investment, as the segment now accounts for 40% of total revenue.

Also, the firm is targeting marketing to developers via its developer evangelism team and scaling its channel partnership efforts with national resellers.

As to its financial results, topline revenue rose by 27% year-over-year, while gross profit margin was flat.

The company’s net retention rate was 114%, indicating reasonably good product/market fit and good sales & marketing efficiency. Its B2 Cloud Storage segment produced a 123% net retention rate.

The firm’s Rule of 40 results have been poor, with a negative (3.5%) result for the trailing twelve-month period ending in Q3.

However, SG&A expenses as a percentage of revenue have risen substantially in recent quarters, producing worsening operating losses and negative earnings.

For the balance sheet, the firm finished the quarter with cash, equivalents and short-term investments of $77.4 million and only $2.5 million in long-term debt.

Over the trailing twelve months, free cash used was $17.9 million, of which capital expenditures accounted for $4.8 million in cash.

Looking ahead, management is seeing ‘some challenges in the macro environment and [are] not completely immune to those.’

The company isn’t seeing as much benefit from its growth efforts as it had hoped.

Regarding valuation, the market is valuing BLZE at an EV/Sales multiple of around 1.3x.

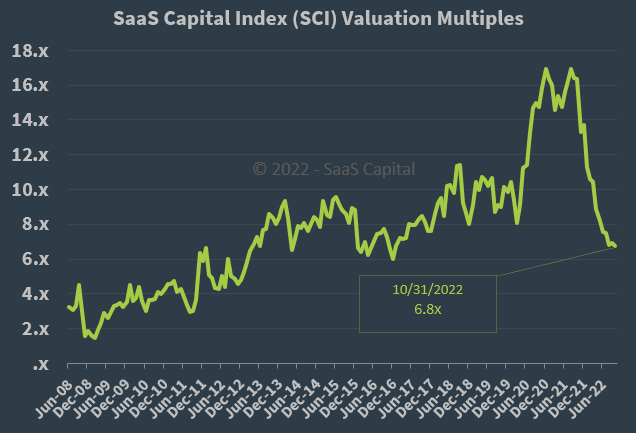

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.8x at October 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, BLZE is currently valued by the market at a significant discount to the broader SaaS Capital Index, at least as of October 31, 2022.

The primary risk to the company’s outlook is an apparently underway macroeconomic slowdown or recession, which may accelerate new customer discounting, produce slower sales cycles and reduce its revenue growth trajectory.

Given BLZE’s slower-than-expected revenue growth, increasing operating losses and worsening negative earnings, I’m on Hold for BLZE until it can produce a meaningful turn toward operation breakeven.

Be the first to comment