Jess Bray

Disclosure

Within this article, the company Novo Nordisk A/S (NVO) will be mentioned. For the reader, I’d like to disclose that I’m an employee of the company. The nature of my position is an office job that does not concern sales.

The Current Market

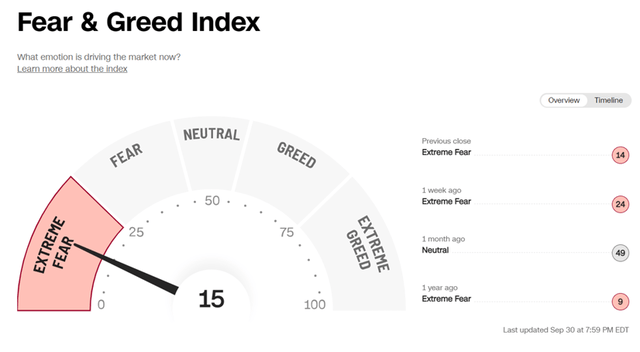

As of writing this, the S&P 500 (SPY) is down more than 25% YTD while the Nasdaq is down more than 33% YTD. The CNN fear & greed index is well into extreme fear territory and most investors will be deep in red at this point and so am I. During my most recent post back in early July, I stated the next market test would be during the upcoming earnings season, as it would expose us to profit warnings and weakening outlooks. We’ve already seen investor favorite Nike (NKE) sink 11% intraday due to weakening margins, piling inventory and a need for the stock price to correct due to the premium valuation.

There is more to come as we start to see reduced consumer sentiment sink into actual earnings and outlooks. However, it’s during moments such as these, where opportunities to establish great long-term positions arise. It’s with this mindset that I’ve strived to build positions during both Q2 and Q3 where I’ve seen great opportunities present themselves, while trying to allocate funds primarily during the down months, meaning I allocated most of my funds during September in the last quarter, while also adding some in beaten down companies during the bear market rally we had earlier in the quarter.

No one knows if the market bottom is 5%, 10% or 20% away from where we are today, but seen from my standpoint, this is not about timing the market. In five years from now, I’ll not be able to determine whether I paid a couple of percentage points more or less for an individual company, but I’ll be glad I did buy.

All I know, is that I’m in this market with a time horizon measured in decades, and that I consider bear markets a great opportunity to build positions in companies with great mean reversion potential and strong long-term outlooks.

Don’t forget that

- 100% of bear markets have been followed by markets reaching new highs

- Strong returns are created during bear markets as markets enter the early stages of a new bull market – stay invested

- The average bear market length is 289 days compared to average bull market length of 991 days – with the Covid-19 crash being the shortest bear market in history, but also a great setup for having created strong returns since

- The stock market has historically represented the greatest wealth generation vehicle for those able to show patience and consistency

As investors, we must try to stay level-headed, and make good use of the opportunities presented during bear markets. Naturally, if one is close to retirement and the point in time where they start relying on their portfolio for income, this moment will indeed be very ill timed. However, if you are still accumulating, it’s an opportunity to initiate strong long positions.

My Market Activity

Keeping it brief, I’ve made use of the market to add new positions as well as expanding existing ones as I utilize dollar cost averaging to try and steer around potential earnings revisions causing valuation contraction. In fact, I made 14 buys in total during the quarter, showing the idea of buying in tranches to level out volatility.

- I’ve initiated a new position, buying 11 shares of Cummins Inc (CMI), corresponding to invested capital of $2141, meaning my position is only at roughly half of what I consider a full position for my portfolio. I laid out my thesis for Cummins in my article titled “A Look At Cummins Before The Upcoming Dividend Hike” with the stock being up 2.7% since then, while the S&P 500 is down 7.6% meanwhile. With my position still being 5% up, I’m patiently awaiting if the stock needs to retest its lows before I’m planning on adding again. In the current market it’s all a matter of prioritization, and Cummins remains one, but I’m looking to other existing positions first, as Cummins could perhaps find a lower bottom before the current sentiment passes.

- I’ve initiated a new position, buying 15 shares of Stanley Black & Decker (SWK), corresponding to invested capital of $1371, meaning my position is roughly at one third of what I consider a full position for my portfolio. I laid out me thesis for Stanley Black & Decker in my article titled “Stanley Black & Decker: A Dividend King On Sale.” While the stock was on sale, it had a lot further to go, currently down 30.7% since being published, with the S&P 500 only down 6.9% during the same period. In my opinion, the mean reversion potential has only grown stronger, having added to my position at $97.2 per share, $86.8 per share and most recently at $79.49 per share. My own position is therefore down 18% so far, and I plan on expanding my position further once more funds become available. I established my position before the earnings and became victim of the very effect I mentioned earlier in this article, the reduced FY outlook as well as reduced consensus estimates for 2023. With a new EPS outlook for FY2022 between $5.0 to $6.0, I noted in the comment section that a price per share between $75-90 shouldn’t be unrealistic, and right now, the price is indeed hovering just above $75. Surely it can continue to fall as the P/E multiple may continue to compress but dealing with a company that’s been around since the mid-19th century, having survived countless recessions and hiked its dividend for more than five consecutive decades, I’m not that worried and instead consider it a long-term opportunity.

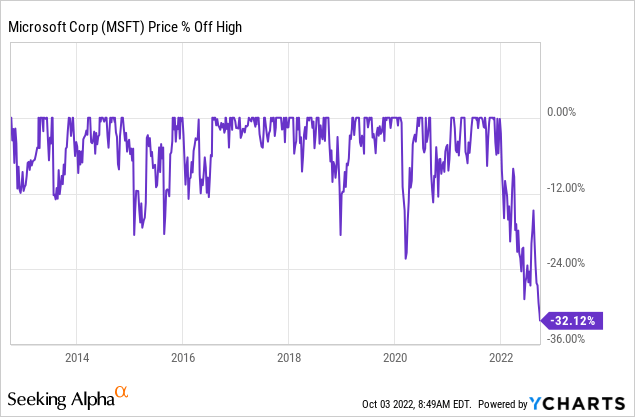

- I’ve initiated a new position, buying a single share of Microsoft Corporation (MSFT) so far. We have to go all the way back to 2016 to find a time in the market where Microsoft was trading at a lower price to earnings multiple, but I remain patient despite Microsoft not having traded this far off its most recent high at any time in the recent decade. While the current valuation is fair, it’s not a screaming buy in my book, so I’ll add to it slowly.

In terms of adding to existing positions, I’ve expanded within my broad-based ETFs, as well as T. Rowe Price Group (TROW), Alphabet (GOOG, GOOGL), Tyson Foods (TSN), AT&T (T), as well as Semrush Holdings (SEMR). T. Rowe. Price Group and Alphabet have grown to be considered full positions, but I won’t exclude the possibility of adding to them one final time. Meanwhile Tyson Foods has just recently crossed into buying territory again, which I’ve also covered in a recent article titled “Tyson Foods: Underappreciated Dividend Growth Stock At Forward P/E 9.9, FCF Yield Of 5.1%” published on September 14th. T and SEMR are an income and growth play, respectively, with more room to add in both.

Q3 Dividend Hikes & Development

My portfolio was gifted with several dividend hikes during this quarter, here is a summary.

- Stanley Black & Decker with a 1.8% hike during July

- Cummins with a 8.3% hike during July

- Altria Group (MO) with a 4.4% hike during August

- Starbucks (SBUX) with a 8.2% hike during September

- Lockheed Martin (LMT) with a 7.1% hike during September

Great news for my forward income, with more hikes coming in the next quarter. Soon McDonald’s (MCD) is expected to announce their annual hike, followed by AbbVie (ABBV), Visa (V), and Nike (NKE). Lastly, Tyson Foods and Enbridge (ENB) should round out the series of hikes for this year in my portfolio.

As always, I’ll be looking forward to especially Visa, which has the muscle to provide strong hikes, and as always, I expect a double-digit raise.

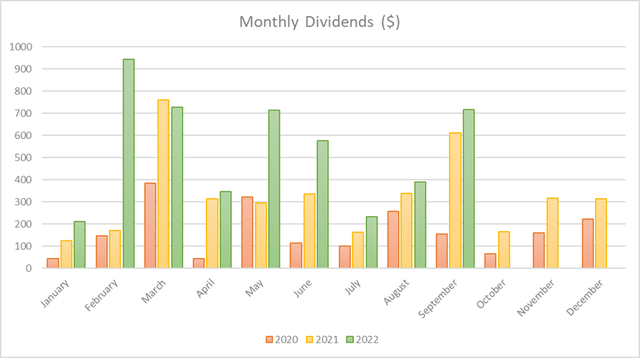

Speaking of dividends, above you can see my dividends received YTD, totaling $4864 compared to $3119 during the same period last year. As such, the dividend is up a mammoth 54.7% compared to last year, and 76.3% when converted to my native currency. I put as much as I can back into the market, but that amount would theoretically make a big impact in my personal finances at this point, which is quite awesome given I’ve got decades to continue growing it. This is what I love about dividend growth investing.

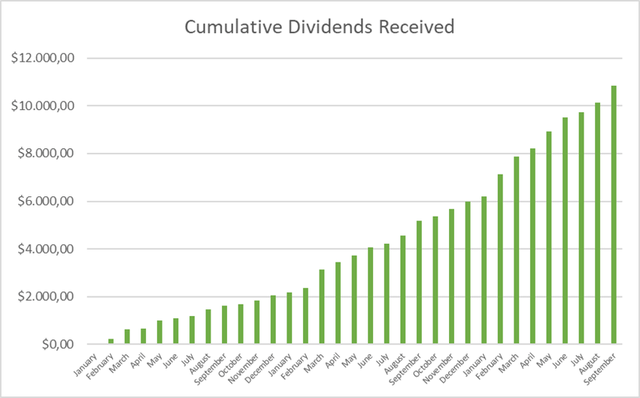

Accumulated for the same time period, and the journey looks the following. The cumulative dividends received also unveils the fact that I’ve been fortunate to receive extraordinarily high dividends during 2022 from some of my holdings, operating within basic materials or commodities, which can’t be taken for granted in 2023. Hopefully however, I’ll have added sufficiently of new capital to outgrow a potential reduction from those extraordinary dividends. On a forward basis, I expect to receive $5675 in dividends over the coming twelve months, scrambling towards swapping that 5 for a 6.

The Portfolio

During my last portfolio update, I highlighted how I was looking to secure more exposure to industrials, and as I’ve already presented, I’ve added within a couple of names since the last update.

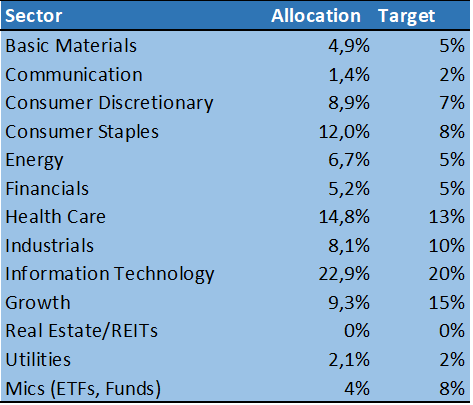

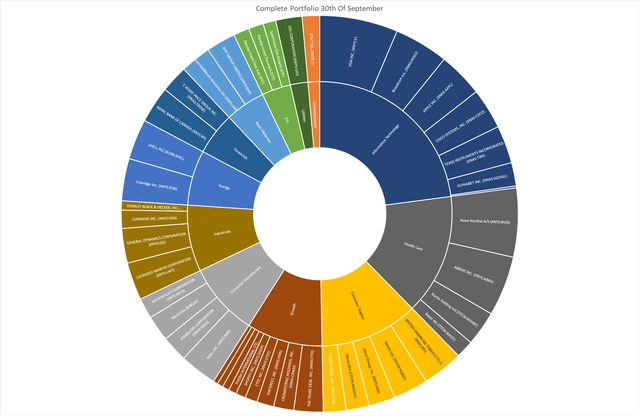

Authors Own Creation

My combined portfolio is beginning to move more in direction of the exposure I’m looking for. Consumer Staples is getting thinner as a consequence of adding elsewhere, while I’ve at long last managed to increase my exposure within industrials, where my only two previous positions were in companies providing defense and aerospace solutions in form of Lockheed Martin and General Dynamics (GD). My exposure within Health Care stood at almost 20% for a long while, and I’m pleased it’s also getting to a lower plateau.

Going back to April, my portfolio was valued at $178.870 on the basis of $126.553 in invested capital. Today, the portfolio stands at $150.778 on the basis of $135.950 in invested capital. On the positive note, I’m adding a lot of fresh capital, but the total value is haemorrhaging due to the market drawdown.

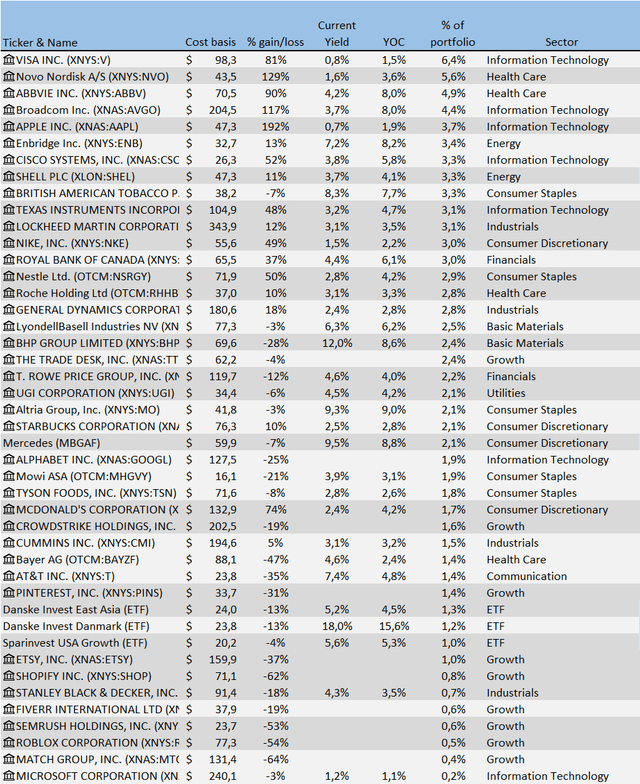

Above is the full portfolio ranked according to portfolio weight of the individual holdings. The pain continues as more and more positions move into red territory, with the portfolio overall remaining in green. It’s not a pretty sight these days, but this too shall pass.

On the positive note, when my portfolio moves deeper into red, it means dividend yields are becoming ever more attractive and as investors, we always look to the future.

The visual illustration above provides a much cleaner overview of how I’ve decided to allocate my funds across sectors. The focus is largely on dividend growers, but my “growth” exposure has increased significantly over the last year as I’ve utilized pullbacks to build positions.

What I’m Keeping An Eye On

With the “extreme fear” continuing to dominate the market, I’ll focus on expanding my newest positions to full size, coupled with adding to the fallen angels. For example, Nike somewhere between $70-80 per share would be very interesting in my opinion, currently trading at $83.12 per share. Similarly, I hope we get to see Texas Instruments (TXN) go below $150 per share, currently at $154.8 per share, a stock that has traded with a premium valuation for a very long time.

I find that Tyson Foods is already in buy territory, so I may also add some shares here, as my current position remains below a full size one.

I’ve recently covered Lowe’s (LOW) and Home Depot (HD) in an article titled “Home Depot Vs. Lowe’s: Which Stock Would The Dividend Growth Investors Choose?” While these companies could get hammered even further due to their cyclicality and the potentially freezing housing market, I’d be interested in dollar-cost averaging my way into either, as I view the current price as a fair opportunity to go long.

Given my time horizon, measured in decades, I will also continue to add to the beaten growth names, where I’m bleeding but trying to make bets that I consider worthwhile in the long run.

Wrapping up

It’s been an eventful year to date, one where I’ve managed to expand my dividend footprint substantially, but also where my real value of the portfolio has been getting hammered consistently. It’s not fun these days, but investing is about having a stomach that can handle it, patience and boldness in situations of extreme market fear, allowing oneself to get a larger size of the pie at a lower cost.

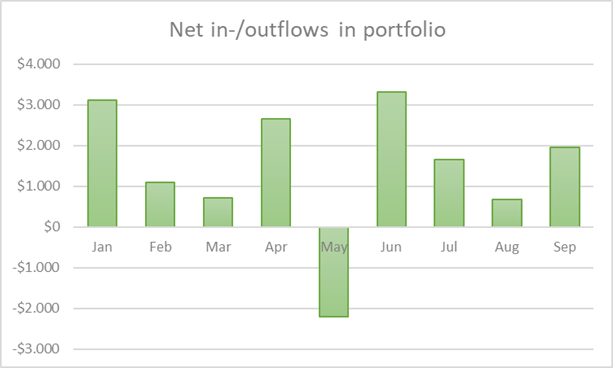

Authors Own Creation

I’ve compiled the net in- and outflows in my portfolio YTD, with only May showing an outflow as I trimmed my largest holding significantly as I deemed it overvalued and ripe, allowing me to buy other lower priced quality stocks. I expect I’ll be able to add less during the last quarter of the year, but perhaps I’ll move closer to breaking the $6000 in forward dividends.

I’d like to thank you for reading this piece concentrated on updating my portfolio overview.

If there is anything else you would like for me to add to these updates or discard, please say so in the comments section and I’ll consider adding or removing it for future posts.

Be the first to comment