sutiporn/iStock via Getty Images

Micron (NASDAQ:MU) is a stock we called out in late-2021 as overvalued. Since then, it has dropped almost 50%. At that point, we began to cautiously recommend re-entering the stock. However, with a deteriorating macroeconomic environment and the company’s flat share price rather than downtrend, we recommend investors hold off on the stock.

Micron Capital Spending

Micron has changed its capital spending profile substantially.

Micron Investor Presentation

Micron Capital Spending – Micron Investor Presentation

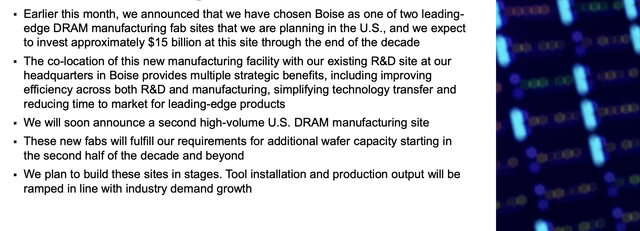

Micron has taken advantage of new support to localize manufacturing back in the U.S. from the current administration. The company has announced Boise as one of two leading manufacturing sites where it’ll invest $15 billion over eight years and it’s planning to announce another one soon. These two high volume sites will help the company take advantage of volume growth.

More so these sites are a key part of the company’s capital plan through the end of the decade representing approximately 40-50% of its planned capital spending.

Micron Market Performance

Micron is in a market that’s continuing to struggle, which could hurt its future performance.

Micron Investor Presentation

Micron Market Performance – Micron Investor Presentation

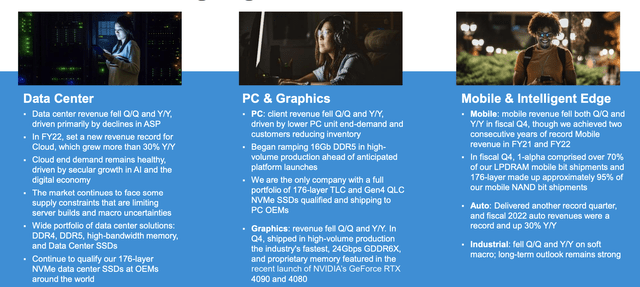

The data center, which has traditionally been a fast segment of growth, has suffered primarily due to ASP struggles. However, the company’s cloud business has continued to outperform and the company sees end demand as remaining healthy. The company is continuing to qualify new businesses such as higher volume NVMe.

The PC & Graphic segment has suffered more as an industry that remains susceptible to macroeconomic concerns. Given the poor reception to Nvidia’s latest 4xxx GPU release, we don’t see this changing anytime soon, at least going into next year. That’s despite the proprietary high-speed RAM that the company has put in new products.

In auto, the company has one of its few businesses that’s continued to outperform and grow YoY, however, in mobile revenue the company suffered.

Industry Guidance

The industry guidance for Micron shows short-term weakness, but long-term potential.

Micron Investor Presentation

Micron Industry Performance – Micron Investor Presentation

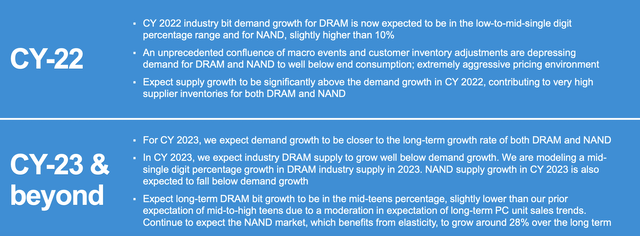

The company expects bit demand growth to be roughly 10%, which given normal capacity increases, is seen as quite low. That, combined with inventory adjustments, are causing demand from the manufacturer to be even lower hurting pricing significantly. As the company itself states, it’s expecting a substantial disconnect between pricing and supply.

However, the company is forecasting a change for next year. It was wrong about the expected market weakness in FY’22, so it’s worth keeping that in mind. However, the company expects supply growth to be well below demand growth across both DRAM and NAND with growth rates going back to the long-term rates. The company is slightly adjusting its long-term DRAM bit growth forecast.

Overall, the takeaway here is that the next few quarters will be volatile. Whether or not the company is correct, we’ll find out soon.

Micron Financial Performance

Micron’s financial performance for the year actually improved YoY despite QoQ weakness.

Micron Investor Presentation

Micron Financials – Micron Investor Presentation

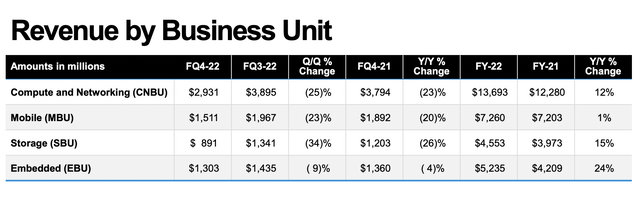

Across the company’s business units, its embedded unit has performed the best. However, its other segments had much worse performance dropping by ~25%. YoY the weakness was there too with double-digit decreases across the board. However, despite a weak ending to the year, the company’s overall 2022 performance saw YoY growth in every business.

Financially the company saw just over $3 billion in FCF for the year, despite a massive $12 billion in capex. The company’s guidance for next year is $8 billion implying $7 billion in FCF in a normal environment, or an almost 15% FCF yield. How well the company performs here depends on the recovery in the markets, and our cautious guidance is based on our uncertainty here.

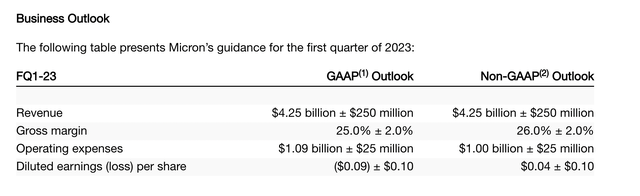

Micron Guidance

Micron is guiding for a rough FQ1-23, however, we expect the next few quarters to be the worst for the company.

Micron Investor Presentation

Micron Guidance – Micron Investor Presentation

Micron is guiding for $4.5 billion in revenue, a substantial YoY decline, versus FY-22 annualized revenue of almost $8 billion and a 40-45% margin throughout the year. The company is now guiding for a 25% margin, which is just over $1.25 billion in cash flow. Subtracting the operating expenses, the company’s earnings will be barely positive Non-GAAP.

Effectively it’ll be a quarter where the company loses no money but makes no money. The guidance is worth paying close attention to as it will show whether it represents the worst for the company or whether it’ll worsen from that point forward.

Potential Turnaround

It’s clear from the theme of our article here that Micron’s future performance is based on the company’s turnaround.

The company, as we discussed above, is guiding for making no money next quarter. There’s a number of things that can cause the drop to turnaround. An end to the war in Ukraine could rapidly help solve the energy crisis. OPEC+ is looking into production cuts to protect prices in what could very well be the last bull market in our view.

The market could outperform if inflation and supply crises are resolved. It could underperform if things get worse. China and its zero-Covid-19 policy is another thing worth paying close attention to. Whether or not a turnaround happens, that’s the closest thing worth paying attention to for the next few quarters.

Until we have an answer to that, we recommend against investing at the current price.

Thesis Risk

The largest risk to our thesis, in our view, is continued weakness in the markets. Micron effectively operates in a commodity space where the fixed costs to operate its assets are incredibly high and that means when volumes drop, the company can start losing money incredibly quickly. That hurts the company’s ability to drive future returns.

Conclusion

Micron continues to remain one of the strongest players in the DRAM industry and we don’t expect that to change anytime soon. The company essentially operates in an oligopoly at this point, which means that the chance of being driven out of the industry, as was once common, is now much less likely.

However, it still operates in a commodity environment here. That means that the company is continuing to grow bit capacity much faster. That’s versus demand growth in recent years, which means prices have dropped substantially. The company isn’t expecting to make any money in the next quarter and if the financial crash gets worst so too could the company’s numbers. That’s worth paying close attention to.

Be the first to comment