Michail_Petrov-96

By Peter Hayes, James Schwartz, & Sean Carney

Market overview

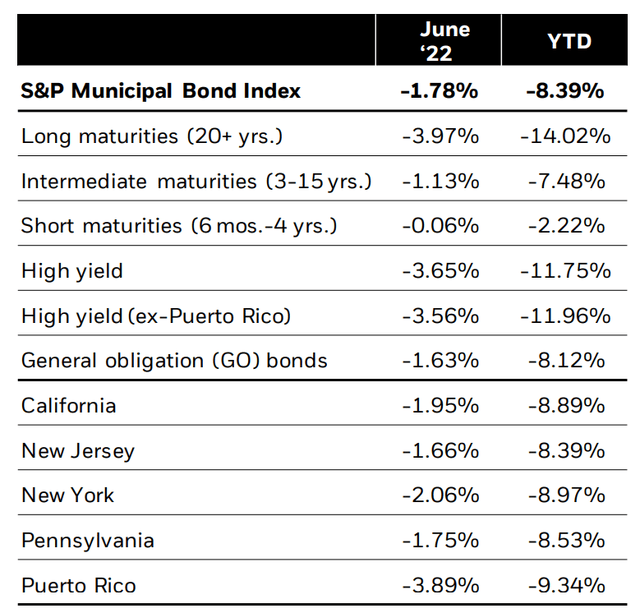

Municipal bonds posted negative total returns in June alongside rising interest rates as inflation eclipsed expectations, and the U.S. Federal Reserve delivered its first 75-basis-point rate hike since 1994. Strong gains garnered in May were quickly erased as less attractive valuations and heightened volatility spurred weaker demand and prompted underperformance versus comparable Treasuries. The S&P Municipal Bond Index returned -1.78%, bringing the year-to-date total return to -8.39%. Shorter-duration (i.e., more sensitive to interest rate changes) and higher-rated bonds performed best.

Supply-and-demand technicals underwhelmed in June. Mutual funds started the month by posting their first weekly inflow since mid-January but reverted to steep outflows as performance turned negative. As a result, bid-wanted activity remained elevated at over $1.4 billion per day on average and continued to pressure the market. Issuance was supportive at just $32 billion, 17% below the five-year average, and was outpaced by reinvestment income from maturities, calls, and coupons by over $16 billion. However, given the waning demand backdrop, deals were just 3.5 times oversubscribed on average, slightly below the year-to-date average of 3.7 times.

Although valuations look attractive, summer seasonal trends are historically favorable, and credit fundamentals remain sound, we continue to believe that near-term performance will remain dependent on interest rates. Funds flows are unlikely to turn positive until the market receives additional clarity on the future path of monetary policy. However, should steeper borrowing costs materially slow economic growth, municipals are poised to benefit from risk-off sentiment and increased demand for bonds.

Strategy insights

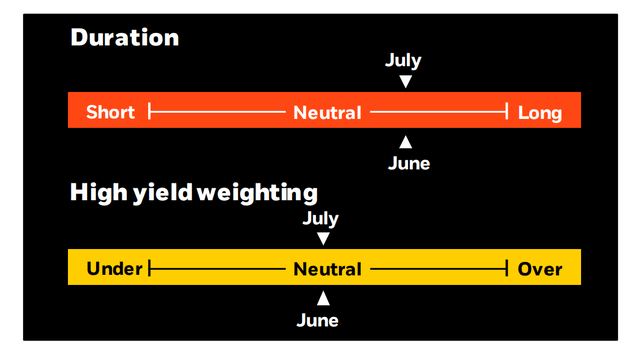

We maintain a modest, long-duration stance on municipal bond positioning while targeting moderate cash balances. We favor the 7- to 12-year part of the curve to maximize income while avoiding significant duration risk. We prefer higher-quality bonds overall, with a neutral allocation to non-investment grade bonds.

Author

Overweight

- Essential-service revenue bonds.

- Select highest quality state and local issuers with broadest tax support.

- Flagship universities and diversified health systems.

- Select issuers in the high yield space.

Underweight

- Speculative projects with weak sponsorship, unproven technology, or unsound feasibility studies.

- Senior living and long-term care facilities in saturated markets.

Credit headlines

Of the 46 states that begin their fiscal years on July 1, 44 have enacted budgets for the fiscal year 2023, according to the National Conference of State Legislatures. Sixteen of the 46 states enacted biennial budgets during their 2021 legislative sessions. Only two states, Massachusetts and Pennsylvania, did not have budgets in place at the start of their July 1 fiscal years. However, Massachusetts, which has a record of late budget passage, has an interim spending plan through July 31. In addition, Pennsylvania’s legislature is expected to address outstanding issues next week, with no major service disruptions anticipated. Solid state-credit fundamentals, specifically strong revenue collections and high reserve levels, have made budget agreements easier to achieve by the deadlines. Last year, as state economies reopened and benefited from earlier federal stimulus, just five states went beyond the July 1 fiscal year start in passing their budgets.

The American Dream mall missed its property tax payment that secures $800 million in non-rated PILOT revenue bonds, triggering a draw on reserves to pay the June 1 coupon. Subsequently, the Trustee informed bondholders that the developer made a ~$13 million payment on June 15th. This past week, the developer also made good on a late interest payment from the overdue PILOT payment. Since opening, the mall has continued to struggle with revenues, far underperforming original expectations. Poor operating performance raises concerns that the mall’s owners will be successful in their ongoing challenges to its current $3.4 billion valuation in New Jersey Tax Court which could materially impact the tax revenues available for the repayment of its bonds. This is an example of highly speculative projects that can be financed by high-yield municipal bonds and should be minimized or avoided in a well-diversified portfolio.

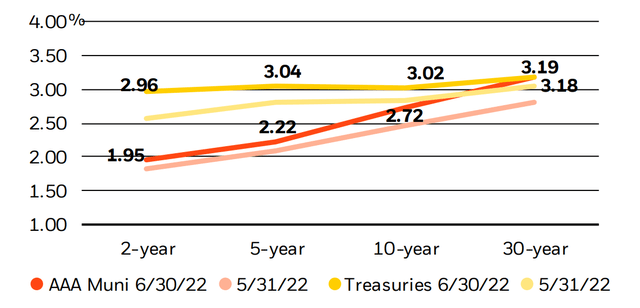

Municipal and Treasury yield movements

BlackRock, Bloomberg

Municipal performance

S&P Indexes

This post originally appeared on the iShares Market Insights

Be the first to comment