Chris Hondros

Goldman Sachs (NYSE:GS) is one of America’s most well-known investment banks. In recent years, the company has diversified its operations, adding consumer banking and other more stable recurring revenue streams to complement its traditional investment banking and trading operations.

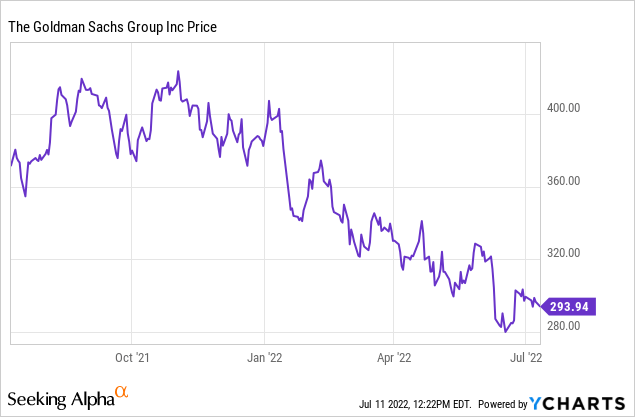

The company should currently be on people’s radars as it just announced a large dividend hike. That, combined with a significant sell-off in GS stock in recent months, has made this an attractive entry point for Goldman stock.

What Is Goldman Sachs’ Current Dividend?

Goldman Sachs is currently paying a dividend of $2.00 per share per quarter, which works out to $8/share annualized.

Unlike many companies, Goldman Sachs doesn’t always increase its dividend at the same time every year. Its less reliable dividend-increase schedule is due to the Federal Reserve’s capital adequacy tests. Big banks can only increase their dividends when they are in compliance with the Fed’s stress test metrics.

As a result of the Fed’s limits, Goldman Sachs passed up a dividend hike entirely in 2020 during the height of the pandemic. However, Goldman gave investors a big increase in 2021, raising the dividend from $1.25 to $2 per share with its August 2021 distribution. And now, another big increase is on the way.

When Will GS Stock’s Dividend Increase?

Goldman Sachs issued a statement June 27 regarding its latest results in the stress capital buffer tests. Goldman scored well, with its Standardized Common Equity Tier 1 (“CET1”) ratio coming out to an agreeable 13.3%.

As a result of this, Goldman Sachs has considerable leeway to increase its return of capital back to shareholders. To that end, it will be upping its quarterly dividend from the current $2.00 per share to $2.50, for a cool 25% increase. This will boost the annualized dividend to $10/share. That results in a forward yield of 3.4% based on the current stock price. The increased dividend policy should go into effect in the third quarter of this year.

What Is GS Stock’s Long-Term Forecast?

In general, banks aren’t as complicated as some people make them out to be. A bank has given number of loans at an average interest rate, has an efficiency ratio (overhead costs) and a set tax rate. Plug in the numbers and you can generally get pretty close to a bank’s overall operating results. Or, at least, that’s true for most regional and community banks.

With something like Goldman Sachs, however, earnings are much closer to the proverbial “black box” that banks are often thought to be. Goldman has so many different moving parts – including things such as proprietary trading – that are impossible to forecast from the outside that I don’t put much stock in quarterly earnings results for a bank like Goldman Sachs. You’d rather see a higher EPS number than a lower one, all things being equal. But there can be so much noise in quarterly earnings on a too-big-to-fail bank that it’s not the best metric.

Rather, I prefer to look at longer-term trends. Is a bank’s net interest margin performing in-line with expectations given the changes in interest rates? Is its efficiency ratio getting better or worse? Is the bank’s deposit base getting stronger or weaker on a per branch basis? These tend to give you more useful information on a big bank’s condition than headline quarterly earnings results.

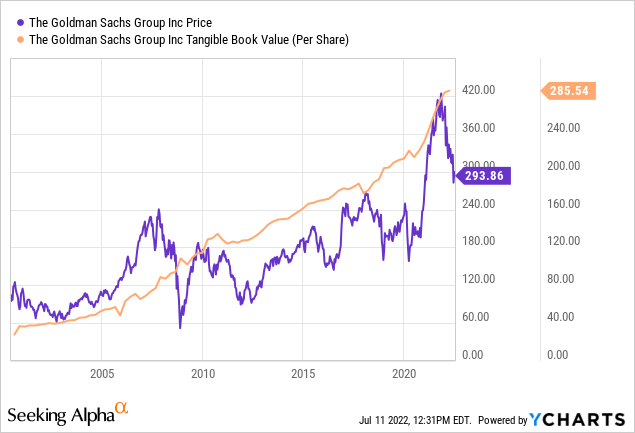

And, arguably, no one indicator is more useful for Goldman Sachs in particular than its tangible book value. I certainly don’t understand the ins and outs of every one of Goldman’s lines of business.

When I invest in GS stock, it’s my putting confidence in the management team to be able to earn above industry average returns. And the quickest way to measure that is if the bank is consistently growing its book value at an acceptable rate. Quarterly earnings rise and fall, and there are tons of one-off gains and charges in the big banking industry. Over time, however, a bank’s ability to compound its book value is one of the clearest signs of whether it is a superior operator or not.

Here is Goldman’s tangible book value per share (orange line) graphed against its stock chart over the years:

With Goldman Sachs, its book value evolution argues for it being one of the single best big banks in the country. This is just about as both consistent and strongly upward-sloping as you’ll find in the United States. Unlike almost all its peers, Goldman Sachs didn’t take a material hit to its business or balance sheet in the Great Financial Crisis.

And it navigated the fast-changing 2010s with considerable skill as well. A bank that does reasonably well in the good times and avoids taking significant losses during recessions is generally going to be a top-tier overall performer. As an exclamation point, since 2020, Goldman has grown its tangible book value at a tremendous pace, with it rising from around $220 per share to $285 in just 24 months.

Is GS Stock A Buy, Sell, Or Hold?

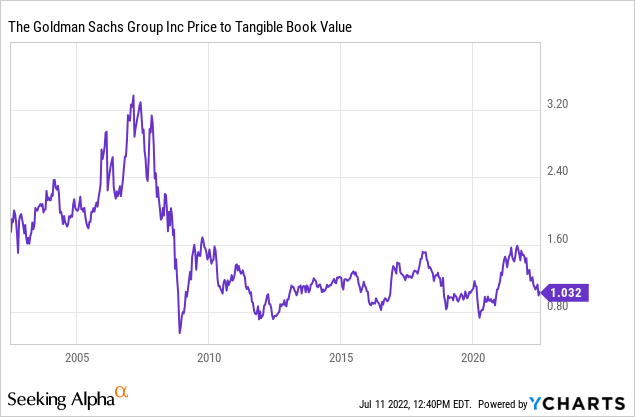

With that in mind, the question is what is a good entry point for GS stock? We can reasonably debate how much of a premium Goldman deserves to book value. Given the considerable questions about opacity of its business model, regulatory pressures, a weakening economic outlook and many other such concerns, I understand why GS stock doesn’t trade at a large premium to book value. However, no premium at all to book value seems much too harsh. Would Goldman Sachs be worth more dead than alive? In my view, of course not. Yet, that’s how the stock has been trading as of late.

As you can see, GS stock is back to just 1.03x price/tangible book now, and isn’t far from the 0.8x level that has served as fantastic buying opportunities on various occasions over the past 15 years:

When this happened previously in 2018 and 2019, I suggested buying GS stock given that it was at a discount to tangible book value. That paid off handsomely, with GS stock doubling by 2021 as shares hit a more reasonable 1.6x tangible book value.

Will such a sudden revaluation happen again this time around? I’m not sure it will; there are some rather significant economic headwinds on the horizon for the intermediate-term. That said, buying at tangible book value is such a great entry point that it’s hard to imagine losing too much money from this entry point. Historically, you have to like buying at this part of Goldman’s historical valuation range.

Meanwhile, the company’s strongly-capitalized balance sheet is giving income investors plenty to cheer about.

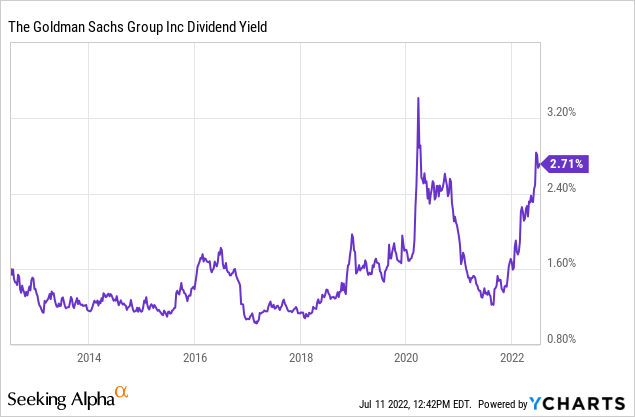

The company’s trailing dividend yield of 2.7% is already near its highest point of the past decade. And, once the latest dividend hike goes into effect next quarter, the already generous dividend yield will jump to 3.4%. That should be plenty to attract income investors to this well-run banking powerhouse.

Goldman Sachs is still primarily a capital gains story, as management keeps delivering massive book value gains over time and the stock price follows book value higher sooner or later. However, with this growing track record of aggressive dividend hikes, there’s a lot to like as an income investment as well.

Be the first to comment