JHVEPhoto

Dear readers/Followers,

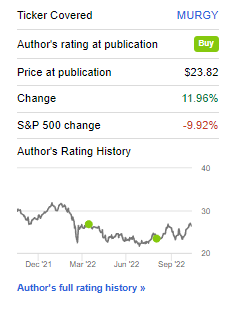

We’ll look at Munich Re (OTCPK:MURGY) in this article, and see if the company can still be considered attractive after doing this since my latest published piece.

Seeking Alpha Munich Re (Seeking Alpha)

I mean, we’re not yet close to talking about full normalization. I expect triple-digit RoR inclusive of dividends once we see the company return to normal levels and levels considering the company’s upside and safety – but we’ve begun the climb.

And this might be one of your last chances of getting into Munich Re at a truly “cheap” multiple.

Let’s see what we have here.

Munich Re – An update

Remember the basics about Munich Re. With over 140 years of tradition under its belt, this company is one of the more significant reinsurance businesses, and in terms of size, it’s the largest of all. The company became famous after the San Francisco Earthquake in 1906, as it was the only insurer that remained fully solvent after paying out all claims, around 15.5M marks at the time.

I’ve covered this company multiple times – so basics can be found in articles like this one. Instead, this particular piece will be about the updated results as well as the future thesis for MURGY. The half-year financials came in, and the results are what formed the basis for the recent bout of outperformance.

MURGY was able to confirm 2022 profit outlooks despite a fundamentally challenging environment. The company’s underlying EPS in Property & Casualty were very well, with major losses well below the company’s estimated budget.

COVID-19 is of course a heavy blow for the company’s L/H lines, but the company saw significant sequential and YoY improvements during 2Q22, leading to underlying improvements.

The market, of course, hasn’t been favorable uptil about a week ago – so results here are worse than one might expect, with a low investment result, but the company’s reinvestment yields meanwhile are up substantially.

The company’s 2025E ambitions remain.

MURGY IR (MURGY IR)

From a high-level and top-line growth perspective, the company’s results weren’t at all as impaired as one might believe. Munich Re wrote €2.5B more in gross premiums than YoY for the half-year period, and the company’s combined ratio improved to 90.5%. RoI was down slightly due to the market, but Reinvestments yield were up almost the same amount as drops in RoI, leading to a mixed consolidated result of around €1.4B for the period, with an RoE of 11.2%.

This is down for the year, but the recent trends in the market should show you what the markets do expect from the company’s performance.

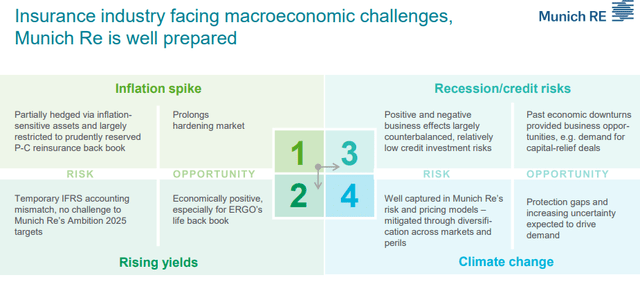

And Munich Re is one of the best-prepared Re businesses on earth.

In terms of inflation, Munich Re is one of the only insurance businesses that go out and clearly states that inflation needs to be considered as an integral part of the world, and its strategy. the company manages this through prudent claims reserves and the fact that claims inflation isn’t actually driven by CPI numbers – which is something many investors outside of the insurance/reinsurance space do not actually realize. Instead, I focus on things like wage inflation, construction, and medical inflation.

Munich Re is also in a solid position to pass along and work with costs and pricing. The current claims reserves for P&C are well-sized for the short and long term both.

Also, remember that rising interest rates are a net positive for insurance, reinsurance, and finance businesses. It means that the long-dead NII (net interest incomes) are going to be driving returns once again, as opposed to simply fee-based businesses. I for one am looking forward to this. Remember, higher interest rates aren’t necessarily a negative – simply prepare for them.

Fixed income investments are seeing massive improvements, up nearly 1% YoY, and for Munich Re these rising interest rates have the immediate effects of reducing the on-balance sheet reserves, and liabilities being discounted with invariant interest rates, leading to Solvency II ratio improvements from 227% to over 250% as of the latest quarter.

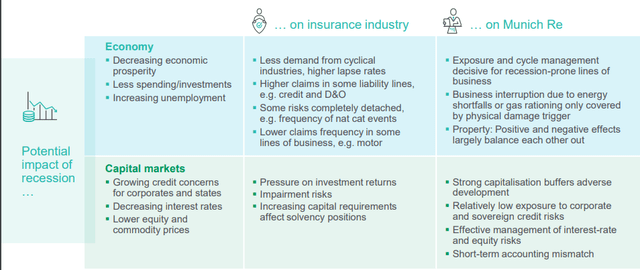

What about Recessions?

Some effects, but not necessarily all that dire either. The company’s outlook shows this. The company expects €64B written in gross premiums for the year, and from that revenue, to manage about €3.3B in net result to a >2.0% RoI, lowered from around 2.5% due to current macro.

The currently rising interest rates are a net positive for the company’s goals of 2025E, and MURGY is on track to deliver some really superb long-term results. And in terms of the company’s capital position and investment position, there is really nothing to worry about here, with an investment portfolio of €231B mostly pushed into fixed-interest securities, loans, and other safe alternatives, now yielding 2.8% due to favorable credit spreads and better rates.

Munich Re has made a history of performing well when competitors have been down or posted losses, thanks to titanium-clad underwriting standards and safeties. It’s what allowed them to post a near €3B net profit during the financial crisis.

Most European peers, including Swiss Re (OTCPK:SSREY) and Hannover Re (OTCPK:HVRRY), posted losses in 2008. The company repeated this feat during COVID-19, posting a €1B net profit during a time when most reinsurance companies were suffering massively due to a global pandemic.

On a high level, Munich Re is perhaps the most conservative, traditionally German-led reinsurance business on the entire planet. And this has, and is paying off in spades during crises. It’s also fair to consider the worldwide and especially European reinsurance markets to be quasi-oligopolies. Small players have no room in this business area. You need insane amounts of capital backing to even start considering a reinsurance business.

That brings with it ridiculous amounts of fundamental safety. It would be silly to consider an investment here anything except “safe”, when you look at what the company offers.

On a high level, reinsurance is the primary contributor here. More than 60% of Munich Re’s annual profit levels are from reinsurance – though, as you may see, insurance, which the company now has through ERGO is a better-margin operation.

Reinsurance operations also suffer from cyclical characteristics, doing well from 2012 to 2017 because of no major losses, but tend to be worse performers during world events. Since then though, things have been far worse. You’ll know we’ve been through quite a few of these during the last few years. It began with hurricane claims in late 2017, followed then by COVID-19 and other events, leading to calls for higher sector discipline. Prices for reinsurance increased in 2018 and have increased more or less since that point.

The aforementioned 2025E targets are, in no specific order:

• Return on equity to increase to 12-14% by 2025

• Earnings per share to increase annually by 5% on average by 2025

• Dividend per share to increase annually by 5% on average

• Solvency ratio to remain in the ideal corridor of 175-220%

• Extensive decarbonization strategy: shifting away from coal, oil, and natgas/LNG.

And the latest results do nothing except confirm that this is very possible. Fundamentally speaking, Munich Re is among the highest-rated reinsurance shops on the planet. It has a AA- S&P credit rating, with equal ratings from Fitch/Moody’s. The company has around 2% debt, 75% of which is subordinated. The likelihood of the company facing imminent fundamental danger to its operation due to capital limitations Is close to zero.

Unlike other German businesses, it also has ridiculous levels of dividend safety and growth, broken not once in the last 10+ years by macro. The worst that happened during COVID-19 was a freeze, not a cut.

Let’s update the valuation here.

Valuation for Munich Re

I’ve invested 4-5% of my core portfolio into Munich Re at very attractive valuations. This means that after the company’s recent surge, I’m up around 30% including FX in my position, and the company is now a solid part of that portfolio.

Is there an upside left?

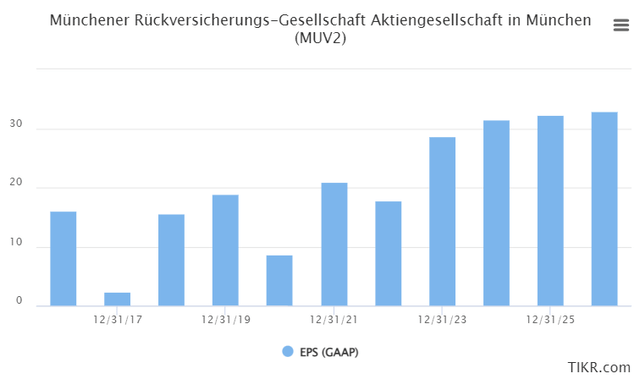

I answer that with a resounding “yes”. Despite somewhat of a drop in adjusted EPS forecasted here (as well as GAAP), the future seems to be rosy enough for the company going into the next few years, as some of these rate increases settle and start to flow down.

Munich Re EPS Forecasts (TIKR.com/S&P Global)

Following this year, the yeas should bring about EPS growth well into mid-double digits. The company currently trades at a blended P/E of around 14x for the ADR, and this is well below where it should be, given its fundamentals. The native yield is no longer 5% – it’s 4%. So if you didn’t buy before, you’ve missed out on about 1% – but you can still make a decent return even so.

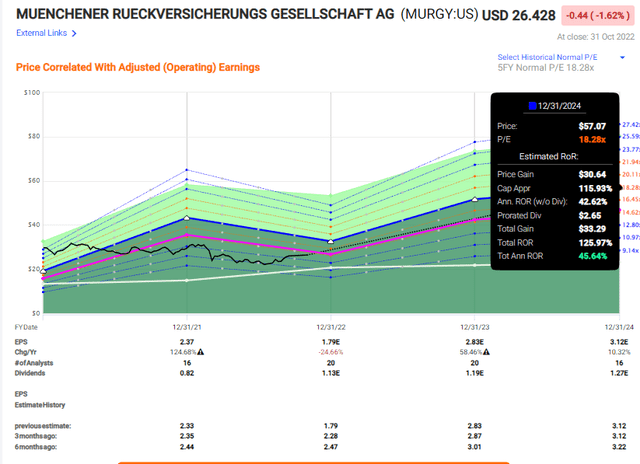

Estimating MURGY at a 5-year average P/E of 18.3x brings about annualized RoR of no less than 45% here, or 126% in 3 years.

Munich Re upside (F.A.S.T graphs/FactSet)

Current analyst targets and data are no less clear. I bought when the company was expected to be at around a €285/sharer fair price, from a range of €240-€340 from 20 analysts following the company. €285 is still the FV target, with 15 analysts at either a “BUY” or an “outperform”, but as a result of the recent surge of nearly €40 for the native, the upside given by the analysts is down to around 7%. I consider it far higher for the longer term.

Munich Re follows a “safety and profitability before growth”-approach, which I’m very into. It’s conservative and extremely risk-averse, and they’ve paid off for 140 years. Based on the company’s valuation, I’m prepared to say that Munich Re is, as of writing this article, still undervalued in every single relevant metric.

I was in a range of €280-€290 before, and I’m bumping that to better align with the longer-term targets. I believe Munich Re is worth at least €300/share for the native.

You may target it lower than this, but you’ll still have an upside. I believe that MURGY isn’t the “best” financial stock available on the market today, but I do believe it’s solid enough to consider investing in still, expecting double to triple-digit longer-term returns.

Thesis

My thesis for Munich Re is as follows:

- Munich Re is the largest reinsurance company in the world, and also one of the most conservative in existence. It has a double-A credit rating, a high, 4%+ yield, and a set of fundamentals and titanium-clad underwriting processes that make the company a no-nonsense leader in the business.

- The recent set of results confirms the long-term upside for me, and I see no reasons why this company should be valued as it currently is – even though I am happy that it is.

- MURGY is a “BUY” here – the equivalent of the PT would be around $30 for the ADR.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment