JuSun/E+ via Getty Images

Description

I recommend buying Membership Collective (NYSE:MCG). The platform has strong network effects and is the only business to have successfully launched and scaled a worldwide private membership platform. It has high scarcity value, pricing power, and low annual member churn. I believe it also has a lot of room to grow, particularly in major global cities where it does not yet have a physical presence.

Company Overview

Membership Collective Group Inc. is a global membership platform. The Company’s platform includes both real-world locations and online communities, bringing together people from all walks of life so that they can share resources and help one another succeed professionally, personally, and culturally.

The Soho House, the core of MCG

When it comes to expanding MCG’s membership platform, Soho House is the cornerstone upon which new member-based businesses can be founded and grown. Keep in mind that the members of each House are chosen by a committee made up of prominent figures in the area’s creative and innovative community. Involvement in member events and the creation of editorial and digital content helps shape and localize the House by fostering connections between members who are invested in shaping the culture of their respective Houses. In my opinion, this increases the prestige of each House and makes joining more appealing to people all over the world.

MCG’s platform has high scarcity value because it is the only global private membership platform that I am aware of, that has considerable pricing power (in my opinion), and experiences only 5% annual member churn. Because MCG’s target demographic associates the brand with opulence and because there are no global alternatives, I expect its membership base to be highly loyal and therefore its recurring revenue to be stable. To my knowledge, MCG is the only business to have successfully launched and scaled a worldwide private membership platform. It has been around for more than two decades, has more than 121,000 members, maintains a global waitlist of 85,000 people, and has 38 active homes at the moment.

Strong network effect

There are now 38 Soho Houses in 14 countries, up from 18 in 2016. The success of other hotel chains with robust loyalty platforms, such as Marriott (MAR) and Vail Resorts (MTN), has shown that a more comprehensive system improves both product and membership value. This is evidenced by the fact that the percentage of Soho House members choosing to pay more for the highest tier membership “Every House,” which grants access to all Houses globally rather than just members’ local Houses, has steadily risen from 75% in 2017 to more than 80% today.

I take this as further evidence of the network effect at work within the MCG, and I predict that as the platform continues to grow in size, it will further solidify its position as the market leader. Indeed, the margin of victory may now be so large that no other companies care to enter the global market.

Pricing power

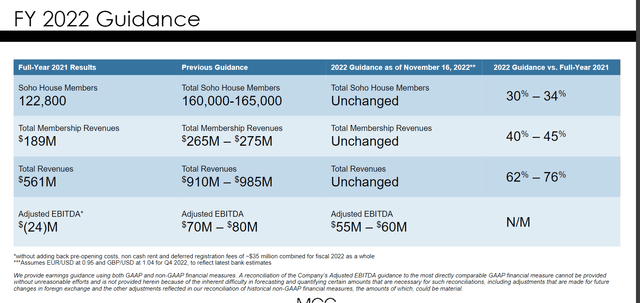

When compared to other location-based memberships and to high-end gym memberships (with which it is on par) and to high-end golf and country club memberships (with which it is significantly below, based on my Google search), the annual MCG membership price seems quite reasonable to me. This is also a key reason why I think MCG can keep its price increases stable. In fact, FY22 guidance reflects an implied rise in revenue per subscriber. In addition, I believe MCG will enjoy a couple of tailwinds in terms of pricing.

First, there should be a significant mix shift impact for MCG because the pipeline is skewed toward North America, where membership pricings are higher. Second, all new members at all houses start at the most recent headline rate, which is higher than the rate that some long-standing members at earlier MCG houses started at. Lastly, the percentage of members switching to the more expensive “every house” membership from the cheaper “local house” membership has increased by 1-3% annually over the past few years.

All in all, I’d say these results show some serious pricing muscle.

Still got many rooms to grow

In my opinion, MCG has a lot of room to grow the Soho House platform. There are two primary reasons for my conviction:one, I think the depth of penetration in major global cities is underappreciated, and Soho House does not yet have a physical presence in many of these cities (including Tokyo, Seoul, and Sydney); and two, I think many cities are currently underserved. For instance, the original Soho House opened in London over 20 years ago, and today there are 13 additional locations throughout the city. However, London’s historic homes are thriving and have avoided material cannibalization. In my opinion, there is no reason why major American cities like New York and Los Angeles can’t catch up to London in terms of home availability.

Valuation

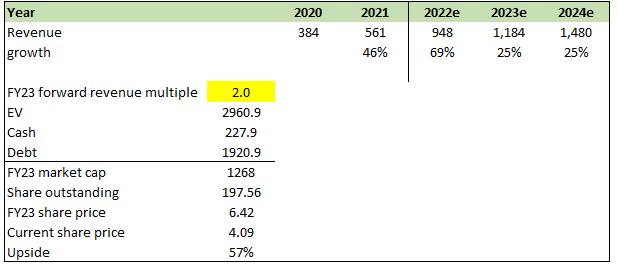

I estimate that MCG will be worth $6.42 per share in FY23, representing a 57% increase from the time of writing. This figure is derived from my model and the following assumptions:

- Revenue will meet expectations in FY22 and continue to grow at a healthy clip in FY23 and FY24. I believe we have a good chance of expanding here (membership waiting list and potential to open new houses). 2020 was a one-time event caused by COVID, and I believe it is unlikely to happen again.

- MCG is currently valued at twice its projected revenue. While I do not believe this is the correct valuation multiple and believe it should trade back to at least 3x (its average), the stock remains inexpensive at its current valuation.

Key Risk

COVID or something alike happen again

The COVID-19 outbreak has significantly impacted global economic activity. If it happens again, there may be an effect on demand for lodgings as a result of travel restrictions or property closures, leading to more churn and possible account freezing.

Brand erosion

MCG’s success is heavily reliant on its membership base, and its ability to attract members and retain members is dependent on the strength of its images. As the company expands, the exclusivity “feel” of its brand could erode.

Summary

MCG is cheap. With its exclusive status as the only company to have successfully launched and scaled a global private membership platform, the platform enjoys powerful network effects. It has strong pricing power, scarcity value, and annual member churn is low. Especially in major global cities where it does not yet have a physical presence, I think it has a lot of room to grow as well.

Be the first to comment