JHVEPhoto

Dear Readers,

In this article, we’re going to be taking another look at Munich Re (OTCPK:MURGY). Under 2022, I’ve been pushing cash heavily into the company, especially after April when the company really started troughing and showing us 5%+ yields. There are superb arguments for why you should be looking at this company as a long-term investment.

Here we look at what the company has been doing since my last article back in the beginning of April.

Updating on Munich Re

There are plenty of reinsurance companies out there – plenty that do generally the same thing that MURGY does. But there are no companies, in the world, that do it with the size or the conservative approach that this company uses in its work.

Founded in 1880 by a Bavarian National, the company was close to insurance peer Allianz (OTCPK:ALIZY), and the two companies have worked hand-in-hand for a very long time. The company became famous after the San Francisco Earthquake in 1906, as it was the only insurer that remained fully solvent after paying out all claims, around 15.5M marks at the time.

I cover the business thoroughly with its fundamentals in the basic article on MURGY that you can find here.

This article will be about the updated results and thesis for the company – because there are a few things to consider that are different to back in April.

So, first off, and most important. MURGY has done perfectly fine – even good – during 1H22. The company delivered solid results, with good profitability and a good expansion supporting the aforementioned EPS targets for the 2025E period.

The strong underlying trends are pretty broad – both in Life/Health reinsurance, Risk Solutions, and the company’s ERGO segment. Broad results like these work to increase the company’s comparative stability to peers and other businesses.

The reinvestment yield increased by almost a full percent, the combined ratio improved to 90.5%, and written premiums on a gross basis increased by €2-5B in a single half-year period. The company isn’t just on track to deliver 2022E, it’s on track to deliver even further going forward.

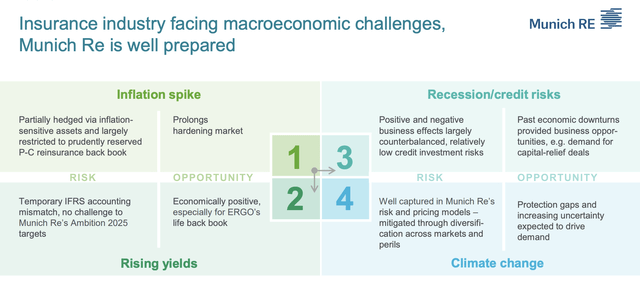

That isn’t to lessen the macro challenges that the reinsurance business is facing. However, MURGY is in a prime position to not only beat or excel here but to rise above perhaps most of its peers based on its market position and conservative approach. The ongoing inflation spike is a headwind, but MURGY is partially hedged and reserved through its mostly restricted Property/Casualty reinsurance backbook. We can summarize MURGY in a few fairly simple words.

The company is prepared for many of the challenges coming its way. It’s also fair to say that a recession can actually be a net positive for a reinsurer, especially a positive one because capital relief deals provide business opportunities and the business is, all things considered, fairly resistant to cycles.

The company’s high degree of diversification and its massively strong balance sheet with a top credit rating limits any downside to this company in the long term and makes it a very attractive business partner for any company needing the services that the company offers.

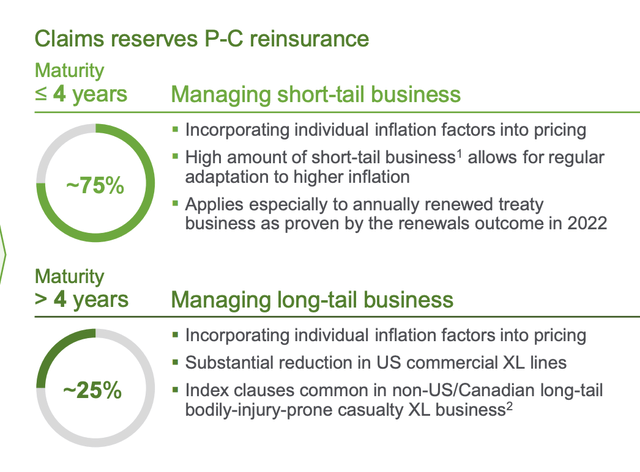

Inflation is on everyone’s mind – and the company considers it very manageable with higher reserves. Also, claims inflation for reinsurance businesses isn’t driven by CPI, but by other economic and societal drivers which haven’t seen the same degree of expansion as the CPI. The company handles both short and long-tail businesses in terms of inflation, and it considers itself well-prepared for these headwinds.

It’s also absolutely crucial to remember that rising interest rates are a net positive for most financial companies, including reinsurance businesses. For years, much of their interest-driven incomes have been suffering, forcing businesses to focus on fees. Now, this can change back again, and NII and interest-related profit will be rising.

MURGY’s solvency has improved – and the results from its fixed income investments are rising, as well as the reinvestment yield the company is seeing.

The company posted a 2022E outlook, and things are continuing to look very well.

Operations today come in three areas – Life, Non-life, and Reinsurance. Reinsurance is the largest at over 70% of sales revenues, with life at about 10% of revenues and non-life at around 6%. All said and done, Munich Re is still a reinsurance major, not a primary insurance major, at over 80% of annual revenues.

A reminder from me at this stage as well. Munich Re has made a history of performing well when competitors have been down or posted losses, thanks to titanium-clad underwriting standards and safeties. It’s what allowed them to post a near €3B net profit during the financial crisis. Most European peers, including Swiss Re (OTCPK:SSREY) and Hannover Re (OTCPK:HVRRY), posted losses in 2008.

The company repeated this feat during COVID-19 once again, posting a €1B net profit during a time when most reinsurance companies were suffering massively due to a global pandemic.

On a high level, Munich Re is perhaps the most conservative, traditionally German-led reinsurance business on the entire planet. It is on this basis that I have been continuing to put capital to work in the business, because there are few insurers or reinsurers safer than this company.

It’s also fair to consider the worldwide and especially European reinsurance markets to be quasi-oligopolies. Small players have no room in this business area. You need insane amounts of capital backing to even start considering a reinsurance business. This makes the moat incredibly attractive as well.

Reinsurance remains the main profit contributor for MURGY at this time. More than 60% of Munich Re’s annual profit levels are from reinsurance, despite the straight insurance businesses being a better play in terms of margins and profit – this will likely increase given the interest rate changes we’re currently seeing.

On a high level, reinsurance operations are both local and macro-oriented. Sets of hurricanes can cause local or national claims, while macro events such as COVID-19 of course massive, global sets of claims which drive up costs for reinsurance contracts. Over the long term, they may be stable as things usually even out, but in the short term, they can go quite up and down.

A recap on the 2025E targets.

• Return on equity to increase to 12-14% by 2025

• Earnings per share to increase annually by 5% on average by 2025

• Dividend per share to increase annually by 5% on average

• Solvency ratio to remain in the ideal corridor of 175-220%

The company is currently already beating most of those fundamental targets, giving me high confidence that MURGY will continue to do so. This is also strengthened by the simple fundamental facts of the business. Munich Re is among the highest-rated reinsurance shops. It has a AA- S&P credit rating, with equal ratings from Fitch/Moody’s. The company has around 2% debt, 75% of which is subordinated.

Count the number of companies with any sort of AA-rating. You won’t find many more than double digits – on the entire planet. This makes the company a great company to consider.

The basic figures and earnings are good. I see no issues in the near term. The company continues to show us strong results, and the forecast is for that to continue.

Let’s look at what this turns valuation for MURGY into.

Munich Re – what is the valuation?

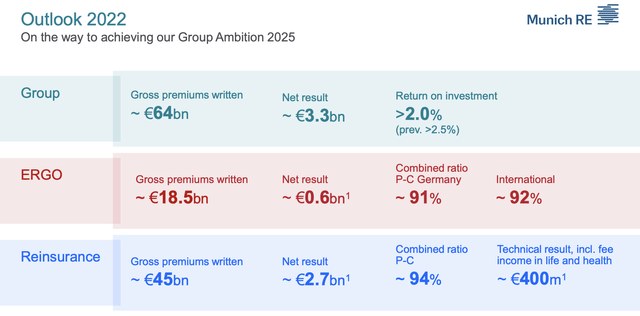

Munich Re operates at the second-highest total shareholder return numbers in the entire sector. At a 4-year TSR of almost 71.6%, the company drives sector-leading profitability and growth, and its outlook for 2022 includes over €60B of gross premiums and a net result of €3.3B. These expectations from earlier this year, have not shifted except that the company now expects €4B more in gross premiums written, and a slightly lower RoI, reflecting some pressures from the market and inflation. The company makes up for the dropoff in RoI through volume.

The appeal I see in the company is that even in the event of a global catastrophe unless we’re talking doomsday-scenario, the company’s trends are relatively easy to forecast. Both in terms of earnings, but also in terms of stock development. This has also remained true for the current period.

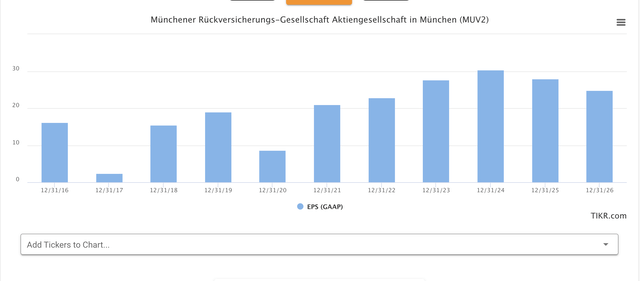

MURGY trades diametrically opposed to its current EPS forecasts. Despite the dropoff in EPS growth to only 1-2% for this year, it’s important to realize that MURGY is most certainly in a positive trend here. Going into 2023-2024, the company is expected to increase earnings further. Take a look at these forecast trends.

Munich RE EPS forecast (Tikr.com/S&P Global)

My goal is to trade or invest in this cycle, then “step out” if necessary when the company reaches a valuation or a level that’s unsustainable for the long run. In the current valuation, every sign that I see is telling me to “BUY” more MURGY.

Why?

We’re at low valuations despite increases in EPS.

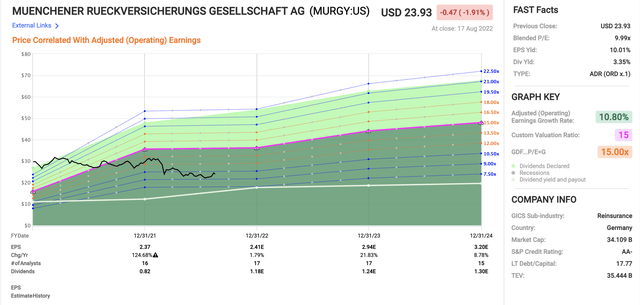

MURGY Forecasts (F.A.S.T graphs)

And 15x P/E isn’t even where the company typically trades – it’s a conservative multiple compared to the 16-17x that’s provably relevant by historical multiples. The upside to the current situation only based on a 15x P/E is 112% here or 37.4% per year.

S&P global analysts consider the company a “BUY” with average target ranges of €242 low for the native, which is above the current share price, and a €325 high or an average of €280. This implies an upside of almost 19%, with 13 out of 19 analysts at either a “BUY” or “Outperform” for the company. The confidence in Munich Re is very high here.

What’s more, the current dividend of €11/share is expected to blossom to €14 in a few years, which means the 2026E dividend yield at the current share price is around 6%. For me, it’s all about market-beating returns with a great dividend – and the company will deliver that dividend, and has a good potential to deliver the returns as well.

We can put together overall estimates for MURGY by checking analyst targets with my own estimates. There’s a low-end range target of €240 and a high end of €330, based on 20 S&P Global analysts. The difference in this target is how you value some of these assets and how you expect the company to grow. Some of the analysts likely use up to a market-equal 10-12X P/E for some of the company’s SOTP valuations.

Back in April, I ended at a conservatively-adjusted PT of €280. I see no reason at all to shift this valuation at this stage. While the company will deliver slightly more business, it’s also weighed down by the fact that returns will be slightly lower. I call this neutral, and neither lower nor raise the stakes for MURGY.

As always though, I consider the low-range target to be needlessly conservative, and the high end to be needlessly positive. I believe the truth to be somewhere in between these. The main point here is that yes, I believe that Munich Re, at this valuation, is an undervalued business with an upside for the conservative investor.

My current stance for the company is a “BUY”, and I give MURGY a long-term target of €280/share for the native.

Thesis

My thesis for Munich Re is as follows:

- Munich Re is the largest reinsurance company in the world, and also one of the most conservative in existence. It has a double-A credit rating, a high, 4.5%+ yield, and a set of fundamentals and titanium-clad underwriting processes that make the company a no-nonsense leader in the business.

- The recent set of results confirms the long-term upside for me, and I see no reasons why this company should be valued as it currently is – even though I am happy that it is.

- MURGY is a “BUY” here – the equivalent of the PT would be around $28.5 for the ADR.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (bolded).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment