Pgiam/iStock via Getty Images

***This report was first published on May 31st. All data herein is from that date or earlier.****

Update: Since the publication of this report, DMB has moved up sharply. We recently recommended members take profits on that trade and move to other current buys on our muni portfolio lists.

———————

As we lay out below, the topping of rates as well as the relative valuation of munis makes them a compelling investment today. We are not out of the woods, however, and remain cautious so we take a measured approach to the space preferring to rotate from open-end funds rather than cash.

We still have not really even begun to experience the quantitative tightening from the Fed with balance sheet runoff and higher short-term rates. But the market has priced in a lot of that already and we think the risk is that the Fed doesn’t go nearly as far as feared.

Leverage costs are on the rise and many more distribution cuts are likely coming. Discounts have priced in a lot of those cuts in many funds. It is entirely possible that nearly all leveraged muni CEFs cut to some extent.

I continue to believe rotation trades rather than new cash is the proper way to play it. That can be open-end funds like mutual funds and ETFs with muni portfolios being moved into CEFs. I have not quite been ready to commit new cash at this point but wouldn’t bemoan others who did.

Our top picks today are: MVF, NZF, DMB, and VPV. We would include MYI into the mix if the discount widened as well.

The Lay Of The MuniLand

Muni closed-ends (“CEFs”) have continued to bleed lower since our last UPDATE in mid-April. In that update we remained on the sidelines noting that trends and valuations weren’t where we needed them to be:

We continue to be cautious on municipal securities and the price action today – along with the rise in long-term rates and curve inversions – is indicative of that stance. Additionally, the valuation of the sector isn’t where we would need it to be in order to be able to offset some of the stronger risks and headwinds.

The market remains a precarious one and I continue to be in a wait-and-see mode. I have made several swaps as you can add significant value through tax-loss harvesting but as for new money, that is sitting on the sidelines.

The bearish take is that rising interest rates all along the curve and rising rates are the kryptonite to any long-maturity bond. We also have inflation and to continue the analogy trend, inflation and bonds are like oil and water.

Investors scared of inflation are shunning bonds. After all, if inflation is 8% and your bonds are earning 4%, even after the decline, you’re real return before taxes is a mere -4%.

And interest rates rising has a dual effect on munis, especially as it relates to CEFs. Rates moving higher on the long-end of the curve depress bond prices, as they have an inverse relationship. This has the effect of depressing bond fund (all bond funds) NAVs. Higher short-term rates have the effect of raising bond CEF leverage costs. That means the net investment income, the leftover income after fund expenses including interest on the borrowing, is going to be reduced since, all else equal, your expenses went up. This reduces the stability of the distribution.

Schwab

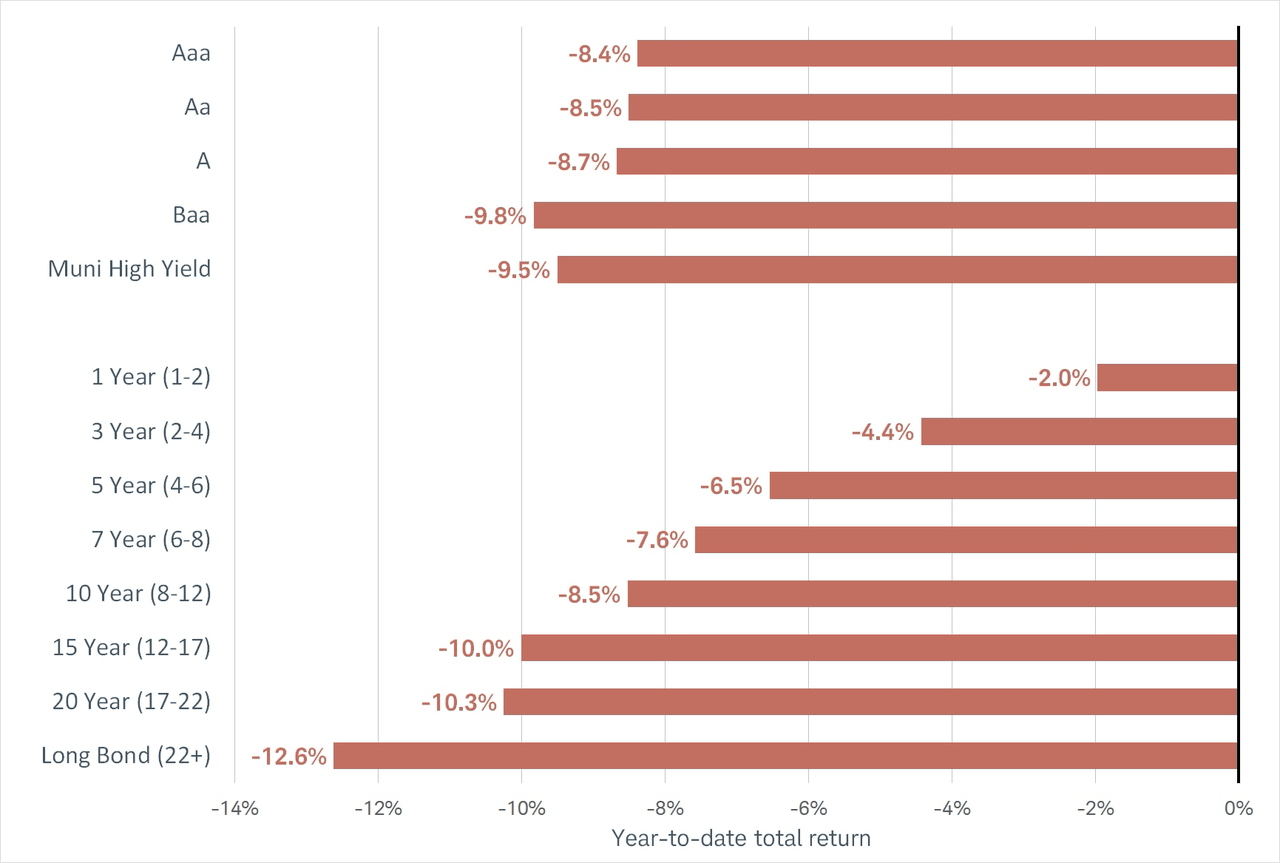

Both of these factors are the largest reasons why the bond market has seen so much pain in 2022. The drawdowns in most areas of the bond market have improved valuations dramatically. The yield-to-worst of the muni index and the high-yield muni index is now 3.42% and 5.33%, respectively. In December, those numbers were 1.11% and 3.11%, respectively.

In other words, your yield today on a YTW basis is three times what it was back in December. That shows you how fast we’ve moved in a short period of time.

The below chart shows the changes in muni bond prices of various credit quality and maturities. It is clear that duration was the largest driver of weakness this year.

Nuveen

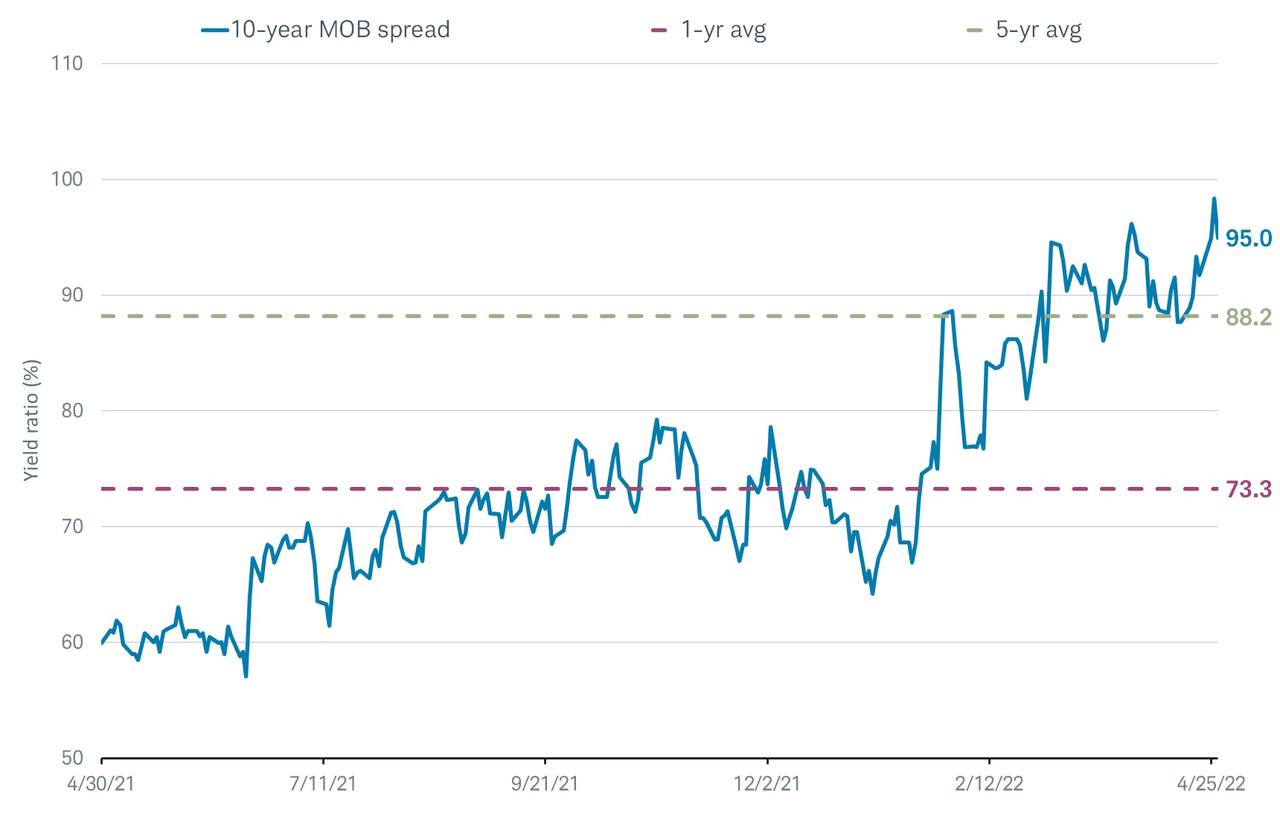

From Schwab:

Relative to other fixed income investments, muni yields are attractive, too. One common metric to analyze the relative attractiveness of the muni market is the municipals over bonds (‘MOB’) spread. It’s a ratio of the yield on a AAA muni to that of a Treasury before considering the tax benefits that munis offer. Since the start of the year, the MOB spreads for most maturities have been steadily climbing and are now above their five-year averages.

Nuveen

Municipal CEF Valuations

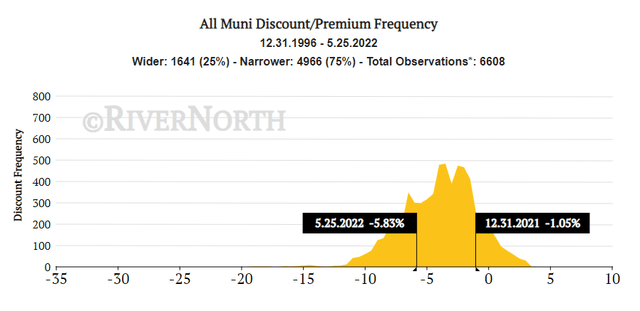

As we discussed in the last update and many times since, I’ve been very surprised about the lack of true capitulation in the muni space. Given what we discussed above, I thought we would see retail investors flee further from muni CEFs than they did in 2015 and 2018.

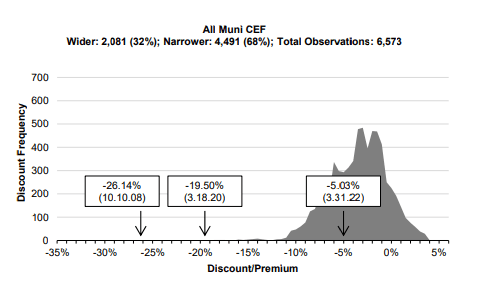

In 2018, the last time we saw rising rates and the market get scared, muni CEF discounts reached the 99th percentile. That means they were only wider in 1% of observations going back to 1996.

Today, they are around the 75th percentile. While that’s cheap, and far cheaper than 6 months ago when they were in the 20th percentile, and certainly cheaper than last summer when they were in the top decile, they are not a screaming buy here.

RiverNorth

In the below chart, we see some of those outlier dates in muni CEF discounts. The distribution of the discounts has a fat left-tail. This occurs in the depths of bear markets and “crisis” like we saw in 2008 and 2020. Buyers are simply nowhere to be found and sellers plentiful. In a less liquid market like muni CEFs, that means the floor is gone and gravity takes you down hard.

RiverNorth

So are muni CEFs cheap? Well, they’re cheaper. Not necessarily cheap. But I do think we can start stepping in and here’s why.

Do I Buy Or Do I Wait?

As I’ve been discussing for nearly the last month, we think moving up-quality makes a lot of sense here. And that typically means moving from a credit risk portfolio to an interest rate risk one. Our rationale has been two-fold:

1) The majority of the move in long-term interest rates has likely been made and the risk is now to rates moving lower. That means a move towards duration rather than running away from it.

2) As a mild recession becomes more probable, we want to move away from credit risk holdings (default risk) and towards holdings that are interest-rate sensitive (duration). Those include munis, treasuries, investment-grade corporates and mortgages, and high-quality preferreds.

Portfolio decisions are a series of trade-offs. Most of the decisions you make come with imperfect information. There’s more luck involved in success and failure than many people are willing to admit.

Buying munis here means you are not buying something else or holding cash. Any sense of whether or not you made a good decision is based on that relative outcome.

The way I look at the decision is will I regret this move in 1 year? 2 years? 5 years?

My answer today is far more favorable than unfavorable. I think a lot of the downside risks have been priced into the markets.

One way I’ve been telling investors to approach this is to forget about timing the bottom. You won’t. It’s impossible.

Instead, think about minimizing regret by legging into the muni CEF space over time. If the current rebound we’ve seen this week is a dead cat bounce, it allows us to average down over the next couple of months.

A good option would be to divide your anticipated muni CEF allocation by 6 and then buy-in on the same day of the month over the next six months. If you think we’re closer to a bottom than not, you could weight the purchases to the front (front-end load them) by making the initial couple of months larger than months five and six.

Conversely, if you think more volatility or higher rates are coming, back-load the purchases towards months five and six and reduce the purchases in months one and two.

There is no hard or fast rule to this. And it’s FAR more luck than it is science. Without a crystal ball, it is impossible to know. But employing these tactics can minimize regret.

Some Options To Buy

Top Pick:

1) BlackRock MuniVest (MVF): This is a nearly $1B fund with the 39% leverage factor. But it is lower cost with management fees at 0.71%. The yield on the fund is 5.34% and an effective duration of 13.4 years. The current discount is -8.3%. As of the end of March, coverage is 99.7% and UNII is 1.3c. For now, we think the distribution is safe. The vast majority of the portfolio is investment grade. Lastly, just 15% of the portfolio is callable over the next two years.

2) Nuveen Municipal Credit Income (NZF): One of the largest muni CEFs at $3.4B and 250k shares traded daily. This one has plenty of liquidity. However, as is customary with Nuveen (vs BlackRock), it is a bit more expensive at 94 bps. Anything that comes out of NAV no what the purpose will reduce the net portfolio yield. To an investor like us, that is a deadweight loss for no reason. Still, it is not egregiously expensive. The fund has 40% leverage and a leverage cost of 1.53% (up from 0.6% at the start of the year). The average bond price in the portfolio is right at par and once the fund absorbs another Nuveen fund, NEV, it is likely to go lower meaning capital appreciation potential. Coverage is 106% and UNII around zero. Distribution appears okay for now. The yield is 5.4% and the shares trade at an -8% discount.

3) Invesco Pennsylvania Value Muni Income (VPV): This is a state-specific fund so for PA residents, its completely tax-free, even at the state level. But you don’t have to be a PA resident to enjoy the tax-free federal income. The fund is a bit smaller at $480m and less liquid with only 37K shares traded daily. Coverage is 92% even after cutting in March so it’s likely another cut is in store for the fund down the road. The portfolio is mostly investment grade and has an average market price of $103. Duration is lighter at 8.1 years. The current discount of -12.5% is compelling in this market with a yield of 5.20%. The call schedule is benign for the next few years.

4) BNY Mellon Muni Bond Infra (DMB): (we no longer recommend this CEF) This is one we advocated selling months ago given the rich valuation. Today, the shares trade around a -7% discount after a strong rally this week. The fund seems to have shed its large call wall that it had two years ago – at least according to CEFConnect (we are still trying to confirm the data is accurate). The yield is 5.4% at a -7% discount. Leverage in the portfolio is 35% and has an effective duration of 8.25 years.

Concluding Thoughts

I think it may be far too early to call a bottom – and we won’t know a bottom is in until much much later – however, I do think you can swap some funds around and/or start a few small new positions here.

As we’ve discussed, we think the bulk of the rate move has been made and we could even see some further long rate declines. However, the main thesis is that we want to move into higher-quality at the expense of non-investment grade given recession risks and still relatively tighter spreads.

We would make swaps when available. In the last week, the following swaps make a lot of sense:

- Sell OIA — > Buy NZF

- Sell NMCO —> Buy LEO

- Sell PMX —> Buy PMF

- Sell BTA —> Buy MVF

- Sell EVN —> Buy MYI

Be the first to comment