vchal/iStock via Getty Images

As you know, most of my articles on Seeking Alpha are bullish. But from time to time, I do seek to steer investors away from certain stocks, asset classes, or economic areas.

This includes real estate investment trusts ((REITs)) when necessary.

Considering the economic reality we face, where preservation of capital is so clearly necessary, today is one of those times. I want to highlight a sector that could cause investors considerable pain and, therefore, should be avoided, in my opinion.

That would be residential mortgage REITs, also known as mREITs.

Keep in mind that mREITs raise debt via lower rates and short-term loans and equity – via new share issuances – to purchase longer-term and higher-interest-rate real estate debt and related securities.

The difference (aka spread) between the cost of borrowing and lending is how they earn their profits. It’s also, therefore, what ultimately supports the dividend.

As Simply Safe Dividends points out:

“… mortgage REITs function as a less-regulated, riskier kind of bank, aggregating cheap capital and then indirectly lending it out at higher interest rates by purchasing mortgage-backed securities.”

If you think that sounds like a delicate balancing act, you heard right. It’s hardly a business model that fits well with the faint of heart.

And, sometimes, it might not fit well with anyone at all.

Understanding mREITs Requires Understanding Debt

The more debt mREITs use, the greater their potential for gain or loss.

That’s true of any investment, of course. When we buy stocks on margin, we’re leveraging investment returns with debt.

Any asset carried on high margin involves substantial risk. Again, that should be obvious, no matter how we’re all too prone to ignore it. If the asset’s value declines, so will the original investment (principal)…

Just to a much larger degree.

This is the primary reason I never recommend mREITs for retirees. If you have a low- to medium-risk tolerance and require consistent income, I can’t see any other way around it.

These stocks are most definitely not for you.

Yes, borrowing has its benefits. Most of us couldn’t afford to be homeowners without borrowing. Or pursue higher education for ourselves or our kids. Or start and continue businesses.

And necessary or not, borrowing money can magnify returns. That’s part of why spreads for mREITs are wider and dividends are much higher than equity REITs.

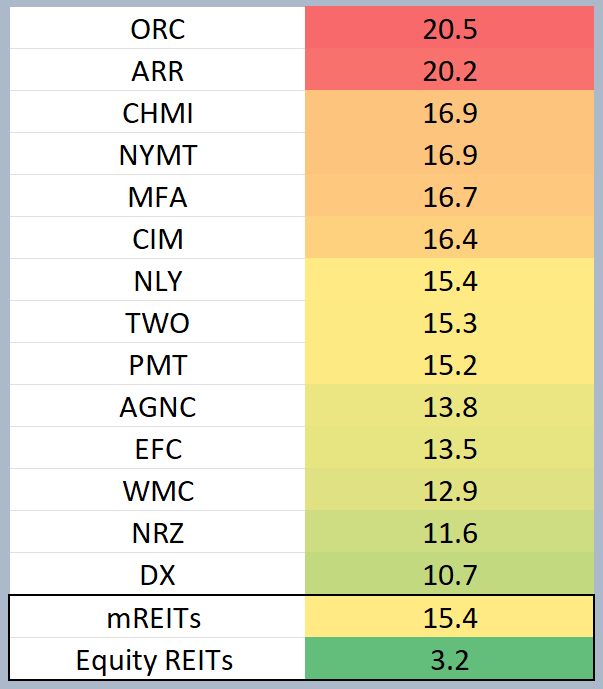

Take a look at the chart below. When you do, you can see that the average dividend yield for the 14 mREITs listed is a whopping 15.4%.

The average dividend yield for equity REITs, meanwhile, is just 3.2%.

(iREIT on Alpha)

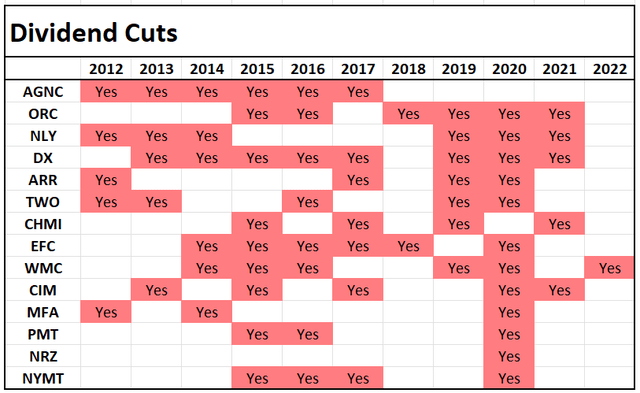

But before you get too excited about those juicy yields… take a look at their associated dividend cuts:

(iREIT on Alpha)

That’s why you need to ask yourself whether you really want to strap yourself into a roller coaster like this.

Be Afraid. Be Very Afraid

That question is relevant during the best of times, since anything can happen around the next bend. And we’re definitely not dealing with the best of times right now. Not for these kinds of companies.

Any rise in interest rates will reduce net interest spreads, since short-term rates tend to rise faster than long-term ones. Book values will fall due to higher long-term rates. And investors will lose money.

Still not scared? Think you’ve got the situation figured out anyway?

Consider that, on the surface, the real moving parts are often obscured from view. Most mREITs use a variety of methods to try to protect book value through what basically boils down to hedging. They’ll turn to euro-dollar swaps, interest rate swaps, Treasury futures, interest-only strips, principal-only strips, options, swaptions…

And the list goes on.

In addition to spread compression, changes in interest rates affect prepayment rates on underlying mortgages. An increase or decrease in prepayments reconfigures their amortization and accretion, affects assumptions, and could lead to further losses.

Hardly an optimal situation for an investor to find themselves in.

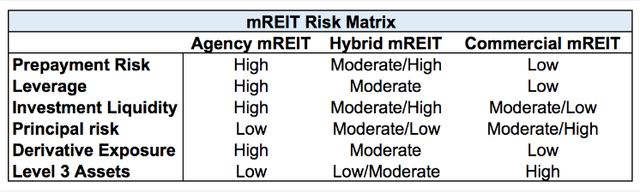

In short, mREITs are highly specialized financial companies. And understanding both their business models and risks is vital to long-term investing success.

(Brad Thomas)

As Simply Safe Dividends explains (emphasis added):

“Residential mREITs, because most of their business is agency-backed MBS [mortgage-backed securities], have little principal (i.e. default) risk since they are backed by the government.

“However, the lower yield on these types of securities means that residential mREITs need to take on higher leverage and hedge against changes in interest rates via derivatives such as interest rate swaps and swaptions.

“This is important because residential mortgages, usually being fixed, fall in value with rising interest rates, which negatively affects the value of a residential mREIT’s loan book (i.e. book value, or net asset value per share).”

And, it continues, “since the share price generally follows the trend in book value, residential mREITs generally thrive in a falling interest rate environment but suffer if rates rise.”

Let’s Consider mREIT History…

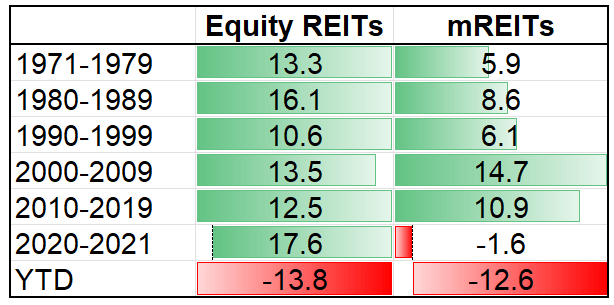

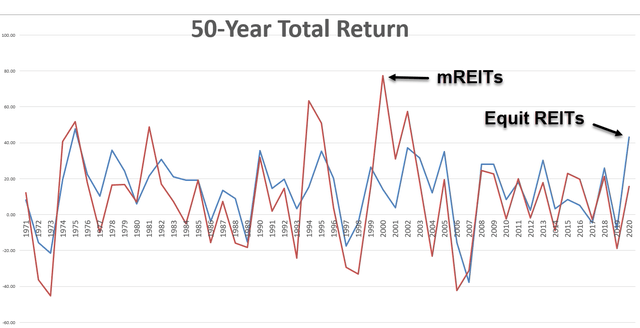

In case you’re wondering, I went back in time to analyze mREIT performance since 1971. Working with Nareit data, here’s what I discovered about their annualized total returns:

(iREIT on Alpha/Nareit)

As you can see, equity REITs have crushed mREITs over almost every decade. That’s been true in periods of rising and falling interest rates alike.

As for our current period, year-to-date, mREITs have outperformed equity REITs by just 120 basis points.

Also, as you can see below, equity REITs returned an average of 13.4% over the last 50 years. mREITs, for their part, returned 8.9%.

(iREIT on Alpha/Nareit)

As far as I’m concerned, the only thing predictable about residential mREITs in particular are dividend cuts.

Let me repeat that: The only thing I find consistent about this category is its proclivity for failure, in something that REITs were created to uphold.

This leads me to my next section in the article: providing some attractive equity REITs to buy without chasing yield.

Citing Simply Safe Dividends again (emphasis added):

“… keep in mind that the general direction of interest rates since 1982 has been downward, meaning that it’s possible that the success of mREITs that have been around longer, such as Annaly Capital (NLY), may be due to a massive, generation-long interest rate megatrend that is now at an end (since rates likely have nowhere to go but up over time).

“And even if mREIT management teams are capable of navigating a potentially more challenging rate environment, keep in mind that all mREITs are variable pay dividend securities.”

That’s why I’m not recommending them today. There are much better fish to fry instead.

3 Blue-Chips To Buy

The three non-mREIT “fish” I’m enjoying this time around are as follows:

All three are net-lease REITs, and all three stand the dividend test.

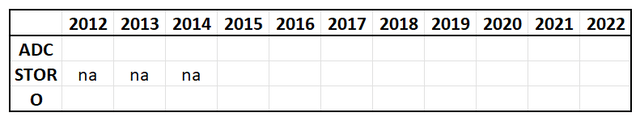

But before I get started really talking about them, let me show you how many times these three blue-chip REITs cut their dividend during the same time period as I used above:

(iREIT on Alpha)

In other words, zero.

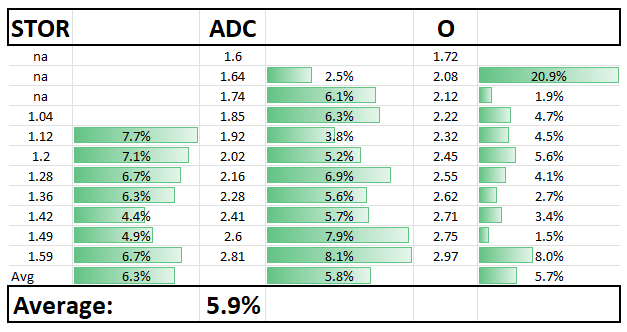

That’s right. These three picks had no dividend cuts during this period. In fact, their average annual dividend growth averages 5.9%:

(iREIT on Alpha)

Remember, folks: the key to long-term success in the stock market is not in chasing double-digit dividends. It’s in focusing on companies that offer enduring models of dividend repeatability.

If you don’t believe me, just take a look at this sample set of annualized total returns since January 2012:

- Realty Income: 9.8%

- Agree Realty: 13.3%

- Annaly: 1.4%

- AGNC Investment (AGNC): 2.6%

- Dynex Capital (DX): 3.7%

Please, please, please do not get suckered into these residential mREIT “sucker yields.” If we truly think it over, we all know how this will eventually play out.

That’s just one of the reasons why I maintain that you’re much better off purchasing shares in high-quality dividend growth REITs…

Like the three I listed to begin this segment that we’ll explore starting with the next one.

Safe And Secure With Non-mREITs Like These

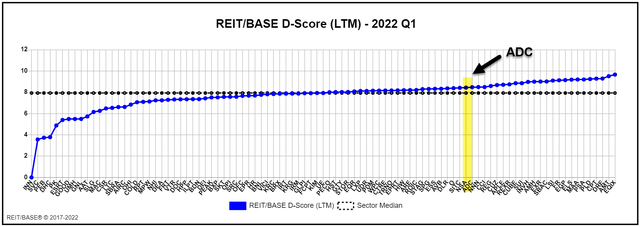

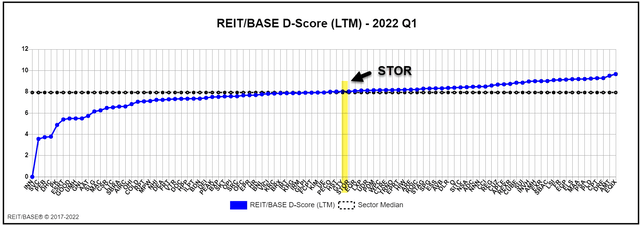

Agree Realty, for starters, has grown its dividend by an annual average 5.8% since 2012. The company has a dividend safety score of 8.5 out of 10 with a 75.5% payout ratio.

That’s as of Q1-22 based on adjusted funds from operations (AFFO).

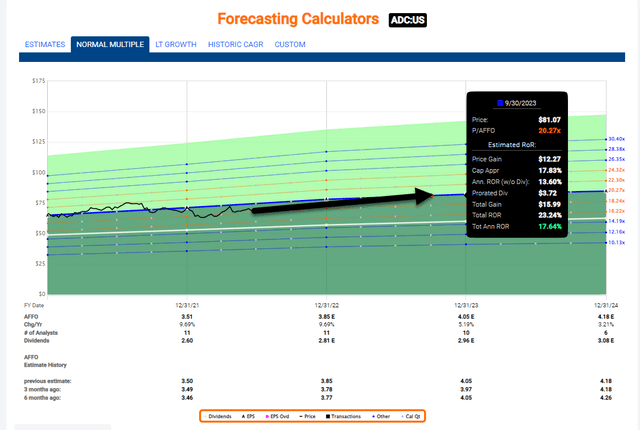

(REIT Base)

ADC’s dividend yield is 4.1%, and its p/AFFO is 18.8x – below the five-year average of 19.9x. Analysts expect earnings to grow by 10% in 2022 and 5% in 2023.

This translates into an iREIT-modeled total return of approximately 17% over the next 12 months.

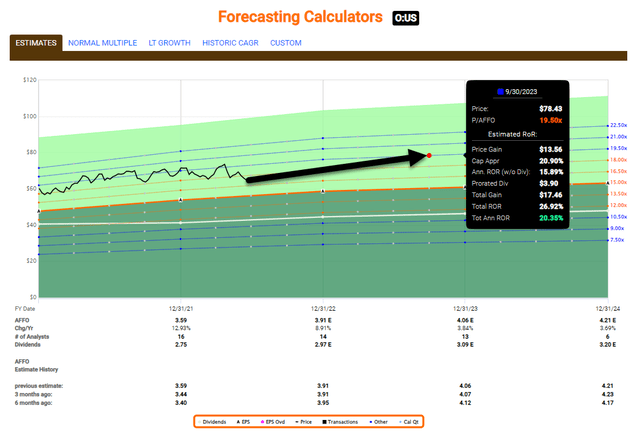

Fast Graphs

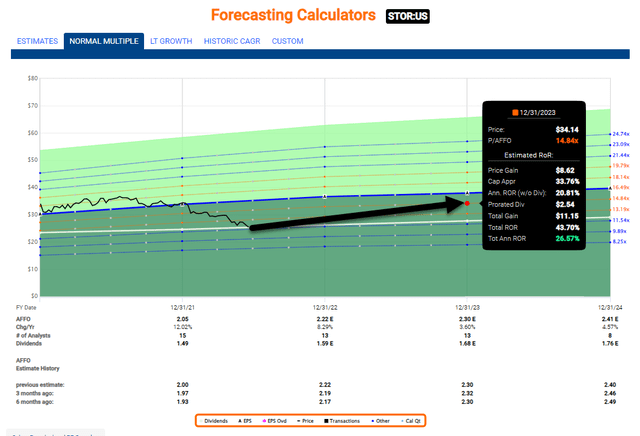

Then we have STORE Capital, which has grown its dividend by an average 6.3% per year since 2015. Its dividend safety score is 8.03 with a 69.2% AFFO payout ratio as of Q1-22.

(REIT Base)

STOR’s dividend yield is 6%. And its p/AFFO multiple is 12x, compared to a five-year average of 16.3x.

Analysts expect earnings to grow by 8% in 2022 and 4% in 2023. This translates into an iREIT-modeled total return of approximately 25% over the next 12 months.

Fast Graphs

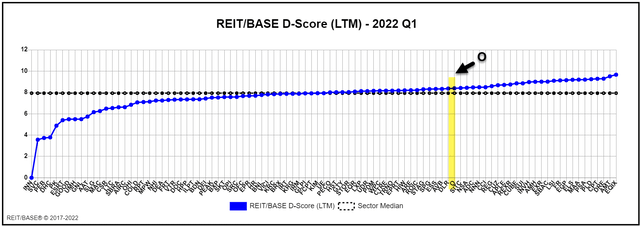

Finally, Realty Income has grown its dividend by an average of 5.7% per year since 2012. O is also a dividend aristocrat that’s increased its dividend for over 25 years in a row.

The REIT has a dividend safety score of 8.4 with a 78.3% AFFO payout ratio as of Q1-22.

(REIT Base)

O’s dividend yield is 4.6%, and its p/AFFO multiple is 17.4x – below its five-year average of 20x. Analysts expect earnings to grow by 9% in 2022 and 4% in 2023.

This translates into an iREIT-modeled total return of approximately 20% over the next 12 months.

(Fast Graphs)

In Conclusion…

Now scroll back up to the first chart I showed you: the one with all the double-digit “sucker yields” ranging from 11% to 20%.

History demonstrates that these yields aren’t sustainable. That eventually the market recognizes the true value of these securities…

And that they’re nothing short of fool’s gold.

While I consider myself a tremendous cheerleader within the REIT sector, I’m becoming increasingly skeptical of residential mREITs. From everything I’ve seen, they’ll likely cause investors to lose large sums of money.

The writing is on the wall. And I, for one, don’t want to be around when the writing comes true.

Consider yourself warned.

Thank you for reading, and I look forward to your comments.

P.S. My next mREIT article will likely be titled “Another One Bites The Dust.”

Buyer beware!

Be the first to comment