yongyuan/E+ via Getty Images

Main Thesis & Background

The purpose of this article is to evaluate the BlackRock MuniHoldings California Quality Fund (NYSE:MUC) as an investment option at its current market price. This is a fund that offers broad-muni exposure, but specific to the state of California. As a result, this is a great option for California residents, but those living outside the “Golden State” will likely only save on federal taxes – not state taxes.

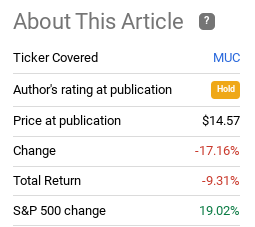

As a major player in the muni sector, MUC is a fund I keep close on my radar. However, it has been about two years since I wrote about it, at which time I placed a neutral/hold rating on the fund. I saw inflation as a major long-term challenge, and that certainly came to pass. In fact, since that review, MUC has seen some weakness while the broader equity market saw strong gains:

Fund Performance (Seeking Alpha)

While I was modest on munis for most of 2021 given the interest rate risk and general risk-on market fervor, that attitude has shifted in 2022. Admittedly, I got bullish on this sector a bit too early this year, as more losses accumulated. However, I stayed the course and munis have finally started to offer positive returns. Rather than take short-term profit here, I believe adding makes sense – to the right fund. MUC is one such fund, as it has a cheap valuation, is supported by strong credit quality, and offers a competitive yield even in an inflationary environment. As a result, I am upgrading my rating on this CEF to a “buy”, and will explain why in more detail below.

Valuation Is Very Attractive

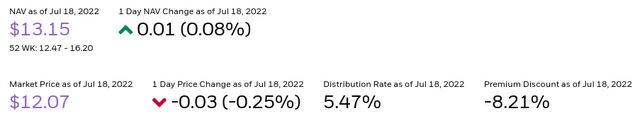

My first point is a simple one, so I won’t dive into it in a ton of detail. But it is important, so highlighting it early on makes sense. This is the fund’s valuation, which is trading at value levels that I view positively in this difficult market environment. Specifically, MUC has a current market price that trades at a discount of over 8% to its underlying value:

MUC Valuation Stats (BlackRock)

The takeaway for me is that this makes MUC worth the risk. The fund has a big discount to NAV and that should limit potential downside going forward. Can MUC drop in price, even with this discount? Of course, and 2022 has taught us that because this option did have a discount most of the year. But it does represent some value and it should at least limit any future pain if the market once again turns on this sector. This is not a sure thing by any means, and buying at a discount does not equate to automatic positive returns. But it does put my mind at ease somewhat, and suggests MUC is a better option than other muni CEFs that trade at premiums (or narrower discounts).

Let’s Reflect On Why I Don’t Think The Poor Performance Will Continue

I now want to reflect on the macro-environment to give some insight into why MUC has been performing so poorly. While the future outlook is more important than past performance, understanding the why behind the weakness can give us a better mindset when evaluating what the future will bring. After all, if the same factors that led MUC to perform poorly still exist today, then perhaps it is difficult to give this a buy case.

And just how difficult has the environment been for MUC? Quite a bit. While it is fair to mention that the market as a whole (with some exceptions) has had a tough go of things in 2022, munis are supposed to be a safer asset class. This makes the 20% year-to-date drop hard to stomach, in my view:

YTD Performance (Seeking Alpha)

MUC has offered an attractive income during this same time period, especially on a tax-adjusted basis. But that still leaves investors nursing a loss near 20%. That is poor performance, no getting around that fact.

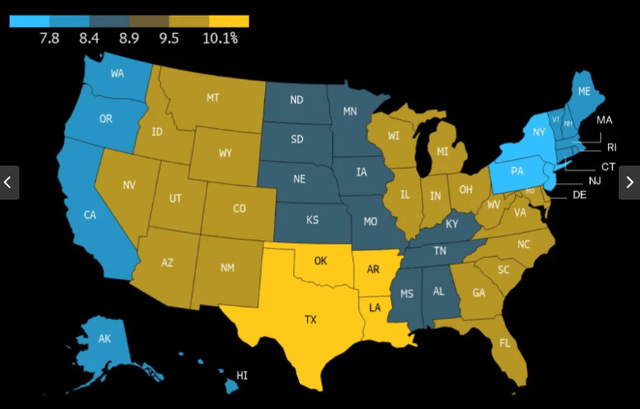

So, that begs the question – why? The primary reason is that inflation has been rampant. It really began to take hold in 2021 and only picked up steam in 2022, negating the “transitory” message that I never took seriously. Inflation is a global problem for sure, and it is hammering states across the U.S. pretty consistently. Inflation is high everywhere, it is just a matter of how high:

CPI Growth (By State, Annualized) (Yahoo Finance)

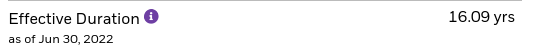

Why does this matter to MUC? It matters to all bond funds because bond prices fall as interest rates rise (and inflation has been the driver behind the recent interest rate hikes). With the exception of floating rate debt, income-oriented investors have seen their investments decline pretty aggressively this year. MUC has been a victim of this trend, perhaps even at a disproportionate rate. The reason being is that this fund is very interest rate sensitive. Consider that its duration (a measure of interest rate sensitivity), is a whopping 16 years:

MUC’s Duration (BlackRock)

This should make it pretty clear why MUC has fallen by so much. In a rising rate environment, the fund’s underlying assets were going to get hit – and they did.

With this backdrop, how could one possibly be bullish on MUC? After all, we are still in an inflationary environment and the Fed still has plans to hike interest rates. This is a very fair point, and I would emphasize that I would not go crazy buying at these levels. I see value, yes, but there is plenty of interest rate risk still on the horizon. And that could very well continue to pressure the fund. However, I personally feel that most of this has been baked into the share price at this point.

I feel this way for two reasons. One, the Fed has been telegraphing its moves on inflation. There is another upcoming interest rate hike, but the market has priced in a .75 basis point move. So this should theoretically have impacted MUC already, at least to a partial degree. Two, I think the Fed’s movements beyond this next hike will be limited. I believe inflation will start to come down modestly after this hike, and recessionary fears will keep the Fed from getting more aggressive.

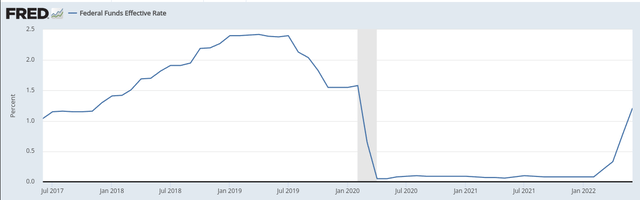

While the Fed’s “dot plot” suggests their benchmark rate could settle around 3.4% by year-end, I personally think that isn’t going to happen. The July rise (if it occurs), will put us in the 2.25 – 2.50 basis point range. This does leave almost a 1% move, if the Fed’s dot plot is to be believed. But, as I stated, I think recession fears are going to put the Fed on a more dovish path to wrap up the year than the course they are currently on. Further, if we look back over a 5-year period, we see that the Fed’s benchmark rate has not exceeded 2.5% at any time:

Federal Funds Effective Rate (St. Louis Fed)

What I am seeing here is a pretty significant ceiling. This is where we are likely going to be after the July Fed meeting. While the rate can certainly go higher from there, and the Fed has indicated a willingness to do so, I am of the opinion they are going to slow down. If I am right, that will be bullish for MUC, and for most fixed-income products by extension. The market has been working under the assumption the Fed will stay on an aggressive path, and I see the tide turning the other way.

Muni’s Actually Provide Some Inflation Protection

My next point is an extension on the inflationary environment. I have noted that bonds in general fall when inflation and rates rise. That is true, and MUC’s performance in 2022 is indicative of that. However, one point that the market is not considering if that munis actually do offer some inflation protection. This may sound counter-intuitive, and it certainly does not make up entirely for the fact that bonds tend to lose value when inflation rises. But from a credit perspective, the underlying quality of the muni asset may actually be in a better position than investors realize.

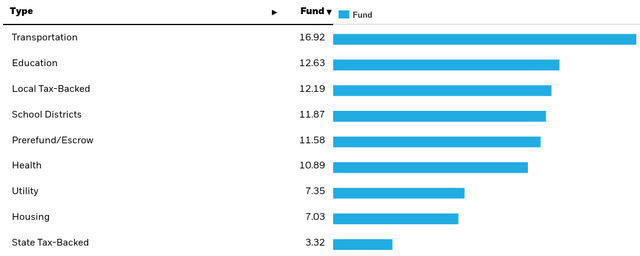

To understand why, let us consider MUC’s portfolio make-up. The fund is well diversified across a number of sectors. It currently holds about 15% of its assets in tax-backed securities, along with almost 7% in securities backed by the Utility sector:

MUC Portfolio Sector Holdings (BlackRock)

These are areas that I see actually rising in value along with inflation. For example, bonds backed by sales tax generally benefit from rising prices and inflation because as the price of goods increases, so does the level of sales tax collected. This is a net benefit because debt service repayment schedules are usually fixed. Therefore, tax collections rise, but debt obligations remain the same. This gives issuers positive net cash flow, improving their credit quality and lessening the likelihood of delinquency or default.

The same is true for Utility-backed bonds. Most public utilities have rate covenants, allowing the companies to set rates at levels that generate revenues at a set level above expenditures. So, as costs rise due to inflation, rates charged are allowed to similarly rise. This can take time to go into effect, and can require regulatory approval, but it does bode well for the sector compared to other muni-backed areas. The same is true for some transportation bonds – the top sector in MUC’s portfolio. Toll roads and public transportation can often raise their levies along with rising costs and inflation. Again, this helps mitigate the impact of broader inflation on the underlying security.

With MUC’s 20% drop this year, I do not think the market is reflecting this reality. This supports the belief there is value here.

Income Story Is Positive

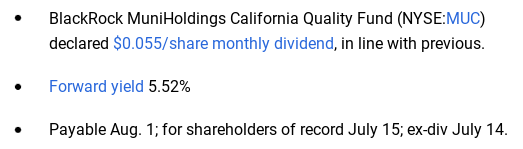

The next thought relates to income. This is certainly an important attribute for MUC. Most muni investors are in it for the tax-free income, so an assessment here is vital. Fortunately, the back story is quite positive for this particular fund. Even with inflation running pretty hot and the Fed raising rates, MUC offers an attractive distribution. At a current yield over 5%, this could very well offer a positive real yield even after accounting for inflation, once tax savings are factored in (tax savings differ by investor based on their own personal tax rate):

MUC’s Last Distribution Payout (Seeking Alpha)

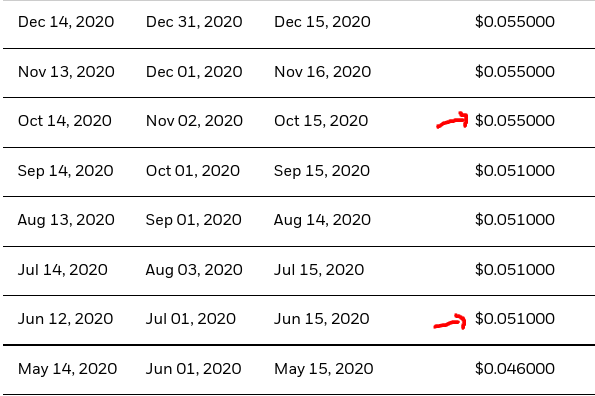

Beyond this immediate story, readers should also note this is a fund that has increased the payout twice in the past two years. While both these increases were a while ago, it remains relevant to me because the distribution has been supported since then even at this higher level:

Prior Distribution Hikes (BlackRock)

To me this puts my mind at ease when considering MUC for muni exposure. The income story has a positive track record for the long-term. While the share price moves have been unnerving, this metric has stayed rock solid. That is a trend I can get behind.

California Has A Budget Surplus

My final point relates to the credit quality of the state of California. As MUC is a state-specific fund, the happenings in the Golden State are of paramount importance. If the broader picture for munis is strong, but the state is in a precarious position, then a bull case for MUC would be difficult to make.

Fortunately, MUC holds mostly investment grade quality debt, with the majority of its underlying securities rated in the top tranches. in addition, the financial footing of the state appears sound. According to the State Controller’s Fiscal YTD 2022 State Cash Report, total General Fund revenues came in at $35.4 billion (21% ahead of the FY 2023 governor’s budget). The outperformance is due to increased tax revenues from the three largest taxes: personal income taxes came in 21.9% above budget, sales taxes 7.8% above budget, and corporate income taxes 43.7% above budget.

I view this positively because it means the state has the ability to make good on its debt obligations. Until this story changes materially, I will continue to see IG muni bonds for California as having a strong investment case.

Bottom Line

MUC has had a painful run in 2022, but I believe the worst is over. The fund is backed by a state with a strong credit rating, underlying securities that are rated highly, a healthy discount to NAV, and an attractive income stream. While inflation and further rate hiking from the Fed are headwinds, I think most of the pain is baked in at this point. Further downside certainly exists if the Fed’s efforts to stymie inflation are not successful, so readers do need to evaluate that risk here. But I see the risk-reward proposition as favorable, enough to upgrade my rating on MUC to “buy”. As a result, I would suggest readers gives this fund some consideration at this time.

Be the first to comment